Eurozone industry holds up better than expected in the pandemic aftermath

Despite a huge energy shock in the economy, production has held up well. There are no miracles here, though. Currently, the post-pandemic catch-up has simply outweighed the negative impact of higher energy prices. For now

Industrial production held up well in a challenging 2022

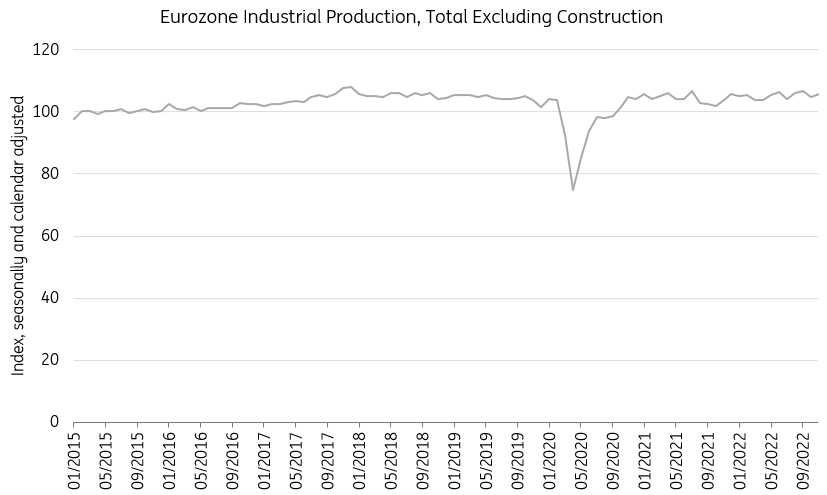

Despite substantial energy reduction efforts, the eurozone industry held up relatively well in terms of production. The most recent data show annual growth of 1.9% in industrial production in the eurozone, which almost sounds too good to be true. If an energy crisis of the magnitude just experienced is not resulting in production setbacks, do we need high levels of energy use to begin with?

Looking under the hood of industry data, we see that indeed this conclusion is too good to be true. There are multiple shocks working against each other that have an important impact on different sectors and result in a relatively neutral impact so far. Let’s also not forget that industrial production in the eurozone is currently only just above its pre-pandemic level. In any case, if the energy crisis were to persist, the impact on production will likely become more broadly visible in 2023.

Production has surprised on the upside as dramatic scenarios are avoided

The energy shock has weakened production in energy-intensive sectors

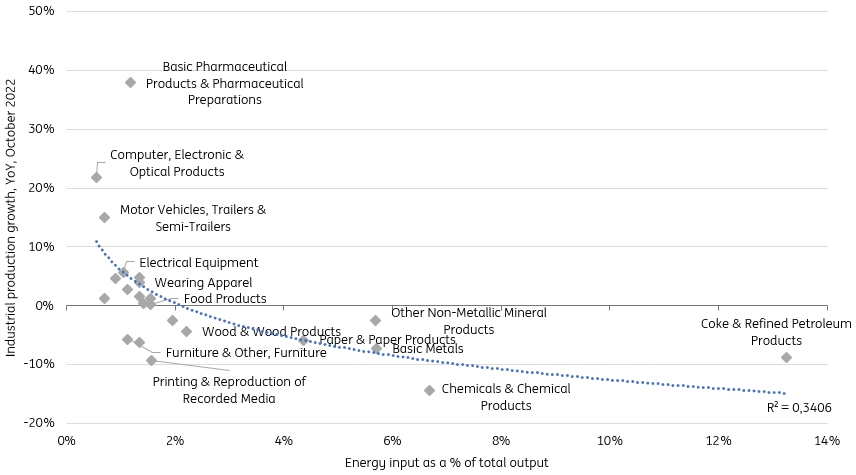

When we look at the performance of different industrial subsectors over the past year, we see that there are big differences. The weakest performing sectors are all among the most energy-intensive within the broader industry. It is therefore no surprise why they have seen contractions of up to -14% for the chemicals industry.

In chart 2 we see the relationship between energy inputs as a share of the total output of the sector and production growth in the past year. The sectors that are very energy-intensive are all showing negative output growth and there is quite a strong relationship in terms of energy intensity and production over the past year. The paper industry has seen a decline of -6%, basic metals -7% and coke and refined petroleum products -9%. So far, there are no miracles happening. Germany is currently the only country in which the statistical agency releases a time series for energy-intensive production, which was down by around 13% year-on-year in November.

Energy intensity is strongly related to production performance over the past year

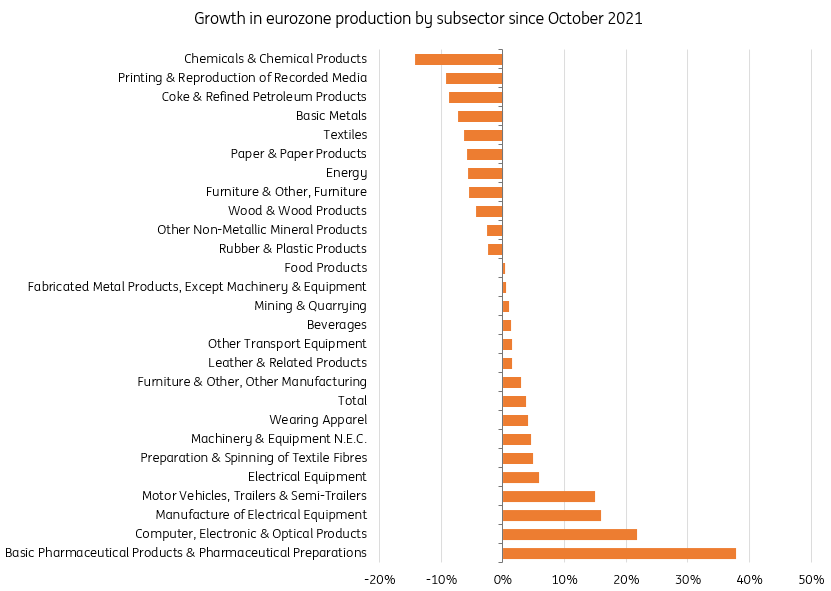

The aftermath of the pandemic shock now boosts production

As the energy-intensive sectors have clearly taken a hit, the question is why some of the other sectors are performing so strongly. There are two main reasons for such outperformance: pandemic winners and post-pandemic winners. The so-called pandemic winners are the sectors which benefitted from the pandemic, like pharmaceuticals. Strong production growth still continues as we saw growth of almost 40% in production over the past year. We also see strong growth for another stronghold during the pandemic: computers, electronics and optical products. With shortages of semiconductors having faded, production continues to be strong for these products, resulting in 20%+ growth.

And then there are the post-pandemic winners, e.g. the sectors that were hit by the pandemic but are catching up and reducing backlogs as supply chain frictions fade. The main representative of this group is the car industry. Production of motor vehicles, trailers and semi-trailers increased by 15% last year.

All in all, production has held up well because two shocks are playing into one another at the moment. The aftermath of the pandemic shock to the economy is at this point quite favourable as supply chain problems fade which boosts industrial production. The energy shock on the other hand has the exact effect that you’d expect as the most energy-intensive sectors are all seeing large declines in production. The reduction in energy consumption in industry does often not refer to less energy consumption in production but rather to the very ordinary reduction in heating.

The pandemic winners lead the pack of sub-sectors in recent production growth

Outlook is getting less bleak as energy crisis moderates

The question for 2023 is whether industry can weather the energy shock without an overall dip in production. The good news is that post-pandemic effects should fade, but likely not immediately. Supply chain problems are continuing to fade at the start of 2023, which should benefit the more restrained sectors in terms of inputs. The auto sector for example is expected to continue the recovery of production at the start of the year which is a large part of total industrial production. Besides that, current energy prices are a lot more favourable for production than prices seen in most of 2022. That means that the energy-intensive sectors could rebound a bit on the back of lower input costs.

Still, risks may have moderated but chances of the energy crisis flaring up again in the coming months are high. It is also not unreasonable to expect that the energy crisis will simmer for longer than post-pandemic catch-up effects as demand for goods has been decreasing over the course of last year with people spending more on services again now that economies have reopened. The Inflation Reduction Act is just an example of how lower energy prices elsewhere combined with local subsidies could further weaken industrial production in the eurozone.

All in all, while industry has surprised by not contracting according to the most recent data, we shouldn’t expect too much from industry over 2023 and the risk of a delayed contraction continues to hang over the sector.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article