Eurozone: Hangover in the making while the party’s in full swing

Third quarter growth will likely be stronger in the countries hardest hit by the lockdowns earlier this year, but worries about a double dip recession, thanks to higher trending Covid infections, should be a large warning sign against complacency for policy makers

The last shall be first, judging from mobility data

It feels a bit like being in the twilight zone. While incoming hard (and lagging) economic data for the eurozone is still painting a picture of the size of the rebound in the third quarter, soft and other leading indicators are providing a first glance of the shape of the subsequent recovery. As the third quarter of the year is coming to a close, we have a first look at what the latest data is telling us about both.

Up to now, hard economic data for the third quarter has been limited to the month of July. Thanks to base effects from the rebound in May, June and July, third quarter growth in industrial production, retail sales, new car registrations and exports will be massive. Taking available data for July and leaving that stable for the rest of the quarter yields quarterly growth of 7.1% for retail sales, 14.6% for industrial production, 16.7% for exports in goods and a whopping 106.9% for new car registrations. Our expectations for 3Q GDP growth are therefore around 10%.

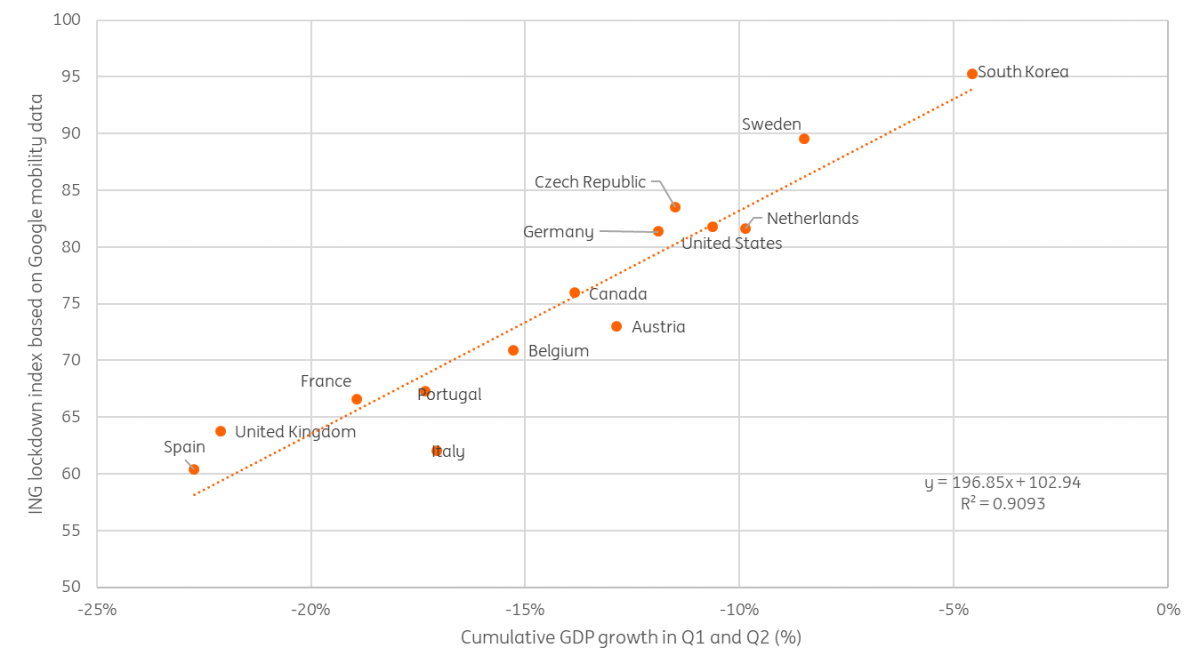

Turning to more experimental data, our favourite, Google Mobility data, gave a good proxy of 1Q and 2Q GDP growth for most advanced economies. In the third quarter, however, seasonal factors could undermine the predictive power of the Google Mobility data. The mobility data measures movement, which was very useful to gauge the dip when activity was restricted by the virus. Now that mobility data is closer to “normal levels”, seasonal movements like people going on holidays distort the impact on GDP, which filters out seasonal trends.

The decline in GDP has been very well correlated to Google mobility data in advanced economies

Source: ING Research, Google COVID-19 Community Mobility Reports

Note: index of activity since 15 Feb for retail & recreation, groceries & pharmacies and workplaces using Google Covid19 Community Mobility Reports with data through 30 June. 100=baseline of activity between 3 Jan and 9 Feb

Nevertheless and notwithstanding the above mentioned caveats, Google Mobility data points to a strong economic recovery in the third quarter. The countries with the largest improvements are also the ones which experienced the deepest declines in March and April, indicating that the mechanical rebound effects are strongest in the countries with the larger economic fallout. That is encouraging, as it means that the third quarter numbers will show a bit of a reduction in GDP divergence between countries. Still, we do expect output gaps to remain a lot larger in the countries hardest hit in the first half of the year.

Countries with deeper GDP declines in the first half have also seen a stronger recovery in mobility data in 3Q

Source: ING Research, Google COVID-19 Community Mobility Reports

Note: index of activity since 15 Feb for retail & recreation, groceries & pharmacies and workplaces using Google Covid19 Community Mobility Reports with data through 11 September. 100=baseline of activity between 3 Jan and 9 Feb

Brightest before dusk?

Looking beyond the third quarter, this week’s traditional confidence indicators have fuelled fears of a double dip. The eurozone services PMI even dropped below 50, indicating that the sector is experiencing a contraction in activity. According to the survey, the decline was related to the surge in Covid-19 cases impacting business. Also, in our view, the drop in the services PMI could reflect the notion that longer-lasting social distancing measures will have a more structural impact on some sectors. It therefore does not only come as an early warning for policy makers that second wave concerns are developing but also that the structural impact from the crisis could gain traction. While the reversal of reopening measures has been very limited so far, it is concerning to hear that businesses are already noticing a decline in activity thanks to the resurgence of the virus.

The latest Google mobility data does not yet indicate significant declines in activity again though. Data through 11 September indicates an improvement from the end of summer onwards, consistent with people returning from summer holidays and increasing activity. This means that perhaps the increase in Covid cases may be impacting a limited or specific number of businesses at the moment, we’re unsure. We do know that the concerns in the services sector indicated in the PMI are a wake-up call for policy makers that it’s not necessarily smooth sailing from here.

When celebrating third quarter GDP data one should remember that the hangover will not be far away.

Most recent mobility data does not yet point to a large shift in behaviour as new Covid cases are increasing again

Source: ING Research, Google COVID-19 Community Mobility Reports

Note: index of activity since 15 Feb for retail & recreation, groceries & pharmacies and workplaces using Google Covid19 Community Mobility Reports with data through 11 September. 100=baseline of activity between 3 Jan and 9 Feb

The boost of reopening has already determined that GDP growth in the third quarter will be massive, but this could mask another dip or at least a slowing of economic activity. It is a reminder that as second round effects from lockdowns are gaining traction and new – for now just - local lockdowns are popping up, there is a chance that the eurozone recovery could come to an abrupt stop. A vaccine will be needed before the recovery can be sustainable, as recent developments show. And even then, the longer-term impact from social distancing, as well as the structural transition in some sectors which was not started but accelerated by Covid-19, should continue to weigh on growth in 2021 and beyond.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

24 September 2020

Covid spikes threaten the recovery This bundle contains 10 Articles