Eurozone: Half full or half empty?

While the eurozone economy hasn’t suffered too much from the trade skirmishes, uncertainty around both the Italian budget and the Brexit deal is likely to prevent any growth acceleration in the second half of the year. With inflation only likely to pick up at a snail’s pace, the odds of seeing much monetary tightening remain low over the next two years

Second quarter growth was OK-ish and cease fire in trade war is good news

Is the glass half full or half empty? That seems to be the question for the eurozone economy. The second quarter saw 0.4% quarter-on-quarter GDP growth, the same as in the first quarter which was held down by exceptional factors. So no acceleration, but at the same time the eurozone economy hasn’t suffered too much from the trade skirmishes, initiated by President Trump. Where do we go from here? On a positive note we should mention Jean-Claude Junker’s visit to Washington D.C., which resulted in a cease fire in the trade hostilities, taking away some uncertainty for European companies. The first increase in nine months of the German Ifo-index in August is testimony to that.

Let’s also not forget that still loose monetary policy and a weak euro exchange rate will remain growth-supportive in the months ahead. At the same time, the international economic environment has become less upbeat, with several emerging economies experiencing financial tensions, though this might be compensated to some extent by the still buoyant US economy.

Italian budget poses uncertainty

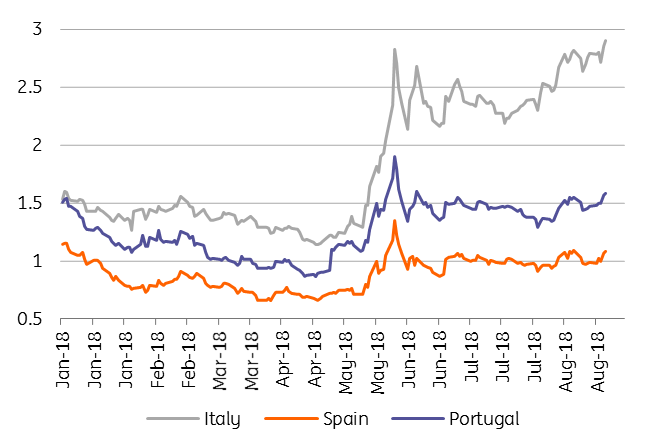

Some of the major risks to growth are still political. The new Italian government has been on a confrontational path with the European Union since the beginning of its mandate. At first, it was immigration but the next battlefield is likely to be the budget. While Finance Minister Giovanni Tria tries to reassure European partners that all deficit rules will be respected, leaders from his coalition partners seem to be willing to up the stakes with a more expansionary budget. No wonder the Italian 10-year bond yield has shot up from 1.6% in May to around 3.30% at the start of September, partially reflecting redenomination risk.

Italian risk: 10yr spread with Germany

The potential of a no-deal Brexit deal remains a risk to the recovery in 2H 2018

Fitch’s recent change of the rating outlook to negative is not helping either. We expect tensions to remain in the coming month, though the final budget deficit foreseen for 2019, is likely to stay below 3.0% of GDP, with the European Commission grudgingly approving. Meanwhile, the critical deadlines for a Brexit deal are also rapidly approaching. While the impact of no-deal is likely to be more harmful to the UK economy than to the European Union, it would still inject an element of uncertainty and is likely to be felt in the countries with the strongest trade ties with the UK. A no-deal still looks very likely to be avoided, though October has already been abandoned as a deadline.

Growth momentum to remain 'decent'

While in these circumstances it looks rather unlikely to see a growth acceleration in the second half of the year, the underlying growth momentum remains strong enough to sustain the 0.4% quarter-on quarter growth pace for a bit longer. Real disposable income is now growing at a pace close to 2%, while unemployment fell to 8.2% in July. On top of that, German fiscal policy is becoming more expansionary, which should sustain consumption in the quarters to come. Although sentiment indicators have fallen back from the extremely high levels seen earlier in the year, they remain at a level signaling sustained growth. All in all, we expect 2.0% GDP growth this year. That said, 2019 and 2020 are likely to see some deceleration, which is not that unusual given the fact that the output gap has now all but closed. The more forward-looking indicators like the credit impulse or the OECD leading indicator confirm that the growth pace has left its peak behind. We anticipate a 1.7% expansion in 2019 and 1.5% in 2020.

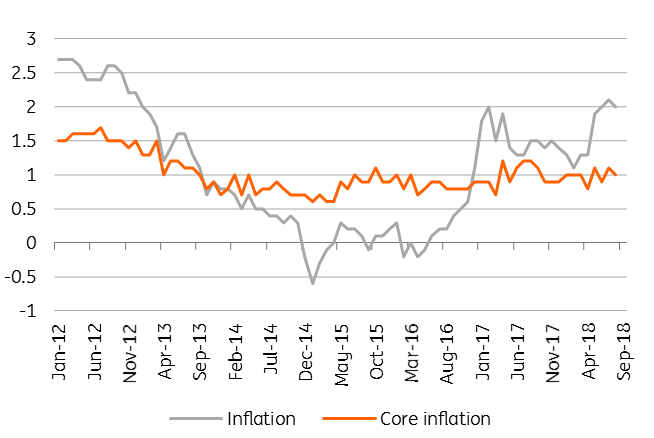

Increasing wages should gradually exert some upward price pressures

Headline inflation at 2.0% in August is basically an oil story, as underlying inflation remains stuck at 1.0%. That said, growth in compensation per employee increased from 1.8% in the fourth quarter of 2017 to 2.0% in the first quarter of 2018, while growth in negotiated wages increased from 1.5% to 1.8% in the first quarter of 2018. So the trough in wage growth now looks behind us and the Phillips curve relationship, which still holds according to recent research by the IMF, is pointing to further upward wage pressure, which should ultimately also push core inflation higher. However, this is likely to be a very gradual process as inflation persistence in the eurozone can be important, meaning that a period of low inflation has a tendency to keep a lid on future inflation.

Core inflation is stuck at 1%

The scope for more rate hikes is very limited

The ECB remains at ease with its exit strategy, stopping the net asset purchases by the end of this year and starting the interest rate hike process in the second half of 2019. While we see the deposit rate at 0% and the refi rate at 0.25% by the end of next year, this is largely a normalisation process. After that the ECB will tread more cautiously in tightening monetary policy. Our end of year forecast for the refi rate in 2020 is only 0.50%. One has to bear in mind that with markets starting to anticipate a slowdown in the US, pushing down the dollar, the scope for monetary tightening in the eurozone will indeed be very limited.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

EurozoneDownload

Download article

7 September 2018

Global Economic Update: Peak Trump? This bundle contains 6 Articles