Eurozone: Growth party with euro headache

The Eurozone growth story looks to be continuing into January but subdued inflation and rapid euro strengthening mean that the ECB will have to tread carefully when removing monetary stimulus

2017 saw the strongest growth in 10 years

With 2.5% GDP growth in 2017, the Eurozone economy recorded the strongest expansion in 10 years. On top of that, 2018 saw a strong start, with the composite PMI surging to its highest level in 12 years in January. While real activity does not necessarily match sentiment indicators (the PMI suggests 1% non-annualised GDP growth), there is no denying that the current batch of economic data signal above-potential growth.

Consumption should be an important growth engine in 2018

Whereas last year consumption growth remained below the overall growth rate, we expect household expenditure to be a strong growth driver this year. Indeed, the assessment of the labour market is at the strongest level since the year 2000. Higher employment, gradually rising wages and a declining savings rate should boost consumer spending this year. At the same time, investment and construction look to be in for another bumper year.

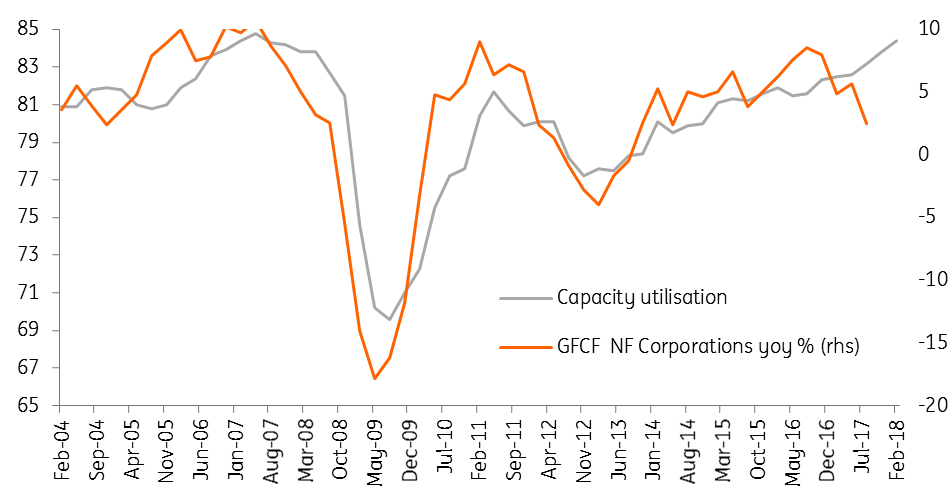

Corporate investment for a bumper year

The stronger euro might temper the expansion in the second half

However, the markets’ attention is now shifting towards the strength of the euro exchange rate. Since the beginning of November the euro has gained more than 7% against the dollar. While it is too soon to detect an impact on growth or inflation, one shouldn’t completely downplay the potential harm of a sudden currency appreciation, even when the strengthening is based on an improving economy. Export volume expectations in the manufacturing sector, though staying at a high level, declined slightly in January, while the assessment of the competitive position also diminished marginally. If sustained, euro strength will probably cause a gradual growth deceleration in the second half of the year.

Inflation expectations are up but currency strength might reverse the trend

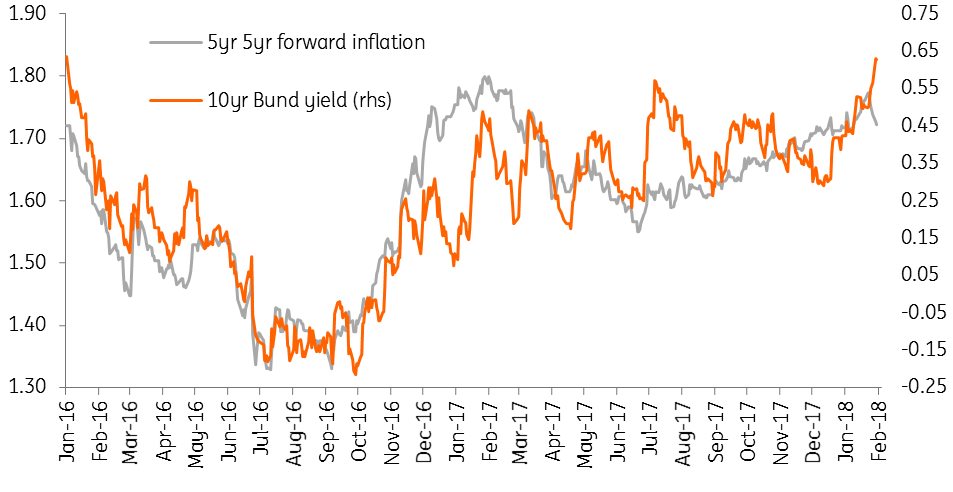

For the ECB the strength of the euro complicates the outlook for monetary policy. A number of reports are signalling rising pipeline inflation. And markets have been scaling up their long-term inflation expectations. On the other hand, a stronger currency and a stabilisation or slight decline in oil prices point into the opposite direction. According to the bank’s models, a 1% effective appreciation of the euro results in a 0.1ppt lower HICP inflation rate after one year. Headline inflation in January came out at 1.3%, while core inflation was 1.0%, still significantly below the ECB’s objective.

No reason to expect early exit from loose monetary policy

In that regard, the dovish statements of the ECB’s chief economist Peter Praet look important: “Even if incoming data were to validate the expectation of a gradual build-up of inflationary pressures, this would not be sufficient to affirm a sustained adjustment, if even less supportive monetary policy conditions were to imperil the inflation trajectory”. While a number of central bank governors have recently pleaded for a timely end to the quantitative easing programme, there still seems to be consensus to have a short taper after September. This means that we maintain our scenario of an end to the QE programme in December and a first deposit rate hike by the summer of 2019. While we think that a gradual increase in bond yields looks likely in that regard, it would not be abnormal to see the recent abrupt rise in bond yields partially reversed, before heading higher again.

Italian elections unlikely to result in a strong government

On the political front, the Italian political landscape continues to shift in the run-up to the March elections. The departure of the 5 Star Movement’s founder, Beppe Grillo, opens up the possibility of coalitions with other populist parties like Lega Nord. This is a risk, as Lega Nord is against the euro, but we don’t believe that such a coalition would be able to clinch a majority. That said, the fragmentation of Italian politics is likely to result in weak governments. While this may not upset markets in the short run, it could become a problem when the next downturn arrives.

A Greek exit out of the third bailout programme seems heroic

Meanwhile, we are also nearing the end of the third Greek programme, meaning that Greece will have to stand on its own feet from 20 August onwards. The government very much hopes for a “clean exit” like Ireland and Portugal, but with Greek bonds still rated as junk (and therefore not eligible anymore as collateral at the ECB if Greece is no longer in a programme), some form of assistance, such as a precautionary credit line, still looks needed. That could be this year’s summer story.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article