Germany: Late is not too late

Between the late-cycle and the golden decade, the German economy is experiencing an unusual fluctuation in high-frequency data but the underlying trend remains robust. Could feel a bit like an Indian summer of sorts for a while

Contrary to the national football team, the German economy didn't have a rude awakening at the start of the summer. Instead, the economy returned as an outperformer of the Eurozone. The economy grew by 0.5% 2Q18 from 0.4% in the first quarter, on the back of strong domestic demand.

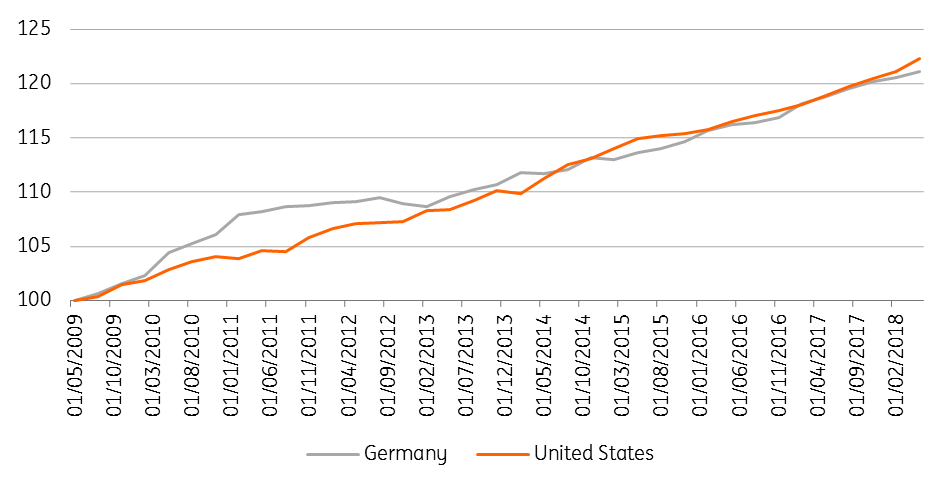

Like the US, Germany faces the question whether an economy in its tenth year of expansion is about to slow down or whether the old saying that economic recoveries never die of old age still holds

At face value, the current expansion remains impressive. The economy has been on a growth path for 34 out of the last 37 quarters, private consumption has been growing for 18 consecutive quarters, and even investments have started to increase significantly over the previous two years. Despite the international criticism, the German economy is already showing a very balanced growth model.

Like the US economy, Germany faces the same question whether an economy in its tenth year of expansion is about to slow down or whether the old saying that economic recoveries never die of old age still holds.

Cycling together

(GDP, Q2 2009 = 100)

Several arguments in favour of the golden decade's protraction

The positive take on the economic outlook is based on a continuation of favourable external factors and solid domestic demand. Low-interest rates and a weak euro exchange rate should provide the economy with enough steroids to maintain its current growth pace. Also, the government's decision to deliver on its election promises regarding a series of social policy measures should give domestic demand another push next year. Over the summer months, the government agreed to tax relief, pension increases and lower social security contributions to the tune of some 0.4% of GDP.

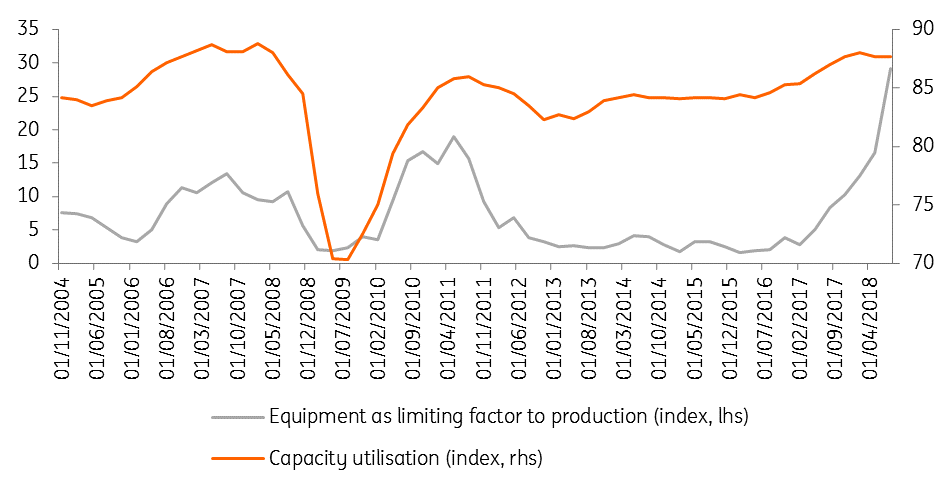

The biggest trump card for German growth in the years ahead is probably investment

The biggest trump card for German growth in the years ahead is probably investment. Recently, economic activity has increasingly been affected by supply-side constraints. While capacity utilisation is now at its highest level since 2008, the lack of skilled employees and adequate equipment has never been a more limiting factor to production than now. This simply means the economy urgently needs more investments, which it will eventually get but just not as quickly as one might have hoped.

Increasing supply-side constraints

Downside risks don't only stem from the external environment

The biggest risks to the positive outlook are clearly external. Even though up till now the trade war has hardly left any marks on the German economy, further escalation between the US and the EU and/or China would affect the export sector.

Lack of structural reforms, drop in international competitiveness particularly in the areas of digitalisation and education, and problems in strategically important sectors all bear the potential to hamper

For the time being, the EU seems to be off the US radar, but the list of German export partners getting hurt by sanctions, tariffs or economic crises is getting longer. Just think of China, Russia, Turkey, Iran or potentially the UK. If this trend continues, the recently witnessed restrengthening of Germany’s Eurozone trade partners would not be sufficient to offset adverse effects from a fully-fledged trade war.

Admittedly, not all risks stem from the outside. The lack of structural reforms, drop in international competitiveness particularly in the areas of digitalisation and education, and problems in strategically important sectors all bear the potential to hamper German growth significantly. However, it is near impossible to predict when any of these structural shortcomings will start to show up in macro data.

Domestic politics has become more complex

Against the above background, ongoing tensions and developments in domestic politics matter.

The integration of refugees remains one of the most heated discussions in German politics. Over the summer, tensions within the government on border controls but also a further rise in polls for the Alternative for Germany (AfD) on the back of riots in Saxony shows how fragile the often-referred-to political stability in Germany actually is.

The next important milestone for German politics will be the regional state elections in Bavaria on 14 October. These elections and the political goal for the Bavarian CSU (the sister party of Angela Merkel’s CDU) to defend the absolute majority of the last elections have been the basis for several tensions within the federal government. The CSU is afraid that it could lose the absolute majority as conservative voters move on to the AfD, illustrating the side effects of the CDU/CSU’s shift towards the political centre under the long leadership of Angela Merkel.

Significant losses in the Bavarian elections could push the CSU to more extreme positions within the federal government, leading to new tensions and complicating the last years of what still looks like Angela Merkel’s final term in office.

The trend of the last few months, i.e. a permanent seesaw of disappointing and impressive macro data, will continue. Maybe this is simply what characterises a late-cycle economy.

But all of this is assuming a very gradual end to QE and monetary policy normalisation as well as no further escalation of the trade conflict between the US and the EU.

The German economy in a nutshell (%YoY)

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

17 September 2018

ING’s Eurozone Quarterly: A late-cycle economy? This bundle contains 13 Articles