Eurozone: Gauging possible supply chain disruptions from Covid-19

As Covid-19 goes global, supply chain risks to the eurozone economy have increased materially. Our analysis finds risks to the eurozone mainly come from China and Italy

As coronavirus spreads, one big question is how much will the eurozone economy be impacted. Obviously, there are several channels through which the eurozone economy will be affected - for example, weaker demand from China and other Asian countries, the impact of preventive measures and increased uncertainty in general. But supply chain disruptions are a big one. As factories shut down, production becomes increasingly fragmented worldwide, and this can have a significant impact on eurozone production.

To gauge the eurozone's overall supply chain exposure to Covid-19, we use eurozone value chain exposure to four countries that have seen the most cases of the virus except Iran. This leaves China, Korea and Italy.

Using the intercontinental input-output tables of the OECD, we estimate value-added of China, South Korea and Italy in the total output of Eurozone countries. This is the sum of intermediate inputs produced by the affected countries used in final goods produced by eurozone countries. For example, a car part from China used in German car production. Indirect inputs are also included in this estimate, think of a Korean semiconductor that is used in an electronic component imported from the US by a eurozone producer. Sounds complicated? That’s because global supply chains usually are these days.

The countries that rely most on Chinese intermediate inputs for their production are Slovakia, Estonia and Slovenia

We find that the exposure of the rest of the eurozone economy to Italian intermediate inputs is not as large as one would expect. While in general, the golden rule holds that proximity increases the impact on a country’s economy, this is not necessarily the case for Italy. The rest of the eurozone’s exposure to Chinese production is, in fact, larger than the exposure to Italy at 0.8 and 0.6% of eurozone value-added respectively.

The Korean exposure to eurozone production is far smaller at 0.1% and therefore poses a much smaller risk. However, if inputs are essential and difficult to substitute, they may have a material impact on the supply chain when unavailable, despite the smaller contribution of Korean industries.

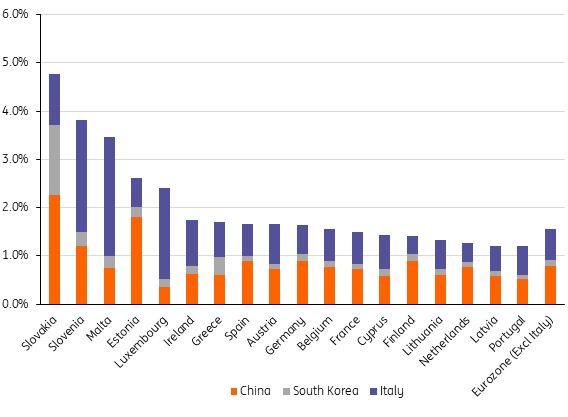

Fig 1: Country exposure to COVID-19 affected countries

Country exposure as % value added of affected countries in country output.

Large differences in terms of country exposure

Take countries like Slovakia, Slovenia and Malta for example as they have a relatively large exposure to Italy, bringing them to the top of the list in terms of eurozone countries overall exposure to the three countries at 4.8%, 4% and 3% of value-added.

Larger economies like Germany, Spain, France and the Netherlands have an exposure of around 0.8% to China

The countries that rely most on Chinese intermediate inputs for their production are Slovakia, Estonia and Slovenia at 2.3%, 1.8% and 1% of value-added. Larger economies like Germany, Spain, France and the Netherlands have an exposure of around 0.8% to China. Slovakia is the only eurozone country with material exposure to Korea at 1.5% of value-added. For Italy, neighbouring Slovenia and Malta both have sizable exposure of 2%, while Luxembourg and Slovakia also have exposure of above 1%. France, Germany and Spain all have similar exposures to Italy at 0.7, 0.7 and 0.6% of value-added.

By sector, textiles, electronics and electrical equipment rank high on the list. Thanks to exposure to both Italy and Germany, vehicle and other transport production are also high up on the list, which have already been struggling with supply-side issues after the new emission standards.

Even though Korea has an important role in the global supply of semiconductors, the exposure of eurozone electronics to Korean inputs is limited compared to Italian and Chinese exposure. But, even small disruptions can have a material impact.

Fig 2: Eurozone sector exposure to COVID-19 affected countries

Sector exposure as % value added of affected countries in sector output.

Supply chain exposure in value terms is not linear. An essential input but low in value could still cause the shutdown of an entire supply chain if unavailable. The exposure in terms of value-added should be seen as indicative for the potential number of essential parts in a supply chain produced by the affected countries.

As the impact on total GDP seems small, one might think that the impact will be minor, but small disruptions can cause disruptions in production much larger than suggested by these numbers.

This is why it is difficult to gauge where production will be disrupted most, but differences in exposure to China, Korea and Italy show which countries and sectors on average have a higher chance of being affected.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

9 March 2020

In case you missed it: Pandemic pandemonium This bundle contains 13 Articles