Eurozone: Full speed ahead

The Eurozone economy is set for a fourth consecutive year of above-potential growth in 2018. While the output gap is gradually closing, inflation is only expected to rise very slowly, keeping in place expansionary monetary policy throughout the year

It's all systems go!

The Eurozone recovery seems to be going into overdrive. As far as confidence indicators are concerned, 2017 ended with a bang. The European Commission’s economic sentiment indicator (ESI) surged to 116 in December from 114.2 in November. The Business Climate Indicator rose to 1.66, hitting its highest level since 1985. Since October 2016 the Economic Surprise Index has been continuously in positive territory, reflecting an uninterrupted stream of economic indicators coming out better than expected.

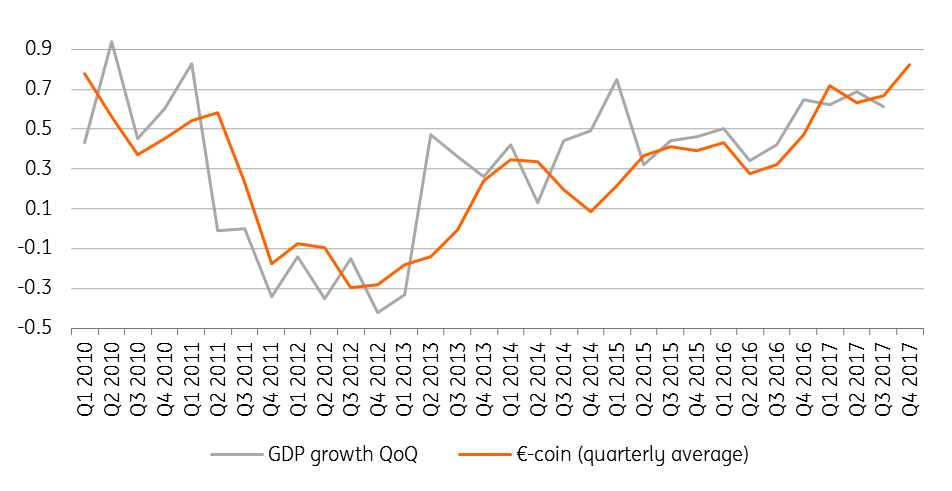

The €-coin indicator, a proxy for the underlying growth momentum, hit 0.91% in December, suggesting an above 3% annualized growth pace. While we doubt that this pace will be maintained throughout the year, we believe that GDP growth in 2018 will be at least as good as in 2017. That would be the fourth consecutive year of above-potential growth. With employment rising 0.4% in the third quarter, December consumer confidence hit its highest level since January 2001, boding well for consumer expenditure.

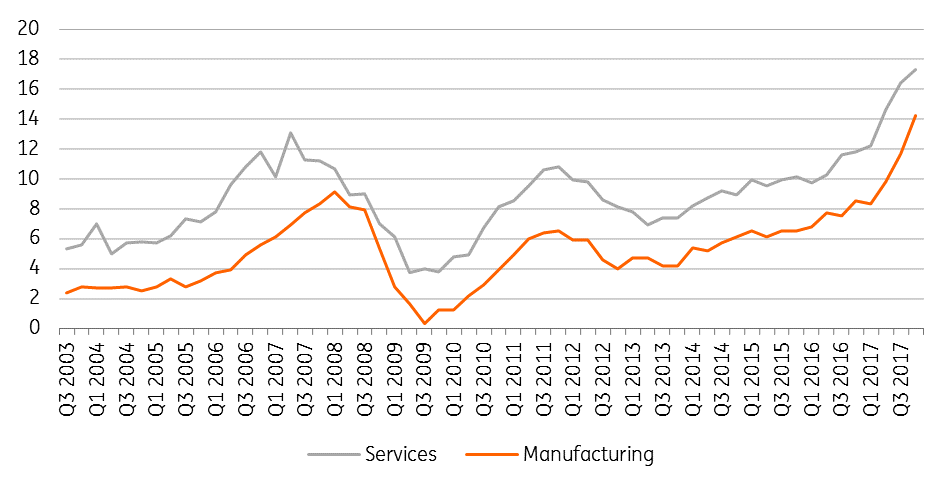

Rising supply constraints and generous financing conditions are likely to continue to underpin the business investment revival. Notwithstanding the strong euro, export perspectives remain upbeat. The rebound in global investment is particularly helpful for Eurozone exports. The assessment of export orders in the manufacturing sector is now at the highest level in 10 years.

Growth pace continues to accelerate

The political angle

True, politics could still cause havoc, but probably not enough to spoil the growth party, we believe. With the pro-independence parties still holding a majority after the regional elections in Catalonia, the problem is not going to be solved rapidly, though we don’t think that the Spanish economy will suffer significantly from the current stalemate. That said, some negative impact cannot be avoided. The budget for 2018 has still not been approved, as the Basque National Party is refusing to support the draft budget of Rajoy’s minority government, as long as the Catalan issues have not been settled.

Some difficult political problems remain

In Germany, there is still no new government, which is quite unusual for the country. It is still unsure whether SPD party members will give the green light to another grand coalition. However, the biggest problem that the current power vacuum creates is rather European, as in the current circumstances Chancellor Merkel doesn’t have a mandate to support ambitious reform plans for the Eurozone. A new grand coalition might be more “euro-minded”, one of the demands of Martin Schulz, but it remains to be seen to what extent this is true in practice.

Finally, 4 March has been set as the date for the Italian general elections. At this moment no clear winner looks likely, which will make the formation of a workable coalition difficult, but we consider the likelihood to have an anti-European government quite small (about 10%).

What could spoil the party?

Of course, we cannot exclude sudden shocks on financial markets, which could also temper the growth momentum. As a matter of fact, it would be a surprise if the low volatility and depressed risk premia would remain in place for the whole of the year. In that regard, it still looks wise not to overdo the expectation of continuing above-potential growth.

Be careful not to get too excited

That said, we believe that 2018 GDP growth will come out at 2.4% on the back of a strong base effect and the current growth momentum. From the second half of the year onwards, growth is likely to start converging gradually towards the longer-term growth potential, which for the Eurozone is definitely below 2%. The European Commission now actually expects that the output gap will already become positive in 2018, which limits the potential to continue to expand at above 2% growth rates.

Limits to production

The inflation conundrum

The inflation story is puzzling us. Pipeline inflation is definitely rising, while the labour market is tightening.

Pipeline inflation is rising rapidly

But we still have some doubts about the speed of transmission into higher inflation rates. In the PMI Manufacturing Survey businesses reported elevated rates of inflation in both output prices and input costs as supply chain pressures increase, with average vendor lead times lengthening to one of the greatest extents on record.

The unemployment rate, standing at 8.7%, has now been declining continuously since May 2013 to reach the lowest level since January 2009. Looking at the hiring intentions published in the European Commission’s Economic Sentiment Survey, this decline is bound to continue. Indeed, in December employment plans reached the highest level in 30 years in industry, while they also improved in construction (to a 10-year high) and in services. The unemployment rate is, therefore, most likely to fall below 8% by the end of this year.

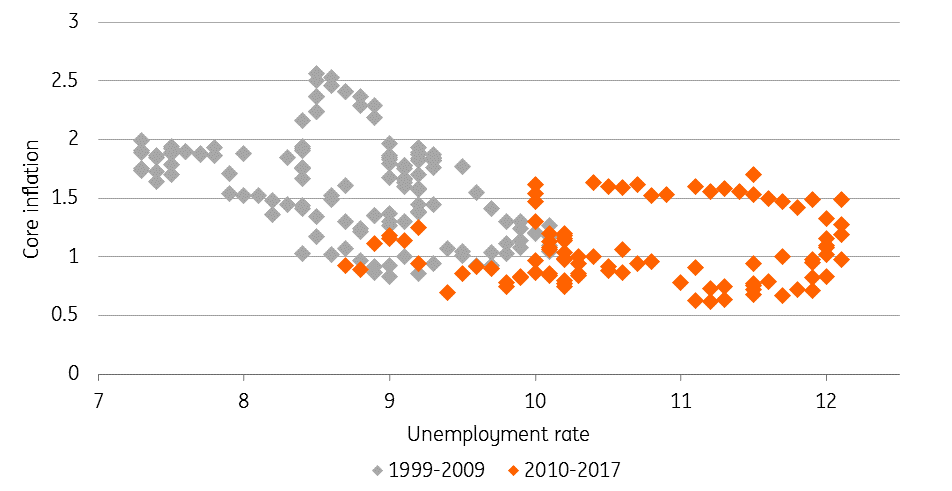

Phillips curve has flattened

A renewed focus on wages

With the percentage of companies mentioning the scarcity of labour as a factor limiting production now at the highest level since the start of the monetary union, wage growth should start to pick up. Annual growth in compensation per employee rose already from a low of 1.1% in the second quarter of 2016 to 1.7% in the third quarter of 2017 and we believe that this trend will continue in 2018.

In Germany IG Metall (where, admittedly, labour tightness is the most advanced), the trade union for the metal and electrical industries, started nation-wide "warning strikes" to support its demand for a 6% pay-rise and a 28-hour working week. Of course, this is not necessarily going to be the outcome of the wage negotiations, but gradually rising wages look likely in an environment of tightening labour markets. That being said, the amount of slack still present in the European labour market means that the increase will be rather at a snail’s pace. Core inflation will probably also grind higher, though from its very low current level of 0.9%. Looking at the relatively flat Phillips curve, a fall of Eurozone unemployment to 8% by the end of the year, will probably push core inflation to around 1.5%. That’s a step in the right direction, but far from an inflationary shock.

The ECB's next moves

Nevertheless, with the growth picture looking very strong, the calls to end the ECB’s expansionary monetary policy will grow louder. The president of the Bundesbank, Jens Weidmann repeated in an interview with Spanish daily El Mundo that the ECB should set an end-date for its asset-buying program. That said, a majority within the Government Council will want to avoid the repeated mistake of premature tightening, certainly given the stubbornly subdued inflation dynamics.

Watch for subtleties in the ECB's communication

But even if backpedalling on its announced QE timeframe looks out of the question, a small change in communication is not to be excluded. Indeed, from the minutes of the December meeting, it transpired that “the view was widely shared among members that the Governing Council’s communication would need to evolve gradually, without a change in sequencing, if the economy continued to expand and inflation converged further towards the Governing Council’s aim”. We still expect a short lengthening of the asset purchase program until December 2018, to allow some further tapering. While net asset purchases will definitely have ended at the start of 2019, a first rate hike might have to await the summer of 2019.

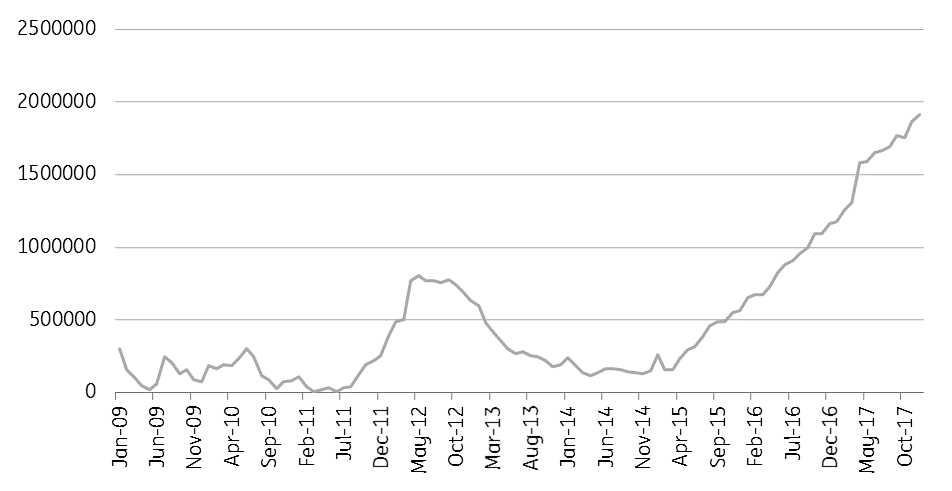

Excess liquidity likely to increase further

Excess liquidity

On the back of the ECB’s QE program excess liquidity is likely to hit €2000 billion in the course of 2018 and start only to decline very slowly in 2019. As the enormous excess liquidity keeps money market rates close to the ECB’s deposit rate, they will most probably remain in negative territory until the summer of 2019. As for bond yields, we believe the QE program will limit the upward shock on yields. However, some contagion effect from higher US yields and the expectations that in 2019 net purchases from the ECB will end is likely to result in a gradual upward trend.

Eurozone economy in a nutshell (%YoY)

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

18 January 2018

Our ECB decision day guide This bundle contains 4 Articles