Belgium: Still rich, but not like before

Expressed as a percentage of GDP, Belgian households have the highest net financial wealth in the Eurozone, which is a key element of the country’s financial stability. But keep an eye on the low saving ratio and the growth of household debt that is currently slowing down the growth

Strong household wealth

Many indicators can express the financial stability or vulnerability of a country. Markets often focus on the public debt, but this is just one aspect of the complex reality. Financial wealth accumulated by households is one of the many other factors that contribute to the financial situation of a country. As an example, this wealth could potentially be used to compensate for the lack of external investors in the country's public debt during a market turmoil.

Belgium leads the way in terms of net financial wealth, and this situation isn't changing anytime soon. With a total of €1,340 billion or slightly more than three times the GDP, the gross financial wealth accumulated by Belgian households is certainly a key element of the financial stability of the country. Relative to GDP, it is the second highest level in the euro area, with Netherlands being the first. Also, the total debt of households is far lower than any other country.

Having said that, the net financial wealth of Belgians has stopped growing at the beginning of this year. In fact, it declined to €215,000 per household from €217,500 in 2017. Apart from the fact that the total number of households is continuously increasing, this downward evolution (the first since 2008) is the direct consequence of several factors.

Net financial wealth of households across Eurozone countries (% of GDP)

Less growing wealth

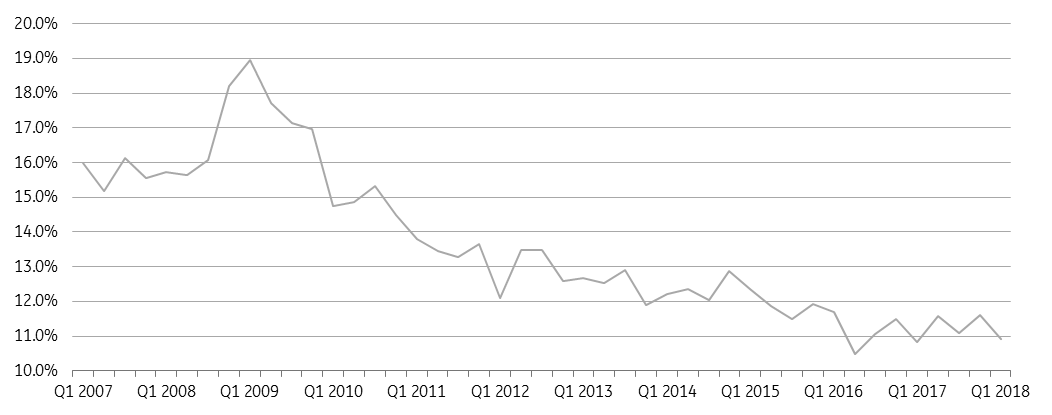

First, the gross financial wealth of Belgian households is rising at a slower pace than before, mainly because saving flows originating from income have dwindled since the second half of 2015. This is a direct consequence of the downward trend in the saving ratio over the last few years, as it has dropped from 19% of disposable income in 2009 to around 11% for the time being.

Belgian households’ saving ratio (as % of disposable income)

Low yielding assets

Secondly, the wealth composition is focused on low-yielding assets, such as savings and current accounts.

These accounted for 27.5% of total assets in the first quarter of 2018, while only 24% of the portfolio is made up of risky assets in the form of securities or shares, bonds, and mutual funds. This composition limits the exposure of Belgian households’ portfolio to market fluctuations. But the downside of this cautious behaviour is that, in an extended period of low interest rates, it reduces the growth of their wealth.

On top of that, assets already held by households saw their increased value eroded by the events in the stock markets, mainly in the first quarter of 2018, which also didn't help much in improving their financial wealth.

Higher debt

Thirdly, net financial wealth is also being affected by Belgians' indebtedness.

While assets have only risen by 0.4% year on year in 1Q18, debts have jumped 4.4% YoY, or €12 billion (the biggest jump in the last five years), to reach €282 billion (of which 81% are mortgage loans) - equivalent to 110% of households' gross disposable income and 64% of GDP.

This growth is mainly down to looser conditions for granting loans, as observed by the National Bank of Belgium for 2017 in its latest report on financial stability.

The most recent households’ balance sheet numbers confirm the leader status of Belgium in terms of financial wealth but also ask to keep an eye on the future evolution of several factors, including the saving ratio and the total household's debt.

Finally, let’s not forget these numbers are just averages. They don’t say anything about the repartition of the financial wealth. Data from the National bank shows that there is more inequality in the total distribution of wealth in Belgium than in the distribution of income, with the richest 5% holding almost 30% of the total wealth.

Without property assets, and not even taking into account those households who have no financial wealth, the gap between the richest and the poorest is one of the most significant in the Eurozone: the richest 10% of Belgians have financial wealth 13 times greater than the median Belgian.

However, as a result of widespread home ownership (around 70% of Belgians are homeowners), the inequality in the distribution of wealth is far lower in Belgium than in its neighbouring countries.

See the full publication about the financial wealth of Belgian households here in French or Dutch here.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

BelgiumDownload

Download article