Belgium: An election year in sight

The Belgian economy continues to grow at a moderate pace. Having said that, the labour market is still doing well. In the short term, we don’t expect many economic policy changes, as the long election period has just begun

Weak consumption

Despite being positive, Belgian economic growth disappointed once again in the first half of this year at 0.3% and 0.4% in the first and second quarter respectively.

What is interesting is that while domestic demand was the biggest contributor to economic growth in 2017, things seem to be changing this year. Foreign trade contributed as much as domestic demand in the second quarter of this year, while the contribution of inventory changes was negative. Unfortunately, we can't say foreign trade contribution increased, but rather it was the domestic demand that decreased.

Domestic demand was the biggest contributor to economic growth in 2017, things seem to be changing this year

The evolution of household consumption remains the main handicap to more dynamic domestic demand. It increased only by 0.2% in the first half of the year, which is very low. For sure, households nominal disposable income rose in the second quarter by 2.9% year on year. This is due in particular to a decent increase in employment (+39,000 jobs during the first six months of the year).

However, considering the nearly 2% inflation, this leaves little room for consumption to increase in real terms. As a consequence, Belgian households have once again reduced their savings rate, (which is now below 11% and remains below the European average) to maintain the weak growth rate of consumption.

GDP growth contribution (percentage point)

Better conditions for growth, but...

The important question is therefore whether household consumption will accelerate over the coming quarters.

We can't exclude that the savings rate won't fall further, allowing consumption to improve, however, in the second half of the year, other factors should play favourably.

On the one hand, steady jobs creation will continue to fuel household disposable income. On the other hand, a wage indexation of civil servants and employees will take place in the very short run, while at the same time inflation should decrease somewhat.

This is why we believe growth should at least continue at the current pace. and if we're lucky, maybe even speed up a bit. In this case, GDP growth is expected to reach 1.6% this year and 1.7% next year provided that trade tensions don't escalate as that would undeniably be a negative shock for economic growth in Belgium, given its importance.

Election year

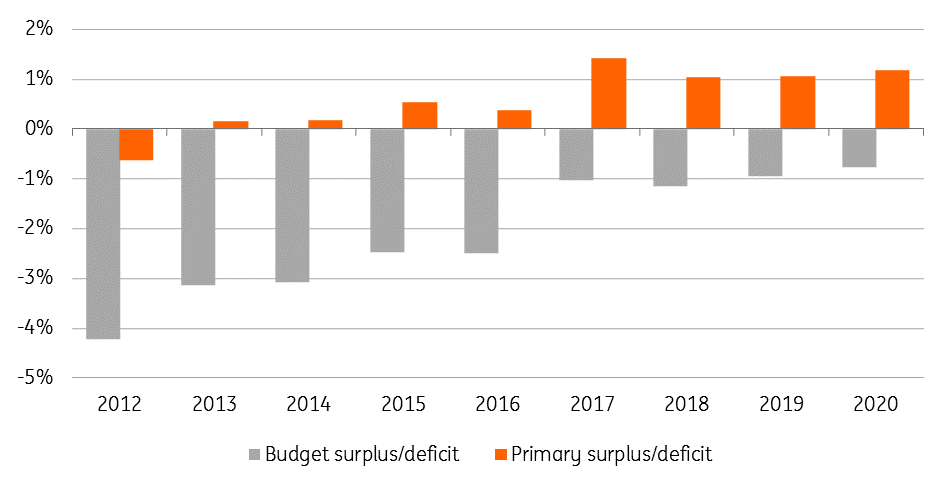

In the current climate, it'll be difficult to further reduce the public deficit by 2020, which as a reminder went down from 2.5% of GDP in 2016 to only 1.0% in 2017. All the measures taken up till now should make it possible to maintain this level next year, but much harder to improve it.

This is all the truer as new economic policy initiatives are not likely to be taken in the coming months. Indeed, an election year has just begun. On October 14, local elections will be held and on the 26th of May 2019 the federal, regional and European elections will take place.

Local elections aren't the best time to assess the underlying strength of the different political parties. In many municipalities, citizen lists are proposed, or parties join together on a common list. It is only in the big cities that all the traditional parties are represented. This poll will nevertheless be an opportunity to assess the weight of some extremist or populist parties, but this will only give a partial picture. Afterwards, the preparation of the general elections of May 2019 will begin.

In this situation, it is likely that compromises to launch new economic policy initiatives will become increasingly difficult to reach. Indeed, let’s remember that (i) the federal government brings together parties with very different objectives; (ii) only one French-speaking party is in the federal majority, which means that there is no majority in the French-speaking part of the Parliament and (iii) the federal and regional governments are formed of different coalitions. Therefore, it is not clear that the parties currently in power will be able or even want to maintain the current coalitions after the elections, making it more unlikely that they want to allow their coalition partners any success on new policies in the run-up to the elections.

The recent announcement of the launch of a strategic investment pact could, therefore, be the last major project of the federal government. In concrete terms, this aims to strengthen investments in six key areas: digital, cybersecurity, education, health care, energy, and mobility. An amount of € 150 billion has been agreed by 2030. That said, the funding mechanisms will involve public-private partnerships. This is not, in itself, a net increase in public investment, but rather a political incentive to concentrate the resources available in certain sectors. So we don’t expect much from this announcement, certainly not in the short run.

Public deficit has been considerably reduced…but is now likely to stabilise

Conclusion

So, the Belgian economy isn't doing that bad after all; though, as we've said, it could do better. Ultimately, it remains highly dependent on the international economic context, and the risks that weigh on it.

In terms of domestic policy, major reforms have been undertaken in recent years to structurally improve public finances and make the Belgian economy more attractive. But this reform package is coming to an end now, as a long series of elections begins.

The Belgium economy in a nutshell (%YoY)

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

17 September 2018

ING’s Eurozone Quarterly: A late-cycle economy? This bundle contains 13 Articles