Energy Outlook: European utilities driven by higher tariffs and investment

While many smaller energy companies are struggling, larger ones are doing well. This year we expect an average 6% EBITDA growth in the European utility sector and the issuance of €35bn of green bonds

These are great times for European utilities, but not all of them

In 2021, power and gas consumption recovered across Europe. At the same time, power and gas prices reached incredibly high levels on the back of the economic recovery in most European countries. Other elements also played a crucial role in pushing up prices, including natural gas shipment shortages, high carbon prices, and the decommissioning of coal power plants.

Costly power and energy tariffs have become a challenge for a number of energy-intensive sectors. As a whole, we believe that the European utilities sector will benefit strongly from the elevated prices, but not every player in the sector is benefiting – smaller utilities, most of them pure retailers, have declared bankruptcy due to margins being squeezed.

The energy crisis and its implications for utilities

In the UK, more than anywhere else in Europe, elevated power and gas prices have turned into the most acute crisis for the weakest players in the sector, mostly energy suppliers without any power-generation assets. With business models based on contracting new customers on low tariffs in order to gain market share, a large number of retailers have faced a price squeeze in 2021. Last year, some 29 gas and electricity companies declared bankruptcy in the UK.

| 29 |

UK utilities declared bankruptcy in 2021 |

Incumbents gain customers on the back of retailer bankruptcies

Locking clients into mid- and long-term contracts at low tariffs, while they had to buy electricity and gas volumes at wholesale prices that rose steeply over time, is the main reason why UK utilities went bust. These companies, based on a low margin business model to attract customers, either abruptly or progressively sank as wholesale prices continued to spiral upwards, resulting in deep negative operating margins. In the UK, energy supplier bankruptcies affected about 2.6 million customers in 2021.

In order to maintain energy deliveries to residential homes and businesses, the UK regulator assigned the failed customers to other utilities. The winners have been Shell Energy, EDF, British Gas and E.ON which gained approximately 630,000, 580,000, 530,000 and 250,000 clients, respectively.

With nine energy suppliers going bankrupt in 2021, the Benelux (Belgium, the Netherlands, and Luxembourg) market has been less impacted, but more utilities could fall in 2022

In the Netherlands, seven companies lost their license to operate due to a margin squeeze by the end of December 2021. The biggest bankrupt utility, Welkom Energie, shifted its clients to Eneco, the market leader in the country.

In Belgium, two small retailers – Energy2Business and the Vlaamse Energieleverancier – ceased activity and existing clients were transferred to Fluvius, the Belgian Flemish network distribution company, before finding a replacement utility. More Belgian energy suppliers could disappear in 2022. The company Watz, for instance, asked for protection from its debt holders at the end of 2021.

In France, one energy supplier, Hydroption, went bankrupt in October 2021 having been in difficulty since 2018. Hydroption was the energy supplier of 18,500 corporate clients including the Paris city hall and its branches, as well as cities of the French army. This year could see more bankruptcies. Barry energy (owned by Fortum) and Bulb are in great trouble. The clients of the bankrupt utilities will be handed over to the incumbents operating the local distribution network. Across French territory, 90% of the electricity distribution grids are operated by EDF.

In Spain and Italy, no energy suppliers have filed for bankruptcy due to the energy crisis so far. This can be largely explained by the fact that many consumers pay variable tariffs which are closely linked to the fluctuation in wholesale prices. This has allowed retailers to cover their high procurement costs when wholesale prices surge.

Regulation in the UK and France limits the ability to pass on high energy prices

There are two reasons why utilities do not fully benefit from high energy prices in France and the UK.

1. Regulations in place can restrict passing high energy prices on to customers

If the highest number of bankrupted utilities can be found in the UK, this is in part because of the cap put in place by the regulator, Ofgem, on how much utilities can charge their clients per year.

For a household with a typical energy use, this cap was re-evaluated at £1,277 (+£139) on 1 October 2021. This increase does allow utilities to boost revenues but does not reflect wholesale power prices that grew threefold over the course of 2021. Many energy suppliers continue to sell electricity at a loss. The UK regulator revises the tariffs cap twice a year and it could be revised upwards significantly.

France still has retail regulated electricity and gas tariffs that consumers can choose from instead of signing up for market tariffs.

More importantly, energy suppliers that operate on French territory can buy an aggregated volume of 100TWh per year from the national incumbent, EDF. These volumes have a fixed price of €42/MWh and have benefited EDF’s competitors during this energy crisis with a wholesale price that has remained stable and affordable. Earlier this month, the French authorities announced that the volume will be upgraded to 120TWh, at a price of €46.2/MWh. This 120TWh corresponds to a bit more than 30% of EDF’s total power generation in France in 2022.

While the French government’s measures are meant to partly protect consumers from energy price hyperinflation, EDF estimates it will cost the company some €8.3bn. EDF withdrew its 2022 leverage and result guidance.

2. Clawback taxes could confiscate profits for subsidies distribution to consumers

Already subject to windfall taxes during periods of economic crises in the past, the sector saw this issue reappearing last June. Despite the limited announcements so far, we would not be surprised to see the subject coming back into the spotlight if energy prices stay elevated for a very long time. Windfall taxes imposed on power-generating companies are generally meant to compensate government subsidies to sweeten high energy bills.

With gas and electricity bills expected to increase by 42% and 55%, respectively, in the first quarter of 2022, the Italian government is looking for ways to limit the negative impact of heavy energy bills on the poorest consumers. A package of measures, potentially including clawback taxes on energy suppliers accused of benefiting from windfall gains in this current energy crisis, could be introduced. The Italian authorities, however, want to give themselves the time to study the effectiveness of reintroducing clawback taxes before a final decision is made.

Also in January 2022, the Belgian Federal government announced it was working on a package of measures to limit the impact of high gas and electricity prices. The high profits in 2021 of the utilities operating on Belgian territory have drawn attention.

In June 2021, the Spanish government said it would retain €2.6bn of the profits from utilities generating electricity from renewables and hydropower, given the lower cost of these technologies. The introduction of this taxation resulted in Iberdrola paying €85m, but exemptions brought to the decree in November had positive implications for the company.

Higher energy tariffs and investment will be key growth drivers

The European utility sector remains a defensive one. We had expected to see a much more severe impact of the Covid-19 pandemic restrictions on European utilities’ 2020 financials, but overall the sector’s EBITDA retrenched by around 2% during the height of the pandemic.

After an already strong recovery in 2021, integrated European utilities will benefit from the higher wholesale power prices hedged in 2021 and are expected to remain elevated during 2022. Large previous and upcoming investments in networks and renewables will also boost the sector with a growing asset base and cash flow generation.

| 6% |

We expect the European utility sector’s average EBITDA to grow by 6% in 2022 |

After a very challenging Covid-19 pandemic and accompanying restrictions, the rebound of the world's economies, which is set to continue in 2022, should benefit utilities greatly. We expect European utilities to post a sector EBITDA of approximately 9% for the full year 2021 and to register 6% growth on average in 2022 (excluding the potential impact on EDF’s EBITDA).

EBITDA continues to do well, with integrated utilities outperforming regulated utilities

Earnings before interest depreciation and amortisation, year-on-year growth (%)

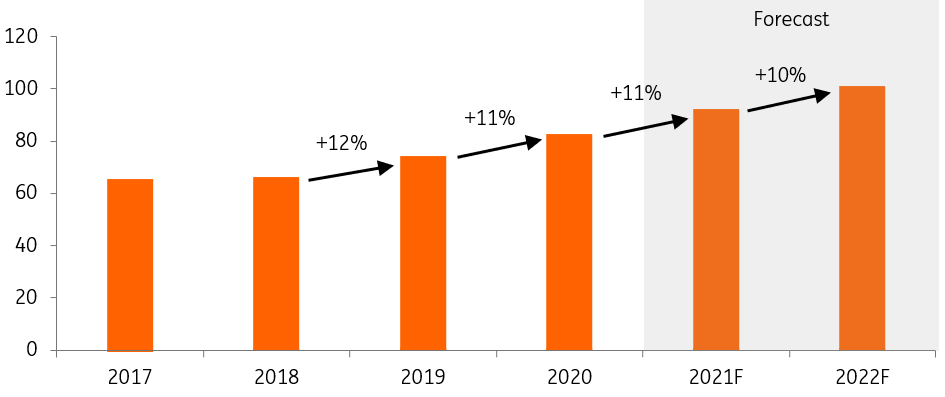

The high investment cycle is set to continue for many years

The Covid-19 pandemic has not stopped European utilities from investing massively. The capital expenditure plan of our sample of 37 European utilities shows that investment will increase by another 10% in 2022.

| 10% |

We expect the European utility sector’s investment to grow by 10% in 2022 |

This is in line with the beginning of the high investment cycle that started in 2019. The 37 European utilities* should reach the €100bn line of investment in 2022. By comparison, they spent a mere €65bn in 2017.

With their international size, integrated utilities form the bulk of the total investment which should see a 9% jump in 2022 vs. 2021 according to the companies’ business plans. However, network companies continue to show the strongest progress with capital expenditure set to increase by 12% in 2022.

European utilities will increase investment again in 2022

European utilities’ investment plans (€bn)

European utilities are at the heart of the green transition

The European Union has a set target for 2030 of a 55% net reduction in greenhouse gas emissions. According to preliminary data published by the European Environment Agency in 2021, the EU's net emissions in 2020 were 34% below 1990 levels. While carbon emissions have declined in all sectors, the energy sector has been at the forefront of the energy transition.

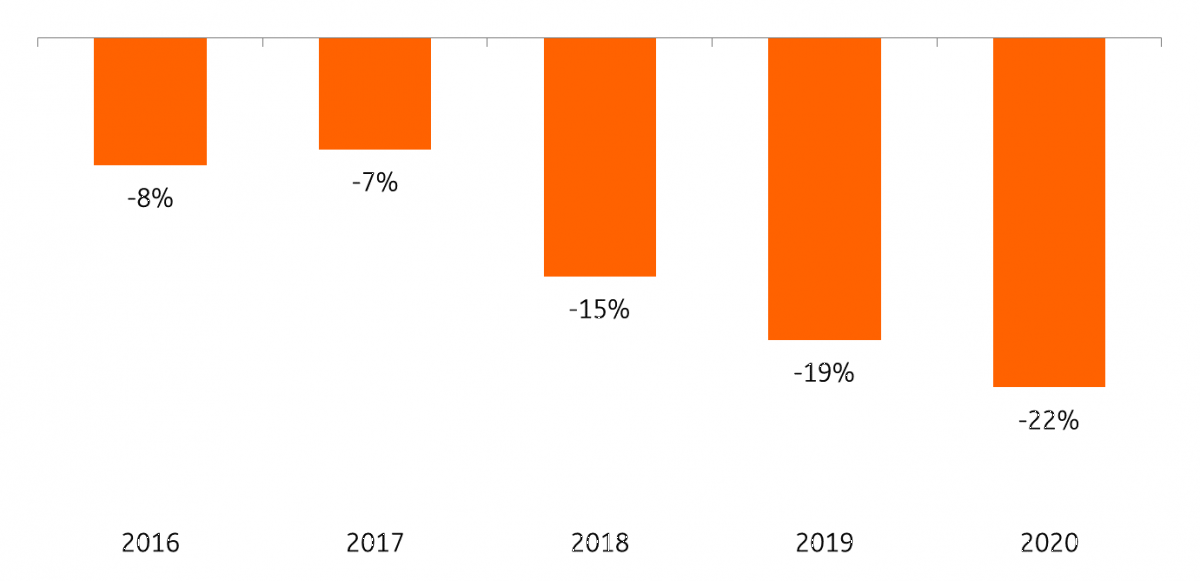

The 15 biggest utilities in Europe halved their carbon emissions between 2016-20

The efforts of Europe's biggest energy players have resulted in a significant reduction of CO2 emissions. Data provided by the 15 biggest utilities in Europe shows that they halved carbon emissions between 2016 and 2020 with a sharp reduction of 19% in 2019 and 22% in 2020.

An important part of the reduction is due to the replacement of the most polluting power-generation assets, notably coal-fired power plants, by renewables. But, part of the carbon emission reduction is also due to asset disposals which do not cancel carbon emissions but transfer them to other owners.

The top 15 European utilities continue to improve on their carbon emissions

Carbon emissions reduction per annum of the top 15 European utilities

Utilities are expected to issue €35bn of sustainability bonds to finance investment

Globally, we expect corporates to issue €100bn of benchmark size sustainability euro-denominated bonds in 2022. By sustainability, we mean green, sustainable and sustainability-linked bonds. This compares with €80bn in 2021 and €38bn in 2020.

These numbers represent 9% of total euro corporate bond issuance in 2020, 27% in 2021, and would account for 35% of total corporate euro bond issuance in 2022. Out of this €100bn, we believe the energy sector (utilities and oil & gas companies) will account for 45% of the total.

| 70% |

of utilities’ euro new bonds will be sustainability bonds |

For utilities alone, we expect another strong increase in the issuance of euro bonds in the sustainable bond market in 2022, with about 70% of the bonds marked as green, sustainable or sustainability-linked. This means some €35bn of benchmark-size bonds out of a total sector issuance of c.€47-50bn. In 2021, 45% of the sector’s new euro bonds were sustainability bonds.

*The 37 utilities in our sample are: A2A, Acea, Alliander, Centrica, CEZ, EDF, EDP, Elia Belgium, Enagas, EnBW, Enel, Enexis, Engie, E.ON, Eurogrid, Fluvius, Fortum, Hera, Iberdrola, Italgas, National Grid, Naturgy, Nederlandse Gasunie, Orsted, Red Electrica, REN, RTE, RWE, Snam, SSE, Stedin, Suez, TenneT, Terna, Vattenfall, Veolia, Viergas.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

26 January 2022

Energy Outlook 2022: Powering ahead This bundle contains 5 Articles