European utilities’ commitment to investment remains high

European utilities are at the heart of the European Union's energy transition plan. Higher operating expenses and the rising cost of debt had cast some doubt on the sector's ambition and ability to maintain investment plans. But targets for 2023 point to further strong progression for capital expenditure

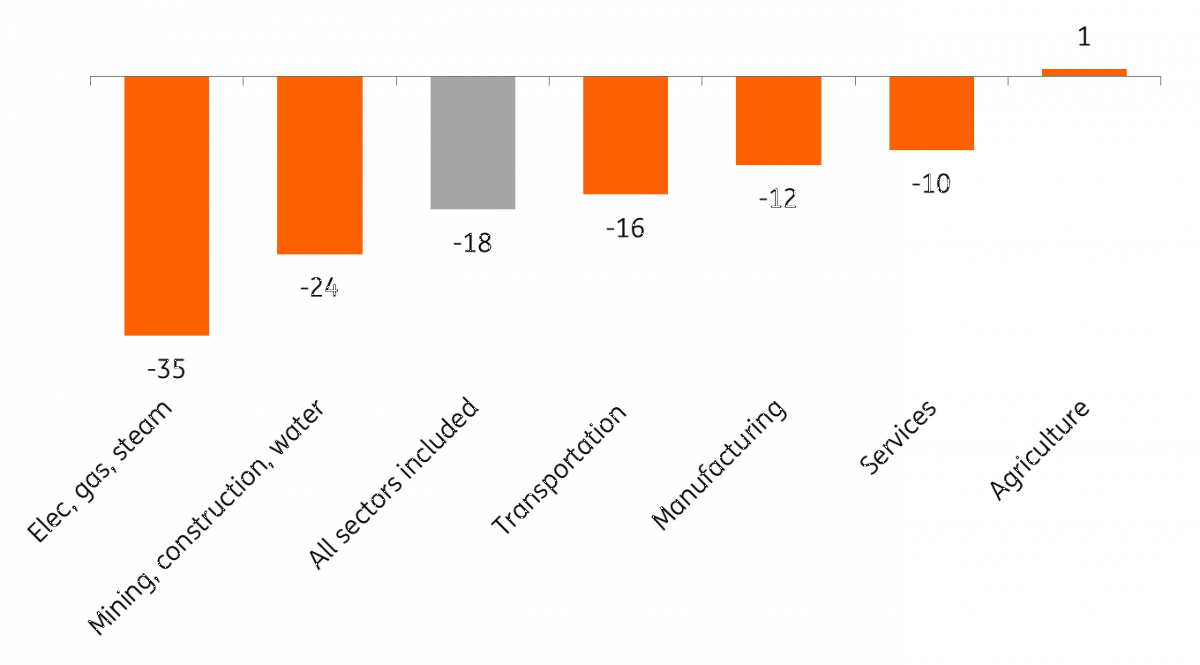

European utilities have made significant progress in reducing carbon emissions

European utilities are at the heart of the EU's energy transition plan. The energy sector has been responsible for the largest carbon emissions in the atmosphere with electricity produced by coal and natural gas power plants. Decarbonisation has already started, and the sector has made important progress. Taking all sectors into account, European economies have lowered their carbon emissions by 18% between 2010 and 2021, according to Eurostat’s statistics. From 1,115m/t in 2000, to 720m/t in 2021, the electricity, gas and steam activities have recorded the strongest reduction in CO2 emissions with a 35% decline over the period.

Utilities have reduced carbon emissions most significantly (% change - 2010 - 2021)

Eurostat, ING

Targets for the next two decades include an 80% share of renewables in the total power generation mix in the EU and a carbon-neutral target objective for most European utilities by 2040. This transition towards more renewable energy and the necessary adaptation and expansion of the grids requires massive investment. For several utilities, capital expenditure entails external funding, and the surging cost of debt could be a threat to the amount of investment that utilities might want to execute. Nevertheless, year-end 2022 financial releases and targets for 2023 show that European utilities will continue to invest strongly.

Top 40 European utilities to invest a total of €128bn in 2023

In our study, we took into consideration the top 40 utilities¹ operating in Europe. The sector is larger than our selected group of utilities. Nevertheless, altogether, these companies represent more than 90% of the EU gas and electricity markets and thus do offer a good picture of the sector’s trends. In 2022, our group of utilities spent a total of €110bn in investment. The utilities provided analysts and investors with their capital expenditure plans for 2023 (and sometimes beyond). In 2023, a total of €128bn will be spent on renewable and conventional energy, grids and other assets and services. The amount represents a 16% increase compared with 2022.

| +16% |

average increase in investment in 2023 vs. 2022 |

Integrated utilities² (utilities operating generation, supply and transmission and/or distribution units) will again account for the biggest share of total investment with 75% of this executed by this sub-segment. Pure network players will account for 25% of the €128bn or €31.5bn. This being said, grid operators see their capital expenditure needs growing faster than integrated utilities. In 2023, electricity and gas network utilities’ investments will surge by an additional 24% compared with 2022. In the period 2017-2023, grid operators will see their investment growing 115% which compares with 78% for European integrated utilities.

European utilities: 2017-2023F investment development (in billion EUR)

Renewables now account for half of capital expenditure

Integrated utilities continue to drive the largest share of total investments (€96.5bn expected in 2023). This is explained by the fact that Europe hosts the largest integrated utilities across the globe in terms of revenue generation and assets base. Their vertically integrated model obliges them to dedicate capital expenditure to the development of their grids, but the largest share of their investment is now dedicated to electricity production, especially through the development of renewables.

| 40GW |

of additional renewable capacity in 2023 made by the top 40 European utilities |

According to the European integrated utilities’ capital expenditure plans, 48% of their investments will be dedicated to renewables, representing about €46bn in total. In 2018, investment in renewables represented 33% of the sub-group’s capital expenditure. The European integrated utilities we studied will develop an additional 40GW of renewable installed capacity in the course of 2023. We estimate that between 70% and 75% of this 40GW will be installed in Europe.

26% of their investments will go into the maintenance and expansion of the gas and electricity networks they operate. The other 26% of the capital expenditure is meant to maintain and build conventional power generation assets such as nuclear and natural gas power plants. This part of the capex plans also includes investments in supply businesses and efficiency programmes to better serve clients.

Investments by segment 2018 vs. 2023F (in %)

Not all investments are earmarked for Europe

Utilities purely focused on energy transmission and distribution grids have made the vast majority of their investments within the continent of Europe. But it is different for integrated utilities. Not only are Europe's integrated utilities the largest in the world, they are also geographically diversified. 30% of the €86.5bn they will invest in 2023 will be spent outside of Europe with North and Latin Americas as their favourite destination.

| 30% |

of European integrated utilities’ investments are dedicated to international markets |

The utilities planning to invest up to 50% of their total investments outside of Europe are mostly based in Southern Europe. Iberdrola, Naturgy, EDP and Engie have established a strong presence in the United States where returns on investment have been more attractive for renewable energy assets. The Biden administration’s sustainability programme and its tax incentives risk attracting even more European investment at the expense of Europe itself. Iberian utilities also have strong ties with Latin and Central America where they have found strong growth potential for renewables and attractive remunerations for electricity and gas grids. German and North European utilities are far less internationally diversified with operations and investments mainly in their respective domestic markets, as well as in the Netherlands, and Eastern Europe.

For network utilities, capital expenditure poses a serious challenge

In 2023, pure electricity and gas network operators³ see further strong growth in investment needs to adapt and expand their grids as energy transition plans accelerate across Europe. Investments are particularly strong in Germany and in the Netherlands where the transition towards renewables has started later than in Southern European countries.

The recent energy crisis and the former reliance on Russian natural gas reinforced the obligation to shift towards renewables. Looking at TenneT Germany, Eurogrid, Amprion, and E.ON’s distribution grids and TransnetBW's (owned by EnBW) 2023 capex plans, some €10bn will be disbursed. This amount does not take into consideration the distribution grids owned and operated by German municipalities themselves, which means that investments in electricity and gas grids are actually much larger in that country.

Investment needs will not diminish in the medium term. A recent draft by the German transmission system operators on their grid development plan for 2037/2045 presents several scenarios. The draft’s B scenario comprising 21,730km of cables to connect new offshore and onshore renewables by 2037 corresponds to an investment need of €198bn. The sum climbs to c.€240bn by 2045.

In the Netherlands, Alliander, Enexis, Stedin, TenneT and Nederlandse Gaunie will invest a cumulative €6bn in 2023, an amount that is also likely to surge in the coming years to accommodate for a growing renewable asset base and the infrastructure required to transport green gas.

The energy transition across Europe is becoming an operational and financial challenge for grid operators. On average, we estimate that pure network utilities’ investments will represent 129% of their cash generation (EBITDA).

For network utilities, cash flow generation is not sufficient to fully finance investments (capex to EBITDA ratio %)

Dutch and German stakeholders will need to put their hands in their pockets again

In Europe, electricity and gas grid operators fall under regulatory frameworks that determine their allowed remuneration through a weighted average cost of debt and equity methodology. The lower cost of debt in previous years limited the remuneration upside and a number of utilities do not generate the minimum financial proceeds to fully cover their investment needs. This is particularly true for German and Dutch utilities.

Dutch grid operators’ response to the lack of organic funding for full capital expenditure is now known. Municipalities and regions have already provided electricity and gas grid operators with equity injections and loans to avoid debt ballooning and credit rating downgrades. These interventions can bring temporary financial relief, but capital injections will need to occur at a more regular pace in the years to come. Alliander, Enexis and Stedin have reached a “framework of agreements” with the Dutch Ministry of Finance and the Ministry for Climate and Energy Policy. The Dutch government will reinforce the DSOs’ capital in exchange for a stake. As far as TenneT is concerned and the 70% share of investments for its German activities, the Dutch state has become very reluctant to inject capital for activities outside its domestic economy. Discussions between the German Federal state and the Dutch government are ongoing and could result in the breakup of the TenneT Group by the end of the year.

TenneT Germany could end up being controlled by the German state in order to allow the appropriate funding for the adaptation and expansion of the electricity transmission network. Other German grid operators, Amprion and TransnetBW have been vocal about their future financial funding needs. Stakeholders will have to put their hands in their pockets again and if this is not sufficient would also contemplate the introduction of a new shareholder (the German federal state) into their capital.

¹ Combination of ² and ³

² Integrated utilities: Acea, A2A, Centrica, Cez, EDF, EDP, EnBW, Enel, Engie, E.on, Fortum, Hera, Iberdrola, Naturgy, Orsted, RWE, Suez, Vattenfall, Verbund, Statkraft, Veolia

³ Network utilities: Alliander, Amprion, Elia Belgium, Enagas, Enexis, Eurogrid, Fingrid, Fluvius, Italgas, National Grid, Nederlandse Gasunie, Red Electrica, Redexis, REN, RTE, Snam, Stedin, TenneT, Terna

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article