Europe’s industry outlook: we’re still riding the energy and pandemic shockwaves

Industrial production growth in Europe has more or less stagnated since late 2020 as the speedy recovery that followed the first round of lockdowns came to a halt. At the same time, the sector is in an incredible state of flux; structural changes around energy and trade are providing substantial challenges for businesses

The pandemic and energy shocks still determine the short-term outlook for industry

The European manufacturing sector has been hit by a number of shocks in recent years, and that's had a big impact on doing business. The pandemic and subsequent supply chain problems, along with the energy crisis, have had a deep impact on performance and have left a lot of uncertainty about which factors will have a lasting impact on the sector and which won’t. In this outlook, we're taking a look at the latest trends in performance and will examine what to expect from supply chain problems, globalisation trends and the energy crisis for the years ahead.

Big differences between sectors result in overall flatlining production

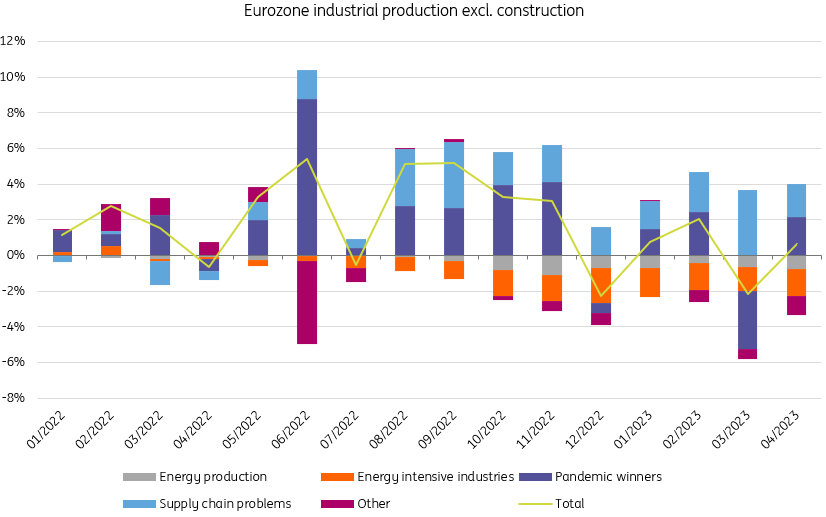

In European industry, the shockwaves from the pandemic and energy crisis hit different sectors at different times, which can be seen in the chart above, where we use eurozone industrial production data broken down into rough categories. It shows that sectoral differences have been substantial. At the start of 2022, the ‘pandemic winners’ – pharma and computer and electrical equipment – was the most important contributor to growth. But as the year progressed, supply chain problems eased, and this resulted in a rebound in production from sectors previously plagued by supply chain issues. Think of the car sector, for example. That said, since the start of the war in Ukraine, the energy-intensive sectors have seen a steady decline in production.

So while overall production growth has been relatively weak, it very much depends per sector how performance has developed. The question is where production is headed from here on. In the short run, it looks like the aftermath of the pandemic works to the sector’s disadvantage. At the moment, surveys indicate that industry is going through a downturn. Businesses indicate sliding production expectations, and new orders continue to come in weak. The surge of post-pandemic catch-up production seems to have run its course as backlogs of work are coming down. At the same time, goods are not very popular as people are spending disproportionately on services to catch up on holidays and other leisure spending. This means that the production outlook for the coming months remains sluggish at best, and a moderate downturn is a realistic prospect.

Our forecasts for industrial production for 2023 through 2025

Structural factors do not necessarily move in European industry’s favour

As the effects of the pandemic wane, the outlook for the manufacturing sector in Europe remains challenging. The key question for the medium term is which changes seen in recent years are structural and which ones will fade once pandemic effects run their course. We expect that energy problems are set to remain with us for the medium term in Europe, while supply chain problems are likely to pop up at a smaller scale than seen in the pandemic aftermath. Reshoring seems to be a minor trend for now, but diversification of imports to a larger range of countries is an emerging trend.

European energy-intensive competitiveness remains at stake

For the medium term, concerns about the energy outlook remain. Cutting ties with a large cheap supplier is a costly affair despite the fact that market prices for natural gas have fallen dramatically since the end of last year. Relatively full storage, warm weather and favourable global market conditions, thanks in part to the disappointing reopening of China, have contributed to the low market prices for the moment. Recent developments have seen market prices increase again, but nowhere near the levels seen in 2022.

At the same time, it would be naïve to assume that structural problems with the European energy supply will not re-emerge. While futures prices remain relatively benign for the foreseeable future, the case for more volatile and even structurally higher energy prices in the eurozone seems pretty solid. It’s just the degree to which this will occur that is key here. While we don’t expect full-blown shortages to emerge in the coming years, price volatility in times of colder winters is not unrealistic. Overall, that does mean that energy-intensive industries will likely face structural cost pressures that are set to make Europe a somewhat less attractive place for production.

Don’t expect the supply chain problems of the recent past to return

The upside to the outlook is that supply chain problems have been fading rapidly. The main problems around world trade in 2021 and 2022 were related to supply chains. Since the middle of last year, more or less coinciding with the peak in world trade, we've started to see a turnaround in supply chain problems. They have eased substantially since then as global demand for goods has weakened and production capacity has been improving.

The broad-based supply chain problems of the past few years share a root in the pandemic. Thanks to sizeable government and monetary intervention, incomes in advanced markets stabilised or even jumped despite a huge drop in GDP. In terms of consumption, services were very restricted, which resulted in outsized demand for goods. This resulted in overheating global demand for goods while supply was still very restricted because of pandemic-related limitations and because businesses had scaled back production capacity. This rare mismatch of supply and demand resulted in extraordinary imbalances and broad-based shortages.

Since then, demand has been normalising as services are more widely available again. For many inputs, swiftly created new production capacity is coming online and resulting in higher production. This has resulted in rapidly improving supply chain problems. The lesson for the future is that the unique nature of the shock allowed for such widespread problems to occur. While we expect that shortages will continue to feature on the economic agenda as labour shortages remain more persistent and the energy transition could lead to new supply squeezes, we do deem it unlikely that similar broad-based shortages will return without a shock the size of the pandemic.

Structurally, advanced markets are diversifying trade partners – but Europe is lagging behind this trend

It looks like diversification of sourcing products is the most dominant response to the supply chain problems seen in recent years. That is not just the case anecdotally and indicated in surveys, we also find this when looking at import country concentration. To gauge whether trade has been diversifying in terms of countries, we use a Herfindahl–Hirschman index to determine concentration. Using the IMF DOTS dataset on trade, we can go back several decades to find out how concentrated or diversified imports have been for advanced markets. (Read more on methodology in our full trade outlook here)

Advanced markets have steadily diversified their source of imports

Since 2016, we have seen steady declines in our import concentration index for advanced economies. This indicates that we indeed see some form of diversification happening in terms of imports from different countries. Interestingly, we do see notable differences between Europe and the US. In the EU, we see relatively little diversification so far outside of the pandemic shock. The US is the main diversification force at the moment. American imports are now a lot more diversified than they were in 2016, and this is mainly driven by a clear trend towards a lower dependency on China for imports.

Geopolitical problems are heating up and are starting to have more of a structural impact on world trade. We see that advanced economies are diversifying trade partners, mainly in the US for now, but this trend is likely to take off in Europe as well, thanks to expected higher trade barriers and continued geopolitical concerns in the years ahead.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article