Euro bank lending looks to have hit the speed limit

Eurozone bank lending growth is stabilising, but what's with consumer credit?

| 2.6% |

Eurozone bank lending growthTo households |

Eurozone bank lending growth hitting a 2½% speed limit

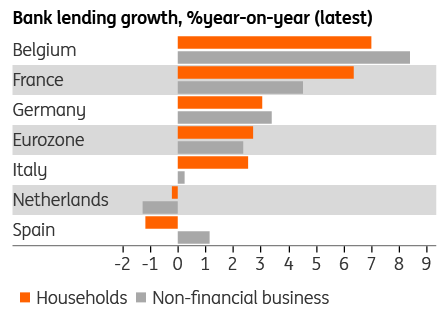

Eurozone bank lending growth to households held steady at 2.6% Year-on-Year in June, while bank lending to non-financial businesses fell to 2.1%, from 2.5% previously. Bank lending to both households and businesses has been hovering around the 2.5%-mark for a few months now. Given the European Central Bank has the pedal to the metal, we might be hitting the current Eurozone bank loan growth speed limit.

Markets for bank lending remain strongly segmented. Belgium and France are seeing the most buoyant loan growth for both households (mostly mortgages) and businesses. In Germany, lending to households has been gathering more steam. Mortgage growth is now running at 3.8% YoY there, business lending is stable at 3.1%.

Bank lending growth

Percentage, year-on-year (latest)

Consumer credit growing strongly in Southern Europe...

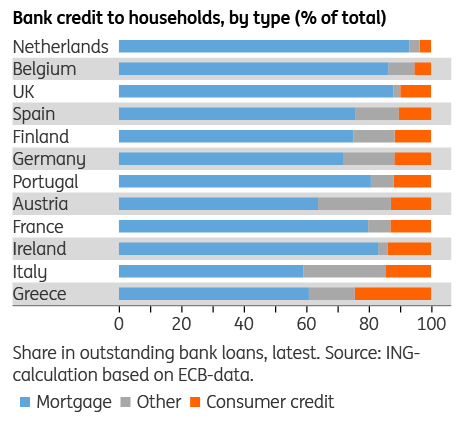

Developments are very different in southern Europe. On the Iberian peninsula, bank mortgage lending is still shrinking, at -2.8%. Some compensation is coming from consumer credit, increasing at 17% YoY in Spain and a more moderate 9.9% in Portugal. Italy is also seeing strong consumer credit growth (+8.7%), paired with moderate mortgage lending (+2.3%).

Eurozone bank lending to households

Year-on-year growth by type of loan (latest)

Consumer credit not extraordinary

It should be noted that while consumer credit is growing strongly in southern countries, its total share in outstanding loans is not out of the ordinary, compared with northern Europe. In fact, at 10.5% of household loans, the consumer credit share is lower in Spain than in Germany (11.8%). Portugal is at 11.9% and Italy at 14.5%. Only Greece stands out, with a 25% consumer credit share.

Bank credit to households by type

Percentage of total.

"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).