Euro bank lending looks to have hit the speed limit

Eurozone bank lending growth is stabilising, but what's with consumer credit?

| 2.6% |

Eurozone bank lending growthTo households |

Eurozone bank lending growth hitting a 2½% speed limit

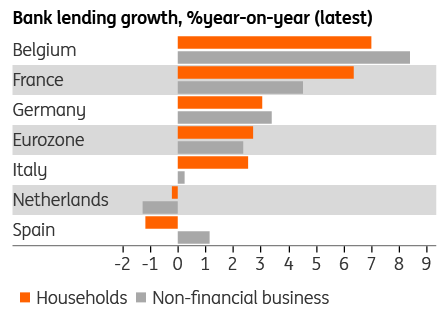

Eurozone bank lending growth to households held steady at 2.6% Year-on-Year in June, while bank lending to non-financial businesses fell to 2.1%, from 2.5% previously. Bank lending to both households and businesses has been hovering around the 2.5%-mark for a few months now. Given the European Central Bank has the pedal to the metal, we might be hitting the current Eurozone bank loan growth speed limit.

Markets for bank lending remain strongly segmented. Belgium and France are seeing the most buoyant loan growth for both households (mostly mortgages) and businesses. In Germany, lending to households has been gathering more steam. Mortgage growth is now running at 3.8% YoY there, business lending is stable at 3.1%.

Bank lending growth

Percentage, year-on-year (latest)

Consumer credit growing strongly in Southern Europe...

Developments are very different in southern Europe. On the Iberian peninsula, bank mortgage lending is still shrinking, at -2.8%. Some compensation is coming from consumer credit, increasing at 17% YoY in Spain and a more moderate 9.9% in Portugal. Italy is also seeing strong consumer credit growth (+8.7%), paired with moderate mortgage lending (+2.3%).

Eurozone bank lending to households

Year-on-year growth by type of loan (latest)

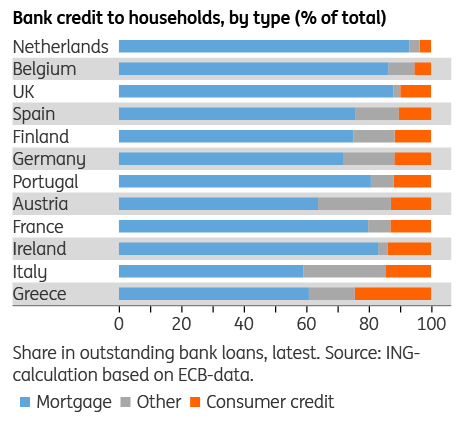

Consumer credit not extraordinary

It should be noted that while consumer credit is growing strongly in southern countries, its total share in outstanding loans is not out of the ordinary, compared with northern Europe. In fact, at 10.5% of household loans, the consumer credit share is lower in Spain than in Germany (11.8%). Portugal is at 11.9% and Italy at 14.5%. Only Greece stands out, with a 25% consumer credit share.

Bank credit to households by type

Percentage of total.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

Spain Lending Households Germany France Eurozone Europe EU Consumers Business Banks Banking Bank lendingDownload

Download article