EUR/USD: Looking beyond the market’s trust issues with the Fed and ECB

EUR/USD is trading close to 1.0900 after the Fed and ECB meetings, as markets showed little faith in the (modest) attempts by Powell and (fierce) attempts by Lagarde to stay hawkish. Markets’ doubts on ECB guidance may be a larger short-term driver, and delay another big EUR/USD rally to 2Q, when rate differentials may swing meaningfully in favour of the EUR

Why markets are doubting hawkish communication

EUR/USD is trading close to 1.0900 at the time of writing, the same levels observed before Wednesday’s FOMC announcement. Remember, the pair touched a 1.1033 10-month high before the ECB meeting triggered a correction.

The recurrent theme of these two days of central bank activity has been the diffidence by markets around the reiteration of hawkish rhetoric. Take the Fed: the message that “ongoing rate increases remain appropriate” was out-shadowed by:

- Mentions that the disinflation process has started

- A lack of an explicit pushback against dovish rate expectations

- An open-ended approach to the direction of Dot Plot adjustments in 2023

Those details, which emerged during Chair Powell’s press conference, triggered a dovish-surprise market reaction, with risk assets climbing and the dollar falling.

On paper, the European Central Bank went the extra mile to cement its hawkish message, saying it intends to hike by another 50bp in March following today’s 50bp move. However, the market reaction also went in the opposite direction, with European bonds rallying (bunds -22bp, BTPs -39bp) and the euro falling.

- This reaction boils down to Lagarde essentially failing to convincingly justify the ECB’s tightening plans,as:

- The ECB also stated that the inflation outlook is no longer facing upside risk but is now more balanced

- The reiteration of a meeting-by-meeting approach seemed to clash with a commitment to another 50bp hike in March

- Lagarde refrained from providing direction on the size or pace of increases after March, offering a breeding ground for speculation on the dovish side

Dovish bets on the Fed look more appropriate than on the ECB

We think that markets' ongoing dovish repricing of the Fed’s rate expectations has more solid foundations compared to those of the ECB. First, because yesterday’s comments by Powell signalled no urgency to push back against the loosening of financial conditions, while Lagarde explicitly warned markets against not trusting the ECB hawkish guidance.

Second, because the Fed’s higher policy rates inevitably leave more room for a readjustment lower by the end of the year, especially given the deteriorating growth outlook and ongoing decline in inflation.

We currently estimate 125bp of tightening by the ECB and no cuts in 2023, while we expect only one more 25bp hike by the Fed and 100bp worth of cuts in 2H23.

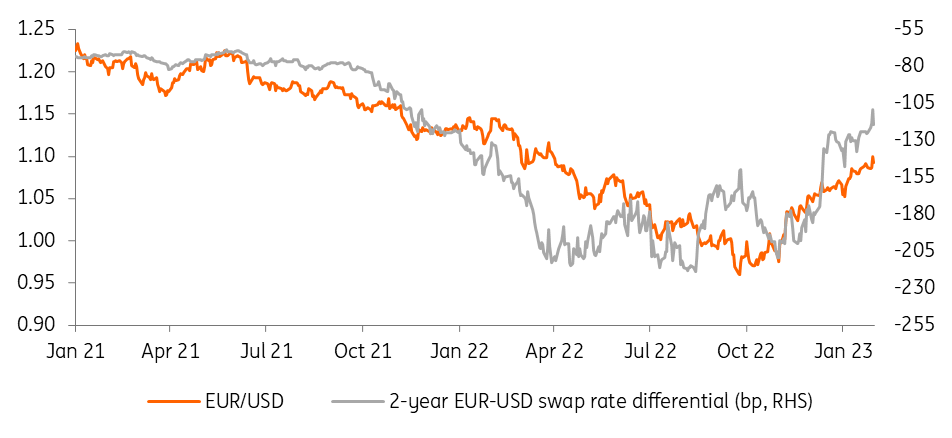

EUR/USD and short-term rate differential

EUR/USD: Patience before another big rally

All those considerations lead us to reiterate our core view that the EUR-USD rate differential is still more likely to swing in favour of the euro (largely on the back of falling USD short-term rates) this year. However, another big rate-driven EUR/USD rally may not be a story for this quarter, as the March meetings may see the Fed push back against rate cut speculation and the ECB still struggles to sell its tightening plans to the market.

The second quarter of this year is when the ECB-Fed divergence may emerge more distinctly, as we expect the ECB to deliver another 75bp and strongly signal rates won’t be cut for some time, while an acceleration of the slowdown in the US economy and inflation will heavily challenge any pledge by the Fed to keep rates at 5.0% for long.

We target 1.15 in EUR/USD in 2Q23, and 1.12 in 4Q23.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article