EUR/USD close to 1.23 is still undervalued

Even after breaking yet another multi-year high, we see EUR/USD as still undervalued - by around 1-2% based on our short-term fair value model. This points to a benign outlook for the cross, with a fairly limited downside risk. Strong EUR translate into a sweet-spot for CEE currencies

Fully justified move in EUR/USD higher

EUR/USD broke a new multi-year high, trading shy of the 1.2300 level. Was a such a move justified and in sync with fundamentals or is the EUR/USD rise overdone? We believe it is the former.

As per Figure 1, our short-term financial fair value model not only identifies the recent EUR/USD rise as justified (both the fair value and the spot increased) but in fact the EUR/USD still looks undervalued. The model-based EUR/USD cheapness looks to be worth between 1%-2% depending on the use of either swap rate or sovereign bond based model. This, in turn, translates into a EUR/USD short-term fair value of around 1.24-1.25.

EUR/USD is undervalued, even after the recent rise

Two “headline” and “underlying” drivers

While two “headline” news events triggered the recent push in EUR/USD higher (the more hawkish ECB Minutes and the tentative progress on the German coalition talks), based on our short-term fair value model two “underlying” drivers sent EUR/USD higher over the past weeks:

- The relative steepening of the German bund curve vs the UST curve (which, on the EUR side, should be attributable to the expectation of the end of the ECB QE rather than a premature ECB depo rate hikes);

- The benign risk environment, which is supporting EUR.

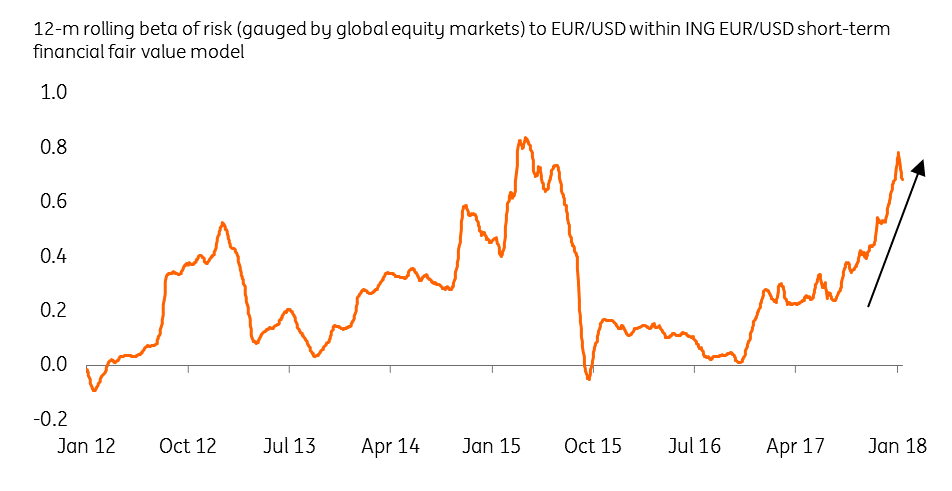

The importance of the latter for EUR is very clearly seen in Figure 2 which shows the beta of the risk factor to EUR/USD within our short-term model. Clearly, the sensitivity of EUR/USD to the risk environment has been rising meaningfully over the recent months, underlying the shift in investors’ attitude towards the common currency, with EUR turning into an investment currency.

EUR/USD sentitivity to risk rising

The journey towards EUR/USD 1.30 intact

The fact that the EUR/USD strength seems fully explained from a short-term fair value model perspective (in fact the model identifies the recent EUR/USD rise as muted compared to the levels suggested by the fair value) suggests that the fears of an overdone move in EUR/USD may not be justified. As per our FX 2018 Outlook, we embrace the strong EUR and expect EUR/USD to break the 1.30 level later this year as the market starts focusing on the second step of the ECB policy normalisation - the eventual deposit rate hikes. Note that the OECD estimate of the long-term PPP fair value is at EUR/USD 1.33.

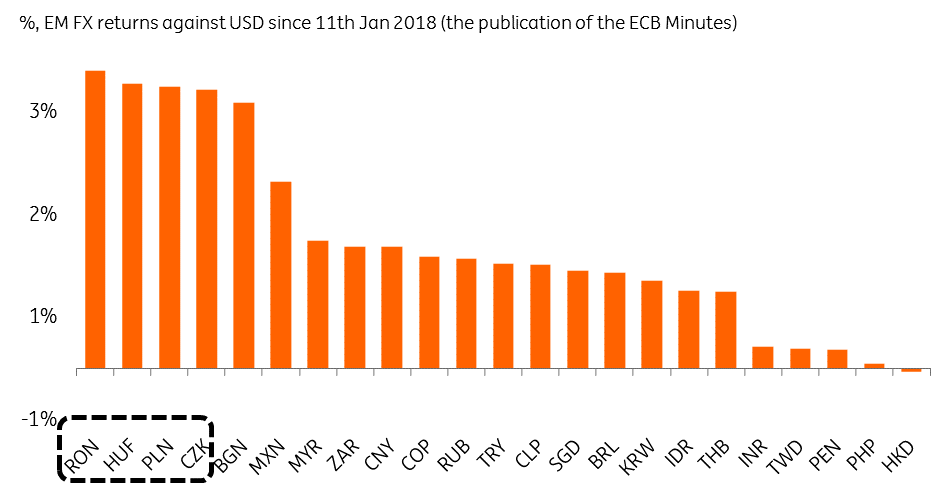

CEE FX to key EM beneficiary from higher EUR/USD

In the EM FX world, the CEE currencies should be the key beneficiaries of a stronger EUR/USD. As per 2018 FX Outlook, the CEE FX is the only EM region that can neatly and directly benefit from a higher EUR/USD. This has been very much evident on the price action since last Thursday (when EUR/USD started rising), with all four CEE currencies (RON, HUF, PLN and CZK) being the top performers in the EM space (Fig 3). We expect this pattern to stretch further throughout 2018, with our top pick being lower USD/CZK. We expect the cross to test the 19.00 level by the end of 2018.

CEE FX benefits from stronger EUR/USD

Download

Download article"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).