EUR/USD: A new range after the ECB meeting

With the ECB dropping its forward guidance and markets heavily speculating on 2022 tightening, EUR/USD may find consolidation within the 1.13-1.15 range in the run-up to the pivotal 10 March ECB meeting. In the medium-term, we think the downside risks for EUR/USD have decreased, although too aggressive ECB rate expectations should put a cap on the pair

A big shake-up after Lagarde’s hawkish shift

As discussed in our economics team’s ECB meeting review, President Christine Lagarde’s press conference fell quite clearly on the hawkish side of the spectrum today. The stance on inflation has continued to mutate into a more alarmed one, as risks to prices are now seen as tilted to the upside despite lingering expectations that inflation will ease later this year. Most importantly, the explicit guidance for rates to be kept unchanged in 2022 was dropped, and Lagarde seemed to put a lot of focus on the March meeting, when an updated forward guidance may well be released along with the new staff projections.

After the press conference, it was also reported that the ECB is indeed gearing up for a policy shift in March, and now agrees it is sensible not to exclude a 2022 hike.

All this has clearly paved the way for markets to speculate quite freely on a change in forward guidance in March (i.e. explicitly signalling the chance of a 2022 hike) and by extension on the pace, size and timing of ECB tightening. The market reaction saw eurozone bonds sell off sharply, the December 2023 Euribor dropping by around 20 ticks, markets moving to price in a first 10bp rate hike in June 2022 (and around 50bp of tightening by year-end), and EUR/USD jumping to the 1.1400 level.

EUR/USD to consolidate within 1.13-1.15 into the March ECB meeting

Today’s spike in EUR/USD followed a strong rebound from last week’s 1.1130 2-year lows, which was fuelled by a combination of EUR strength after the high inflation numbers on Monday and a generalised weak dollar environment caused by soft US data and some position-squaring. We suspect the dollar will have to process the fall-out of a likely subdued January jobs report tomorrow before finding some fresh support, which should help EUR/USD hold on to post-ECB gains for now.

Incidentally, a market that is aggressively speculating on an ECB hawkish shift in March and a start the tightening cycle by the summer should continue to offer some idiosyncratic support to the euro in the coming weeks. After all, even if the market’s hawkish bets are overdone, they may not be strongly challenged until the 10 March meeting itself.

We think that the post-FOMC 1.11-1.13 range in EUR/USD has now given way to a 1.13-1.15 range, which may hold into the March ECB meeting.

The longer-term: Less downside risks, but upside room remains limited

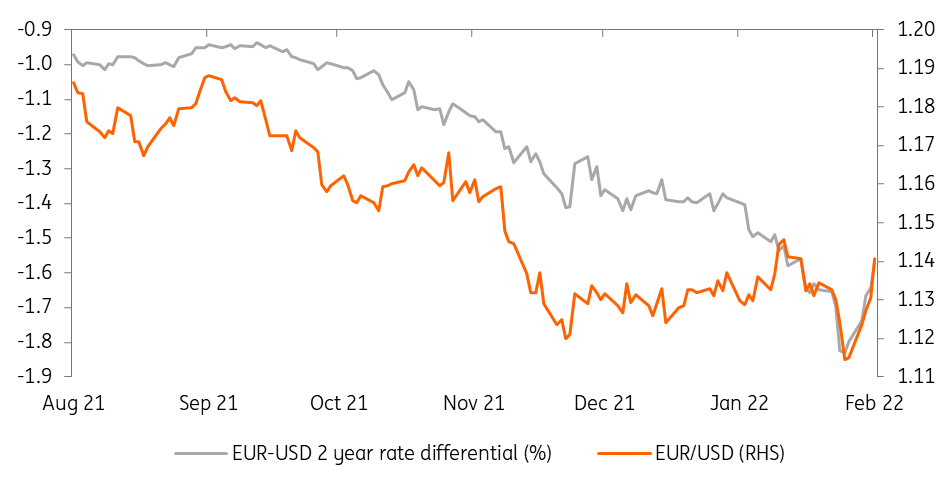

Last week’s 1.1130 lows in EUR/USD were embedding a wide divergence in the Fed-ECB monetary outlook: as shown in the chart below, the differential between US and German 2-year yields had reached 180bp after the Fed’s hawkish message, the highest since March 2020.

With the ECB having now dropped its dovish forward guidance and markets pricing in multiple hikes this year, it’s not unreasonable to conclude that the peak of the Fed-ECB policy divergence is past us. Accordingly, and given the relevance of rate differentials as a driver of EUR/USD in the current market environment, it can’t be excluded that the pair touched a cyclical bottom last week.

Still, we remain reluctant to shift to a medium-term bullish view on EUR/USD, as even though a 2022 rate hike in the eurozone now appears increasingly likely, we doubt it will be delivered before 4Q, and we therefore expect some re-pricing of the current aggressive ECB rate expectations further down the road this year. On the contrary, the market’s pricing on Fed tightening (five hikes in 2022) is in line with our economists’ call, and objectively not as aggressive as the ECB pricing considering the much higher inflation outlook and three hikes already included in the FOMC Dot Plot.

With this in mind, we continue to see some moderate downside risk for EUR/USD for the remainder of the year, although we acknowledge that sub-1.10 levels now look too extreme, and instead favour a flatter profile around 1.12-1.13 into year-end.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

3 February 2022

We find the ‘excitement’ from Thursday’s ECB announcement This bundle contains 3 Articles