EUR/SEK: Four scenarios for 2023

We outline four different paths for EUR/SEK in 2023 based on developments in four key areas: global risk sentiment, Europe’s economic performance/energy prices, Riksbank-ECB policy divergence and Sweden's domestic economy. Our baseline scenario is moderately bearish for EUR/SEK, and expect to see sub-10.50 levels by 3Q23 before a 4Q rebound

We recently revised our EUR/USD forecast higher on the back of a radically changed global macroeconomic picture. Slowing inflation and a deteriorating data-flow in the US have forced a dovish repricing in Fed rate expectations, while the European Central Bank looks determined to keep hiking at a sustained pace. Meanwhile, a positive re-rating of growth expectations occurred in both China (thanks to the easing of Covid rules) and Europe (thanks to lower energy prices). All this points – in our view – to dollar weakness and a more benign environment for high-beta currencies in 2023.

In this article, we outline four potential patterns for EUR/SEK based on four key factors set to drive the pair over the short and medium term: global risk sentiment, Europe’s economic performance/energy crisis, Riksbank-ECB policy and Sweden’s economy. The range of outcomes is derived from the expected volatility priced in by the options market.

Four scenarios for EUR/SEK

External environment

The first two factors in our scenario analysis are purely external to Sweden. Global risk sentiment remains – statistically – the single most important driver of EUR/SEK in the medium term. The Fed’s policy is a key driver in this sense. Our economics team has recently highlighted how the deterioration in forward-looking data (like the ISM Services), combined with the easing in inflationary pressures, are shedding doubts on whether the Fed will be able to deliver another 50bp of total tightening and take rates to 5.00%. We now expect a larger easing package (100bp) in the second half of 2023 compared to what markets are pricing in (60bp).

While lower rates should be a straightforward positive factor for global equities and high-beta currencies such as SEK, there is a key caveat. Should the easing cycle be triggered primarily by a pronounced US economic underperformance rather than primarily by falling inflation, the net positives for high-beta currencies would be offset.

SEK should benefit from the improvement in the eurozone's growth picture

SEK presents one of the strongest sensitivity in G10 to eurozone’s growth sentiment, which at this historical juncture is very strictly a function of energy prices and geopolitical developments in Ukraine. ING’s views on the eurozone’s economy can be found in our economics team's “Eurozone Quarterly”: one key point is that the abatement in gas prices (largely thanks to mild weather) has allowed a recovery in the euro area's economic outlook, and a recession can now be averted.

The improvement in the eurozone’s outlook should have – in theory – weighed on EUR/SEK, since SEK tends to have a higher beta than the euro to the eurozone’s growth. However, this has not been the case lately. There are two reasons for this: first, the hawkish surprise by the ECB triggered EUR-specific strength; second, risk sentiment was rather weak into year-end and only margianlly recovered at the start of 2023.

We discuss in the next paragraph the relevance of ECB and Riksbank policy for EUR/SEK, but an important takeaway is that SEK has some room to catch up with the improved eurozone growth picture, although that can only occur in a stable or recovering risk environment.

Sensitivity to rate differential rising

The sensitivity of EUR/SEK to the EUR-SEK two-year swap rate differential (which tracks the ECB-Riksbank policy divergence) has started to pick up again recently. This happened largely thanks to: a) gas prices abating and no longer being the key driver of short-term moves in European currencies; and b) the ECB turning increasingly aggressive on tightening.

For most of last year, the correlation between EUR/SEK and its short-term swap differential was rather muted – as shown below. The large hikes by the Riksbank were not translating into a stronger krona: the 100bp hike in September was a case in point. This was observed across many developed central banks.

We think that a generalised improvement in the global risk picture can keep rebuilding the FX-rate differentials relationship in 2023, including for EUR/SEK. Accordingly, the ECB-Riksbank policy divergence should regain relevance for the pair.

EUR/SEK and short-term swap rate differential

ECB and Riksbank policy

We expect the ECB to hike by 125bp by mid-2023, in line with the Governing Council’s recent rhetoric and the improved economic outlook in the eurozone. That would take the deposit rate to 3.25%, which is currently what markets are pricing in. Unlike the Fed, we expect rate cuts will only be a 2024-2025 story in the eurozone.

We expect 75bp of hikes by the Riksbank, but 100bp are also on the table

The Riksbank’s policy rate is currently at 2.50% and our baseline scenario sees 75bp of additional hikes in Sweden and a peak rate of 3.25% like the ECB deposit rate. This is in line with market expectations. We see, however, an elevated risk of 100bp being delivered. The reasoning behind this is that: a) inflation is still very elevated in Sweden (CPIF 10.2% year-on-year, core CPIF 8.4% YoY) and proved rather sticky in latest reads; b) there is a rather explicit interest by the Riksbank to support the krona (which would help fight inflation).

On this second point, the most straightforward approach to support SEK is not to underdeliver compared to market expectations on monetary tightening, especially at a time when the ECB is hiking aggressively. In our baseline scenario, we see the EUR-SEK short-term rate differential being capped as ECB tightening is fully priced in and the Riksbank can still moderately surprise markets on the hawkish side.

The Riksbank explictly wants a stronger krona

The timing of rate cuts is another important point, especially for the EUR/SEK outlook in 2H23. In our view, for the same reasons mentioned above – and especially the Riksbank’s preference for a stronger SEK – the discussions about monetary easing will be delayed as much as possible. We currently pencil in the first rate cut by the Riksbank in 2024, and we expect it to come a few months before a similar move by the ECB.

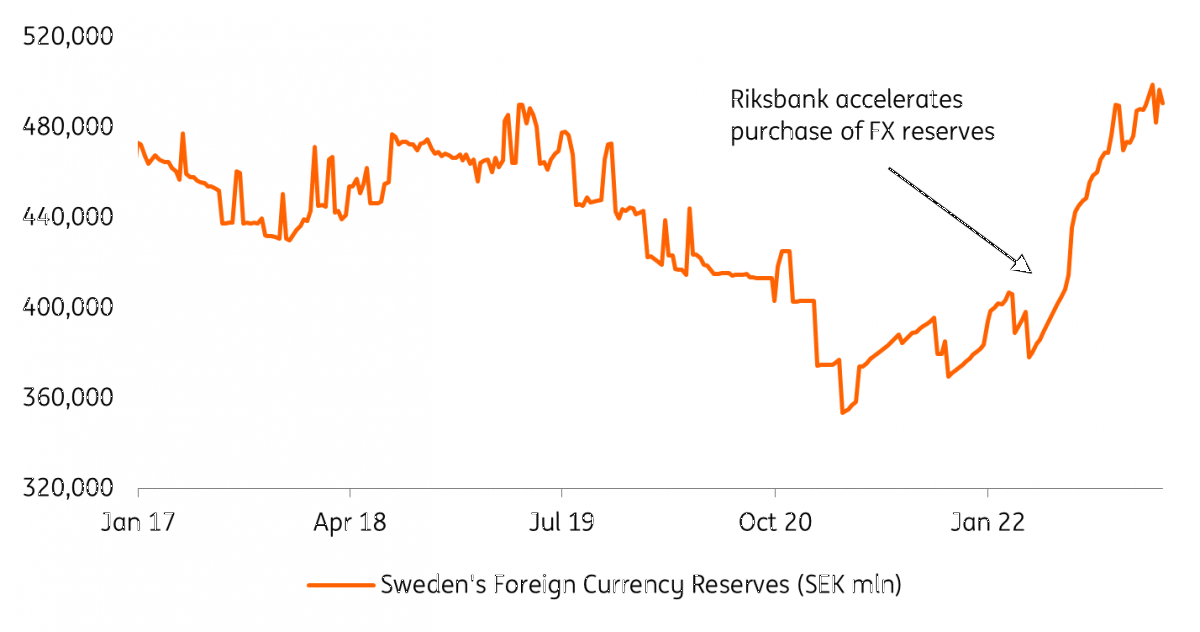

Another approach to support the krona could go through FX reserves. The Riksbank accelerated the build-up of its FX reserves in early 2022, which essentially implied selling SEK to purchase foreign currencies (mainly USD and EUR). This seemed counterintuitive given the desire for a strong currency, but the Riksbank highlighted how reserve management was not part of the monetary policy framework.

Pace of FX purchases slowing

FX reserve data shows that the pace of purchases has abated recently, and that reserves are now above the 2019 recent peak. This is already good news for SEK, but it does not look hihgly likely – for the moment – that the Riksbank will start actively selling FX to support the krona. It could become a more viable option later this year should SEK feel more depreciating pressure despite a hawkish monetary policy or should the bank be forced to halt hiking earlier than expected.

Some uncertainty around the Riksbank’s policy is also tied to the recent change of governor. Erik Thedéen took the role at the start of the year, but we do not have enough information about his stance on monetary policy to conclude he will bring any substantial changes in the bank.

Riksbank facing a housing dilemma

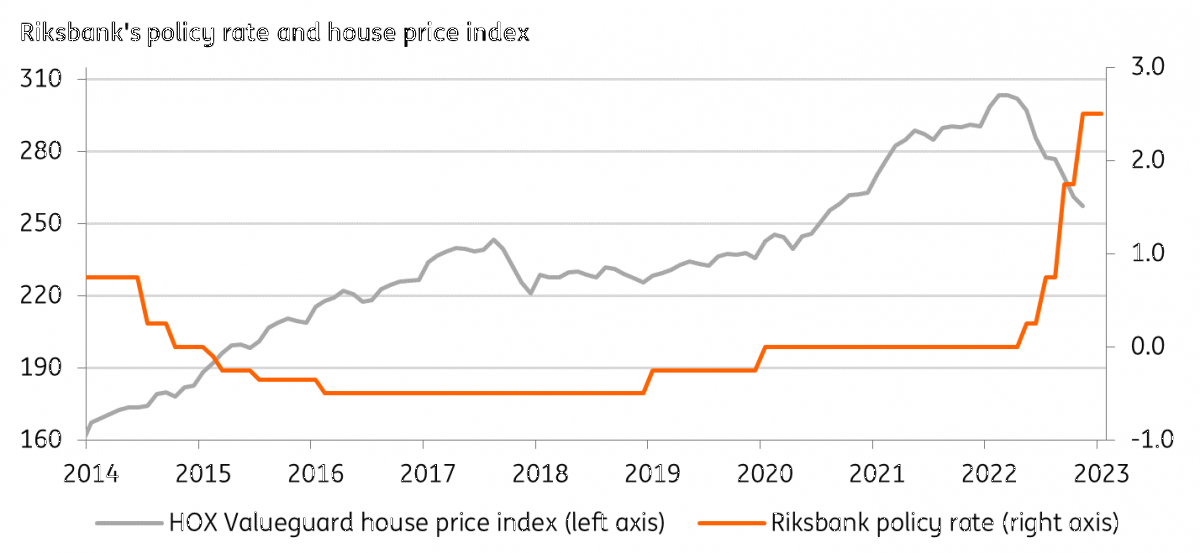

There is one key downside risk to our 'hawkish' scenario for the Riksbank. Unlike the ECB, the Riksbank has to deal with a very vulnerable property market.

Indeed, tight monetary policy is already weighing on the Swedish housing market. Rising costs for debt servicing and construction had drastically reduced consumer and investors’ appetite, resulting in prices falling substantially. The headline Valueguard HOX index shows a peak-to-trough fall of 15.2%, and the Riksbank forecasts a further decline until the third quarter of 2023.

Swedish housing market under pressure

Looking at the Swedish mortgage market, only 10% of new loans have a fixation period of longer than five years, and over half of the total loans are on variable. Together with the Swedish household debt proportion to net disposable income rising steadily over the past two decades to 200 percent, there are some limits to how far the Riksbank can go with tightening before triggering a fully-fledged property crash.

Mortgage markets breakdown by interest rate type, new loans (%)

A black-swan scenario for SEK could materialise if ultra-sticky inflation forces the Fed, the ECB and the Riksbank to push rates considerably higher than what markets are currently expecting, triggering a crash in the housing market. That could also lead to big rate cuts in late 2023 to support the economy.

In our baseline scenario, the 75-100bp of tightening by the Riksbank should keep fuelling the property market correction, but in a controlled manner and not excessively exceeding the Riksbank’s estimates.

Our forecast for EUR/SEK

After discussing the range of possible patterns for EUR/SEK in 2023, it’s time to sum up our view, which corresponds to the "Cautious optimism" scenario above. We are moderately bearish on EUR/SEK in 2023 given the projected improvement in the eurozone’s economic outlook and in risk sentiment.

More in details, we expect EUR/SEK to trend lower and move sustainably below 11.00 by the end of the first quarter as the Riksbank hikes by 50bp and signals more tightening, while European sentiment improves. Then, we expect EUR/SEK to test the 10.00/10.50 trading range in the third quarter, when Fed rate cuts could give high-beta currencies like SEK an advantage over the EUR, and the beneficial effects for the krona of an improved European economic outlook emerge. However, SEK could experience some weakness towards the end of the year – i.e. EUR/SEK moving back above 10.50 – as colder weather could bring higher energy prices and a deterioration in risk sentiment.

It's important to note that this profile embeds our view for a rather strong EUR in 2023. We expect to see larger SEK gains against the dollar.

ING forecasts

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

Swedish kronaDownload

Download article