EUR & ECB Cribsheet

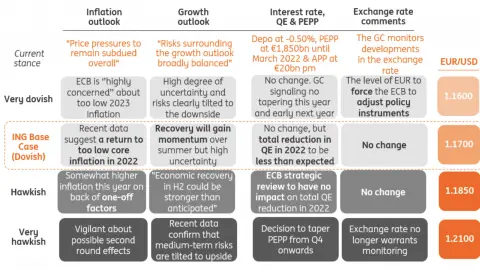

The conclusion of the ECB strategic review means the distribution of probabilities is skewed to lower EUR/USD. The more dovish bias would imply a total reduction of the monthly purchases in 2022, which will be less than previously expected keeping EUR/USD negative – both tomorrow and in 2022 when the ECB-Fed divergence should fully materialise

What was supposed to be a non-event ECB July meeting has turned into a key focus point of the week following the release of the ECB's strategic review.

With the ECB shifting the inflation target from ‘below, but close to 2%’ to ‘2%’ with a commitment to symmetry, the new strategy can be interpreted as either a formalisation of what it has been doing over the last few years anyway or a step towards more dovishness, as 2% implies a more resolute effort (see ECB Preview for more details).

This means the distribution of probabilities is skewed to lower EUR/USD. No change in the ECB bias is unlikely to be enough to send the euro higher as the ECB will remain cautious, and the Fed is much closer to starting the monetary policy normalisation process (both on the QE side and the interest rate side). At the same time, any ECB shift towards the dovish interpretation of the strategic review would underscore the recent downward EUR/USD trend.

While not a discussion for this week, the ECB dovish bias would suggest that the total reduction of the monthly purchases in 2022 will be less than previously expected.

This would further underscore the diverging trend between the ECB and the Federal Reserve and put a lid on any EUR/USD upside while exposing EUR/USD on the downside next year when the Fed should be moving closer to the interest rate hikes.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

ECBDownload

Download article

21 July 2021

It’s ECB day: What you need to know This bundle contains 5 Articles