EUR/CHF: Welcome back, the Swiss franc

EUR/CHF is starting to trade like its old self again.

Coming back in from the cold

For many, the Swiss National Bank's imposition of a currency floor in 2011, and the floor’s haphazard removal in 2015 damaged the Swiss Franc’s (CHF) reputation as a liquid, free-floating currency. Yet there are signs the CHF is coming back in from the cold and a sense of normality is returning. We think there are two key implications here:

- EUR/CHF will rekindle its correlation with risk

- A return to more normal conditions, arguably for the first time since 2008, makes a case for EUR/CHF returning to more normal levels next year - potentially even 1.30

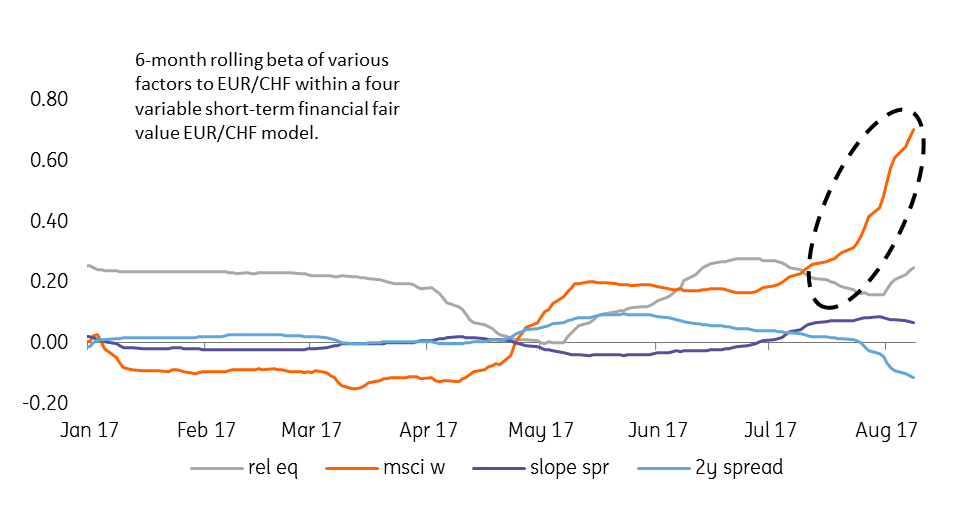

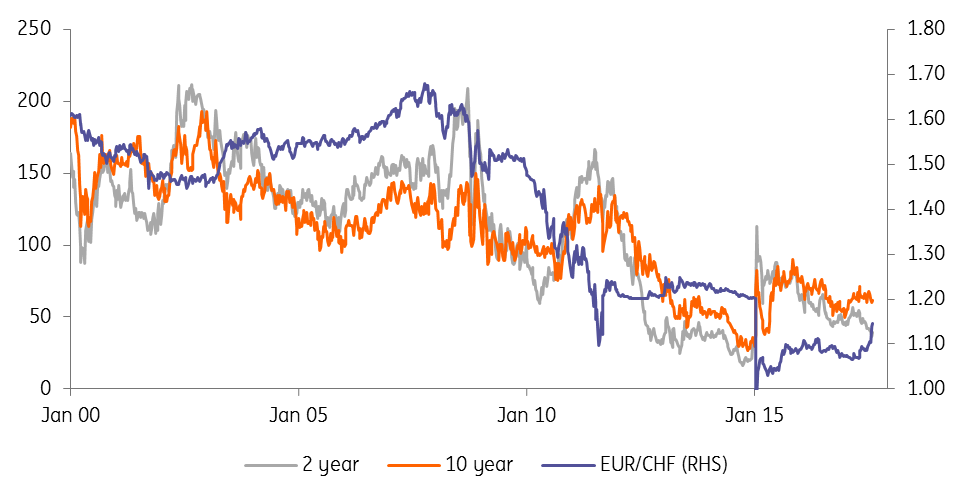

Turnover in spot EUR/CHF Over-The-Counter (OTC) transactions fell 40% between 2013 and 2016 compared to a mere 5% decline for all currency pairs over the same period. But ever since the ECB President, Mario Draghi’s June speech effectively sounded the ‘all-clear’ on the Euro, our short term fair value EUR/CHF model points to sharply rising EUR/CHF correlation with risk – particularly its correlation to world equity prices (Fig 1). And that correlation has returned to the highest levels since 2011 – shortly before the SNB imposed the 1.20 EUR/CHF floor. That the correlation is rising at a time that EUR/CHF is rising, not falling as it was in 2011, is notable.

EUR/CHF rolling correlation (betas) with 4 key variables

A regime shift?

With EUR/CHF now way off the 1.06-1.08 levels, where the SNB has most recently been conducting FX intervention (and provided it doesn’t return to these levels to trigger another wave of SNB intervention), the currency is now set free to react to global market drivers. A regime shift seems to be under way. CHF is transforming from a lame duck into its old self, more sensitive to its traditional drivers.

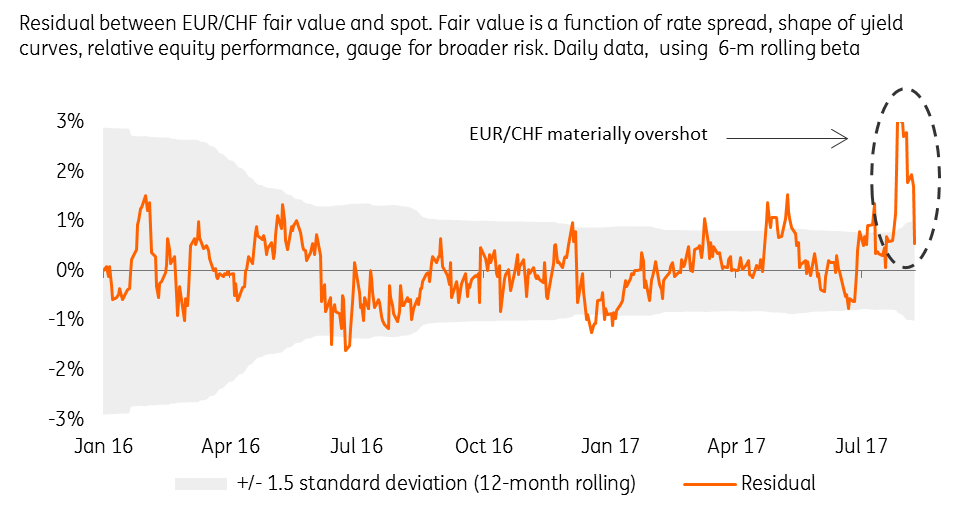

Our short term fair value model also suggests that despite its recovering sensitivity to risk appetite, the late July/ early August move higher in EUR/CHF materially exceeded levels which our model would deem as fair (on a short term basis).

EUR/CHF recently overshot fair value on a short term basis

Three reasons we think chances of 1.30 are under-estimated

1: SNB's to actively drive monetary divergence with the ECB

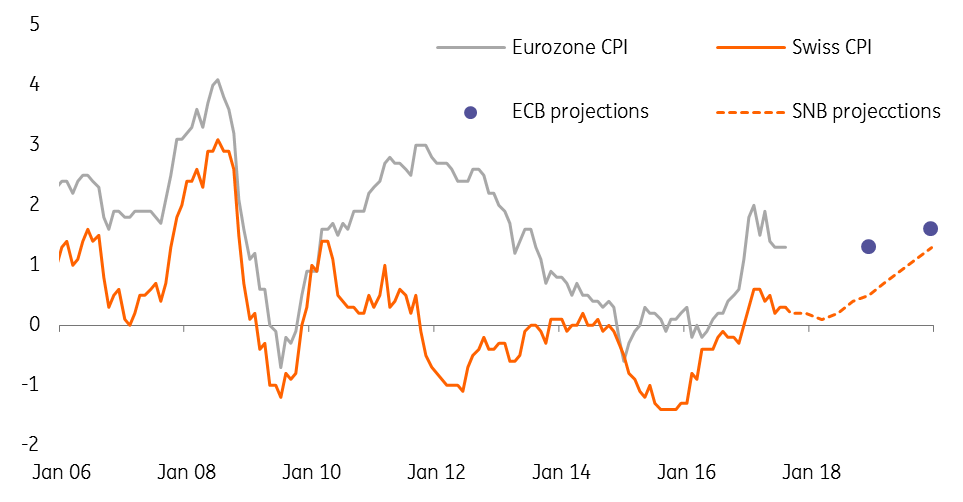

Firstly, he SNB retains its core view that the Swiss Franc is significantly over-valued. Undoubtedly the SNB would like EUR/CHF back above 1.20 and probably above 1.30 as well. One of the SNB’s primary tools for securing 1.20+ levels on EUR/CHF will be to remain consistently dovish in its message, well beyond when the ECB has tapered further (1H18) and raised interest rates (towards the end of 2018). Very low inflation provides good cover for the SNB to leave rates lower for much longer than the ECB, which will very much be the case for the whole of 2018 when Swiss headline CPI runs a full 1% below that of the Eurozone.

We do not expect the SNB to touch its targeted 3m Libor of -0.75% throughout 2018, meaning that interest rate differentials should support EUR/CHF:

- Initially at the longer end of the curve on the back of ECB QE tapering

- Then at the shorter end of the curve in the face of eventual ECB depo rate normalization in late 2018.

Monetary divergence between the ECB and the SNB should thus be a key driver of EUR/CHF strength over the next 18 months.

| 13% |

How markets assign the chance of EUR/CHF trading 1.30 in 2018.We think that risk is priced too low. |

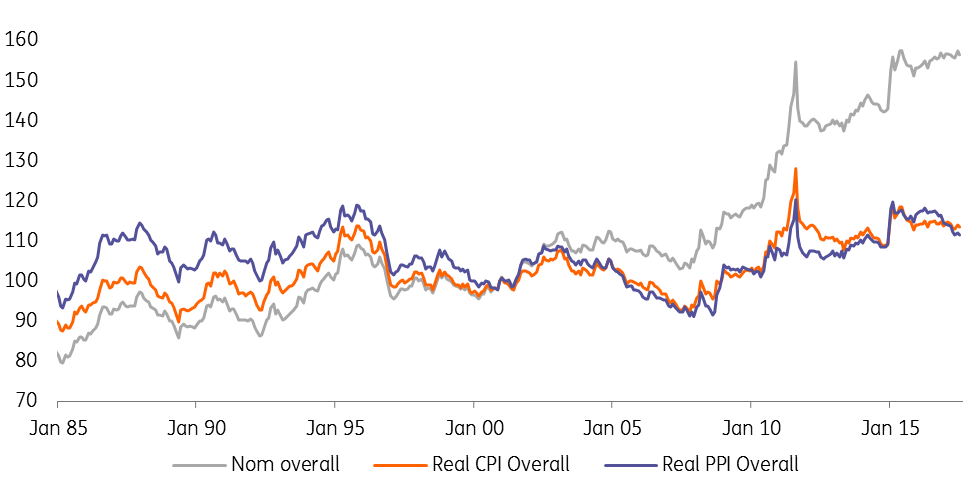

SNB's measures of the trade-weighted CHF

Swiss YoY% CPI expected to run well below that of the Eurozone through 2018

EUR/CHF swap spreads (bp) versus EUR/CHF

2: CHF over-valuation will unwind

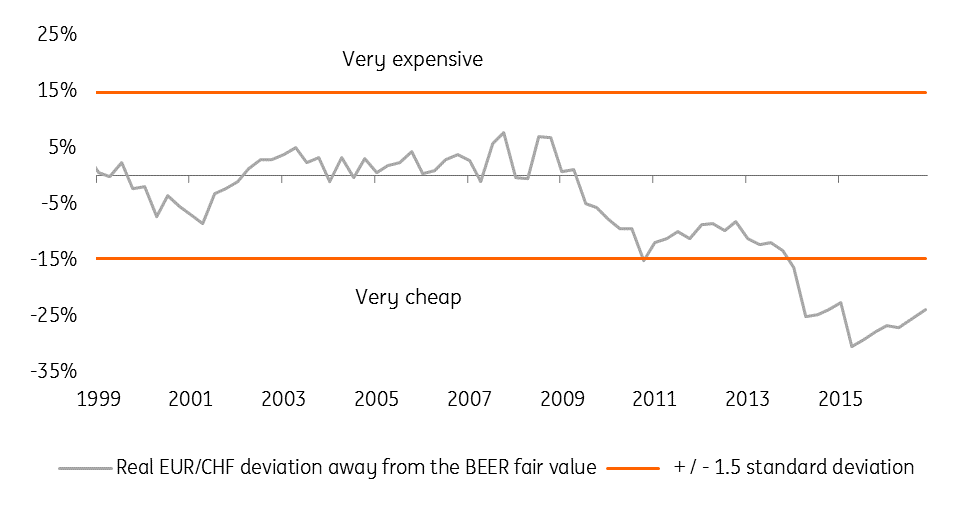

We agree with the SNB that the CHF is significantly over-valued. The scale of the potential medium-term EUR/CHF upside is corroborated by our medium term Behavioural Equilibrium Exchange Rate (BEER) model (which is a function of fundamental factors such as Terms of Trade, Productivity, and Government consumption). As the chart below shows, EUR/CHF remains heavily undervalued, by around 24% (which points at a medium term fair value of EUR/CHF 1.40). Hence, once EUR/CHF further regains properties of an ordinary cross (as well as its sensitivity to ordinary/normal drivers), the medium-term valuation factor should act as an accelerator of the persistent and ongoing EUR/CHF upside.

EUR/CHF trading well below medium term fair macro fair value

3: Swiss banking system de-leveraging has run its course

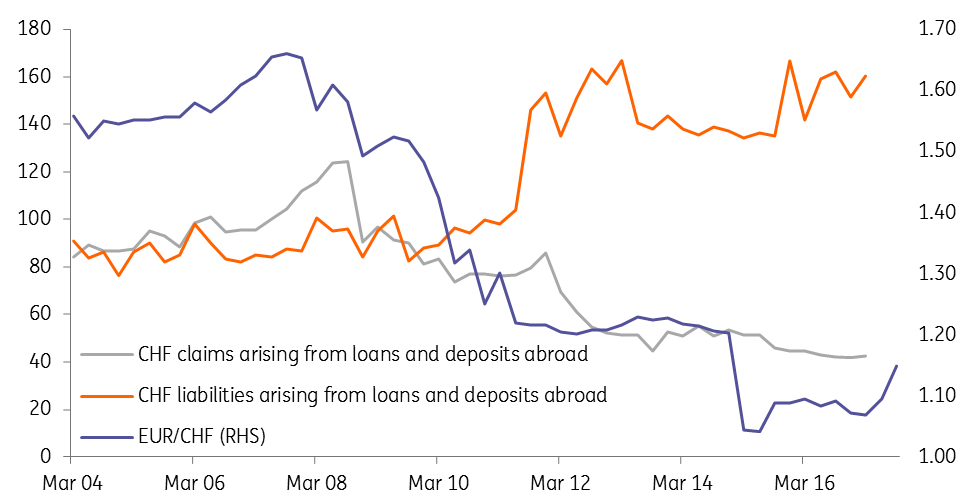

The de-leveraging of CHF loans gave the CHF a major boost after the financial crisis (think CEE mortgages). And the travails of the big banking groups CS and UBS prompted authorities to introduce Too-Big-To-Fail (TBTF) regulation, such that the tax payer should not be called upon in the event of a bail-out. Since then these banks have shrunk their balance sheets from 6.5 times to 2.5 times GDP and look largely there in terms of regulatory standards, so the Swiss banking system de-leveraging looks largely over

These big banks have been handed tough leverage ratios (core capital versus total assets) of 5%. As of Q217, CS had a fully loaded leverage ratio of 5.1%, while UBS was at 4.72%. We think broad-based deleveraging has largely played out now. For the CHF in particular, the chart below shows Swiss Banks’ foreign CHF claims (i.e. CHF deposits placed and loans granted abroad) having shrunk to CHF40bn from CHF125bn in summer 2008. That deleveraging, positive CHF trend looks over.

The second shoe to drop will be the CHF deposits placed with Swiss banks from abroad, which have risen to around CHF160bn from CHF80bn pre-crisis. How long will foreigners be prepared to hold those CHF, if the original factors that drove that portfolio allocation - particularly during the height of the Eurozone crisis 2011-12 – reverse? Timing that wholesale exodus from CHF deposits remains tricky, but moves towards a Euro 2.0 after the German elections in September or a successful passage of Italian elections in 1Q18 could prove a catalyst.

Swiss de-leveraging has run its course

Our Forecasts

As per our July 19th, 2017 FX forecasts submitted to Bloomberg, we see:

- EUR/CHF flat-lining around 1.12 (perhaps a little higher now) into year-end 2017 - largely in line with EUR/USD trading a range around 1.15.

- Through 2018, however, we retain a quarterly forecast profile for EUR/CHF at: 1Q18: 1.13, 2Q18 1.15, 3Q18 1.18 and 4Q18 1.20.

We see upside risks to those EUR/CHF forecasts largely because the exodus from large foreign holdings of CHF could happen at any time.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article