Swiss National Bank to guide EUR/CHF lower by 5-7% per annum

The Swiss National Bank holds its quarterly monetary policy meeting on Thursday and is expected to hike its policy rate by around 75bp to 0.50%. The SNB has also been using FX policy to fight inflation. We think the SNB will continue to guide EUR/CHF lower at a rate of around 5-7% a year, in order to keep its real exchange rate stable

A stable real exchange rate requires a lower EUR/CHF

Since June, the SNB has been very clear: after years of fighting deflation, inflation is currently considered too high and the SNB wants to react by raising its interest rate. Inflation reached 3.5% in August, well below the inflation rate of neighbouring countries but above the SNB's target of between 0% and 2%. Since the SNB is no longer fighting an overvalued exchange rate, but rather believes that a strong Swiss franc is favourable, it can now raise interest rates quickly, without necessarily following the ECB's moves. This is why it moved ahead of the ECB by raising rates by 50 basis points in June. There is little doubt that the SNB will raise rates by at least 75 basis points at Thursday's meeting. A 100 basis point hike like the Riksbank did is not out of the question, especially since the SNB only meets once every quarter, unlike other central banks. However, with inflation "only" at 3.5% in Switzerland and the strength of the Swiss franc allowing imported inflation to fall, 100 points might be a bit too much of a move, so a 75 basis point hike remains more likely.

Turning to FX matters, EUR/CHF has come steadily lower since June. Driving this trend have been some key statements from the SNB that (i) it wants to keep the real exchange rate stable and (ii) it will intervene on both sides of the FX market. In practice, we think that means the SNB wants to manage EUR/CHF lower.

At the heart of the story is a more hawkish SNB and its view that as a small, open economy a weaker real exchange rate is inappropriate right now in that it would be providing additional stimulus at a time when CPI is overshooting its close to, but not over 2% target.

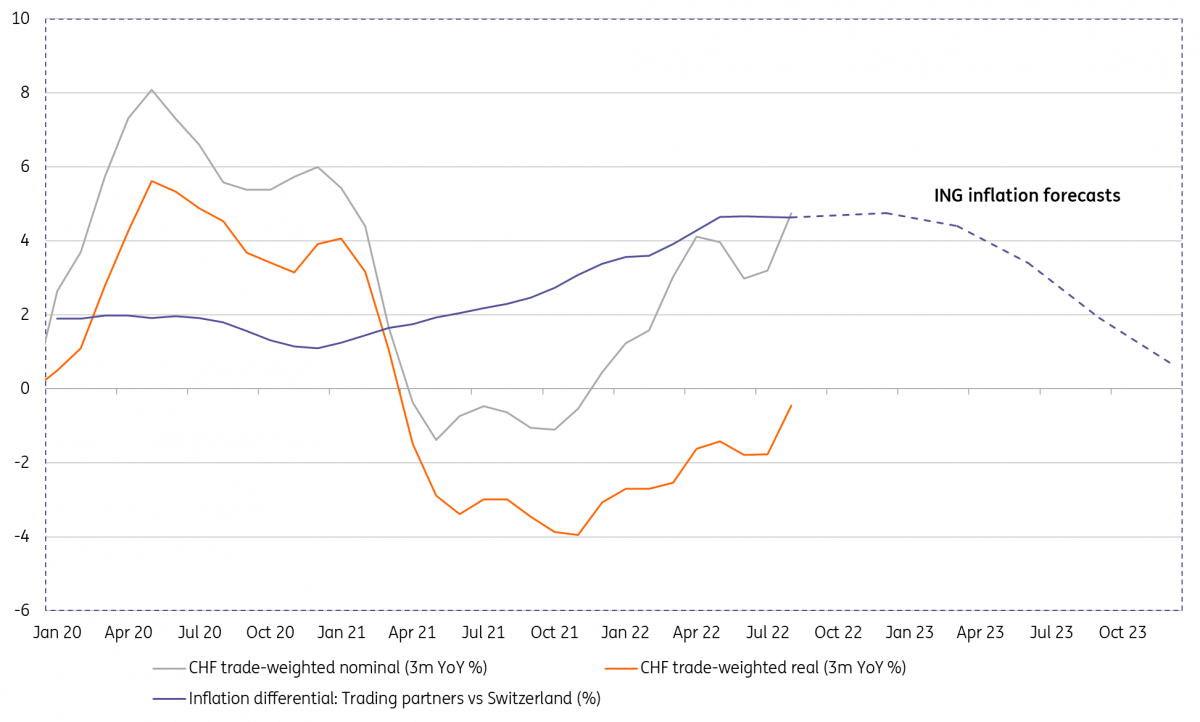

What does a stable real exchange rate mean in practice? In the case of Switzerland, where inflation amongst its trading partners is running nearly 5% higher than in Switzerland, it means that a nominal 5% appreciation of the trade-weighted exchange rate is required to keep the real exchange rate stable. Rather conveniently, as we show in our chart below, the recent bout of Swiss franc strength leaves the trade-weighted Swiss franc around 5% stronger on a year-on-year basis.

Not being a member of the G20 grouping allows Switzerland a little more latitude with its FX practices. And the above analysis suggests the SNB may be running a managed float here. With huge FX reserves of close to CHF900bn, the SNB remains a major force to be reckoned with and has the firepower to back up this managed float. Hence the remarks from the SNB in June that it planned to intervene on both sides of the market.

Like the Czech National Bank (CNB), the SNB has previously experimented with FX floors, but the managed float underway today is more akin to activity undertaken by the Monetary Authority of Singapore (MAS) which more formally uses a managed float in its monetary toolkit.

CHF: Real exchange rate stable YoY, nominal exchange rate +5% YoY

What does this mean for EUR/CHF?

Away from the arcane concept of a real or nominal trade-weighted Swiss franc, what does this all mean to the more familiar EUR/CHF? First, it is important that the two biggest weights in the trade-weighted Swiss franc are: (i) the euro at 51% and (ii) the dollar at 23%. If the SNB wants a stronger trade-weighted Swiss franc then clearly EUR/CHF and USD/CHF are going to have to play their parts.

Secondly, we have said that the SNB wants to keep the real CHF stable. In the chart above, we present our inflation forecasts, which show the inflation differential staying at around 5% into 2Q23 and only dropping back to zero by end 23. The argument then is that the SNB continues to manage the Swiss trade-weighted index firmer at this 5% year-on-year rate into next Spring before slowing the pace of appreciation.

Thirdly, there are many moving parts in the trade-weighted exchange rate, but crucially our stronger dollar view means that USD/CHF may not come lower as the SNB wishes. This places a greater burden on the adjustment in EUR/CHF. Assuming USD/CHF stays flat, EUR/CHF would need to fall at around a 7% per annum rate to get the trade-weighted CHF stronger by 5%.

Bringing it all together – and assuming that the SNB has the wherewithal to control EUR/CHF – we can argue that to achieve its objective of keep the real exchange rate stable according to our inflation forecasts, the SNB could be managing EUR/CHF on something like the following path… 4Q22 0.93, 1Q23 0.92, 2Q23 0.91 and flat-lining near 0.90 in 2H23.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article