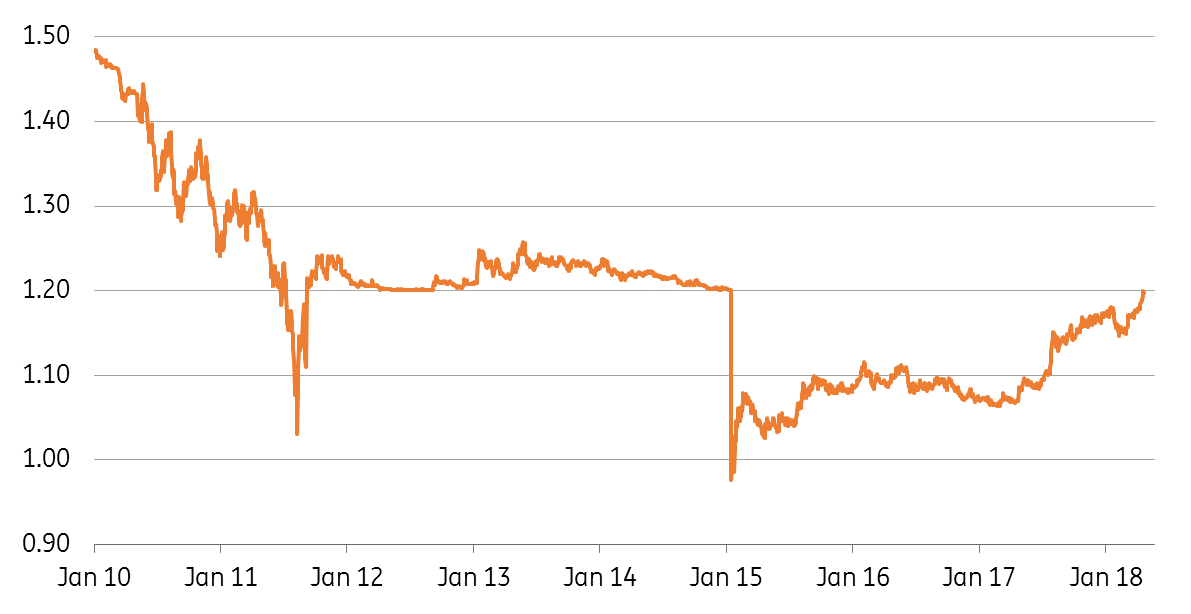

EUR/CHF at 1.20: Thank Trump

This week EUR/CHF traded at 1.20 – the level of the currency floor which the Swiss National Bank (SNB) abandoned so suddenly in January 2015. We think three factors have played a role here, the largest of which has been fresh sanctions on Russia

EUR/CHF back at 1.20

Back where it belongs

It’s taken a while – just over three years in fact – but EUR/CHF has finally made it back to the 1.20 level. 1.20 was the SNB’s currency floor up until January 2015, at which point the prospect of ECB quantitative easing and further EUR weakness prompted the SNB to wave the white flag. We think three factors have been driving EUR/CHF strength over recent weeks.

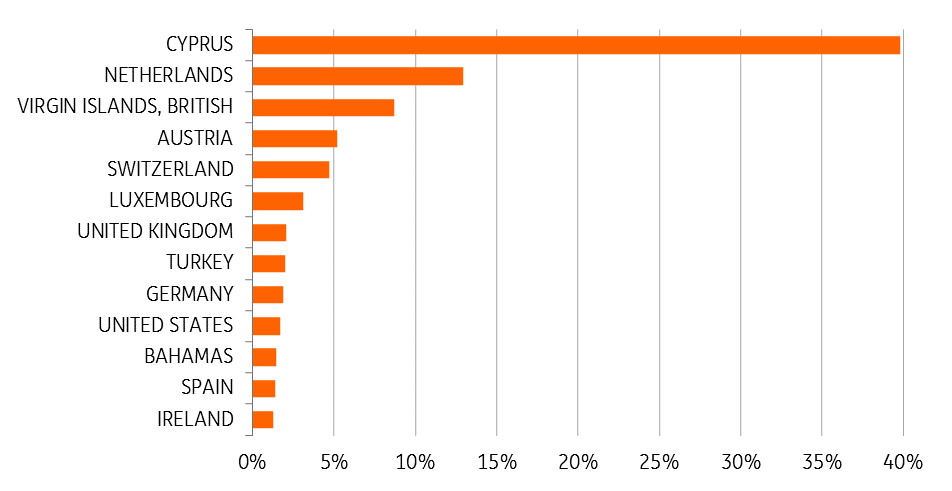

Russia’s overseas assets by geography

Russian sanctions

On April 6th, the US Treasury expanded its list of Russian sanctions to a further seven oligarchs and 12 companies they control. There were some high profile names on the list, including the owner of the major aluminium smelter, Rusal.

What’s the connection to the Swiss franc? Well one of the sanctioned oligarch’s companies, Renova Group, had a controlling stake in the Swiss-listed Sulzer AG, causing Sulzer’s assets to be blocked by the US Treasury. This week Sulzer has undertaken a hurried share buy-back to reduce Renova’s stake in the company to 49% from 63%. The transaction was worth CHF546 million according to Sulzer’s website and may have weighed on the CHF if the market felt Swiss assets were being divested.

The performance of the CHF also reflects Switzerland’s reasonably large role in Russia’s stock of overseas FDI. However, by far the largest concentration of Russia’s overseas assets sits in Cyprus. Russian residents had US$181bn of equity and debt assets listed out of Cyprus as of last September and amongst other things, fresh US sanctions have prompted a sharp sell-off in Cypriot government debt over recent weeks.

Unpicking the network of Russian residents’ international holdings and their response to sanctions is a near impossible task, but this may prove a soft negative backdrop to the CHF over coming months.

‘Vollgeld’ follies?

Another factor impacting the CHF may be the increasing focus on a June 10th referendum in Switzerland on the issue of sovereign money or ‘vollgeld’. Viraj Patel highlighted this on Wednesday. This could be turning into a Brexit-style vote for the Swiss electorate, where a populist backlash against the banks wants the Swiss National Bank to be solely in charge of creating CHF liquidity and not the banks.

Authorities have come out firmly against such a notion, but as we discovered with Brexit, populist stories cannot easily be dismissed when it comes to national votes on complex subjects. The shadow of this referendum may well hang over the CHF into the June 10th referendum.

Dodging the currency manipulator bullet

One final point to mention. With President Trump happy to shower policy prescriptions around the globe, there was always a chance that the semi-annual FX report from the US Treasury released mid-April could have been far more critical of the SNB’s FX intervention to buy EUR/CHF as part of its current monetary policy toolkit. The report, in fact, wasn’t that critical of the SNB, although it did suggest the SNB should consider off-loading some of the near CHF800bn in FX reserve assets acquired since the financial crisis.

Stay on target: 1.25

These three factors have probably been behind April’s weakness in the CHF. But in terms of the bigger picture we continue to expect that the reversal of ECB QE policy – including the return over coming years of portfolio flows driven outside of the Eurozone by the QE policy – will continue to drive EUR/CHF towards our six to 12-month target of 1.25

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

20 April 2018

In Case You Missed It: The unreliable boyfriend returns This bundle contains 6 Articles