Why the EU construction sector is steadily outperforming the US

Both European and American construction productivity has fallen since the start of the 2000s. Surprisingly, though, contractors across the EU have managed to outperform their US counterparts. We have a few answers as to why this might be the case, and what can be done to bridge the gap

Without strategic initiatives aimed at boosting productivity and competitiveness, the EU risks falling behind its global rivals – at least, that's what the Draghi report tells us. This mainly applies to industries competing worldwide, like the manufacturing sector, and less so for the locally oriented construction sector. While the productivity development of the EU manufacturing sector lags behind its US counterparts, the construction sector in the EU outperforms that of the US. Yet, both regions have experienced a decline in labour productivity in construction. Still, a greater focus on productivity-enhancing measures could partly solve persisting labour shortages. For instance, we previously calculated that a 20% higher productivity rate in EU construction would result in 2.5 million fewer construction workers being needed.

Decline in construction labour productivity

Construction labour productivity lags considerably behind manufacturing. It has almost doubled in the US manufacturing sector over the past 25 years, meaning that manufacturing workers can now produce twice as much in the same number of hours. In the EU, this has risen by almost 60%. Growing efficiency means that the manufacturing industry produces more in each given working hour, often resulting in products becoming cheaper. Consider electronics, for example, where we saw prices fall for an extended period.

By contrast, construction labour productivity decreased by 25% in the US and by 15% in the EU in the same period. So, more construction workers are now needed for the same output.

EU construction labour productivity, far behind manufacturing, but ahead of US

Labour productivity of the added value in volume, index 2000=100

This raises several questions – all of which we aim to answer in this article.

- Why is a decline in labour productivity in construction problematic?

- Why is labour productivity lagging in the construction sector?

- Why are US contractors performing even worse than their EU counterparts?

- What can be done about it?

Why is a decline in labour productivity problematic?

Higher prices and labour shortages

Efficiency has dropped in the construction sector in both the US and the EU. Because manufacturing firms have made far greater efficiency gains than building contractors, the manufacturing sector has generated less inflationary pressure. Output prices also weren't raised as often due to efficiency gains.

Output prices across both regions have risen by roughly 35% over the last 25 years – but American construction prices have more than tripled over the same period. Clients of EU contractors were faced with smaller price increases, but still saw an uptick of almost 250%. Contracting is, in general, a local business; it doesn’t affect international competitiveness. However, it makes investments in new premises by firms or consumers more expensive. It therefore slows investments from companies and provides a headwind for new housing project development, while there are enormous shortages in many urban regions.

High price increases in US construction sector

Changes in output prices, index 2000=100

Low labour productivity growth not only affects prices but also causes construction staff shortages. By March 2024, more than 30% of EU building contractors could not complete all of their work because of personnel shortages. This can trigger knock-on effects, like undermining the huge task of making real estate more sustainable.

Nearly 14 million people work in construction in the EU. Additional productivity growth of 20%, for instance, could reduce the demand for additional construction workers in the EU by more than 2.5 million, as we mentioned previously. Productivity improvements may become even more important in the US, given immigration controls and the sector's high propensity to employ foreign workers. For the EU, the ageing workforce is also an important factor to consider.

Why does labour productivity lag behind in the construction sector?

Lagging productivity development isn't exclusive to the EU and the US, though; it's a phenomenon that ripples through the construction sector all over the world. In China and Japan, for instance, labour productivity growth in the construction sector is relatively low.

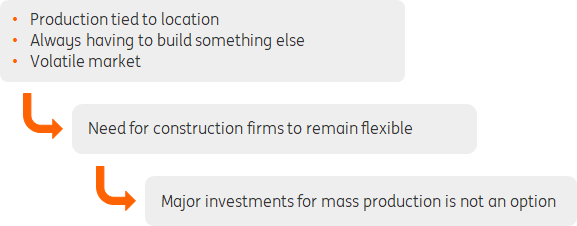

To pinpoint why exactly this is, we might look to the sector's culture, which is often described as traditional and averse to new ideas. It isn't that all construction firms are inherently opposed to innovation and increasing productivity, though. Construction's market structure plays a more important role here, and it's structurally different to that of the manufacturing sector. This comes down to a few key factors:

- Production is tied to specific locations: Construction firms work at different locations for each job. Because production is tied to the location (i.e., the construction site), the construction process is more difficult to industrialise than if the work were to be undertaken in, say, a factory building. Heavy machinery is difficult to move, conditions differ at every location, and regulations vary from country to country. Flexibility is therefore highly important, and construction firms retain it by doing a lot of work manually. This also means that few construction firms operate in other countries, so foreign construction innovations are less readily implemented abroad.

- Often building to someone else’s plan: Building designs are often created by architects (although this practice is dwindling) and then outsourced with specifications and drawings. Construction firms, therefore, have to build something new each time, and must comply with regulations and requirements that often differ from one municipality to the next. Imagine this happening in the automotive industry, with every buyer having their dream car built based on their design drawings. Industrialisation would hardly be possible in those circumstances. This also promotes "beginner’s mistakes" (failure costs), does not encourage industrialisation of the construction process, and results in scant investment in machinery (which can often perform only one type of task).

- Volatile construction market: Construction firms must remain flexible as a result of the volatile demand for new construction. Investments in production resources drive up fixed costs. In times of crisis, this can prove ruinous. Because construction is so localised, it is almost impossible to spread risks internationally, with a resurgence in one market counterbalancing a crisis in another. Lastly, construction companies cannot produce stock, and cushion temporary shocks in demand by allowing stock to increase or decrease.

Need for flexibility makes innovation difficult

This isn't to say that the construction sector is hopelessly lost for innovation that improves efficiency, and we delve into how further progress can be made later on in this article.

Why are US contractors performing even worse than their counterparts in the EU?

As we noted earlier, the productivity decline in the US construction sector has been even more pronounced than in the EU. There are several reasons for this:

Sharper decline in output levels

A larger decline in construction production volumes is one of the main reasons that productivity in the US construction sector was even larger than in the EU. The US building industry did rebound after its fall during the financial crisis, but in 2024, construction output was still 8.4% lower than in 2000. The sector never fully recovered in the EU either, but the blow has been less pronounced; levels are now 4.8% lower than in 2000.

A drop in business turnover volume is usually not a fertile breeding ground for productivity. Contraction often creates overcapacity, meaning workers can be assigned less productively. These two elements also cause companies to invest less in new and more efficient machinery. Typically, there also aren't funds available for this, and because of the overcapacity, there's deemed to be no need for it. Economies of scale also diminish with contraction. In short, production levels being comparatively lower in the US than in the EU explains why labour productivity also remains lower.

Significant drop in US construction production

Volumes changes in construction production (added value, 2024 compared to 2000)

Lower investments in the US construction sector

To make construction workers more productive, they often need machinery, but US construction firms invest structurally less in this kind of capital. US contractors have invested on average 6% of their valued added since the beginning of this century, whereas EU contractors have nearly doubled that (11%). As mentioned above, a sharper decline in the US production levels could help to explain this – although investments were already lower in the US even before the financial crisis.

EU contractors invest more than US counterparts

Investments (capex) as a share of the value added

Fewer robotic machines on US construction sites

Lower investments in capital goods result in less robotic technology being used in the construction sector in the US compared to Europe. In the EU, 10,000 construction workers have 1.5 robots at their disposal; the US has just 0.60. For both countries, this is very low compared to the manufacturing sector, where there are more than 200 robots per 10,000 employees. In fact, it's so low that we'd say it probably has little real impact at all on productivity. Still, it proves useful in demonstrating once again how US contractors have fallen behind their EU counterparts when it comes to progress with new innovations and investments.

It's also interesting to see how, on average, EU contractors have more of these robotic machines than both China and Japan – although the number of robots is rapidly increasing in the Chinese construction sector.

EU contractors have many robots

Number of robots per 10,000 workers, 2023

Digitalisation goes slower in the US

Next to industrialisation, the digitalisation of construction processes is a good way to make efficiency gains. It can also significantly improve the information being provided during the building process. Managing the most up-to-date information flow to colleagues, subcontractors, and suppliers is all taken care of automatically, so all parties are directly informed of the latest adjustments. This also makes it far easier to prevent avoidable errors. Finally, there will only be one digital single source of truth (SSOT), which keeps everyone informed of the latest adjustments to the digital (3D) design and different steps in the building process. All parties are also made aware of real-time updates in the construction process.

Investing in digitalisation is yet another area in which European contractors have invested more than those in the US. The value of software per employee has almost doubled from 2000-2022 (from €546 to €1,065) in several European countries. In the US, it only increased by 44% (from $582 to $840) in the same period. These extra investments in digitalisation could have resulted in more productivity gains among EU contractors.

More digitalisation in European construction

Development software per employee in construction sector, 2000-2022

Composition effect of the subsectors

Some activities within the construction sector are even harder to industrialise than others. For instance, customisation is often needed (especially for renovation and maintenance activities), and this mainly falls into the specialised construction subsector. Infrastructure projects are usually more difficult to industrialise because they involve a great deal of customisation. As with specialised construction, digitalising can certainly help here.

Since the beginning of the 21st century, the share of these two subsectors has risen faster in the EU than in the US. This could have resulted in larger downward pressure on the total EU productivity development compared to the US – and, in turn, productivity development in the bloc's construction sector could actually be even better than the data above suggests.

Larger increased market share of civil engineering & specialised construction in the EU

Share of subsectors specialised construction & civil engineering of total construction output

What can be done?

Digitalisation, industrialisation and timber construction can increase productivity

Despite the obstacles we've covered, there are still ways for construction firms to increase their productivity, at least to some degree. Industrialisation – mainly involving machines and/or robotic machinery – could play a role here, for a more standardised way of working. Using timber could also help prompt more efficient construction; it's not only far more sustainable than other materials, but it's a good industrial product to work with due to the fact that it's much lighter, too. This means that large, prefabricated timber elements are easier to transport, can be processed with a greater degree of precision and are easier to attach. The lower weight also reduces the need for heavy machinery.

Another way to increase productivity is by digitalising the construction process, with digital tools helping to streamline projects and, in turn, make them more efficient. For example, providing information to all departments and chain partners can be greatly improved through digitalisation. Mistakes are also more likely to be avoided. Managing separate information flows to colleagues and subcontractors can be automated with digitalisation so that all parties involved are constantly and automatically informed of the latest adjustments (via SSOT).

More efficient construction is essential for every firm

Efficiency gains are key to coping with personnel shortages, ensuring that prices do not have to rise (too much) and keeping businesses competitive. Further digitalisation is essential in this regard. Barriers to digitalisation, such as initial investments and risks, are relatively limited. While industrialisation must certainly also be considered, it'd be wise to proceed with more caution here because of the initial high investments (plant, machinery and robots). Construction firms that fail to secure solid levels of efficiency will find themselves fishing in an increasingly small pond – and the shift towards a more sustainable and carbon-neutral business model will be made all the more difficult.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article