EU construction sector suffers multiple setbacks

We expect low growth in the EU construction sector this year and next. The EU Construction Confidence Indicator is still positive but optimism is waning. Building material shortages are still high and low water levels are now threatening supply with little relief in sight

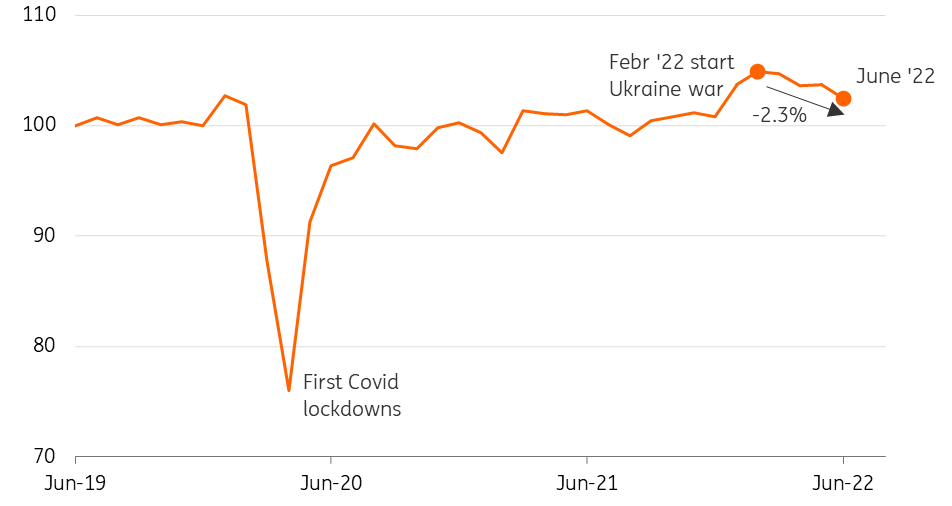

Construction output has decreased since the start of the Ukraine war

In June 2022, the EU's construction output was 2.3% lower than in February before the Ukraine war began. The difference in output between countries is huge. The Austrian and German construction sectors have experienced the biggest declines of -6.3% and -4.5%, respectively. Labour and material shortages are severe in these countries. In addition, German consumers are currently more reluctant to make home improvements than consumers in many other EU countries (see below). Austria has a lower number of building permits in 2021 which is likely to weigh on production this year and next. The Netherlands showed the smallest deterioration (-0.1%), however, compared to a year ago, Dutch contractor volumes still increased by a staggering 5.3%. Growth was especially high in the Dutch residential and commercial building sector. For Dutch civil engineering, the levels of nitrogen emissions in The Netherlands are still an issue.

On the other end of the spectrum, Poland’s construction sector showed the highest year-on-year growth in June (6.7%).

Contraction in construction

Production European Union volume (index June 2019 = 100, Seasonally Adjusted

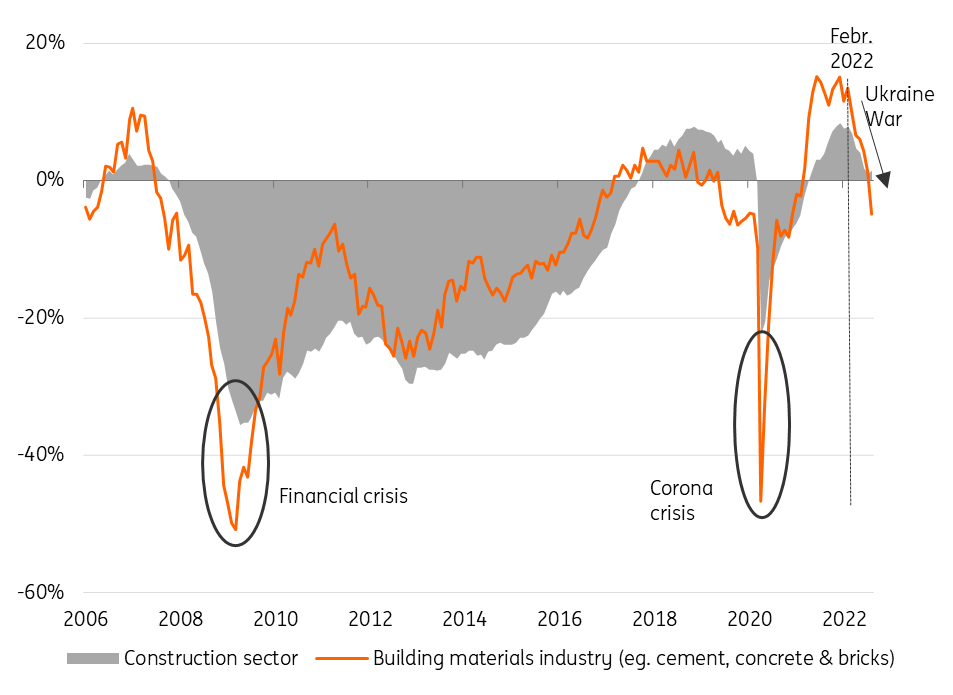

The construction confidence indicator is still positive

When we look at the EU producer confidence indicator, we still see a positive number for the construction sector in August. There is obviously still enough demand for construction products, as indicated by healthy order books. Yet, confidence is abating and EU contractors became slightly negative about the evolution of their order books in July and August. In addition, the confidence indicator in the building material sector moved into negative territory for the first time in August. However, this sector is, in general, more vulnerable to economic shocks than the construction sector.

Positive producer confidence in the construction and building material sector is vanishing

Producer Confidence indicator European Union, seasonally-adjusted (monthly, latest data point August 2022)

Material shortages: from Covid-19 to drought-induced supply chain disruptions

There is enough going on to make contractors and building material suppliers worried. Many contractors still have purchasing problems. In August, 23% of the EU construction companies reported that they have production problems due to a shortage of materials. While this is lower than in April (29%), it is still at a historic sky-high level. Now the former supply chain disruptions due to the Covid lockdowns (in China) are slowly abating, a new hurdle has appeared: low water levels. Waterways are the main mode of transport for many raw building materials (eg sand and gravel). On many rivers, barges can no longer be loaded at full capacity.

This time is different: low water levels are likely to have an impact

Back in 2018, low water levels shaved off some 0.3 percentage points of German GDP growth over two quarters. Yet, the building material industry was quite resilient. German building material production of the concrete, bricks and cement industry moved sideways and Dutch-Austrian firms in this sector were even able to increase their production a bit during this period. However, almost 25% of these German firms mentioned that they had limitations due to material shortages. Yet, this time could be different for the building material production. Back in 2018, the low water period only came in late September. Now, low water levels have come earlier and there is little rain relief in sight. Many more companies are complaining about production limitations due to material shortages. This drives up transport costs as barges are only able to sail with fewer materials, with the rest having to be transported by truck. This is on top of already high input prices, for instance, energy prices.

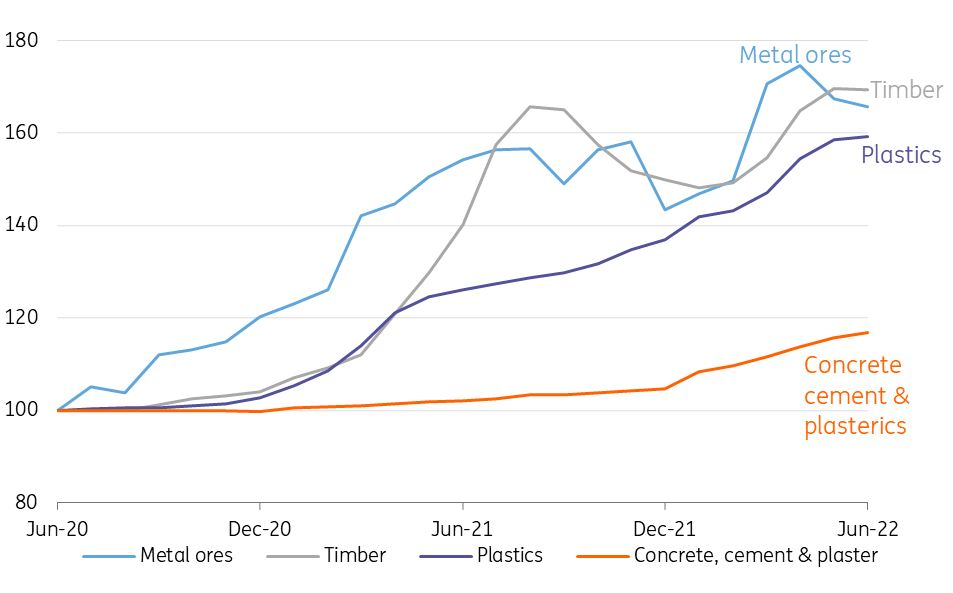

Surging energy prices push up concrete, cement and brick prices

Since the outbreak of the pandemic in 2020, many building materials have increased in price. However, some of these prices have stabilised or have even decreased a bit in the last few months. Steel prices, in particular, have tapered off a bit due to the expectation of lower steel demand as forecasts for economic development in many countries are lowered. Yet, the normally stable prices of concrete, cement and bricks have started to increase this year due to rising energy prices as the production processes of these materials are very energy-intensive. As explained above, higher transport costs due to low water levels drive up these costs even further.

Development building material prices

Producer Price Index, Index June 2020=100, European Union

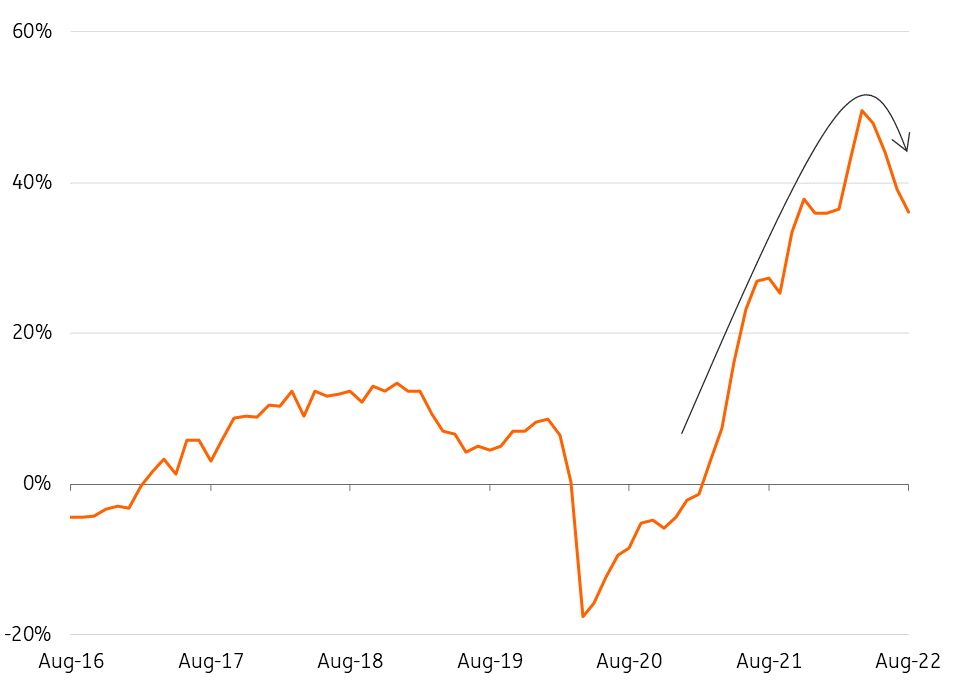

Contractors try to pass through higher costs with higher sales prices

The supply chain disruptions and higher energy prices have led to higher building material prices which have put pressure on the profit margins of construction firms. Therefore, they are trying to pass through these input price hikes to their sales prices. This resulted in a record number of building companies pledging, in April, to increase their prices. On balance, 50% of EU building firms planned to increase prices in April. This is the highest percentage since the start of this survey in 1985. During the summer period, the number of EU contractors planned to increase sales prices actually decreased a bit, but they are still at extremely high levels. In Austria and The Netherlands, in particular, many companies (nearly two-thirds) expect to raise their sales price further. These are the same countries that face high material shortages.

The number of contractors that increased prices has peaked

Balance of construction companies in the EU that expect to increase -/- decrease output prices (over next 3 months)

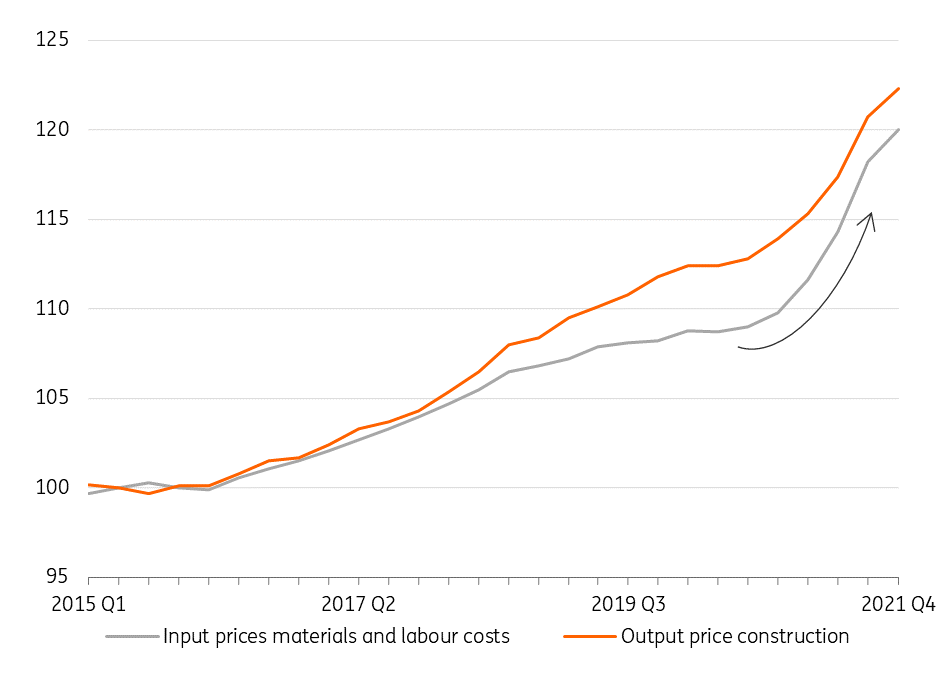

Development output prices have been in line with input prices

The building material price hikes are putting building companies' profit margins under pressure. This can easily lead to loss-making projects as profit margins are thin in the construction sector, generally about 2-4%. However, contractors are in general able to pass through the price increases. For instance, for new residential buildings, output prices have mostly been able to follow input prices. At the end of 2021, sales prices were 22% higher than in 2015 and procurement prices went up by “only” 20%. Yet, passing through higher procurement prices can’t go on forever. At a certain point, higher input prices will harm profit margins and/or will result in fewer orders.

Revenues have been keeping up with rising costs

Construction prices for new residential buildings Quarterly data Index 2015=100, European Union

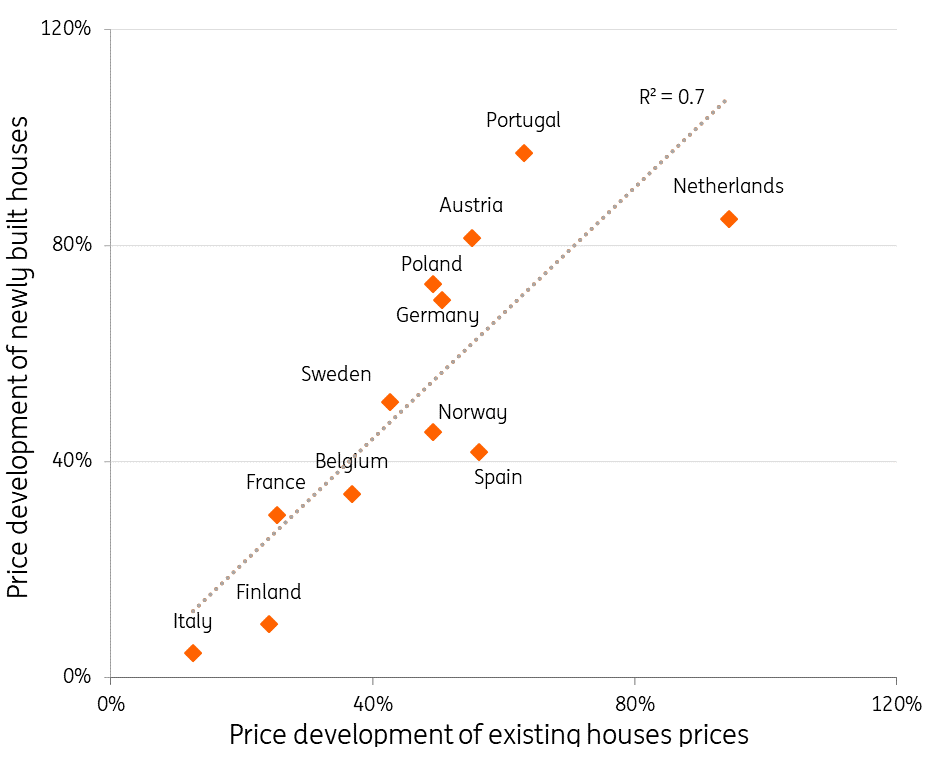

High new home sales prices have made up for a lot

New home sales prices are closely related to the prices of existing homes as they are often substitutes for consumers that are in the market for a new home. Therefore, price developments of the two can’t and won’t diverge too much.

In many countries, we have seen substantial price hikes in existing homes in the last few years. Consequently, this has given room for sales price hikes of new build homes and to pass through the higher input prices. Dutch project developers, land owners, and contractors, in particular, have been able to profit from higher sales prices of new homes as Dutch price increases were the highest and increased by 94% between 2015 and 2022. In addition, Dutch construction companies were able to increase their output prices for residential buildings by 37% in the same period. By comparison, French new home sale prices only rose by 25% during this same period and French contractors were able to increase their output prices by only 16%. Higher mortgage rates and a loss of purchasing power could slow down house price increases. This will give contractors and developers less room for passing through higher material costs.

The prices of newly-built houses follow the general trend in house prices

Price development new and existing houses 1Q22-1Q15

Renovation and maintenance accounts for 50% of total construction volume

The renovation and maintenance (R&M) market is quite often the forgotten market of the construction sector. It is fragmented and therefore dominated by small (one-man) firms, less glamorous than new construction and with a lack of reliable data. However, the EU total construction market consists of approximately 50% of renovation and maintenance activities. This means that the total annual revenue of this sector in the EU is approximately €850bn which makes it an important economic segment. Therefore, a wide range of (large) building material suppliers are depending on the R&M market, from manufacturers of insulation materials, wooden building products and chemical companies that produce paint to suppliers of pipes and cables. Building materials that are less used in R&M are concrete, bricks and cement.

R&M usually less volatile than new construction

In general, the demand for R&M is relatively stable, especially compared to the new construction sector. The need for R&M is an ongoing process and it is therefore less dependent on the economic cycle. In addition, demand can even increase during an economic crisis. For instance, homeowners aren’t able to sell their existing homes and therefore decide to improve their current homes to their new housing requirements. This increases or at least supports the demand for R&M during an economic downturn.

R&M market is choppy

From a historical perspective, demand for renovation and maintenance has recently been remarkably volatile. During the first Covid-19 lockdown, people were reluctant to have handymen in their homes. This gradually changed, however, and demand for improvement grew rapidly in 2021 as many people suddenly required a “home office” as working from home became the norm. In addition, consumers had spare money to invest in their homes as they weren’t able to spend their savings on holidays during the pandemic.

Demand for home improvements has been volatile lately

Balance of EU consumers that expect to improve their home over next 12 months

Inflation leads to less demand for home improvements

Skyrocketing energy prices are decreasing the purchasing power of consumers. This has caused an enormous downturn in the number of people that want to refurbish their homes. In contrast, the demand for energy-efficient investments (eg. solar panels, insulation and heat pumps) is huge as the payback period for these investments has dropped enormously. Many governments also offer subsidies for energy-related renovation projects, now that we have to save on gas. All in all, we expect that the work for residential energy efficiency upgrades will continue to increase, while demand for other home improvements will fall.

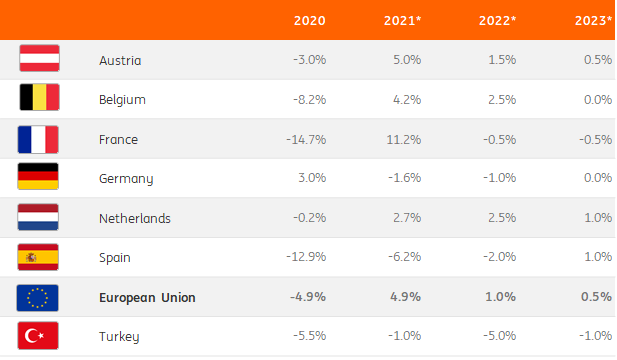

Low growth expected for the EU construction sector

Taking everything into account, we are more pessimistic about the development of EU production volume this year and next than we were in our previous forecast in February (before the start of the Ukraine war). In this period of heightened geopolitical tensions, it is extremely difficult to forecast, especially when it comes to such a volatile sector. Yet, the higher building material costs, skyrocketing energy prices, continuing material shortages, higher interest rates and international risks make our forecast less optimistic. However, order books of contractors are in general still well filled and the EU construction output showed some decent growth in 1Q22 (+2.7%) which was only partially counterbalanced by a small decrease in 2Q (-0.3%). Hence, we expect the sector to grow by a moderate 1% this year.

Different EU construction markets at a glance

In France, construction output was still strong with growth of 2.5% quarter-on-quarter in 1Q. However, 2Q presented a decline of -0.5%. Just like in many other EU countries, the French building sector faces huge material and labour shortages and price increases. Yet, the French construction confidence index was still slightly positive in August (+5) and order books are still well filled with a stable eight months of work in 3Q. All in all, we foresee some minor decline (-0.5%) in the French construction sector in 2022 as a whole. Consequently, French construction output still won’t reach its pre-Covid level.

Slow growing or declining construction volumes in most EU countries

Volume output construction sector, % YoY

German construction output declined by 1.6% in 2021. This was the first contraction since 2015. Among other things, pull-forward effects due to the termination of a VAT reduction at the end of 2020 hampered growth in 2021. In addition, Germany was the only country that did not witness a decrease in construction volumes in 2020 during the Covid crisis which means there was no bounce-back effect as we have seen in some other countries. At the moment, German contractors are among the most constrained by labour and material shortages compared to other EU countries. And as discussed above, the current low water levels will keep the supply chain for building materials under pressure for some time. Order books in 3Q are still higher than in the same period one or two years ago but have decreased a bit compared to the first half year of 2022. German construction output showed a decline in 2Q (-3.0% QoQ) but the previous quarter (4.5% QoQ) was still strong. For 2022 as a whole we, therefore, forecast some moderate contraction of the construction output.

For Dutch construction, we forecast continuing growth for this year and next. Dutch contractors have been profiting from a well-performing economy in the Netherlands in the first half year of 2022. However, it is not all sunshine and Dutch roses. Like in other countries, building companies are facing higher procurement costs, labour shortages are enormous, and the uncertain international geopolitical situation makes companies reluctant to invest in existing and new commercial buildings. Nitrogen emissions are also still an issue and this is especially a burden for the infrastructure sector. The investment in civil engineering projects therefore also decreased in the second quarter of this year. To solve the low supply of houses, the Dutch government aims to build 100,000 new houses per year. However, this is still far out of reach and the number of permits for new dwellings has only been decreasing in the last half year.

For Spain, we forecast a further decline in construction volumes this year. That means that the sector will be in contraction for the fourth year in a row. Production levels are currently more than 20% lower than before the Covid pandemic. Where contractors in other EU countries mainly suffer from material and labour shortages, Spanish building firms primarily suffer from insufficient demand. Almost two-thirds of all Spanish builders mentioned in August that this is the most important factor that limits their production. However, building permit issuance is on the rise. In addition, the Spanish construction sector will see some positive effects from investments in the EU recovery funds. Therefore, we expect some marginal recovery next year.

Polish contractors made a promising start to 2022 with double-digit growth rates. However, growth rates are now diminishing. In July, Polish construction output rose by 4.2% (YoY). The number of approved new home permits in Poland increased strongly in the second half of 2020 and remained stable at a high level in 2021 and is a strong indicator for future production. However, increasing mortgage interest rates, higher building costs and low consumer confidence due to the Ukraine war could slow down the production growth of housing completions. An ambitious investment programme (including the EU Recovery Fund which is still frozen due to a judiciary dispute), could boost the Polish civil engineering sector. Hence, we expect the Polish construction output to continue to grow this year and next but at a slower pace.

For Turkey, expectations remain uncertain due to the effects of the current high inflation in the country and the devaluation of the Lira. In addition, Turkish contractors are facing high import costs for building materials from abroad and demand for new construction is hindered by these high prices. The Turkish construction confidence indicator (EC survey) is quite negative (-13 in August 2022). Contractors’ order books are currently filled at a relatively low level. Therefore, we have lowered our growth expectations compared to our February forecast. We now expect a further decline in the Turkish construction output in 2022 and 2023. This means that the Turkish building output will be in decline for at least five years in a row (from 2018).

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article