EU Construction Outlook: Strong decline this year but signs of recovery in 2025

2024 has been a disappointing year for European construction, but there are clear signs that growth will pick up again in 2025. The issuance of building permits is increasing again, and at the beginning of the value chain volumes are already bottoming out

Decline expected in 2024

We expect a decrease in EU construction volumes this year (-1.5%). This is a down on our previous forecast (-0.5%), mainly because of revised Eurostat data. The European data office recently upgraded the 2023 EU Construction figure from 0.1% to 1.4%. Growth has therefore lasted longer than we expected, and as a result, the decline started later, leading to a larger-than-expected contraction in 2024.

However, the optimistic signs – noted in our previous forecast – are becoming more visible. House prices are increasing further in many countries and the issuance of building permits has risen. In addition, at the beginning of the construction value chain, it looks like the producers of building materials (eg. concrete, cement and bricks) have passed the lowest point of production volumes.

Construction volume decreasing but building material production is starting to recover

EU construction sector volume (Index January 2020=100, SA, latest data point June 2024)

Due to long lead times, new residential and non-residential building volumes will still decline in 2024 with home buyers and firms continuing to avoid investing in new premises. However, for the renovation subsector (including sustainability works) we foresee structural growth in demand. We also expect that investments in infrastructure will continue to grow. The main drivers for this growth will come from the EU Recovery funds, investment in digital infrastructure, waterworks, extensions of the power grid and the energy transition.

Growth returns in 2025

For 2025, we expect the above-mentioned growth trends in the renovation and infrastructure sector to continue. We also expect the new building sector to slowly improve due to the recovering housing market and the increasing amount of building permits for new homes. The result will be that growth will return to the construction sector in 2025.

Housing prices take a positive turn

In many EU countries, house prices have started to increase again, after a period of decline. Structural housing tightness, especially in cities, is supporting demand. Increasing wages and (marginally) declining mortgage interest rates make it possible for house buyers to borrow more, thus driving up house prices.

For instance, in Poland, prices of existing homes went up by more than 4% in the first quarter of the year. During the same period, house prices in Spain and the Netherlands increased by 2%. Yet, in Germany, where the economic situation is more sluggish, house prices declined (by -1.1%).

Prices of newly-built houses follow general trend in house prices

House price development Q1 2024 - Q1 2015

Development of prices

Higher prices of existing houses are good for new residential building volumes, although this will take some time to materialise. Sales prices of new houses are closely related to prices of existing houses as they are often substitutes for consumers who are in the market for a new home. Therefore, price developments of the two can’t and won’t diverge too much in the medium and long run. So, when house prices of existing houses increase again, this also gives the opportunity for project developers to increase the sales price of newly built houses. This is also what we see happening. In addition, building material costs have almost stabilised in the last year, which makes it easier for developers to make projects profitable again. Therefore, more housing projects can be carried out.

Prices of new houses are increasing in most EU countries. Poland and Spain have witnessed the highest price increases in newly built homes during the past quarters. In France and Germany, house prices of new builds (and existing houses) are still declining. The Netherlands also experienced a modest decline in newly built house prices in the first quarter. As Dutch house prices have increased to high levels before and Dutch house prices of existing houses are on the rise again, we see this as a one-off movement.

Price developments of new houses

Prices of new houses, Quarterly index, 2015=100

Issuance of building permits on the rise again

Now that demand for new-build houses is increasing, it is supply that will become the main limiting factor in many countries due to shortages of building land, financial issues, complex project development and/or legal delays. Yet, after two years of decline, the issuance of EU building permits has been rising since the third quarter of 2023 and increased by 6.6% in the final quarter of last year and by 1.5% in the first quarter of 2024. High recovery rates of issued building permits are mainly being seen in Spain, Poland and the Netherlands.

The data doesn’t show any real improvements yet in France and Germany. French and German project developers and building companies are still reluctant to commit to new projects as the housing market in these countries is still sluggish compared to other EU countries. However, housing shortages in these countries will also ensure sufficient demand in the residential sector in the long run.

Permit issuance for non-residential buildings starts to drop

The issuance of permits for non-residential buildings has shown only a marginal decline in the last two years. However, the slowdown of economic growth, higher interest rates and geopolitical and economic uncertainty have made companies hesitant to invest in new premises.

In addition, during the Covid-19 crisis, there was an enormous rise in e-commerce which increased the demand for new logistics centres. Now, that this surge is over, the demand for new storage facilities is declining to more structural levels.

Nevertheless, other subsectors in the non-residential sector have partially counterbalanced the decline. Public spending on buildings for education and health has stabilised aggregate demand in the non-residential sector. As the European economy is slowly recuperating and interest rates have decreased a bit, we expect that the outlook for the non-residential sector will also improve slightly. However, it always takes time before these growth rates become visible in building volumes. We therefore expect that the non-residential sector will start to grow in 2025 after some decline this year.

The issuance of residential building permits is rising again

New buildings permits* in the EU (index 2018 Q1 = 100, SA)

High number of developments in Poland and Ireland

Poland has added the highest percentage of new residences to its housing stock in the period 2021-23. Polish housing stock has increased by almost 1.5% annually. Ireland and Austria also showed high yearly growth rates of new houses during this period. These relatively high rates make it possible to better deal with the scarcity of houses, as a high rate of new supply can lower shortages.

At the other end of the range, we find Italy and Spain. In these countries, the rate of new house growth is low (about 0.3% yearly). This could be due to many issues such as long permit procedures or financial shortcomings. Nevertheless, it keeps the local housing markets in Spain and Italy tight.

Fastest growth of housing stock in Poland

Average yearly new house rate (2021-23)*

Choppy periods for renovation and maintenance

From a historical perspective, demand for renovation and maintenance has been remarkably volatile in recent times. During the first Covid-19 lockdown, people were reluctant to have handymen in their homes. This gradually changed and demand for improvement grew rapidly in 2021 as many people suddenly required a “home office” since remote work became the norm. In addition, consumers had spare money to invest in their homes as they couldn’t spend their savings on holidays.

In 2022, skyrocketing energy prices decreased consumers’ purchasing power. This resulted in a downturn in the number of people who wanted to refurbish their homes. In contrast, the demand for energy-efficient investments (eg. solar panels, insulation and heat pumps) temporarily grew as the payback period for these refurbishments dropped enormously.

Stable growth will return in the renovation sector

All in all, despite the temporary circumstances caused by the Covid-19 pandemic and the energy crisis, the trajectory for residential energy efficiency and sustainability upgrades remains promising. Looking ahead, we expect gradual growth in the renovation market due to sustained government regulations and the structural impact of higher energy prices. Therefore, demand for residential energy efficiency upgrades is likely to return to its upward trend. Consumers also indicate in surveys that they expect to improve their house in the coming months. And after the volatile Covid and energy crisis period, this indicator is slowly moving back to its structural upward trend.

Demand for home improvements has been volatile

Balance of EU consumers that expect to improve their home over the next 12 months

Number of EU contractor bankruptcies back to average

The number of insolvencies among EU contractors has steadily increased and has reached pre-Covid levels. The number of bankruptcies was surprisingly low during the Covid-19 period due to the massive intervention of governments to compensate for the effects of the loss of activity. Furthermore, the construction sector was modestly affected by the pandemic in comparison to other sectors, like hospitality and aviation.

Two countries stand out. In Poland, bankruptcy levels remain low due to relatively favourable market conditions. In Spain, insolvencies of building companies increased during the Covid crisis and this trend has persevered. That’s probably because the contraction of construction volumes in Spain was relatively high during the pandemic and the fiscal measures in Spain were limited compared to other hard-hit countries. In addition, in September 2022, a new Spanish law on insolvency was finally passed, which gives creditors more power. Restructuring processes that previously got stuck in court can therefore be handled faster and this could have resulted in more bankruptcies.

Since the third quarter of 2023, the level of bankruptcies in the EU construction sector has remained stable. We expect that the number of EU building companies that have to close their doors will more or less stabilise at this level during the remainder of 2024 and 2025. Price increases in building materials have mostly stopped and, as mentioned, demand will slowly pick up in the coming quarters.

Number of bankruptcies back to normal level

Number of bankruptcies construction companies in EU (index 2021=100)

EU country construction developments at a glance

Germany: decline continues in 2024

In the second quarter of 2024, German construction volumes decreased by 2.6%. Although the first quarter showed some growth, this comes after three consecutive years of decline between 2021 and 2023. For 2024, we anticipate a further downturn in the EU’s largest construction market.

In August, German contractors were the most pessimistic among major EU countries. The continued drop in building permits for new residential projects in the first quarter of 2024 highlights ongoing difficulties. However, the civil engineering sector in Germany offers some relief. The country’s infrastructure is in poor condition, and investments in roads and digital infrastructure are driving some growth in this subsector.

France: marginal decline in 2024

Overall, we expect that French construction output will decrease by -1.0% in 2024. French contractor sentiment was pessimistic in 2023 and hasn’t recuperated. In August, the French construction confidence index (EC survey) was still negative. In addition, 24% of French contractors are generally unsatisfied with their order books. The issuance of building permits for new houses is also decreasing. House prices are still declining which makes new developments more difficult. Labour shortages are less of an issue and yet 30% of French builders complain about it.

EU Construction Forecast

Volume output construction sector, % YoY

Netherlands: Recovery of housing market but lower production volumes in 2024

We expect that Dutch construction output will shrink by around 3% in 2024, mainly due to a sharp decline in the first quarter. New construction production in 2024 will still be affected by the previous fall in permitting and declining new home sales in 2023. In 2025, there will be a recovery for the Dutch construction industry, mainly due to the upswing in newly built production of homes. At the beginning of the construction value chain, clear signs of recovery are visible. The turnover of project developers is increasing and the number of building permits issued increased in the first months of 2024. In addition, sales of newly built homes are on the rise due to the improving housing market.

Spain: High growth in the construction sector

The Spanish construction sector grew by a very strong 4.5% in 2023 and during the first half of 2024 more or less stabilised. Nevertheless, Spanish building firms have had a difficult period. The production level shrank by almost 25% between 2019 and 2022. Yet, the development of residential and non-residential permits continued to grow in the first quarter of the year after a strong increase in 2023. The EU's recovery fund investments in the Spanish construction sector are positive as well. Therefore, we expect further growth in the Spanish construction sector in 2024 and 2025 but at a slower pace compared to 2023.

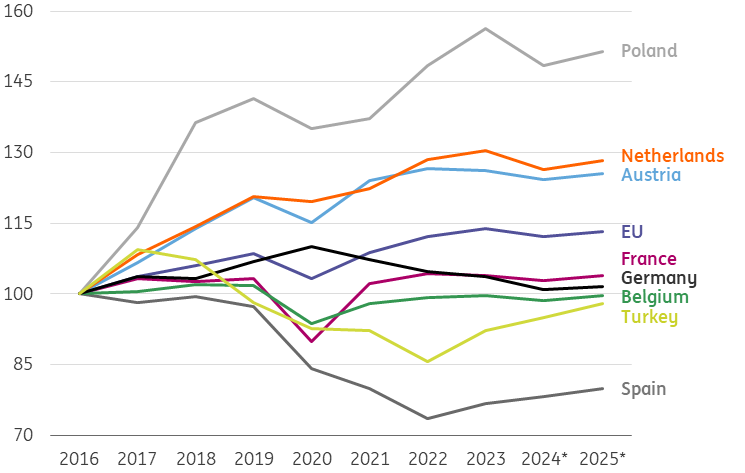

Strong development differences among countries

Volume construction sector (Index 2016=100)

Poland: decline in 2024 but better outlook for 2025

The Polish construction sector grew by 5.3% last year. The higher volumes were mainly driven by the infrastructure sector (+12.4%). Yet, the first half year of 2024 was less promising, Polish construction output fell by -9.8 in the first quarter and -0.9% in the second quarter, both compared to the previous quarter. Many infrastructure projects under the previous EU financial perspective have ended and the startup of new EU-financed projects will take some time. That said, building permits for residential buildings are on the rise again. House prices are still increasing which makes new developments more affordable for developers. However, this also means that people can't afford to own a house anymore. A large rebound in Polish construction as a whole is not likely to occur until 2025. Nevertheless, in residential construction, it could be as early as the second half of 2024.

Turkey: growth after a long period of decline

The Turkish construction sector grew in 2023 for the first time in five years. Production volumes increased by 7.8%. The first quarter of 2024 was also strong with growth of 3.7%. Yet, in August, the Turkish construction confidence indicator (EC survey) was still negative and builders were still not satisfied with their order books. In addition, many Turkish contractors complain about low demand and the issuance of building permits has increased a bit but follows a bumpy road. It could be that the permit data is understated. Usually, most permits are issued by municipalities. Yet, due to special circumstances after last year's earthquake, other institutions are now also granting permits which are not included in the statistics (yet). All in all, we expect the Turkish construction sector to grow further this year and next but less exuberantly than in 2023.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article