EU Chips Act to boost Europe’s technological prowess and strengthen economy

Chips are everywhere and will play an increasingly critical role in society. The EU Chips Act will help Europe strengthen its position as a technological leader in some fields of the semiconductor value chain and promote economic growth in the coming decade

EU Chips Act: a good idea

The EU Chips Act will promote economic growth in the coming decade. It is vital that Europe reduces its dependence on imports from Asia and elsewhere and mitigates geopolitical risks this way. With the help of policymakers, future European industries should be able to benefit from European-based, chip manufacturing capabilities that are state of the art. It would be good if local production capacity of semiconductors matched the demand from European end-markets by the end of the decade. This way, the economy is less exposed to supply chain disruptions, but can also fully take part in future developments in the field of artificial intelligence (AI) and autonomous, industrial systems, where leading-edge chip innovations will play a crucial role. Basically, every sector that will use AI systems needs advanced semiconductors. Europe, therefore, needs to be a part of these developments to remain relevant.

State of the art semiconductors are needed to execute the EU’s sustainability agenda as well. The electrification of the economy requires more frequent use of semiconductors, while any new generation of chips will use less energy. The existing European chip ecosystem will become stronger with additional investments in research and design (R&D). It will also profit from being larger, with more local production and improved availability of resources. Semiconductors are highly complex products. Manufacturing them requires many interdependent steps, performed by multiple companies. A multitude of specialised equipment is therefore required for production as well as hundreds of unique materials and specialty chemicals.

Although European companies are represented in many steps of the semiconductor manufacturing value chain, Europe does not have a complete network of clients, suppliers and knowledge institutes. The presence of a next-generation semiconductor fabrication (fab) plant in Europe, producing leading-edge chips, would be an important next step towards creating a more complete ecosystem and thus have positive spill-over effects, driving investment in European supply chains and act as a magnet for scarce talent. We expect the investment package to amount to more than €12bn in public and private investment on top of more than €30bn of public investment already foreseen. Because dependencies between regions will persist, it is important to have a strong negotiating position, with more local production, to secure supplies, if this is needed in the future.

The European semiconductor sector is focussed on fast growing automotive and industrials clients

Europe has always played an important role in the development of the semiconductor industry. As a result of strategic choices, the existing semiconductor manufacturers target profitable niche segments. European firms remain competitive in the specialised areas of sensors, power and radio frequency chips. There the focus is on materials innovation, not size reductions. The main integrated device manufacturers (IDMs) in the EU are Infineon, NXP and STMicroelectronics. Their chips are mainly made for automotive and industrial sectors. Other chips for these industries may be designed by EU companies, but are made in foundries outside of Europe (in Asia). The absence of a large (consumer) electronics industry means there is no large scale demand for advanced, leading-edge, logic chips, today. Hence the absence of production capacity. As a result, the share of the EU in manufacturing capacity has dropped from around a quarter at the start of the century to below 10% now.

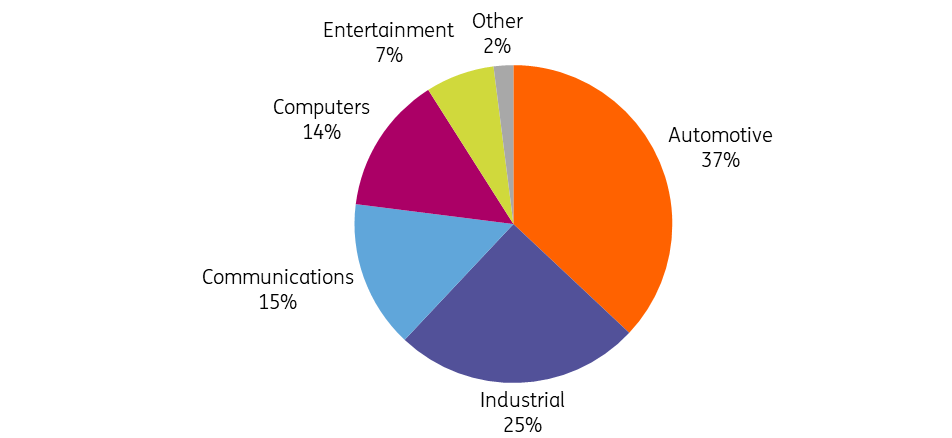

Almost two-thirds of European chip demand comes from industrials and automotive

Semiconductor demand in Europe* by end market, 2019

European R&D and semiconductor manufacturing tools are important for the global value chain

Looking across the value chain we see specialisation in specific regions reflecting the comparative advantage of countries, but also reflecting government subsidies such as provided in Asia. In the US, many research and development intensive business models, such as fabless companies, flourish due to access to engineering talent and leading universities. East Asia hosts the bulk of capital intensive activities such as wafer fabrication and production of materials. This is due to the availability of the required infrastructure, cost efficiencies, a skilled manufacturing workforce and government subsidies. Europe plays a significant role in some R&D intensive fields such as machinery (ASML in the Netherlands is world-leading) and chip intellectual property cores (Arm in the UK). There is strong fundamental research, with research centres such as IMEC in Belgium, CEA-Leti in France, TNO in the Netherlands and Fraunhofer in Germany, linked to universities. However, Europe is a relatively small player in design and manufacturing. According to a BCG study, this is the production step where most of the value is added. Because of specialisation, dependencies exist between companies across the global value chain. Suppliers of equipment and materials have developed their own specialisation. Cooperation between companies is therefore needed. That means no single company or country can go it alone.

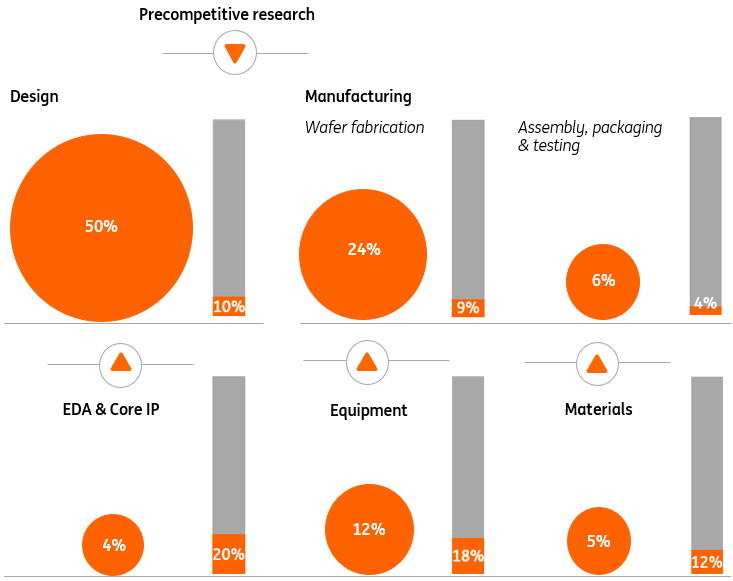

The bulk of semicon added value is in design and manufacturing where Europe has a market share of about 10%

Share of value chain steps in total value added (bubble), market share in terms of value added of Europe vs rest of world per value chain step (bar)

Europe has to invest to become a leader in the field of AI

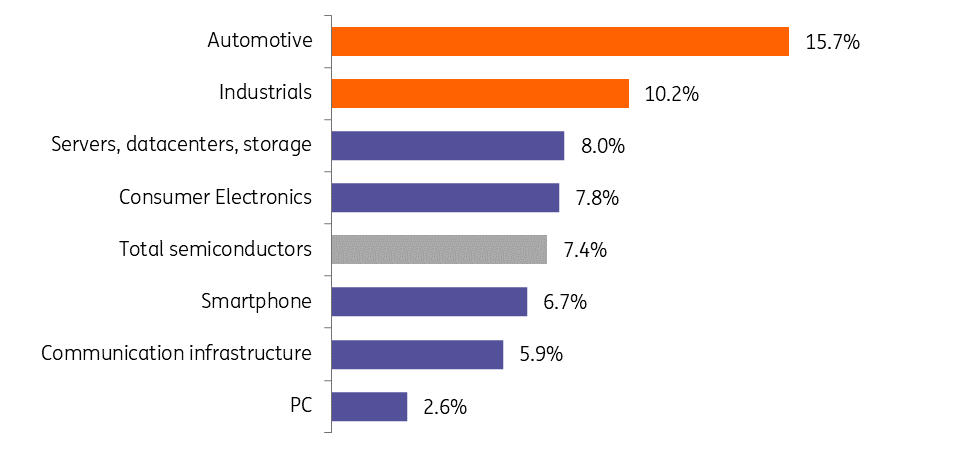

The automotive and industrial sectors are the biggest end markets for semiconductors in Europe. Interestingly, Gartner identifies these two sectors as the end markets with the highest global growth rates. This is because electric vehicles (EVs) will make up an increasing share of production, while they, obviously, require more electronic semi-finished products. The European industry is therefore well positioned to show above-average growth. Also, the automotive sector starts to incorporate more systems that could support drivers to make decisions, such as advanced driver-assistance systems (ADAS) and in the end autonomous vehicles. These trends imply that more chips will be required for production, but also that manufacturers will require more complex chips. The share of semiconductors with nodes below 10nm (nanometers) in automotive is forecast to grow from 2% today to 10% in 2030. Within the industrials segment, the demand for chips is also expected to increase because of developments involving further industrial automation but also because medical devices, machinery and communication equipment will incorporate better analytical and decision-making capabilities. Basically, every sector that will use AI systems, needs advanced semiconductors. Europe, therefore, needs to be a part of these developments to remain relevant.

Highest growth in global chip demand for industrials and automotive

2020-2025 CAGR of semiconductors by worldwide end market

Europe has to work hard to increase its relevance in the complex semiconductor value chain

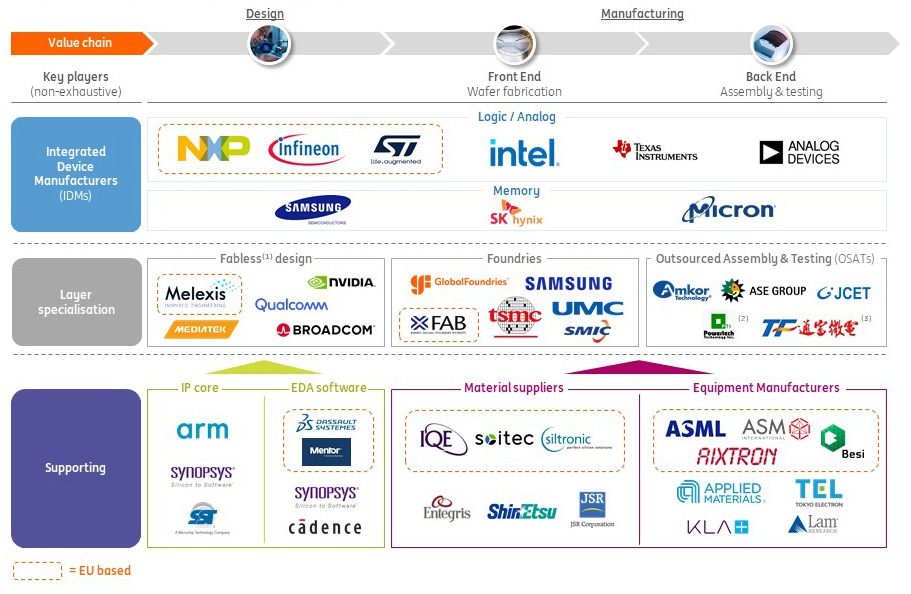

Semiconductors are highly complex products to design and manufacture, consisting of many interdependent steps that involve many companies. In Europe, many products and services of the value chain do not have sufficient scale yet, hence it is not attractive for large fabs to set up production on European soil, at the moment. There is work to do in Europe to improve its attractiveness, by creating a level playing field with Asia through providing subsidies in Europe. What are the important steps in the semiconductor value chain? Companies that focus on one step in the supply chain are fabless companies (design), foundries (front end manufacturing) and outsourced assembly and testing companies (OSAT’s, back end manufacturing). Integrated device manufacturers (IDM’s) integrate across the design and manufacturing steps, the core of the chip-making industry. The design phase requires electronic design automation (EDA) software that enables engineers to design chips, sometimes combining own designs and, so-called chip intellectual property cores (IP cores). Specialised companies could license these software building blocks to start their own design for specific end-users. An interesting development in this field is a new initiative involving chip designs based on an open standard, RISC-V. Unlike existing, patented, architectures, the RISC-V architecture is based on open source licenses. Europe could help foster such an initiative, a development it could also benefit from, because it becomes less dependent on patented designs from abroad. Every end-user functionality has different design requirements, including the use of different materials. The manufacturing phase relies on more than 50 types of specialised equipment and hundreds of unique materials and specialty chemicals. In a nutshell, this shows that it will be very hard to master all skills in Europe.

European companies represented in many steps of the value chain

The semiconductor value chain and the players in it

Huge investments require scale

Semiconductor production is very R&D and capital intensive, requiring both deep technical knowledge of design, production process design and scale. Compared with other industries, investment as a percentage of revenues is amongst the highest. According to BCG, the industry invested about US$90bn in R&D and US$110bn in capital expenditure across all activities in the value chain in 2019. Building a new, state of the art, mega fab from scratch is said to cost up to US$20bn. Scale is key to achieving sufficient returns on investment. Because of this, it is difficult for new companies to engage in the core activities of the supply chain. It also implies that the supplier base in each activity is relatively concentrated. Although European companies offer products and services in many steps of the value chain, Europe lacks scale. It does not have a complete network of clients, suppliers and knowledge institutes. Production of more advanced semiconductors moved to Asia because of economies of scale and government subsidies.

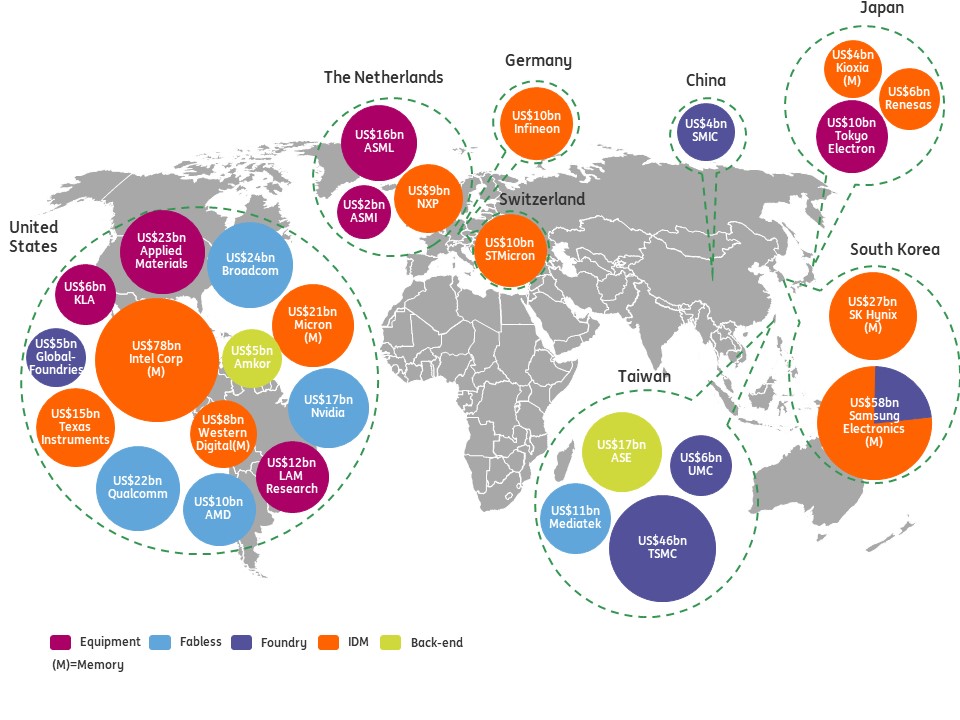

Key global semiconductor companies located in a small number of countries

Main semiconductor companies by type and revenue

Decrease dependencies and support sustainable agenda

Besides geopolitical arguments, there are also other arguments to support the industry. Access to advanced production capabilities should ensure that European industry can benefit from state-of-the-art chip manufacturing, but could also participate more easily in the design of these systems since there is a close relationship between chip design and manufacturing. If Europe wants to control its own destiny, it has to be involved in the design of next-generation AI systems. This requires local R&D, chip design and manufacturing. Demand for leading-edge chips will increase as innovations find their way into products. Production capacity should therefore be able to meet the requirements of EU end markets such as the automotive, medical, industrial, telecom and datacenter sectors of the future.

The plans will also help the EU in its sustainable agenda. New generations of chips are more energy efficient. Because of advances in lithography technology, microchips become three times more energy-efficient every two years. Also, semiconductors are a key component in the electrification of the economy. However, investments should be made under the right conditions. Semiconductor manufacturing is energy and water-intensive. The EU should set as a condition for subsidies that companies adhere to high standards with respect to water usage as well as the use of green electricity. Because substantial subsidies to establish semiconductor manufacturing capacity in Asia are common, European subsidies should be large enough to make it attractive for companies to establish state-of-the-art chip manufacturing plants inside the EU.

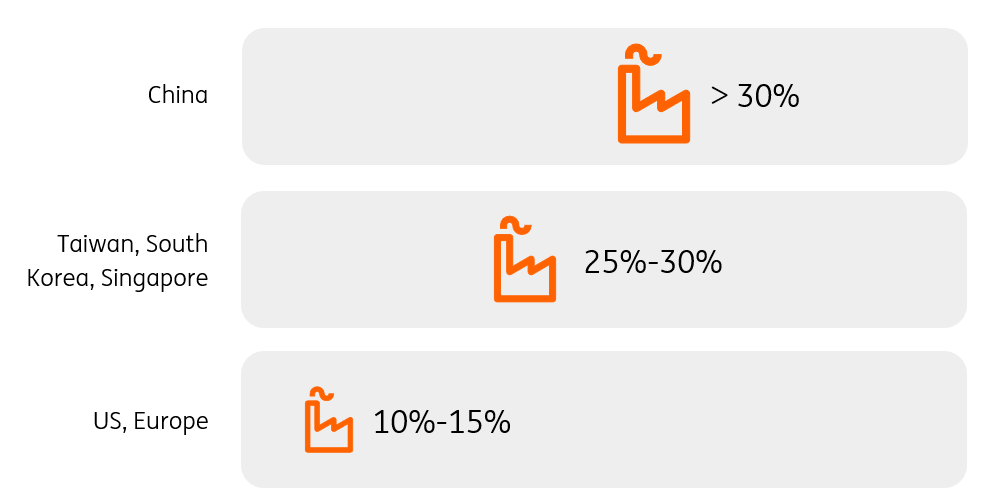

Incentives for new fabs before chip acts lowest in US and EU

Estimated size of government incentives as a percentage of TCO of new fab

Strongly focus on strengthening the existing ecosystem

It is estimated that 90% of European chip demand until the end of this decade will be for chips over 10nm. Therefore, the first priority should be to strengthen the current ecosystem. Europe has a fair market share in the mature nodes segment, although the global market share for these nodes (in terms of global wafer capacity) could improve. Innovation in Europe is not targeted at reducing node sizes, but in other fields, as the (automotive) industry has specific requirements. European R&D, for example, aims to improve the application of new materials such as silicon-carbide and gallium-nitride. Materials research should therefore be included in an incentive package as well. Europe should also build on its existing leading positions, such as in equipment manufacturing, and the expertise of EU research institutes and universities. Preparing the European semiconductor industry for potential future developments involving photonics and quantum technologies should contribute to a future-proof ecosystem.

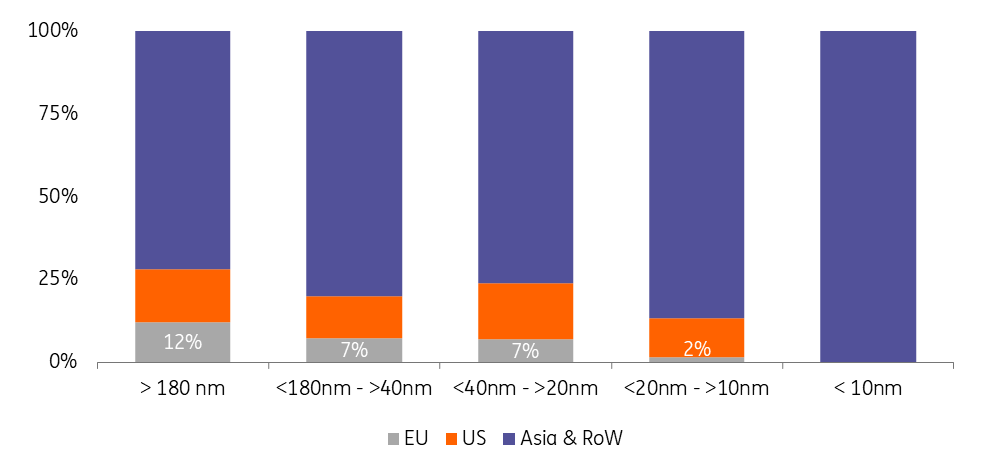

EU wafer capacity also limited in mature nodes

Global market share of EU in wafer capacity for various node sizes, December 2020

Developing advanced semiconductors manufacturing capacity needs the industry

Currently there are no large fabs in Europe that produce leading-edge chips. A lot of knowledge is required to design and build a <5 nm node semiconductor fabrication plant. This knowledge cannot be acquired easily, since it involves advanced knowledge about the efficient use of equipment as well as manufacturing process technology. It also requires contracts with customers to produce large quantities of semiconductors, to reach economies of scale. This is something only experienced operators achieve. The ambition to establish a cutting-edge logic fab in the EU in a realistic way, therefore, needs the involvement of the leading manufacturers: Intel, TSMC and Samsung.

For these companies, it is relatively unattractive to set up a fab in Europe. In Asia companies profit from economies of scale, industrial clustering and government subsidies. Incentives are therefore required to balance the relative high-cost base in Europe. This way, companies have an incentive to bring production to Europe. Determining the exact incentives is a balancing act. Subsidies shouldn’t undermine the competitive position of existing European semiconductor manufacturers. There is a small risk that (local) subsidies in some way could be used to install additional capacity in sectors where the market has functioned rather well to balance demand and supply. If a large foundry could be convinced to increase its planned capacity in Europe instead of Asia, there will be no additional global capacity beyond the capacity already planned. This limits the risk of over-supply. It is important that a newly established mega fab in Europe would be able to produce systems for multiple fabless semiconductor companies, because innovation in Europe (and the ecosystem) would benefit the most from this. We do expect positive spill-over effects for the existing industry of a new mega fab. Establishing a state of the art plant would increase the attractiveness of Europe for suppliers of materials and equipment. This could broaden the local availability of input materials. A bigger eco-system, with more knowledge and more highly-skilled workers, is also something the existing industry could profit from.

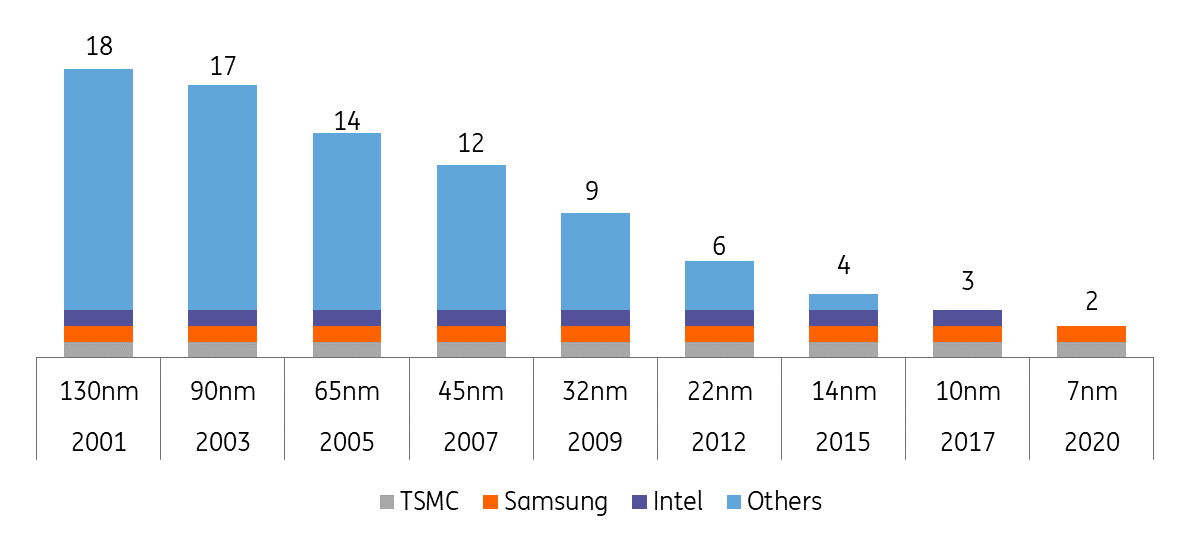

With each generation of leading-edge node the number of manufacturers declines

Leading-edge node manufacturers by production year

What will likely be proposed in the EU Chips Act?

According to the keynote speech by EU President von der Leyen at the 'Masters of Digital 2022' event in Brussels on 3 February 2022, the European Chips Act will address the following. In the EU Chips Act, the European Commission set a goal of producing 20% of the world's microchips in Europe by 2030. On top of more than €30bn of public investments already foreseen (backed by NextGenerationEU, Horizon Europe as well as national budgets) the Act will enable more than €12bn in additional public and private investment by 2030. The act focuses on five areas. First: research, for instance on transistors below 3nm and disruptive technologies for AI. Second, from the lab to the fab, translating excellence in research into industrial innovation, with investment in chips design and pilot lines for prototypes. Third, on production capacity, where state aid rules are adapted to attract private investment in new advanced production facilities. Fourth, the European Chips Act will also support smaller, innovative companies, in accessing advanced skills, industrial partners and equity finance. And finally, on supply chains. To tackle potential bottlenecks that slow down growth the EC will work on semiconductor partnerships with like-minded partners to create more balanced interdependencies, avoid single points of failure and build supply chains that can be trusted.

EU Chips Act promotes economic growth

An EU Chips Act will promote economic growth in Europe. Additional investments in the semiconductor industry are needed to play a leading role in domains such as AI. Europe is well positioned with strong manufacturing and design capabilities in the automotive and industrial sectors. Investment in R&D for their required technologies will help their market positions. Also, supporting investment in European <5 nm node semiconductor manufacturing capacity will likely see spillover effects for the broader economy and European chip manufacturing eco-system. From what we already know from the EU Chips Act today, we expect that the EU will be able to enhance its position as a technological leader in some fields of the semiconductor value chain.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article