EU carbon border tax: Unnecessary for now but still a good idea

At current carbon prices, a carbon border tax as proposed by the European Commission is not necessarily needed, yet. However, despite some disadvantages, such a tax could be a powerful tool to maintain EU competitiveness and to have others join the voyage to a carbon-free world

The European Commission’s ‘Green Deal’ aims to reduce the carbon footprint of the EU to zero by 2050. The policy will work through a framework of regulation and legislation setting clear overarching targets. The European Commission has not come up with a price target for C02 emissions yet, but studies like those of CE Delft show that if we want to commit to the goal of limiting global warming to a maximum of 1.5 degree Celsius, prices should exceed EUR 100 per ton in the coming years (pre Covid-19 crisis was stable around EUR 25 per ton but has fallen since then). At these price levels, the competitiveness of European firms would be hurt, particularly among energy-intensive industries such as European rubber and plastic producers, mineral producers, oil refineries, and chemical industries. To protect the competitiveness of these industries, the European Commission is seeking to impose a carbon tax on imports. Such a ‘carbon border tax’ seems to be a central theme in the European Commission’s ‘Green Deal’.

With this note we would like to shine a light on why the European Commission might opt for a carbon border tax and how high such a tax would be.

Why a carbon border tax?

A global carbon tax is economically the most cost-effective way to bring carbon emissions in line with the Paris Agreement. However, there is no uniform global carbon tax right now and it is unlikely that there will be an agreement reached on such a tax any time soon, given, for example, the withdrawal of the US from the Paris climate deal.

In 2005, the EU introduced a tax on CO2 emissions. EU industrial firms have to buy emission certificates for every metric ton of CO2 they emit[1]. These emission rights are traded on the Emission Trading System (ETS). Carbon taxes have been introduced in many parts of the world, for example in Canada, some states of the US, and Australia. However, the taxes in the EU are supposedly the most extensive ones. As a consequence, imported goods do not fulfil the EU’s CO2 emission standards.

To deal with the discrepancy, the European Commission seeks to impose a carbon border tax, a de-facto import tariff that taxes greenhouse gases emitted during production abroad. There are several arguments in favour of a carbon border tax: i) it would incentivise foreign producers to contribute to the fight against global warming, given the large size of the EU single market; ii) it would be an additional source of revenues to green the economy; iii) it would create a level playing field for European firms against foreign competition; and iv) it would discourage European firms from moving production outside the EU. At the same time, however, a carbon border tax could still undermine EU companies’ competitiveness vis-à-vis other markets not introducing similar carbon emission taxes. As a consequence, EU companies could still consider moving their export-oriented production outside the EU.

[1] Participating countries to the ETS system are the EEA (EU28 + Norway, Iceland, and Lichtenstein). The tax does not only target CO2 emission. Other greenhouse gasses converted to CO2 equivalent units.

Can ETS prices make up for a carbon border tax?

Carbon taxation in the EU induces a price difference between foreign-produced goods and goods produced in the EU. European firms are disadvantaged in their domestic markets relative to foreign competition when the price difference becomes larger than the current import tariffs of the EU (2.8% on average) and the costs of cross border trade.

At ETS prices of around EUR 25 the disadvantage for EU firms is not large enough to be significantly affected by competition from abroad. However, if prices rise further, the competitiveness of the more energy-intensive sectors could be affected in their domestic markets.

To get an idea of how higher carbon prices would affect EU firms’ competitiveness, we assume that to compete with local companies, firms that move their production outside the EU have at least 5% of extra costs to make up for. Then, including the average import tariff of the EU, the price advantage induced by avoiding the EU carbon tax should exceed 7.8% before moving abroad leads to outcompeting locally-producing EU firms (all else equal).

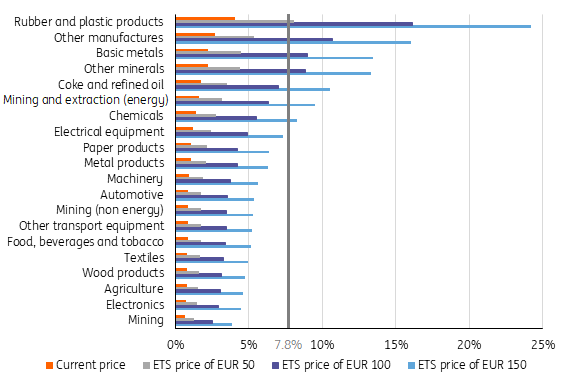

Using input-output tables, we computed the price advantage induced by the European carbon tax for each industry and every country. Looking at all the industries and countries, only 2% of foreign manufacturing industries would have a price advantage larger than 7.8% with carbon prices around EUR 25 per ton CO2. When averaging all the countries within a sector[1], even the sector with the largest price advantage (Rubber and plastics, see Figure 1), only exceeds the EU average import tariff by 1.2%.

When carbon prices triple to EUR 100, 31% of foreign industries have a price difference that exceeds 7.8%. Figure 1 shows for each industry the average price difference for a given carbon price.

Note that some of the industries in Figure 1 are not part of the current ETS system and do not have to pay carbon taxes. Currently the EU ETS system only covers 45% of the EU's greenhouse gas emissions. Activities currently covered are power and heat generation, civil aviation and some energy-intensive industrial sectors such as oil refineries, steel works and production of iron, aluminium, metals, cement, lime, glass, ceramics, pulp, paper, cardboard, acids and bulk organic chemicals. The coverage of the EU ETS system is planned to be extended in later stages.

[1] These are averaged weighted by EU imports

Fig 1: Price difference induced by carbon taxation

At current levels, ETS prices are not really harmful to EU competitiveness. However, once carbon prices rise above 100 euro per ton, energy-intensive industries could suffer. The three most energy-intensive industries (Rubber and Plastic products, Basic Metals and Other minerals) are good for about 2% of EU GDP.

Free allowances

The reason that ETS prices are low is due to the generous handouts of free allowances that are given to those industries that are deemed sensitive to foreign competition. Whether ETS prices will actually reach levels where a carbon border tax becomes necessary to protect the level playing field will depend on European policy with regards to these free allowances. If the European Union decides to crack down on the allowances more quickly to limit global warming to 2 degrees, the level playing field in domestic markets could become an issue, making the introduction of a carbon border tax more urgent.

On the other hand, a carbon border tax may require the EU to give up on free allowances. If the EU taxes greenhouse gas emissions of foreign firms but hands out free allowances to European companies, foreign firms and governments are likely to complain to the WTO.

Carbon border tax doesn't solve EU export disadvantage

Although an EU border tax may protect the level playing field in the Single Market, it does not solve the competitive disadvantage of EU firms caused by carbon taxation in foreign markets. EU firms have to pay a carbon tax that foreign companies don’t. A carbon border tax would add to the current competitive disadvantage abroad as it raises the costs of imported intermediates.

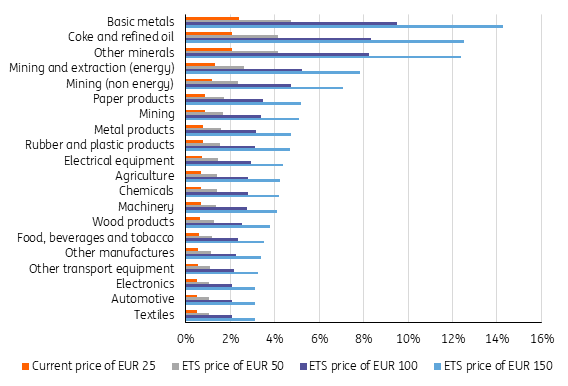

If carbon prices rise, the prices of exported goods will rise, too. This is particularly the case for energy-intensive products such as oil refinery, mining and metal production (Fig 2) because they emit relatively more greenhouse gasses.

Using input-output tables, we have computed the carbon intensity of EU exports and the price disadvantage faced by European exporters due to carbon taxation (including the border tax). Fig 2, shows these price disadvantages for the different EU sectors for the given ETS prices.

At current ETS prices, the price disadvantage induced by carbon taxation is rather small. Only when carbon prices exceed 100 euro per ton does the price disadvantage of the most energy-intensive sectors approach 10%. A logical result is that, as carbon prices increase, production of these three sectors destined for foreign markets might move out of the EU. However, the carbon tax also incentivises efforts to become more energy efficient and reduce carbon emissions. If these industries succeed in cracking down on carbon emissions, the competitive disadvantage induced by carbon taxation becomes less of an issue.

Fig 2: Price disadvantage of European firms on export markets for a given ETS price

Conclusion

Although the level playing field argument does not really hold at current carbon prices, the EU is already pushing the issue of a carbon border tax. The European Commission is using the threat of a carbon border tax to push other countries to implement policies similar to the ETS policy in the EU, such that the level playing field will not be distorted when ETS prices rise.

One reason for the EU to push ahead with the carbon border tax now is that the EU doesn’t expect trading partners like the US to step up their respective environmental policies. As such, implementing a carbon border tax while ETS prices are still low could make it more viable. However, this doesn’t mean that a carbon border tax will not face opposition. Wilbur Ross, the US Secretary of Commerce, has recently warned that the US will retaliate against any carbon border tax that it deems protectionist in essence. China has also warned against “climate protectionism”. These taxes could be the beginning of another potential trade war, as trade disputes have escalated quickly in recent times.

There are several arguments often brought forward in favour of a carbon border tax. At current ETS price levels, such a tax is not needed to ensure a level playing field in the EU’s Single Market. However, with carbon prices potentially increasing quickly, a carbon border tax could offset any disadvantages vis-à-vis foreign competition. A carbon border tax could also allow the EU to leverage its large Single Market, applying a powerful instrument to encourage other countries around the globe to join the voyage to a carbon-free world.

BOX i: Carbon taxation on top of the EU carbon price in Dutch manufacturing

In part to address the insufficient incentive from current ETS-prices, the Dutch government presented in June a Climate Agreement (i) (Klimaatakkoord) that aims to reduce greenhouse gases in the Netherlands by at least 49% by 2030. Dutch manufacturers are among the most efficient in the European Union. As such, the EU carbon price provides too little incentive to realise the reduction target for the manufacturing sector in the Netherlands. The Climate Agreement, therefore, introduces an additional carbon tax for the Dutch manufacturing sector on top of the EU carbon price. Although details are still to be worked out, the Climate Agreement aims for an effective carbon price(ii) of €30 per ton CO2 in 2021 towards €125 to €150 per ton CO2 in 2030(iii). The Dutch Environmental Agency will advise the government on the price level to reach the reduction target for the manufacturing sector. Another leading agency will provide an expert opinion on the impact of the carbon tax on the level playing field for Dutch manufacturers. Based on these expert views, the government will ultimately set the level of the carbon tax.

i https://www.klimaatakkoord.nl/documenten/publicaties/2019/06/28/klimaatakkoord see chapter 3.3.

ii Combined effect of the EU carbon price and the additional carbon tax.

iii These prices are reference values for the total carbon price (EU ETS carbon price and national carbon tax combined).

Methodologial notes:

Note i: Computing the carbon intensities of global industries.

Using the intercontinental input-output tables, we computed for each global industry the non-EEA carbon emission over one US$ of gross output. To do this, we used a slightly altered version of the standard Leontief inverse method, commonly used to derive industry value added in final demand.

To do this, we multiply a row vector with the share of greenhouse gas emissions in gross-output for each industry from each country (CO2_C / GO_C) with the Leontief inverse (I-A)-1 of the OECD intercontinental input-output table. Multiplying the product of those with a column vector with the final consumption for each industry from each country yields the world’s total emissions of greenhouse gasses by industries. This excludes direct exhaust by households or government sectors such as the army.

Equation: Leontief inverse multiplication

A, the input coefficients of industries in each other’s output.

F is the Final use by business consumers and the government for goods from industry C, R or …n

To exclude EEA emissions (since these are already taxed within the EU ETS), we set the emissions shares of EEA countries (CO2_C / GO_C) equal to zero. To compute the carbon content for each dollar of output for each individual industry, we restrict the column vector with final consumption [F] of the output for the industry from the country we are running the equation for to 1. We set the final consumption for all other industries equal to zero.

Note ii: Computing the carbon intensities of EEA exports.

To compute the carbon intensity for each dollar of output by EEA industries, we followed the same operation as described in appendix i-a, except we did not restrict the row vector with emissions shares.

Note iii: Computing the price advantage of a given ETS price.

When having computed the carbon intensity, CI_c, for a specific industry from a specific country, being the carbon emissions for one dollar of gross output of that industry, we can compute the gross-output of that industry needed to produce one ton of greenhouse gas emissions as 1 / CI_c. The price disadvantage of EU firms can then be computed by dividing the carbon price of €25 (UIS$27) by this number 27 / (1/CI_c).

Note iv: Removal of outliers.

The coke and refined petroleum industry for Croatia and Slovenia showed a carbon emissions share: (CO2_C / GO_C), that was 10 to 100 fold what we observed for other European countries. We have removed these two outliers and replaced them with the emission shares of the previous year.

Note v: Comparison with OECD TiVA data.

We have compared our calculations with those of the OECD by looking at the time trend of foreign CO2 emissions resulting from EU final demand over time. Although the pattern over time matches the OECD calculations exactly, our results are five to six percentage points higher. This might be the result of our assumptions regarding the split between Chinese and Mexican global and non-global industries. Where in our calculations, the data for China and Mexico is split in global and non-global industries, the OECD does not distinguish between these global and non-global sectors for China and Mexico in their CO2 calculations.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article