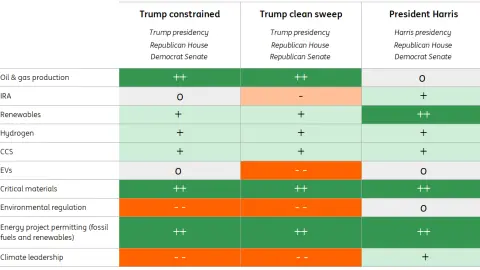

Trump clean sweep scenario: unleashed energy dominance sets back green agenda

While several clean energy incentives under the IRA may find a lifeline, the US’s green agenda could be set back for years. We would expect a much stronger focus on enhancing oil and gas production with substantial environmental regulation swipe-outs and weakened roles on green technology innovation

A Republican president and Congress would trigger substantial disruption to climate policymaking. While certain existing incentives under the IRA may find a lifeline, a lack of comprehensive policy support could create problems for longer-term clean energy deployment. We could see a stronger focus on cheap oil and gas production with significant environmental regulation swipe-outs. Meanwhile, the US is likely to cede to China on the development of green technologies.

Oil and gas

Republicans would put much emphasis on US fossil fuel energy dominance, strongly pushing for increased oil and gas production. In addition to deregulation, easy project authorisation, and more exports, we can potentially see Congress passing legislation facilitating accelerated production.

IRA

As in our "Trump constrained" scenario, the IRA is unlikely to be entirely repealed. Even if Congress is controlled by the Republican party, it would be difficult to ignore the extra revenue and job creation under the IRA (and the IIJA). As noted, 80% of the more than $200bn in clean energy manufacturing investment flows into Republican congressional districts, with those in North Carolina, Georgia, Nevada, and Michigan being some of the largest recipients.

Clean energy manufacturing investment announcement since 2021

Nevertheless, the 30% of IRA likely to be impacted, as identified in the "Trump constrained" scenario, would suffer from a higher degree of disruption. Congress would try to pass additional legislation to undo provisions such as electric vehicle (EV) consumer tax credits, clean recharging tax credits, and clean energy funding under the Department of Energy (DoE).

A Republican Congress would also be emboldened to lower the requirements for IRA technology-neutral clean power tax credits or even set an earlier sunset date for these credits. Finally, the implementation of the IRA would become significantly harder and slower.

EVs

There would be visible slowdowns of EV development, with internal combustion engine (ICE) cars back in vogue. Biden’s EV production targets would be thrown out; the vehicle tailpipe emissions standard would be discarded. EV tax credits would likely be cancelled and the funding for EV charging infrastructure might also be completely scrapped. We can also see lowered clean energy loans and loan guarantees from the DOE under the IRA, much of which has so far flown to battery manufacturing. This would create a much tougher environment for the US EV industry, one that has only recently taken off due to Biden’s supportive policies.

Car companies would still set long-term strategies to produce more EVs, as it would be hard for them to walk away from their sustainability targets under investor and stakeholder pressure. EV development in Europe and China will also encourage US car manufacturers to keep producing EVs. However, without favourable policies, the burden is higher on manufacturers to innovate, reduce costs, make their EV fleet more profitable, and even advance their charging infrastructure. Nevertheless, one positive spin that can help the EV industry is the priority to strengthen domestic battery supply chains.

Renewable power

A Republican White House and Congress would not go out of their way to stifle the industry but would not provide sufficient support either. Over the past two decades, the US renewable power industry has experienced rapid growth and entered a more mature stage thanks to tax credits (which survived the first Trump administration). This has led to a much lower cost of renewable power generation which in several cases has become lower than that of coal. Texas, a Republican state home to ample sunshine and infrastructure, surpassed California last year to have the largest solar capacity in the country.

Therefore, we expect a Republican White House and Congress to accept the economic benefit of the US renewables market. But there could still be modifications, such as an earlier sunset date for the technology-neutral tax credits under a more difficult budget situation. The industry should be able to absorb the change but may still suffer from an initial period of adjustment. Meanwhile, we would not expect much improvement in modernising the grid to be more suitable for renewables. There may even be more restrictions on new offshore wind project authorisation.

Finally, from a power generation perspective, we would expect more natural gas power plants to come online as part of the Republican push to unleash oil and gas production. The increase in gas-fired power generation would also be used to meet rising electricity demand from extreme weather conditions and the energy transition.

Hydrogen and CCS

This scenario will see continued bipartisan support for hydrogen and CCS. But under a clean Republican sweep, there might be revisions towards looser IRA tax credit eligibility standards. These include lowering the required carbon capture rate for blue hydrogen tax credits and loosening the renewable generation temporal or geographical matching criteria for green hydrogen tax credits. A possibly lower level of clean energy funding from the DOE can also weaken the support hydrogen and CCS projects can get from the federal government.

Critical minerals

Same as the "Trump constrained" scenario.

Regulation

A re-elected Trump would move fast to reverse the environmental regulations finalised under the Biden administration (power plants, electric vehicles, methane emissions). And with Republican control of Congress, it would be hard to impossible for the Democrats in Congress to use the Congressional Review Act as a legislative tool to overturn any reversal of regulations. The US would be in a smaller-carrot, no-stick mode for clean energy policymaking.

Climate leadership

The almost certain scrapping of Biden’s climate targets and retreat from the Paris Agreement would further set the scene for a structural change to the US energy policy and climate diplomacy.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

10 September 2024

US election scenarios and how they’ll impact energy and climate policy This bundle contains 4 Articles