Encouraging signs in US CPI, but Fed still set to hike in May

US inflation slowed to 5% from 6% YoY, but the monthly increases in non-food and energy prices continue to run hotter than desired, giving the Fed justification to hike interest rates again in May, Nonetheless, higher borrowing costs and reduced credit availability mean the risks of a hard landing are on the rise and this will get inflation down quickly

Persistent core inflation means May rate hike still probable

US consumer price inflation rose 0.1% month-on-month in March, below the 0.2% rate expected, but core CPI (ex food & energy) continues to run hot, rising 0.4% MoM, which was in line with expectations. That means the annual rate of core inflation rose to 5.6% from 5.5% despite the headline rate dropping from 6% to 5%. Moreover, at 0.4% MoM (0.385% to three decimal places) we are still running at more than double the 0.17% MoM rate needed to be averaged over time to bring the annual rate of core inflation back to the 2% target. Consequently, the odds still favour the Fed hiking rates a further 25bp at the 3 May Federal Open Market Committee (FOMC) meeting.

The details show a 3.5% MoM drop in energy prices, led by a 4.6% drop in gasoline. Food prices were flat on the month while transportation prices fell 0.5%. Airline fares remain a big upward contributor, rising 4% MoM, but most other components showed evidence of a slowing trend in the rate of price increases.

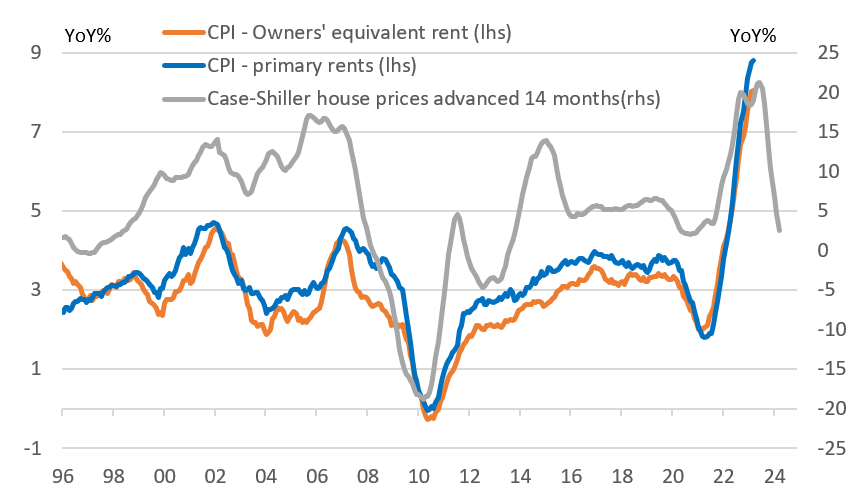

Importantly, we saw a reduced contribution from housing with shelter up 0.6% MoM and owners' equivalent rent up 0.5%. These are slower than the 0.7% or 0.8% prints recorded over the past year, which is significant because housing costs carry the biggest weighting within the basket of goods and services used to calculate inflation.

But inflation will slow as economic conditions deteriorate

Despite the strength in today’s core inflation measure, we expect inflation to slow rapidly through the second half of 2023 as the decline in house prices, which is contributing to a flat lining in new housing rent agreements, feeds through into the CPI.

US house price falls to eventually slow shelter CPI

Higher financing costs are dampening demand in many other key components, most notably the new and used vehicle sectors. These two components also have a heavy weight in the inflation basket and further price falls look likely which will make overall inflation slow more quickly.

Higher borrowing costs are now being accompanied by a rapid tightening in lending conditions due to recent banking stresses. Banks will become increasingly cautious in their lending behaviour, which will restrict access to credit and put up its cost, further weighing on the economy and eroding corporate pricing power.

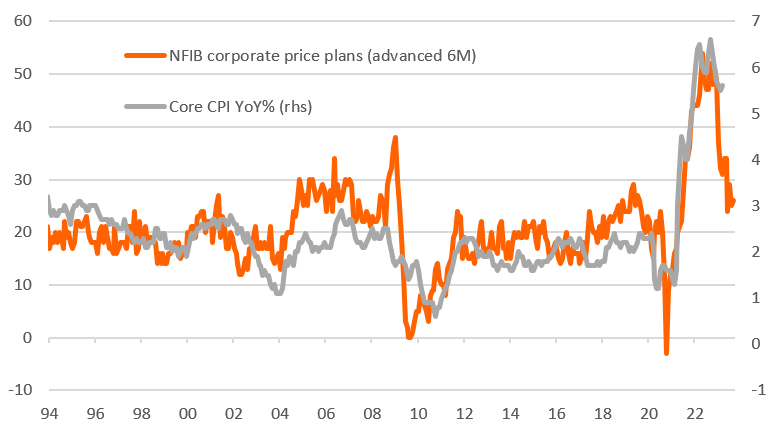

Weakening corporate price plans mean lower inflation

This was again evident in the latest National Federation of Independent Businesses survey on the economy. The proportion of companies that said they raised prices over the previous three months dropped to 37% in March, the lowest reading since April 2021 (having hit 66% in March 2022). More importantly, the proportion of companies looking to raise prices over the coming three months is at 26% versus 52% twelve months ago. As the chart below shows, this has a good lead quality on core CPI and suggests sub 3% inflation may be possible by year-end.

25bp hike in May, but cuts will come

Inflation continues to run ahead of the 0.17% MoM rate required to bring inflation to 2% year-on-year over time, but we are heading in the right direction. Even so the Federal Reserve remains nervous and appears inclined to hike rates 25bp again at the 3 May FOMC meeting.

We think that will mark the peak for the Fed funds rate. The combination of higher borrowing costs and the tightening of lending conditions that will inevitably result from the fallout of the recent banking stresses heightens the risk of a hard economic landing. This will make it even more likely that inflation returns to the 2% target by early next year.

The Fed’s dual mandate of price stability and maximizing employment gives them greater flexibility than most other central banks. Assuming we are correct that inflation slows rapidly through the second half of the year and the unemployment rate starts to rise, we see the potential for the Fed to cut rates by 100bp before the end of the year.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more