Emerging Markets: Growth and fiscal insights from IMF’s economic update

The IMF's latest World Economic Outlook provides a valuable snapshot amid the ongoing pandemic. Compared to April, the fund expects a deeper recession in 2020 (-4.9% vs -3.0%) and a more modest recovery in 2021 (+5.4% vs +5.8% in April), meaning that it will take longer for the global economy to recover lost output while plenty of uncertainty remains

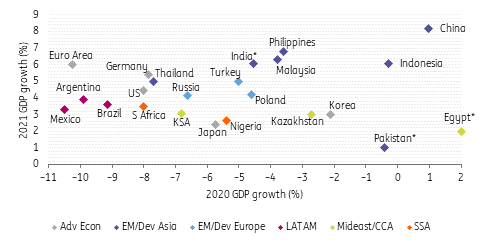

GDP growth projections for 2020 and 2021 (% YoY)

Latin America, South Africa and oil exporters face steepest recessions

The slump in advanced economies is deeper for 2020 (-8.0% vs -6.1% in the April WEO) but growth has been revised up slightly for 2021 (+4.8% vs +4.5%). We remain concerned about the growth outlook in many emerging market and developing economies. Altogether, they are seen contracting by 3.0% this year (vs -1.0% in April) with a depressed recovery in 2021 (+5.9% vs +6.6%). Notwithstanding, the heterogeneity means that deviations across regions and countries are substantial:

- Asia (-0.8% in 2020; +7.4% in 2021) faces a more modest contraction, with China holding up (+1.0% in 2020; +8.2% in 2021) thanks to policy. India is the exception, with growth revised down by 6.4ppt to -4.5% in 2020. Asia remains best positioned for the recovery with growth seen recovering to 7.4% in 2021.

- Latin America (-9.4%; +3.7%) has seen the steepest downward growth revision since April (-4.2ppt), with Argentina, Brazil and Mexico facing a contraction of around 10% as those countries have been struggling with containing the virus.

- In between those two extremes, we find EM Europe (-5.8%; +5.3%), Middle East & Central Asia (-4.7%; +3.3%) and Sub-Saharan Africa (-5.4%; +2.6%). Among them, commodity exporters and South Africa (-8.0%; +3.5%) are facing steeper declines.

Emerging Markets have limited fiscal scope with debt sustainability at risk for some

In response to the Covid-19 outbreak, most economies have followed a combination of containment measures and policy stimulus. Notably fiscal balance sheets are seeing a meaningful deterioration in 2020 due to the weak growth outlook and larger fiscal deficits as we highlighted in a note on the risks of sovereign debt distress on 2 April. In addition to the growth forecasts, the IMF has therefore also provided updated fiscal projections for a small subset of DM and EM economies.

Global gross debt/GDP is expected to rise from 82.8% in 2019 to 101.5% in 2020. Both the high absolute number and the increase over 2020 are skewed upwards by advanced economies (with debt/GDP seen increasing from 105.2% in 2019 to 131.2% in 2020). Emerging markets, on balance, carry a much lower debt burden and see a reasonably modest increase (from 52.4% to 63.1%). Yet, it is here that we are more concerned about debt sustainability, as many advanced economies benefit from reserve currency status and ultra-low interest rates. In turn, EMs are using limited fiscal resources compared to DMs in the fight against Covid-19 (see the IMF’s Covid-19 Fiscal Monitor).

Fiscal deficits for emerging market economies and low-income developing countries (LIDC) are expected to run at 10.6% and 6.1% of GDP, respectively, in 2020. However, a varying degree of fiscal support, economic output, commodity exposure and debt structure result in large divergences across EM economies:

Among those, Brazil (-16.0% of GDP), South Africa (-14.8%), China (-12.1%), India (-12.1%) and Saudi Arabia (-11.4%) will run deficits above the 10% of GDP threshold. Mexico’s deficit is lower at 6.0% of GDP but the deep recession means that it will join the above mentioned to see gross debt/GDP rising by more than 10ppt.

Positively, 2021 will see debt/GDP rising more modestly in most cases as growth recovers. The exceptions are China (+6.6ppt) and South Africa (+4.7ppt) which will see their debt/GDP ratio rising further, with debt sustainability a big concern to us in the latter (despite attempts at fiscal consolidation). In contrast, Brazil’s debt/GDP ratio is set to decline (-1.7ppt) in 2021, but it is the highest ratio (above 100%) among its peers and warrants monitoring.

Interestingly, Saudi Arabia (-11.4% of GDP) has seen an upward revision in its fiscal balance vs April (+1.2ppt), reflecting fiscal austerity efforts due to the slump in oil prices. EM Europe (-6.9%), also thanks to limited budget support measures in Russia and Turkey, will run relatively low deficits. This is also the case for low-income developing countries, as they face tighter financing conditions (notably weaker access to external funding and some having asked for debt suspension).

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article