Emerging markets: A test of nerves

Higher US interest rates and oil prices along with uncertain policy responses are weighing on the most vulnerable emerging markets right now. Investors seem to be sticking with the growth story so far, but will be looking for strong policy responses over coming weeks

Tough times for emerging markets

It has been a tough few weeks for emerging markets. Ever since the dollar started to surge from mid-April onwards, EM currencies and debt markets have come under pressure. Some of the most followed exchange-traded funds (ETFs) that track major EM debt indices are now down 5% year to date. And some of these funds are starting to see net outflows on the year.

For example, the iShares EMB ETF, which tracks hard currency debt issued by EM governments, has seen year-to-date outflows of US$50mn, versus US$1bn inflows over the last year. However, popular EM equity ETFs, such as the Vanguard FTSE EM ETF, continue to see inflows over the last week and year-to-date as well.

Emerging market currencies and debt markets might fare well if US rates rise more orderly amid a healthy global growth outlook. That said, investors will look out for strong policy responses

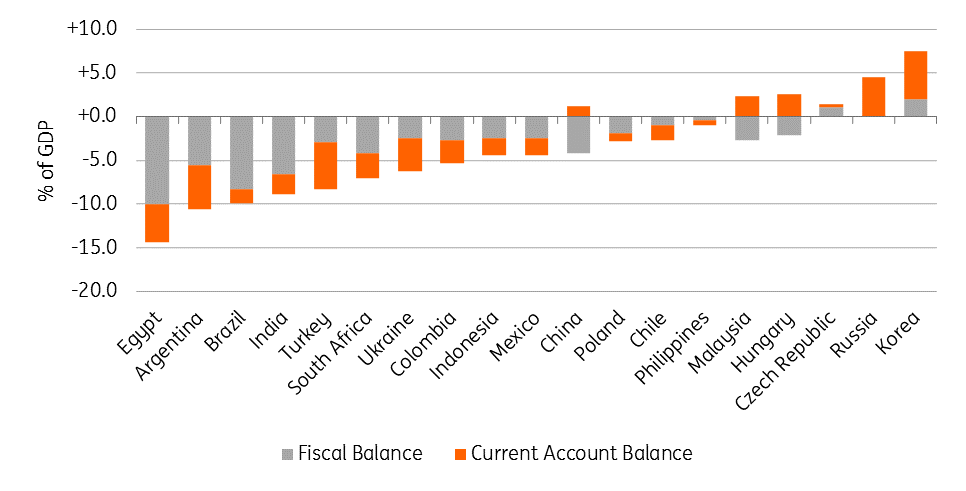

A firmer dollar and higher interest rates create challenges for those economies with large external deficits and also large budget deficits. Argentina scores poorly on both counts and after failing to restore confidence with aggressive rate hikes and suffering heavy losses in FX reserves, has turned to the IMF as a lender of last resort. An informal IMF meeting is scheduled for Friday this week, and expectations are that it will have to accept a fiscally tight policy in response to a multi-year programme.

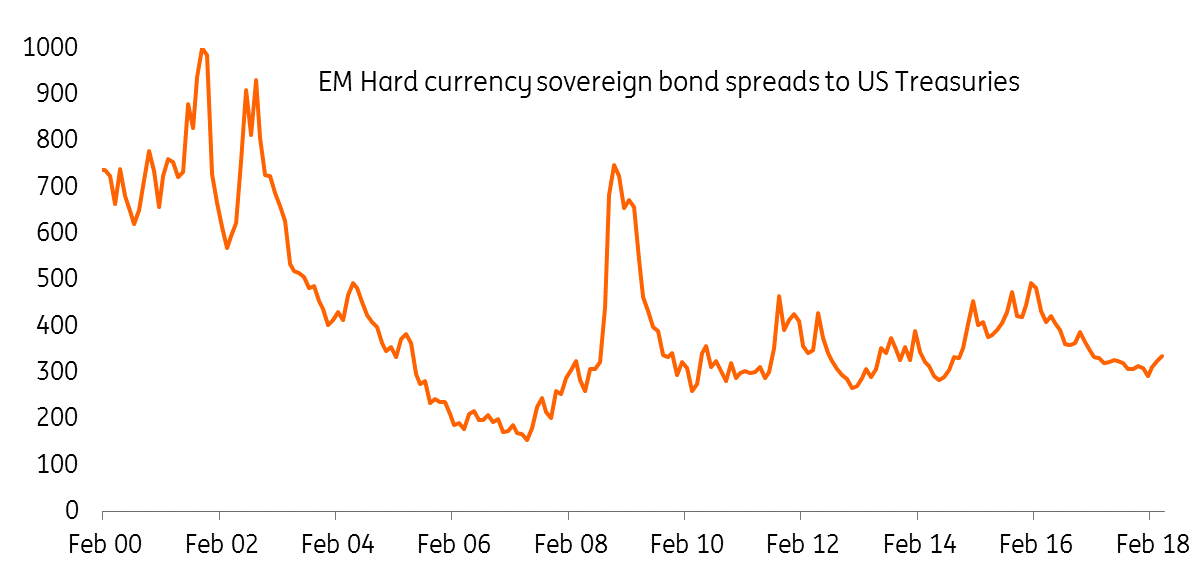

Emerging markets USD denominated debt spreads

Putting the EM debt correction into perspective

In the bigger picture, however, the recent rise in hard currency sovereign yields does not look too severe. The popular EMBI spread, measuring an index of hard currency sovereign bond yields versus Treasuries is still a lot tighter than it was in 2016, let alone 2008 or even 2001 – when Argentina last defaulted. Venezuela defaulted last year too.

Creating a more benign outlook for emerging markets have been better policy responses. Foreign exchange rates have typically been allowed to float, avoiding some of the imbalances seen in the likes of Asia, Russia and Argentina in the late 90s and into the Argentine default of 2001. Managed FX rates contributed to the imbalances in all those cases. And frankly, we're a little surprised that anyone expected the next IMF programme for Argentina to involve any kind of FX targeting agreement.

Emerging market currencies break lower from pegs in the late 90s

Higher US rates keeping the pressure on

However were US rates to continue pushing higher, (seemingly now driven by oil prices), expect investors to stay wary of those economies dependent on external portfolio flows. Turkey is a concern currently where higher oil prices are driving the trade deficit wider, and investors have seen little evidence that the negative inflation-Turkish Lira spiral is soon to be broken. Newswire reports of President Erdogan wanting to have a greater say in monetary policy were not greeted well by international investors.

In addition to Argentina and Turkey, other potential candidates with high external financing needs and twin deficits that will remain on investors’ radars include Egypt, South Africa and Ukraine. That said, the positive momentum in South Africa and IMF programmes in the other two have seen a more contained sell-off so far.

Emerging markets' twin deficits (current account + fiscal) very much in focus

Strong response required

Emerging market currencies and debt markets might fare well if US rates rise more orderly amid a healthy global growth outlook. That said, investors will look out for strong policy responses among those more vulnerable to a weakening macro backdrop. Such a policy response would seem likely in the case of Argentina getting an IMF programme. Less certain is the policy mix which will emerge in Turkey before elections on June 24th.

We'd also add that crude at US$100/barrel wouldn't help either, begging the question whether President Trump might 'encourage' friendly OPEC names to increase output quotas at their next meeting on June 22nd.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

15 May 2018

In Case You Missed It: Testing times This bundle contains 5 Articles