FXFX Talking

EMEA FX: Bad boy leads the pack

In the EMEA space, the clear winners since the beginning of the year have been the Hungarian forint and the Czech koruna, benefiting most from the massive drop in gas prices. But a weaker US dollar should mean a boost for other currencies as well. The macro outlook, however, keeps some currencies still at or even below their starting positions for this year

Source: Shutterstock

Main ING Emerging Market FX forecasts

| EUR/CZK | EUR/PLN | EUR/HUF | ||||

| 1M | 24.00 | ↑ | 4.74 | ↑ | 385.00 | ↓ |

| 3M | 24.30 | ↑ | 4.77 | ↑ | 375.00 | → |

| 6M | 24.50 | ↑ | 4.71 | ↓ | 383.00 | → |

| 12M | 24.00 | → | 4.68 | ↓ | 373.00 | → |

EUR/PLN: PLN continues to underperform on local factors

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

EUR/PLN

4.7158

|

Mildly Bullish | 4.74 | 4.77 | 4.71 | 4.68 |

- Poland's zloty has been underperforming its Central and Eastern European counterparts for weeks. We think this reflects the looming European Court of Justice ruling on FX mortgages, as investors could fear that local banks may close resulting FX positions, selling zloty for euros or Swiss francs (as they may reclassify credits to PLN, while liabilities remain in CHF).

- Fundamental backing behind the zloty is likely to improve in 2023, reflecting better terms of trade and overall tightening in the current account deficit. Moreover, interest rate cuts by the central bank are unlikely at least until the second half of 2024, given persistently high core inflation. This should aid the zloty, as i.e. the Federal Reserve/European Central Bank begin to ease policy.

- Politics may prove a risk though, particularly closer to the general elections (fourth quarter of 2023). Backing for the ruling PiS party may seem to be insufficient to guarantee victory. As such, the government is likely to attempt to improve support via more social policies, or confronting the EU once again. As such, stronger PLN gains are likely to materialise next year.

Source: Refinitiv, ING

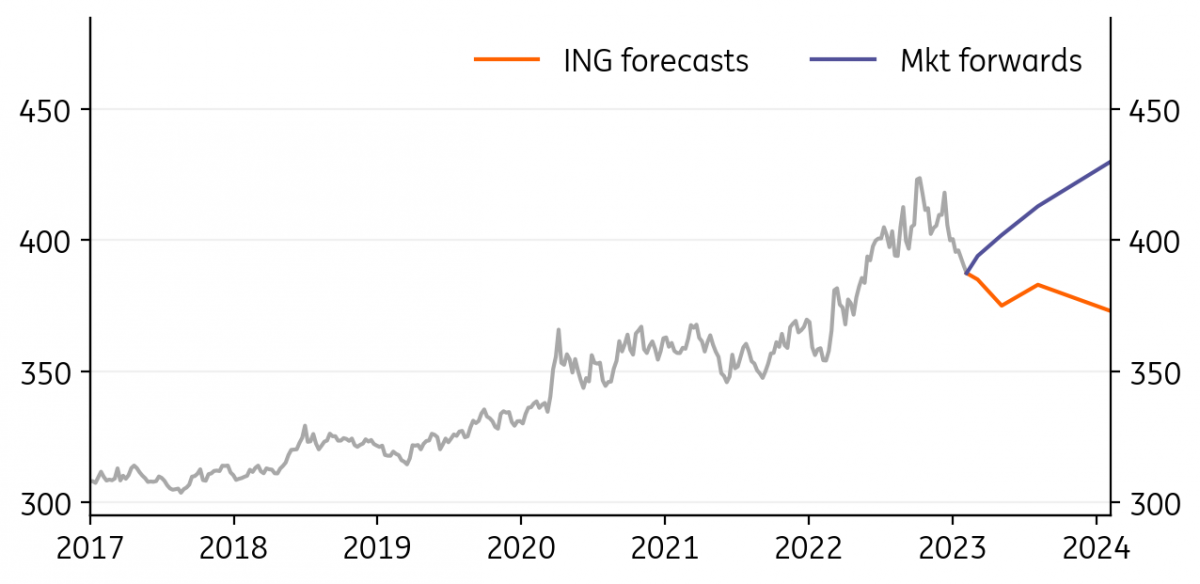

EUR/HUF: The forint still has a lot to offer

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

EUR/HUF

389.26

|

Mildly Bearish | 385.00 | 375.00 | 383.00 | 373.00 |

- The forint has been the top currency in the EMEA region since the beginning of 2023. The National Bank of Hungary confirmed its hawkish intent, and we expect to see further progress in the EU story.

- Moreover, FX-implied yields are by far the highest in the region and the central bank has announced further steps to keep liquidity tight in the market. Gas prices still have room to fall in the first quarter in our view, and it is the forint that may benefit the most within CEE.

- Considering that recent negative sovereign rating events weren’t able to derail the appreciation trend, we think that the forint still has a lot to offer and see it continuing on its current path.

Source: Refinitiv, ING

EUR/CZK: Strong CZK reduces the need for more hikes

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

EUR/CZK

23.821

|

Mildly Bullish | 24.00 | 24.30 | 24.50 | 24.00 |

- The koruna is currently at the strongest levels in more than a decade, driven mainly by falling gas prices and improving sentiment in Europe. This provides additional monetary policy tightening without central bank intervention.

- Our model suggests a fair value at the moment around 24.00 EUR/CZK. Thus, we see risks more towards a correction of current gains.

- On the other hand, falling gas prices can move the koruna a bit lower again. But in a nutshell, we are not looking for a trigger for a move in either direction in the coming months.

Source: Refinitiv, ING

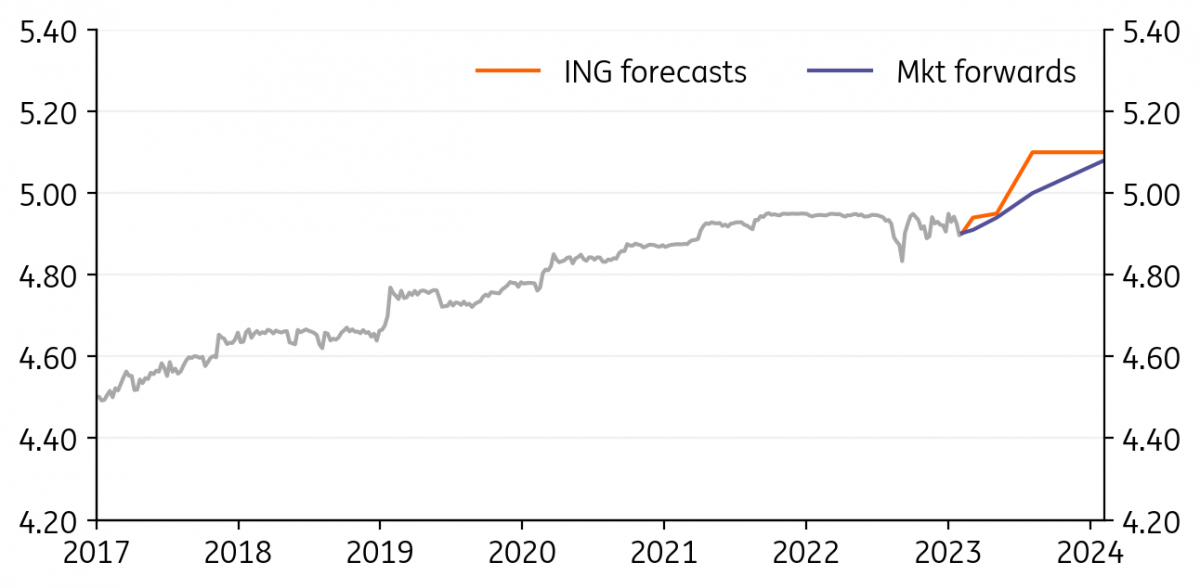

EUR/RON: Massive ROMGB inflows propping the leu

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

EUR/RON

4.8988

|

Mildly Bullish | 4.94 | 4.95 | 5.10 | 5.10 |

- The accelerated year-end spending by the Treasury has dramatically changed the liquidity conditions in the interbank market, which shifted from a deficit to over a RON10bn surplus.

- The ample liquidity backdrop pushed carry rates towards (and even below) the deposit facility. However, lower carry was not a drag for the leu as it overlapped massive inflows into Romanian government bonds, likely financed in part through FX.

- The EUR/RON continues to be well anchored around 4.90 and any attempts towards 4.95 seem to be losing steam fast. We keep our stable view on the currency until the middle of the second quarter when a shift higher towards a new equilibrium can still be expected.

Source: Refinitiv, ING

EUR/RSD: Rate hiking cycle almost complete

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

EUR/RSD

117.37

|

Neutral | 117.30 | 117.30 | 117.40 | 117.40 |

- The ongoing monetary tightening is possibly about to come to a halt after the last National Bank of Serbia decision to reduce the hiking pace to 25bp in January 2023 from 50bp in the previous four meetings.

- The relative stability of the dinar remains one central pillar of the NBS, as it contains the impact of higher import prices on domestic prices, while contributing to the overall macroeconomic stability.

- We maintain our EUR/RSD forecast at 117.4 for the end of 2023, with the shift higher more likely to occur in the second half of 2023, once the inflationary pressures are subdued.

Source: Refinitiv, ING

USD/UAH: Another UAH easing ikely ahead

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

USD/UAH

36.745

|

Bullish | 39.00 | 40.00 | 40.00 | 37.00 |

- Ukraine faces significant costs to stabilise the currency. While those costs came down significantly compared to the peak (around US$4bn monthly in mid-2022), we fear they could rise again should Russia attempt another major offensive. With the current level of international reserves at US$28.5bn (largely owing to international aid), the central bank may be unable to defend the currency at the current level.

- We do not see a swift end to the conflict in sight. High costs and increasing devastation to the Ukrainian economy put the hryvnia at risk of an even more pronounced easing than we anticipate, should the conflict continue in full force into the second half of the year.

- Chances for a major recovery of the Ukrainian currency in the coming quarters are relatively slim. Authorities may maintain an elevated exchange rate to support the economic recovery. Ukraine will require massive imports, while foreign aid may not be fully converted into UAH via the market.

Source: Refinitiv, ING

USD/KZT: Outlook improved on external support, domestic factors

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

USD/KZT

457.11

|

Neutral | 460.00 | 465.00 | 470.00 | 470.00 |

- USD/KZT has remained stable at 460 since the end of December, slightly outperforming our expectations. The primary reason was the more optimistic global mood reflected in the weaker dollar and upward trend in monthly average oil prices despite some intra-month volatility.

- The domestic macro backdrop was also supportive, as the private sector assured a massive $5.7bn net capital inflow in the fourth quarter of 2022 after a $0.4bn outflow in the first nine months of 2022. However, most of this was assured by ‘grey’ flows. The other balance of payments items showed a narrowing of the trade balance and moderate regular capital flows.

- We remain constructive on Kazakhstan's tenge for 2023, given the planned increase in fuel exports and benign house view on global risk appetite. However, risks of unscheduled maintenance and exposure to geopolitics in the region should be kept in mind.

Source: Refinitiv, ING

USD/TRY: CBT in action again

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

USD/TRY

18.829

|

Mildly Bullish | 19.00 | 19.50 | 20.70 | 24.30 |

- Since the release of the 2023 strategy, the Central Bank of Turkey has increased regulatory activity to facilitate more permanent liraisation. We have seen increasing pressure on the CBT’s net FX position since the start of the year, likely attributable to an increase in external finance needs and locals' FX demand. The CBT measures are introduced at a time when pressure on reserves has increased again. So, the objective is to ease locals' portfolio demand for FX and, hence, to support the CBT's reserves.

- In the January Monetary Policy Committee, the CBT left the policy rate unchanged at 9% as expected and seemed satisfied with the inflation outlook. Removal of the forward guidance about “the current level of policy rate being adequate” also attracts attention.

- In this environment, efforts to maintain TRY stability with increasing pre-election measures will continue. Relatively higher gross reserves thanks to reserves accumulation in the second half of 2022 are likely to give the CBT some room to manoeuvre for this objective.

Source: Refinitiv, ING

USD/ZAR: Late starter

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

USD/ZAR

17.511

|

Bearish | 16.75 | 16.25 | 16.25 | 17.00 |

- The rand has lagged behind EM currency gains at the start of the year. Holding the rand back has been weak domestic demand prospects, largely held back by ‘load-shedding’ or power cuts. The South African Reserve Bank (SARB) feels that this can knock 2% off GDP growth this year leaving full year growth below 1%.

- Interestingly, the SARB expects South Africa’s commodity basket to decline 18% this year and the current account deficit to widen to a 1.8% of GDP deficit. These are headwinds to the rand.

- The global environment (softer dollar, stronger China) favours USD/ZAR trading back to the 16.00 area – perhaps even to 15.00. But the headwinds described above suggest caution and as a high beta currency, ZAR gains could easily be handed back.

Source: Refinitiv, ING

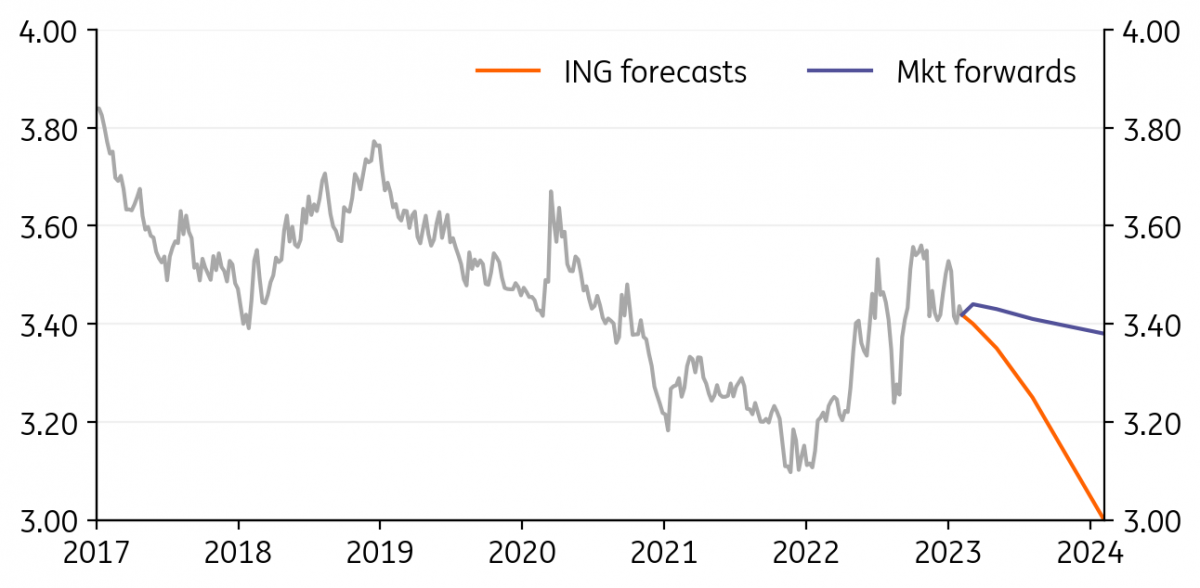

USD/ILS: ILS struggling to rally

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

USD/ILS

3.4469

|

Mildly Bearish | 3.40 | 3.35 | 3.25 | 3.00 |

- USD/ILS is normally a good benchmark for the overall dollar trend and given the 10% fall in the DXY, one might expect it to be trading closer to 3.30. This should be the direction of travel as US rates come off in 2Q on slowing US inflation. In Israel, it looks like the policy rate has peaked at 3.75% (high by Israel’s standards) as inflation expectations sink back towards target.

- 2.8% GDP growth is the forecast from the Bank of Israel this year and as usual, the shekel is backed by a strong current account surplus of 3% of GDP.

- With lower US rates giving the tech sector some reprieve, expect more interest in the shekel. 3.00 looks possible at year-end.

Source: Refinitiv, ING

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download articleThis article is part of the following bundle

6 February 2023

FX Talking: Soft landing, hard landing, no landing? This bundle contains 5 Articles

↑ / → / ↓ indicates our forecast for the currency pair is above/in line with/below the corresponding market forward or NDF outright

Source (all charts and tables): Refinitiv, ING forecast