EM Sovereigns: Three key takeaways from the latest IMF World Economic Outlook

This week’s IMF World Economic Outlook painted a bleak picture of slowing global growth and elevated risks of crises, but also highlighted a few areas of resilience for emerging markets

Downward revisions point to a worsening global growth outlook, but EM growth set to be more resilient

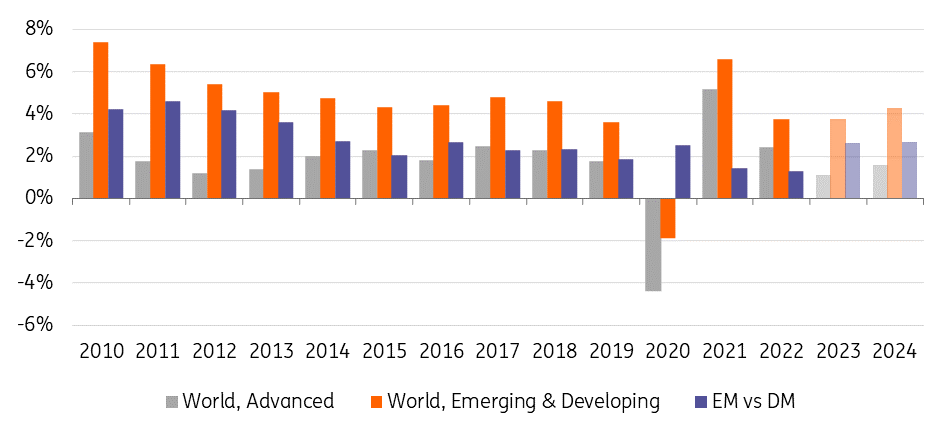

In this week’s World Economic Outlook, the IMF downgraded its forecast for global GDP growth in 2023 to 2.7%, from 2.9% expected in July and 3.6% in April. While a downward revision was largely expected by the market, the latest report does add to the generally gloomy picture on global activity and stagflationary concerns. Excluding Covid and the Global Financial Crisis (2020 and 2009), next year is set to be the weakest for global growth since 2001. When combined with elevated inflation, tightening financial conditions and geopolitical risks, there appears to be little on the surface to get excited about in terms of the backdrop for risk assets.

The downward revision of growth forecasts for advanced economies is the clear driver of the weaker outlook for 2023, in particular for the eurozone. The impacts of the European energy crunch are already starting to be felt across the continent. As a group, advanced economy growth for next year is now forecast at 1.1%, the weakest since 1982, (again excluding the GFC and Covid years).

Global GDP growth over time

However, emerging market growth, while weak and well below the ‘boom’ years of the mid-2000s and early 2010s, is forecast to be more resilient at 3.7%, above the level seen in 2019. This is also stronger than a number of EM crisis years in the 1990s and early 2000s. As a result, the growth ‘advantage’ for EM over developed markets is set to pick up in both 2023 and 2024 to levels last seen in 2016. This should offer at least some optimism for EM investors, although the spillover effects on growth and external accounts for countries with close ties to the eurozone, in particular, will have to be monitored.

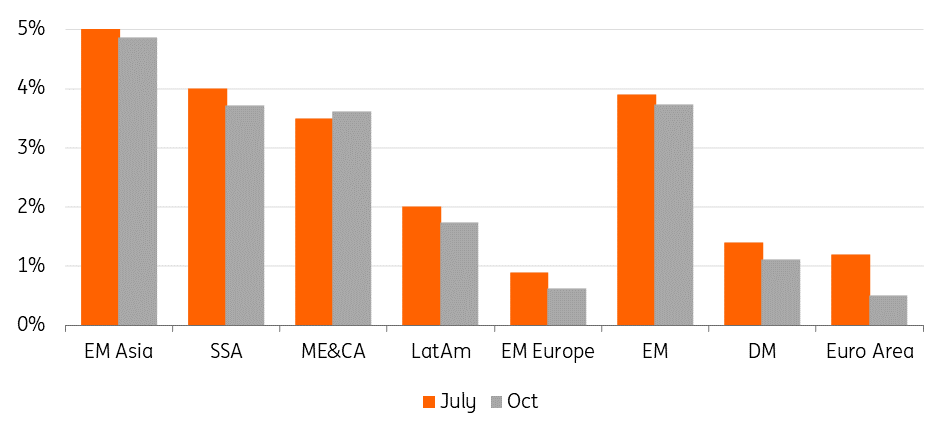

Europe under pressure but plenty of regional dispersion across EM

Unsurprisingly, EM Europe is the region with the weakest growth outlook, given the well-documented dependence on Russian energy flows. The IMF’s forecast for EM Europe has also weakened further since July (in orange below), despite a slight upgrade in the growth outlook for Russia. In contrast, the growth forecast for the largely commodity-exporting Middle East and Central Asia has actually improved since July. Asia remains a key driver of EM growth, although somewhat unusually is expected to be driven less by China and more by the likes of India and the ASEAN-5 (Indonesia, Malaysia, Philippines, Thailand, Vietnam) in both 2022 and 2023.

IMF's 2023 growth forecasts

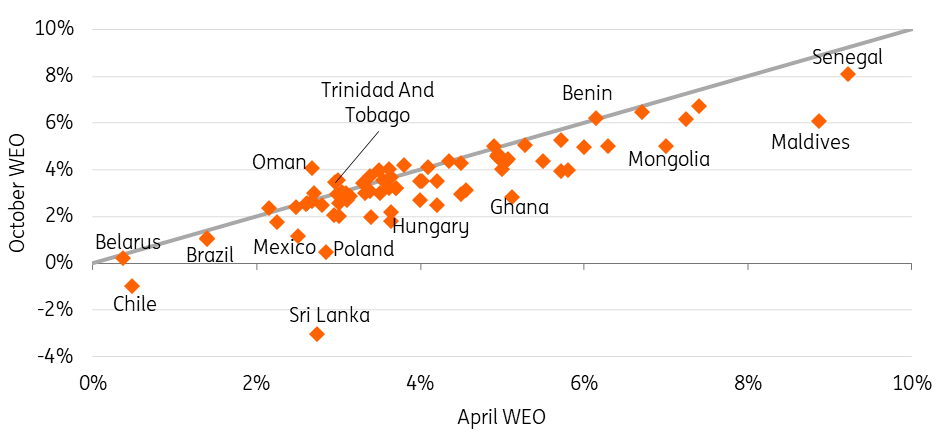

When breaking down the more granular data by country, which is released in the April and October WEO updates, the deterioration in outlook over the past six months is clear. The few bright spots where the growth forecast has improved (above the diagonal line below) include energy exporters such as Oman and Trinidad & Tobago. The effect of financial crisis is clear on Sri Lanka, Eastern Europe’s Poland and Hungary have seen some of the biggest downgrades and even commodity-dependent Chile and Brazil have fairly dim outlooks.

April vs October IMF WEO growth forecasts by country (2023)

Further downside risks are unusually elevated

Along with forecasting a continued slowing of the global economy in 2023, the IMF was clear to highlight that “risks to the outlook remain unusually large and to the downside.” The Fund sees a 25% chance of global growth falling below 2% in 2023, while Chief Economist Pierre Olivier Gourinchas was quoted as saying there is a 15% chance of growth falling below 1%.

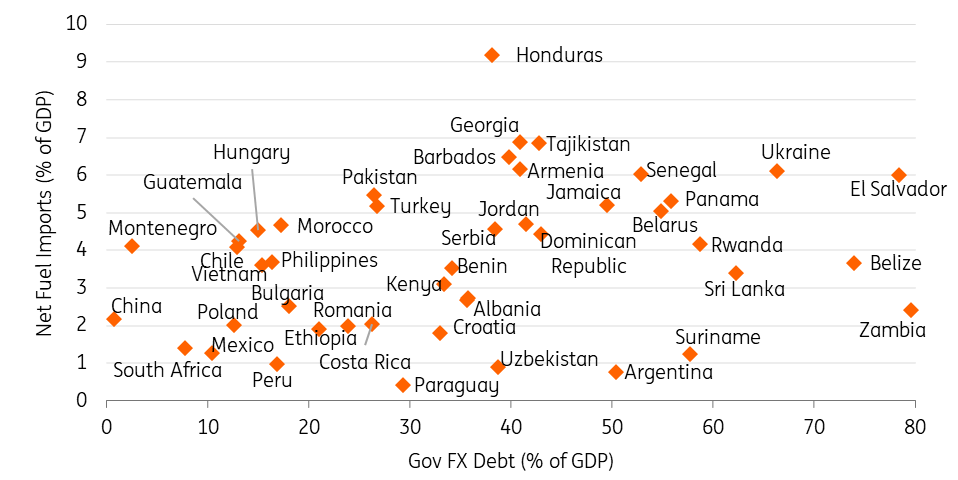

Potential triggers for such a downside scenario could include monetary or fiscal policy missteps, further energy and food price shocks, a Covid-19 resurgence or a worsening of China’s property sector crisis. Within these scenarios, the IMF continued to highlight concerns over the potential for further widespread emerging market debt distress on the back of tighter financial conditions. We would highlight the combination of government FX-denominated debt and large net fuel imports to GDP as specific EM sovereign vulnerabilities in the current environment, shown in the below chart.

EM sovereign FX debt & fuel imports

In response to these vulnerabilities, we expect further IMF support for EM countries will be needed. The below chart shows net IMF lending to EM by year, broken down by type of programme. 2020 saw a surge in emergency lending (Rapid Credit Facility/Rapid Financing Instrument) in response to the Covid crisis, but the focus now is likely to shift back to more traditional programmes which require policy conditionality.

Net IMF lending by year

The IMF has already announced the new Resilience and Sustainability Trust (RST), which can be used to top-up existing programmes, along with further rapid lending to help deal with food shocks. North Macedonia has recently secured a €530mn deal and we see the potential for similar deals for Morocco and Serbia in the near term, while the likes of Egypt and Ghana are high-profile sovereigns that have been in IMF talks recently. The IMF remains a key backstop and policy anchor for EM sovereigns struggling with debt distress.

Overall, the outlook remains tough for EM sovereign debt, but a lot of bad news is already priced in. Asian sovereigns such as Indonesia and the Philippines look set to remain resilient in terms of growth momentum and could surprise to the upside. Longer-term EM issuers such as South Africa and Mexico have fairly low vulnerabilities to energy imports or FX-denominated debt and could therefore be more resilient even if growth is somewhat disappointing. And energy exporters such as the Gulf nations are set to benefit in terms of growth and external accounts from current elevated fuel prices, offering EM investors something of a safe haven within the asset class. The overarching theme is that the outlook for emerging markets offers plenty of variation.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article