EM Sovereigns: IMF remains cautious on World Economic Outlook

Amid a downgrade to the IMF’s global growth forecast, EM sovereigns should remain resilient with areas of relative growth outperformance, easing pressure on commodity importers and fiscal reform momentum. However, rising debt servicing costs and refinancing risks leave the potential for more debt distress among weaker issuers

A slight downgrade to IMF’s global growth forecast

The International Monetary Fund’s (IMF) latest World Economic Outlook highlighted some areas of caution in the global economy, with the focus on risks from banking instability, sticky core inflation and rising public debt levels. The Fund slightly lowered its global growth forecast for both 2023 and 2024 by 0.1% in relation to its previous update in January, driven largely by downward revisions for Emerging Market (EM) economies in recent months, while the outlook for Developed Markets (DM) has actually improved slightly since January. Global growth is now forecast to slow from 3.4% in 2022 to 2.8% in 2023, before ticking up slightly to 3.0% in 2024.

IMF WEO GDP growth path forecasts over time

When zooming out, the clear slowdown in global growth expected in 2023 relative to 2022 is largely driven by the drop-off in growth for DM economies, in particular in Europe. Despite EM growth being expected to remain lower than for much of the last decade (4% year-on-year average over the next three years), it should be more resilient than DM growth. This means an average growth advantage for EM economies over DM in 2023/24 of just over 2.7%, the highest since 2013.

IMF GDP growth forecasts

When coupled with EM economies being generally more insulated from the recent banking system stresses, these factors should mean a relatively more supportive backdrop for EM assets. However, as a downside scenario, the IMF sees a 15% probability of a sharp tightening in global financial conditions driven by financial instability, which would see global growth slow to 1% in 2023. In such an outcome, EM economies would be hit hardest by capital outflows, US dollar appreciation and worsening credit conditions, even if the crisis emanated from the US or Europe. As highlighted by the Global Financial Stability Report, an environment of elevated geopolitical tensions could exacerbate the impact of a financial shock on EM economies, through a reversal in capital flows and re-consideration of capital allocation based on the geopolitical ‘distance’ of foreign countries relative to investors.

Among the larger economies, the picture looks negative for Argentina and Pakistan, with significant downward revisions to the IMF’s growth forecasts since January, amid ongoing debt distress for both. South Africa also saw a significant downward revision by over one percentage point to almost flat growth in 2023 amid its ongoing power supply crisis (albeit this has been clearly telegraphed, including in the nation’s 2023 budget). On a more positive front, the Philippines saw its GDP forecast revised upwards by over one percentage point, while Saudi Arabia’s outlook was also improved.

Public debt in focus at both ends of the development spectrum

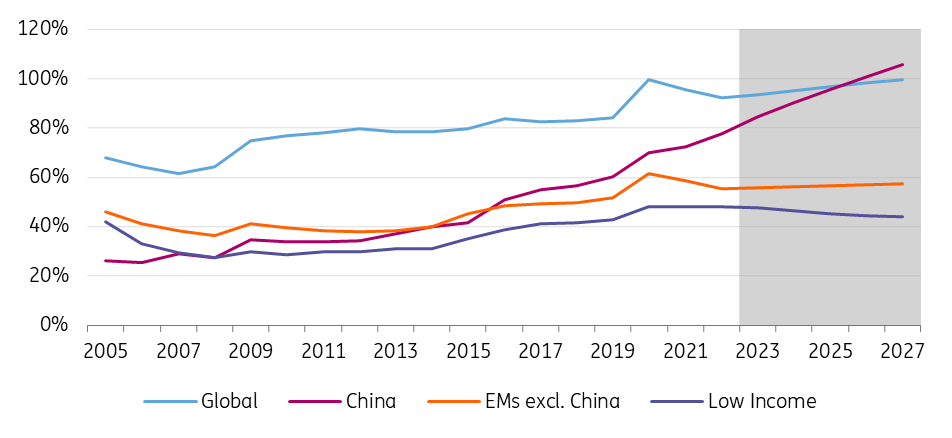

Outside of the latest global growth forecasts, a clear focus of this week’s Spring Meetings was on elevated public debt levels as authorities attempt to normalise fiscal policy. Last year saw government debt levels outside of China largely fall as a percentage of GDP, on the back of elevated inflation. In the coming years, global debt-to-GDP levels are forecast to rise, mainly driven by the US and China, while the increase in debt levels is set to be somewhat more contained in other advanced and developing countries.

Public debt-to-GDP ratio by region

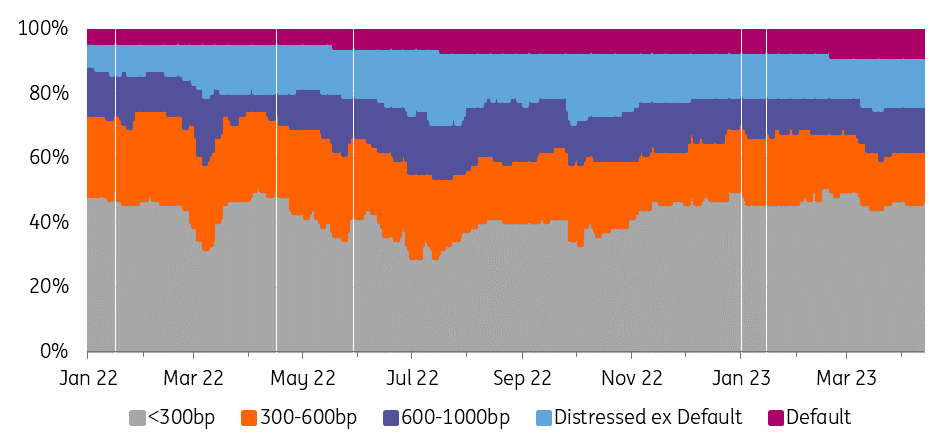

Despite fewer signs of large-scale growth in EM public debt levels, the IMF continued to signal concerns about the risk of further debt crises in lower-income countries. Government debt levels are likely to remain above pre-pandemic averages, while debt servicing costs are projected to rise in the environment of higher interest rates. At the same time, pandemic-era support measures such as the Debt Service Suspension Initiative (DSSI) have ended. The IMF estimates 56% of low-income developing countries are already in debt distress or at high risk of it, while 25% of Emerging Market economies are estimated to be at high risk. This year has seen significant volatility for the dollar-denominated bonds of Tunisia, Pakistan, Ecuador, Bolivia and Egypt in particular. Despite some reduction in the number of distressed sovereigns (with credit spreads over 1000bp) since last summer, around 40% of EM sovereign Eurobond issuers still have spreads over 600bp, meaning refinancing in the market would be tricky. Meanwhile, recent sovereign defaulters such as Zambia, Ethiopia, Ghana, and Sri Lanka are still waiting for concrete progress in their debt restructurings. In this week’s new Global Sovereign Debt Roundtable, global creditors and debtors issued a joint statement agreeing to speed up and streamline the process of sovereign debt restructurings, but we are still awaiting more concrete signs of progress on this issue.

Share of EM USD sovereigns within credit spread buckets

Current accounts adjusting to 2022 shock

Finally, 2022 saw a significant commodity shock, which had differing impacts on EM externals. With the easing in commodity price pressures seen since the back end of last year, some of this impact is set to reverse for both significant commodity exporters and importers. The most obvious impact is the likely moderation of current account surpluses for the large oil exporters, such as the members of the Gulf Cooperation Council. However, these nations should remain in a fairly comfortable position given large sovereign assets and signs of reform to reduce oil dependency, such as in Saudi Arabia and Oman. The GCC therefore should remain a relative safe haven within EM credit.

EM sovereign current account balances, 2022 vs 2023/24 forecast average

At the other end of the scale, there should be some improvement in the wide current account deficits seen in 2022 for many commodity importers. Hungary stands out in likely seeing a significant narrowing in its current account deficit, given its sensitivity to gas prices. The IMF also forecasts improvements in Namibia and Senegal in Africa, along with the Bahamas, Chile and El Salvador in Latin America.

Emerging market economies are set to significantly outperform developed markets in terms of relative growth in the coming two years

Overall, this week’s IMF World Economic Outlook and meetings didn’t come with an overly positive tone on the prospects for the global economy, but there should be key areas of strength for EM sovereign credit. EM economies are set to significantly outperform DM in terms of relative growth in the coming two years, led in particular by robust momentum in EM Asia (Indonesia and the Philippines are well placed). Pressure on the external accounts of commodity importers has started to ease (benefiting Hungary and the dollar bonds of the CEE region in general), while some energy exporters have taken the opportunity to implement structural reforms (evidenced by credit rating improvements in Saudi Arabia and Oman). With credit spreads still elevated on the back of recent banking system concerns and rates volatility, there should be plenty of areas of selective value to be had within EM credit markets. However, with rising debt servicing costs and refinancing risks set to increase heading into next year, there remains the potential for more debt distress in the lowest rating tiers of EM sovereigns, with more support from the IMF and other international financial institutions likely to be required (the spotlight is likely to remain on Egypt, Tunisia, Ecuador and Pakistan).

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

Sovereign rating IMF Emerging markets Emerging market debt CEE region Capital flows Asia PacificDownload

Download article