EM sovereign debt issuance: Encouraging signs but not yet back to business as usual

For bond investors, the primary market is an important gauge for market sentiment. It's here where we can observe supply, through the issuance of new debt securities, meeting investor demand on a larger scale

We're seeing two noteworthy developments in the past week, with Abu Dhabi issuing bonds with a negative new issue premium and Egypt raising US$5bn, being the lowest-rated issuer that has approached primary markets since the start of the crisis. This reflects improving financing conditions, the ongoing search for yield and some optimism that the worst might be behind us. That said, we believe that while higher-rated issuers will find little problems raising funding, the case is less clear for lower-rated frontier markets. On the one hand, those that have shown a strong policy track record benefit from multilateral/bilateral backing and have large external buffers will find it easier. On the other, sovereigns with weaker external and fiscal debt metrics will remain locked out, pointing to risks for more sovereign debt distresses further down the line.

Large financing needs amid outflows raise questions of market access

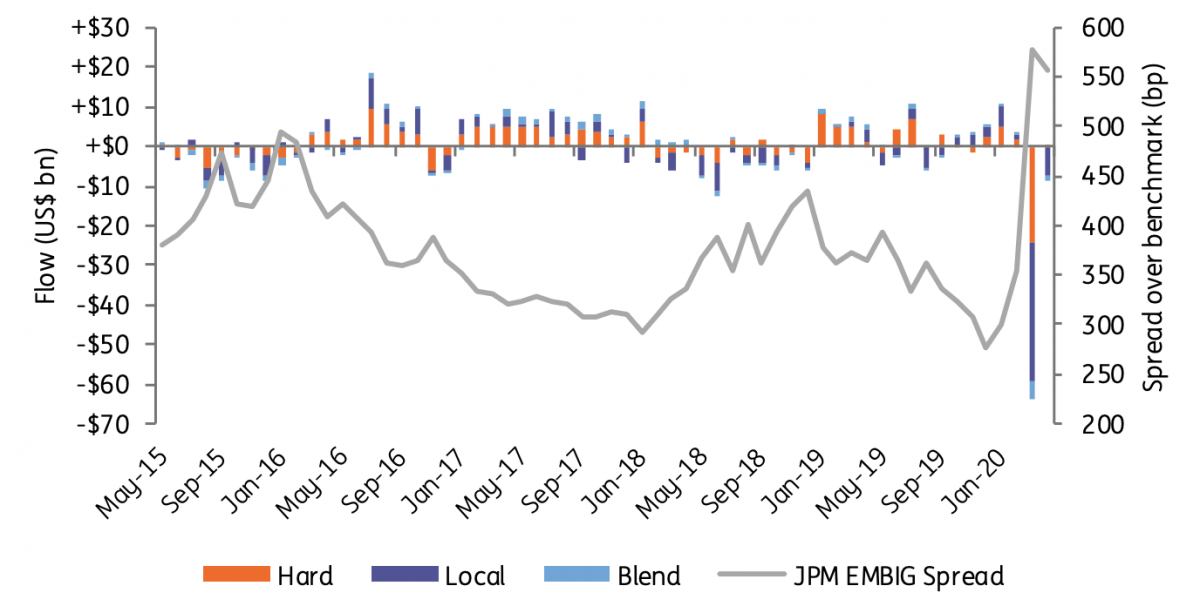

With the onset of Covid-19 and a collapse of the OPEC+ deal in March, emerging markets debt funds registered a record US$63.7bn of outflows in the month (-8.8% of their net assets), according to EPFR Global. Meanwhile, the spread of the J.P. Morgan EMBI Global, a key benchmark for USD-denominated EM sovereign bonds, has risen by 223bp over the month but only recovered by 20bp in April.

EM debt fund flows take a substantial hit in March while risk premium increases

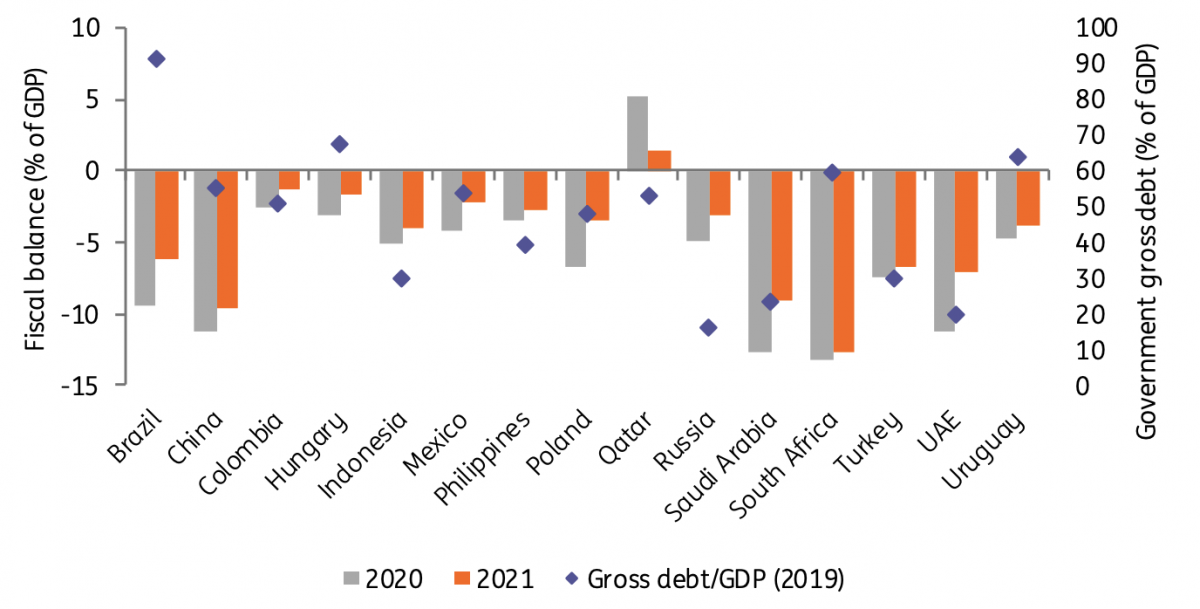

Based on these developments, there are concerns that the crisis could lock out emerging markets issuers from primary markets in the foreseeable future. This is especially the case for governments as they face exceptional expenditure to combat the virus but see their revenues plunge in lower tax revenues and falling commodity prices, resulting in higher fiscal deficits which have to be financed in addition to the refinancing of upcoming debt maturities. Put it simply, the question is whether issuance needs (i.e. supply) would meet enough demand.

Emerging market economies are expected to run substantial fiscal deficits in 2020

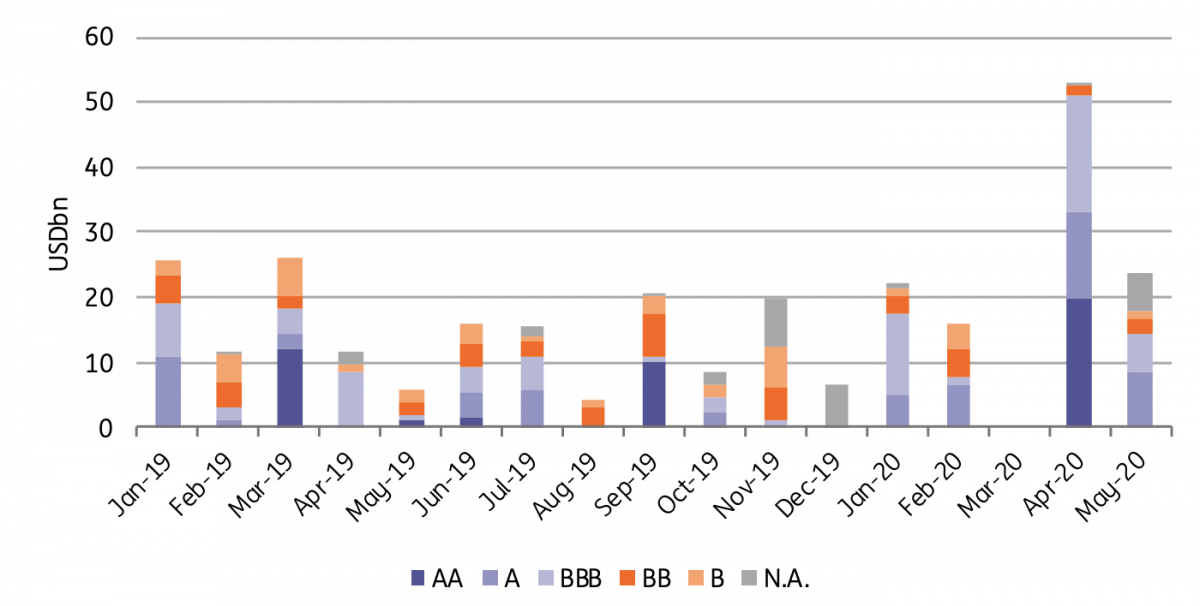

Focussing on USD and EUR-denominated EM sovereign bonds, the primary market came to a total halt in March but has since come back strongly: In April and May so far, EM sovereigns have raised US$76.8bn from new debt issuance (US$65.1bn in USD and US$11.7bn in EUR) which compares to a mere US$17.5bn issued over April/May 2019. Unsurprisingly, this has been mainly driven by investment-grade sovereigns (US$66.2bn of the total) but there has also been a small group of issuers in the BB/B space (US$10.7bn).

EM debt issuance rebounds strongly in April/May but is skewed to investment grade

Negative premiums and a strong comeback for a high yield issuer

Two transactions at different ends of the rating spectrum over the last week have caught our attention and reflect current investor sentiment:

- Abu Dhabi, among the highest-rated issuers in EM (rated Aa2/AA/AA), returned to primary markets to tap another US$3bn, equally divided across the 2025, 2030 and 2050 bonds it issued just a month earlier (bringing the total size to US$3bn, US$3bn and US$4bn, respectively). The tap attracted a book of US$19bn (or more than 6 times the issued amount) which saw the issuer pricing inside the secondary curve, resulting in a rare case of negative new issue premium.

- Later in the week, Egypt (B2/B/B+) raised US$5bn across three tranches, with maturities in 2024, 2032 and 2050 (US$1.25bn, US$1.75bn and US$2bn, respectively). The transactions gathered strong demand (US$20bn book) which allowed the sovereign to raise more than expected (Reuters sources reported a planned issuance amount between US$3-4bn) and reduce the new issue premium. In a broader context, Egypt is the lowest rated EM sovereign issuer to have approached the primary markets since the crisis.

Both transactions reflect the robust demand picture in the primary market despite the ongoing crisis. We believe there are two key reasons:

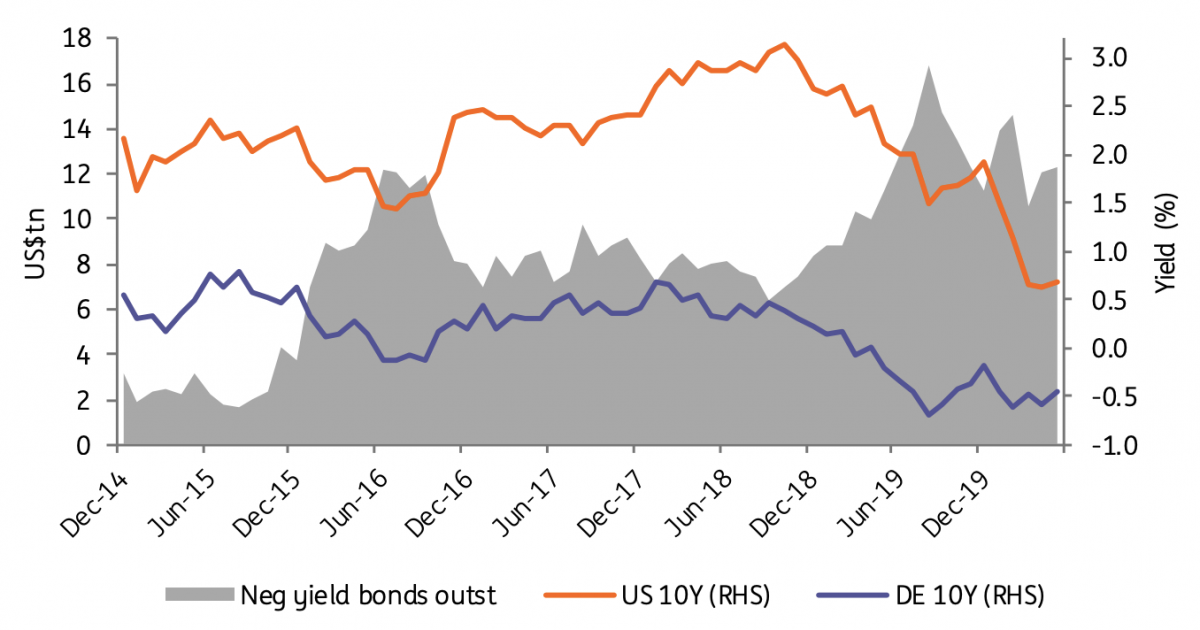

- With major and EM monetary policy easing and the Fed ensuring sufficient dollar liquidity, we have seen improving financing conditions over the last two months. Moreover, with rates stuck in low gear for the foreseeable future, we continue to see a search for yield which favours EM issuers. Based on Bloomberg Barclays Indices, EM IG and HY offer a yield of 3.0% and 9.4%, respectively. This compares to 1.4% and 7.5% for US corporate IG and HY, respectively.

- Market sentiment has improved over the last weeks based on optimism that the worst might be behind us. In EM credit, this has seen a stabilisation in the flow picture and an outperformance in non-investment grade names. In May, EM HY has generated a return of 6.0% so far, above that of IG of 3.0% over the same time horizon.

Search for yield in a low rates environment helps emerging markets

EM high yield outpaces investment grade in recovery rally

Encouraging signs but not yet back to business as usual

The strong demand we have seen in the primary market reflects the continued search for yield and a marked improvement in investor sentiment in EM credit that we have also witnessed in other risk assets We believe that sentiment remains fragile given the recent US-China tensions and higher risks for emerging markets from the still ongoing virus spread.

For lower-rated issuers, Egypt’s strong comeback in the primary market might have opened the door a bit wider. Others will test the waters in the coming weeks but not all issuers will find it as easy as Egypt which has gained a lot of investor recognition for successfully completing a US$12bn IMF programme through 2016-19 and reaching out to the fund once more to combat Covid-19 (access to US$2.8bn Rapid Financing Instrument and reportedly seeking US$5bn under a Stand-By Arrangement).

We believe that investors will remain highly selective when it comes to non-investment grade issuers

We believe that investors will remain highly selective when it comes to non-investment grade issuers, favouring those that (1) have shown a strong policy track record in the past and the present, (2) benefit from multilateral and bilateral support anchors and/or (3) have large external buffers. Countries in this category that had planned bond issuances this year or are more frequent issuers include Belarus (B3/B/B), Brazil (Ba2/BB- /BB-), Cote d'Ivoire (Ba3/NR/B+), South Africa (Ba1/BB-/BB), Turkey (B1/B+/BB-) and Ukraine (Caa1/B/B).

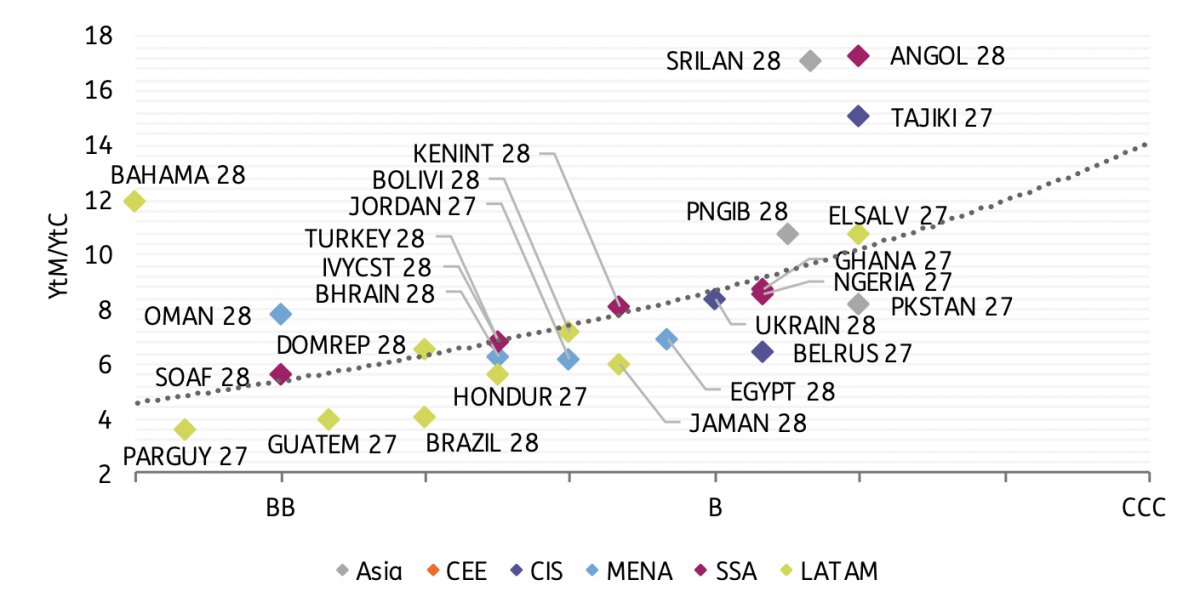

For others, high yields in the secondary market make it practically prohibitive for a return to primary markets (the chart below shows a comparison of USD-denominated EM sovereign bonds with 7 to 8-year maturity). Those can turn to multilateral and bilateral loans, with poorer countries also eligible for a temporary debt payment suspension under a G20 initiative. Kenyan (B2/B+/B+) and Nigerian (B2/B-/B) officials have said that their governments would abandon plans to sell Eurobonds this year and are considering debt relief plans. Cameroon (B2/B-/B), Ethiopia (B2/B/B) and Pakistan (B3/B-/B-) are expected to sign debt moratoriums with the Paris Club in the near-term which would include a commitment to abstain from new non-concessional debt. Tunisia (B2/NR/B) is in discussions with other countries for a guarantee on potential new debt issuance.

The extent of the crisis also points to the risk of more sovereign debt distresses going forward; we've anlysed that here. Argentina (Ca/SD/C), Ecuador (Caa3/SD/WD), Lebanon (Ca/SD/C) and Zambia (Ca/CCC/CC) are seeking debt restructuring, but we also note that bonds in Angola (B3/CCC+/B-), Sri Lanka (B2/B-/B-) and Tajikistan (B3/B-/NR) remain in distressed price territory, with Sri Lanka facing a large bond redemption in October (US$1bn).

The breadth of the non-IG space means that some might find it easier, some harder

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article