EM Credit Supply: Lightning start to year but slowdown begins

EM sovereign issuance has started 2023 at a record pace, driven by the CEE region and higher-rated countries. We expect a slower pace for the rest of the year, with single-B issuance remaining quiet even if global market conditions stabilise from the recent banking system volatility

New issuance has record start to the year as sovereigns seize window of opportunity

Emerging market (EM) primary markets have started 2023 at a frantic pace after a quiet 2022. EM sovereign and quasi-sovereign (state-owned) bonds have already seen the strongest first quarter on record for USD and EUR issuance (including a bumper January of $55.4bn), with year-to-date issuance of $90.8bn over 70% of last year’s annual total and almost 55% of the 10-year annual average. Despite the slowdown relative to January, February was also the strongest on record, with a further $21.1bn issued and quasi-sovereigns particularly active. March has been quieter (notwithstanding a recent $5bn deal for Poland), understandably given the ongoing volatility in global markets, while we generally expect a slower pace of issuance going forward given the significant front-loading of financing needs for the larger sovereigns.

EM sovereign & quasi-sovereign (agency) USD & EUR issuance by year

Higher quality EM sovereigns have seized on a perceived window of opportunity to come to the market, with many having effectively been locked out for much of last year by high borrowing costs and volatile markets. The index level yield for EM sovereigns on average fell by over 150bp from the peak in late October to early February, on the back of tighter credit spreads and lower UST yields, lowering potential borrowing costs for new issues. More broadly, sentiment towards EM also improved given the less pessimistic outlook for global growth (in particular in Europe on the back of lower gas prices, along with for China given the easing of Covid measures), hopes that inflation has peaked in the US, and a softening in the US dollar. That being said, recent weeks have seen much more volatility, with the 10Y UST yield bouncing from around 3.5% to over 4% and back again, with borrowing costs creeping up again since early February for EM sovereigns while credit spreads have widened – this points to a likely further slowdown in the pace of issuance as sovereigns reassess market conditions and the potential cost of borrowing. The EM sovereign USD bond index yield has actually been fairly steady amid the recent stresses in the global banking system in March, with spread widening offsetting the fall in underlying UST yields.

EM USD sovereign index yield breakdown

Early January deals for Romania and Hungary offered attractive new issue premiums of around 30-50bp (relative to the sovereigns’ outstanding spread curves in the secondary market), while the flood of new supply saw the spread level on the EM USD IG sovereign index reprice around 30bp wider over the first two weeks of the year, highlighting some investor nervousness to start the year. However, spread levels consequently recovered, with later deals offering little or no premium when priced, even in smaller and lower-rated sovereigns such as Serbia, Morocco, and North Macedonia. On the whole, new issuance has therefore been comfortably absorbed by the market, with investors heading into this year with large cash balances in anticipation of attractive opportunities in the primary, along with signs of some inflows returning to EM funds at the beginning of the year albeit there has been a clear shift to outflows in recent weeks.

Regional breakdown: CEE has led the way

When breaking down the issuance seen this year so far, a dominant theme has been the uptick in supply from Central and Eastern Europe (CEE) relative to recent years (in particular versus pre-Covid years), with early deals for Hungary, Romania, Bulgaria, Serbia, Poland and North Macedonia in the sovereign space already. CEE sovereigns and quasi sovereigns have issued $30.4bn YTD, compared to $18.5bn in all of 2019 (all of which was in euros). This year’s issuance has come in both dollars and euros, while standing in contrast to the longer-term trend seen in the region in the past decade of most sovereigns shifting to mostly local currency issuance (and away from dollars in particular). We expect the trend of increased hard currency issuance from the region to continue, given ongoing funding needs for energy and possibly military spending, while local currency borrowing costs are likely to remain elevated relative to pre-Covid levels. For the rest of this year, the significant frontloading of financing needs from sovereigns in the region such as Romania, Poland, Hungary and Serbia should be viewed as positive in providing flexibility to issuance plans and acting as a technical tailwind (given the likelihood of lower supply later in the year).

EM sovereign & quasi (agency) USD & EUR issuance YTD by region

Outside of CEE, issuance from the Middle East and North Africa (MENA) has been robust, but largely dominated by Saudi Arabia ($15.5bn from the sovereign and sovereign wealth fund PIF) and Turkey ($5.5bn from the sovereign and Eximbank). Other issuers from the Gulf Cooperation Council, such as Qatar, the UAE, Oman, and Bahrain have been much quieter, in contrast to their heavy issuance schedule in recent years. This can largely be explained by the elevated oil price environment boosting government revenues for these energy producers, meaning they have been able to be far more selective in deciding when to come to the international bond market. Elsewhere, issuance from Latin America has been minimal, while understandably non-existent in Sub-Saharan Africa given the region’s generally lower credit ratings and elevated bond yields in the current environment.

Higher quality issuers have dominated the primary markets

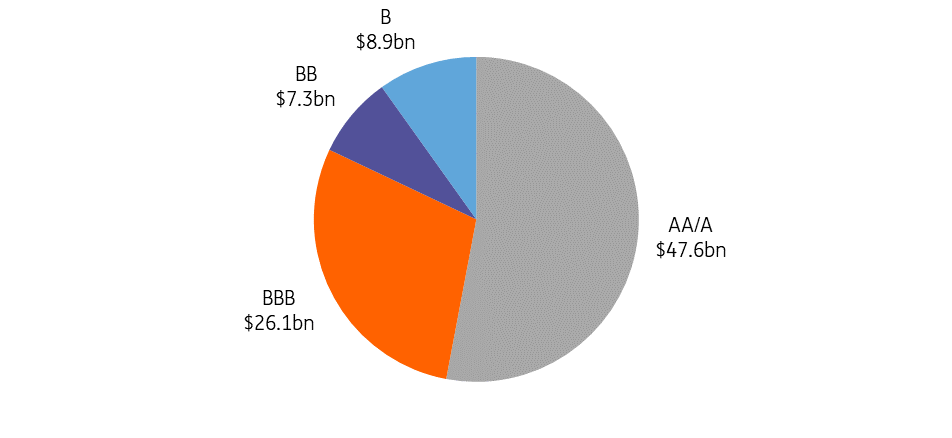

Another clear theme of this year’s issuance has been the dominance of higher-quality, investment grade (IG) issuers. Over half of EM sovereign and quasi-sovereign issuance this year has come from nations rated single-A or higher, while over three-quarters has been from IG issuers (BBB-rated and above).

EM sovereign & quasi (agency) USD & EUR issuance YTD by rating bucket

High-yield issuance has been much more subdued. In the BB space Colombia, Dominican Republic, Serbia, North Macedonia, and Morocco have come to market, two of which are fairly recent downgrades from IG ('fallen angels'). Single-B issuance has been sparse, with Turkey the key name, along with Costa Rica this week, an Islamic sukuk for Egypt and a small refinancing deal for Mongolia. For most lower-rated issuers, refinancing in the current market remains almost prohibitively expensive, with the average yield on single-B USD sovereign bonds around 10%, well above an average coupon of under 7% on outstanding bonds. We would therefore expect issuance from these lower-rated sovereigns to remain subdued through to the end of the year.

Average yield and coupon on outstanding single-B rated sovereigns

Looking ahead: Who might still come to the primary market this year?

As a positive for EM sovereigns in this tricky environment for refinancing, the maturity schedule for HY sovereigns is fairly light in 2023, with just under $10bn left to mature in the rest of this year. In addition, half of this is from Turkey, which has already issued $5bn this year and shown it has market access, albeit with a risk event of elections in a few months. However, this maturity wall picks up in 2024, and further in 2025, so a more prolonged period without market access would be of more concern for the lower-rated tiers of the EM sovereign universe.

EM HY hard currency sovereign bond maturity schedule by year

When looking in more detail at the breakdown of these upcoming maturities to see where risks may lie, the chart below shows refinancing needs on maturing external bonds by HY country and year until the end of 2025, scaled by FX reserves. Bahrain is the outlier with limited reserves and large refinancing needs, as has been the case in recent years, but strong support from peers such as Saudi Arabia mitigates some of this risk. This support means appetite from investors for a potential new issue would likely be higher than most single-B peers. Tunisia’s 2023 and early 2024 maturities present a risk given its CCC rating and distressed yields, while refinancing risks for other CCC-rated sovereigns El Salvador and Pakistan are slightly further away in 2024/25. Despite the sizable refinancing needs, risks for Oman are offset by its strong current account surplus and additional foreign assets held in its sovereign wealth fund. Elsewhere, refinancing pressures will likely remain for larger stressed African issuers, such as Kenya, Egypt and Angola in the coming years, despite Egypt recently demonstrating at least partial market access (with a short-dated sukuk). The likes of Mongolia, Turkey, North Macedonia and Costa Rica have done well in meeting much of their refinancing needs for this year in advance.

Eurobond refinancing needs by year for HY sovereigns (% of FX reserves)

More broadly, we see a few candidates remaining for potential further issuance this year. Higher-rated names with upcoming maturities include Qatar, China, Abu Dhabi, Croatia, and Kazakhstan, while Bahrain is one of the few single-B rated sovereigns we see as likely to come to the market. Large issuers Turkey and Indonesia have the potential to return to the market. Outside of just 2023 Eurobond refinancing needs, we expect Romania to return to the international market at least once more this year (around 70% of planned Eurobond issuance completed YTD), while Hungary has spoken of a potential euro issuance in the second half of the year to pre-finance its needs for 2024. Elsewhere, Albania has reportedly selected lead managers for a €500mn bond issue this year, along with buying back €250mn of its outstanding 2025 notes, potentially following in the footsteps of Balkan peers Serbia and North Macedonia. There could also be issuance from oil-exporting BB sovereigns Azerbaijan and Oman to pre-finance their 2024 maturities given relatively tight spreads on the back of improving fundamentals, while Uzbekistan’s authorities ruled out issuance in the first half of 2023 but could return to the primary market later in the year.

EM hard currency sovereign bond maturities remaining in 2023

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article