Electric vehicles to drive metals demand higher

Road transportation has seen a growing trend in pivoting towards electrification, especially when it comes to cars. This is a trend that is only set to strengthen, which should drive demand for metals

Electric vehicle penetration to continue growing

When it comes to the transportation sector, we focus purely on road transportation. This is the subsector where we see the most potential for metals demand driven by electrification in the coming decades. Electrification of the shipping and aviation sector will likely be marginal and so the potential additional metals demand will be limited.

Electric vehicle sales have picked up significantly in recent years. Global passenger vehicle sales in 2020 grew by 46% year-on-year to 3.1m, including hybrids. This is still only 4% of total vehicles sales, but the share will step up in 2021 again and is set to grow in future, underpinned by government policy. At the same time, automakers are setting targets to phase out the internal combustion engine and shift towards EVs. Technology and efficiency gains will also help, as battery pack costs steadily decline. In the second half of the decade, electric cars are expected to reach a break-even point, making them cheaper to own than conventional cars.

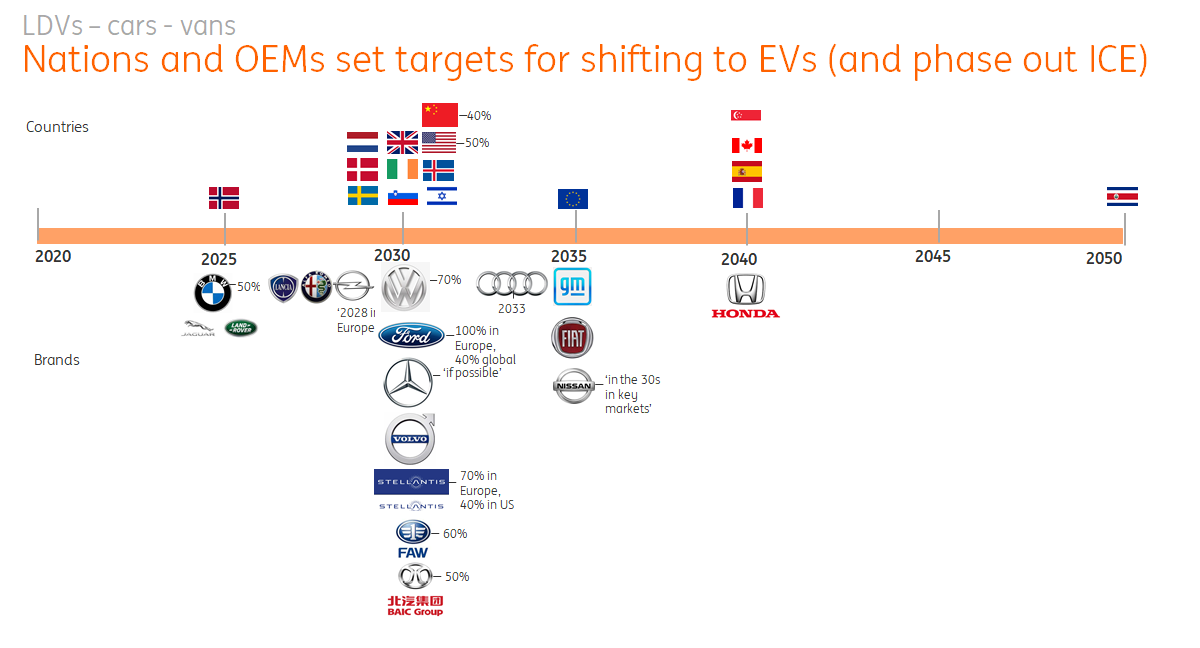

More than 20 countries and states (US/Canada) have EV sales targets or internal combustion vehicle (ICE) bans for cars or two/three-wheelers. China has also imposed a mandate for EVs to make up 20% of all sales by 2025 and 40% by 2030. Meanwhile, the US is aiming for 50% of new vehicles sold in the US to be electric by 2030.

Under our 'Wait & See' scenario, the proportion of EVs to the total vehicle fleet rises from less than 1% currently to over 6% in 2030 and 21% in 2040. Our 'Likely Tech' scenario sees this share rising faster, to 9.2% in 2030 and 39% in 2040. Our most aggressive scenario, 'Fast Forward', sees the proportion of EVs reaching 20% by 2030 and 73% by 2040.

Corporate targets for shifting to EVs

'Lightweighting' to support aluminium demand

Vehicle fuel economy standards are key in pushing decarbonisation across regions, and lightweight strategies are one of the options to improve the average fleet fuel economy, which has been adopted by both ICE vehicles and new energy vehicles (NEVs). For EVs that weigh much more than conventional cars, lightweighting increases the potential to increase the battery pack and driving range, or maintain the driving range with less battery capacity. Aluminium is one of the materials, along with steel and other materials, adopted by OEMs to help reduce the weight of a vehicle. There have been many studies comparing different materials in lightweight strategies looking at both the cost advantage and mechanical performance. However, the current battery chemistries and manufacturing process favour aluminium, according to DuckerFrontier.

Others have looked at the overall life cycle and the total carbon footprint and found that whatever the mileage distance over the vehicle's lifetime, an aluminium vehicle is less intensive in terms of greenhouse gas emissions and energy use. (FKA, 2012). A life cycle analysis of a full-steel and a full-aluminium EV shows that an aluminium EV emits 1.5 tonnes less in greenhouse gas emissions over its complete life cycle compared to a steel EV (including production, driving distance of 150,000 km and recycling).

Over the past two decades, the average vehicle weight has fallen gradually, though the magnitude varies across regions, and the popular SUVs are usually more heavy. Europe and China have led the way in fuel economy improvements in the transport sector, partly driven by regional regulations on vehicle emissions standards. The average aluminium content has risen steadily over the last few decades and is accelerating along with the rising penetration of EVs.

Average aluminium content per car (kg)

According to BloombergNEF, aluminium alloys make up nearly 20% of the weight of a European car compared to just 10% for the average American car. However, the US is expected to catch up, as the Biden administration is looking to lift the nation’s fuel economy standards.

On average, an EV has a higher aluminium content than a traditional ICE vehicle, and significantly more aluminium is used in an EV platform. According to DuckerFrontier data, the average aluminium content varies among different vehicle segments (governments and authorities have developed car classification schemes based on their size and dimensions). Some E-segment cars could contain as much as 363kg of aluminium compared to approximately 127kg on average for both A and B segment passenger cars.

Overall, we see aluminium demand increasingly benefiting from two parallel trends; a) the further adoption of EVs with higher aluminium intensity and b) traditional ICE vehicles using more aluminium to replace some of the steel, although the share of ICE vehicles will continue to decline over coming years, resulting in a net decline in total aluminium demand from this sector.

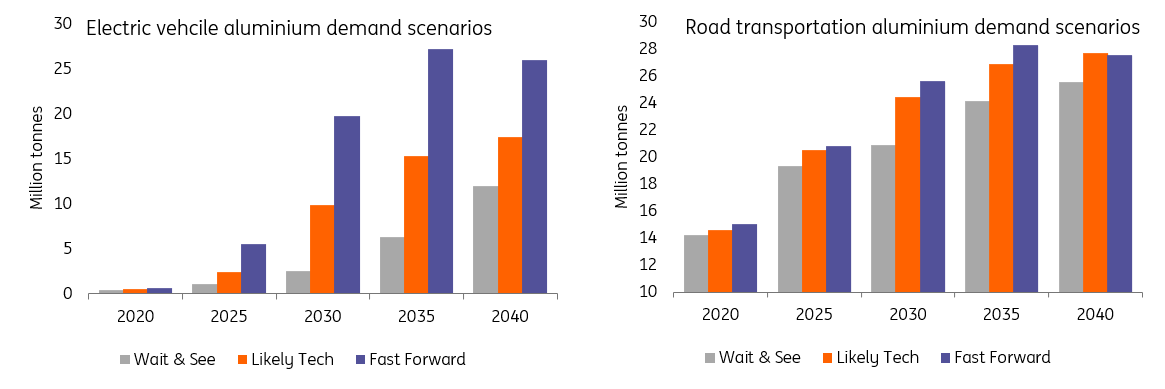

In our 'Likely Tech' scenario, demand for aluminium from EVs could grow from about 500kt currently to close to 2.3mt by 2025, and to more than 17mt by 2030. While in the 'Fast Forward' scenario, it could expand to 5.5mt by 2025, and to around 19mt by 2030, before peaking in 2035 at more than 27mt. However, if we take into consideration ICE vehicles, current aluminium demand is just above 14mt in our 'Likely Tech' scenario, and this could continue to grow in the next decade but is set to decrease from the end of this decade as a result of the contraction in ICE vehicle sales. Adding together the expected demand from both the ICE and EV sectors, aluminium demand is expected to grow from over 14.6mt currently, to over 20mt in 2025, and to around 28mt by 2040, based on our 'Likely Tech' scenario. In the 'Fast Forward' scenario, it could expand to 21mt by 2025, and to around 26mt by 2030, before peaking in 2035 at more than 28mt.

Electric vehicle aluminium demand scenarios

Electrification of transportation a boost for copper

Copper will play a crucial role in the world’s energy transition, given its great conductivity. In the transportation sector, copper demand is expected to benefit substantially from the increasing adoption of NEVs. Copper can be found in different parts of a car, including a large amount of copper wiring.

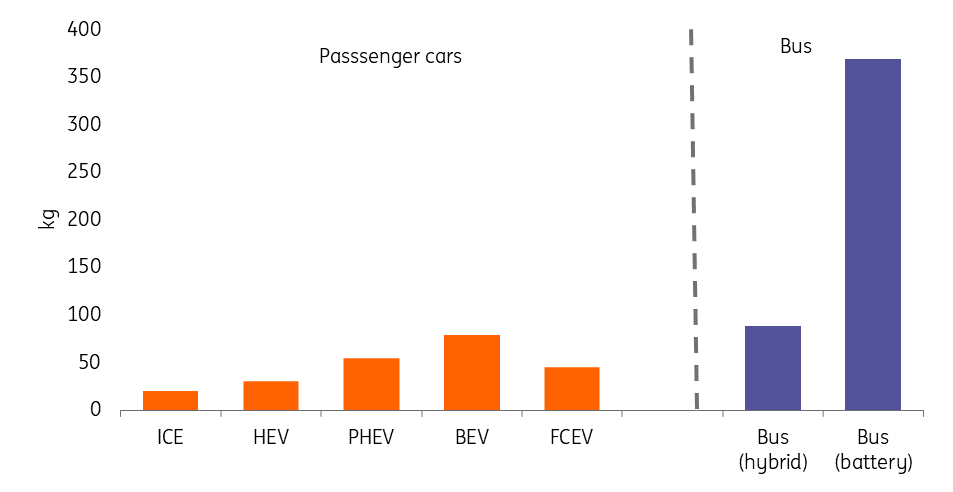

The type of driver train used largely dictates the copper intensity. Compared to traditional ICE vehicles, EVs tend to use more copper, and the more electrified the vehicle, the higher the copper intensity. According to the Copper Development Association (CDA), the average copper content of an ICE vehicle is around 23kg, and this will increase to 60kg for plug-in hybrid electric vehicles and to 83kg for pure EVs. Generally speaking, EVs use almost three times more copper than ICE vehicles. Hybrid electric buses contain 89kg copper on average, while full electric buses - now starting to take over - can use between 224kg to 369kg of copper. The evolution of power trains within the EV sector also points to an increasing share of pure battery vehicles, along with decreasing battery costs and the growing popularity of charging infrastructure. As a result, the average copper intensity of the vehicle fleet will grow in the years ahead. Currently, the global annual sales ratio between battery electric vehicles and plug-in hybrids is less than three, but this is likely to grow to around seven by the end of this decade and further accelerate toward the second half of the next decade with countries phasing out PHEVs.

Copper intensity varies among different power trains

In our 'Likely Tech' scenario, demand for copper could grow from around 440kt currently, to close to 1mt by 2025, and 3.2mt by 2030. While under the 'Fast Forward' scenario, it could expand to 1.8mt by 2025, representing over 7% of the total copper demand, and to around 6.7mt by 2030, before peaking in 2035 at more than 9.5mt.

Electric vehicle copper demand scenarios

With the acceleration of EVs, charging infrastructure will also expand. While charging infrastructure has seen rapid growth, it still falls short of what is required. This implies there is potential for even higher growth in this area.

Copper intensity also varies according to the type of chargers. According to BNEF, public direct current fast charging (DCFC) could use up to 25kg of copper per charger, over 10 times more copper than home chargers. Therefore copper demand would vary largely depending on the type of chargers used. With the growing installation of fast chargers, both public and home, copper demand intensity will also increase accordingly. Copper demand in charging infrastructure is around 10kt currently, and this will expand to close to 15kt in 2025 and 47kt by 2030. However, this does not consider the auxiliary power grid infrastructure needed to connect chargers at different locations.

Copper use in EV charging infrastructure (kg)

Charging infrastructure copper demand (exclude grid infrastructure)

EVs to lead to rapid growth in battery metals

The rechargeable battery is the heart of an EV power train, and the majority of EVs uses lithium-ion batteries (LIB), though the battery chemistry mix and battery pack design vary among manufacturers and are constantly evolving. The performance of LIB is largely determined by the materials that make the cathode and anode. Most of the developments that have been made are related to cathode materials, in order to enhance the performance of the battery.

The rising EV market will be the key driver to LIBs demand from traditional usages such as portable electronics and other stationary batteries. Among major battery cathode mixes, nickel, cobalt and lithium could stand out as major winners, as increasing LIBs will drive demand for these metals significantly higher. Multiple cathode chemistries exist in today’s battery technology, and each has different characteristics that determine the battery performance metrics. There are five main chemistry mixes: 1) lithium-manganese-cobalt-oxide batteries (NMC); 2) lithium nickel cobalt aluminium oxides (NCA); 3) lithium cobalt oxide (LCO); 4) lithium manganese oxide (LMO); 5) lithium-ion-phosphate batteries (LFP).

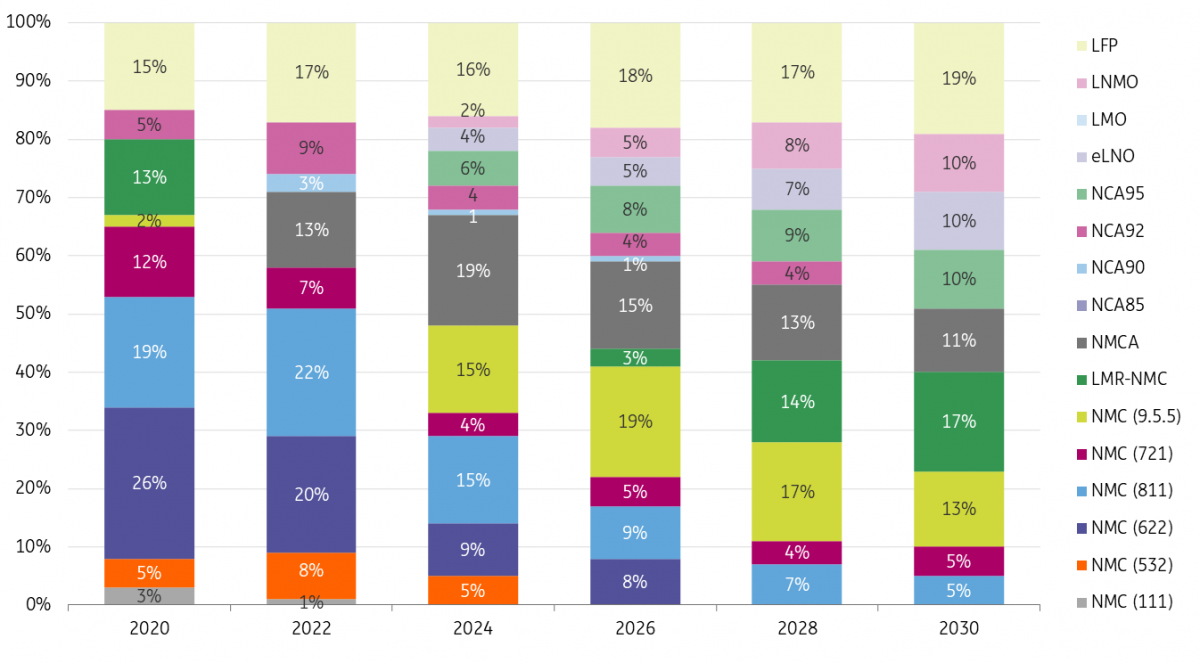

Expected evolution of battery (cathode) chemistry for EVs

The choice of cathode chemistry by EV makers will largely depend on the safety, cost, and performance. The desire for a decent driving range while bringing the cost down should continue to encourage battery innovation. This constant innovation does make it more difficult to accurately model battery metals' demand over the longer term. One example has been China’s Contemporary Amperex Technology Co. (CATL), the world’s largest battery manufacturer, which unveiled a new sodium-ion battery, which has a major cost advantage but relatively lower energy density. However, we assume that the sodium-ion battery won’t substitute LIB batteries any time soon. The choice of battery chemistries also varies slightly across car segments and regions. For example, lithium-ion-phosphate batteries (LFP) are popular among some passenger EVs in China, as they tend to have a longer life cycle and cheaper cost, but a lower energy density. Automakers such as Tesla have noted that they are making the long-term shift towards LFP, but in energy storage and some entry-level EVs. However, in our base case calculation, we assume that LFP will not have a big impact on those nickel batteries, though penetration rates will increase beyond 2030.

According to the Nickel Institute, nickel batteries also come in a variety of chemistries, and they offer the highest energy density. However, among many battery chemistries, the demand is largely centred around the NMC and NCA groups of battery chemistries, as they account for over 90% of nickel demand in LIBs, according to CRU. They are also the so-called nickel-rich batteries with a higher proportion of nickel content relative to other materials. Industry research points to the increasing adoption of NMC811 batteries, which has a battery cathode composition with 80% nickel, 10% manganese and 10% cobalt.

Currently, battery manufacturing accounts for around 8% of total primary nickel consumption, but the area is growing fast. The primary form of nickel used in the battery cathode is nickel sulphate. The chemical is used in both plating and other applications such as ceramics, but the speed of demand growth has increased significantly, driven by batteries. For cobalt and lithium, demand has been traditionally driven by batteries from both the nascent EV sector and other consumer electronics. EV sector demand accounts for just over 10% of total cobalt demand. However, this will grow to almost 50% by the middle of the next decade. A similar pattern is seen in lithium, though the EV sector already accounts for a third of overall lithium demand. This could take the share of demand to almost 80% by the end of this decade.

In our 'Likely Tech' scenario, demand for nickel from the EV sector could grow from about 72kt to more than 400kt by 2025 and almost double to 780k by 2030, based on several battery chemistry assumptions. While in the 'Fast Forward' scenario, it could expand to 450kt by 2025 and to around 1.1mt by 2030.

For cobalt, EV demand is expected to be 2.4 times higher than current levels, to reach more than 40kt by 2025, and then peak at just below 200kt around 2035, based on our 'Likely Tech' scenario.

Lithium demand from the EV sector is likely to grow from around 100kt in lithium carbonate equivalent (LCE) to almost 480kt LCE by 2025 before hitting 1mt LCE by 2035. This could reach over 1mt LCE in the 'Fast Forward' scenario by the end of this decade.

EV battery demand scenarios for nickel, cobalt and lithium

EV sector demand growth by metals through until 2040 (CAGA %)

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

13 October 2021

Energy transition: Metals demand set to take off This bundle contains 7 Articles