ECB’s push for net-zero carbon will grow ESG credit

In the push for reducing carbon, significant investment will be necessary, and in turn, funding will be required. This will provide growth for the credit market, and in particular for anything associated with ESG

The ECB’s Stress Test

The European Central Bank has just released its economy-wide climate stress test results, in which they looked at both physical risk and transitional risks. This main push from the ECB is for all corporates and banks to transition toward zero carbon output. You can read more about that here.

The ECB’s push for zero carbon will be a costly one for corporates as significant investments will be necessary and, in turn, funding will be required. This will provide growth for the credit market, and in particular the ESG (Environmental, Social and Governance) credit market. The majority of the supply increase off the back of this will either be classified as green or as a sustainable bond and will have an ESG tilt associated with it.

ESG supply is growing

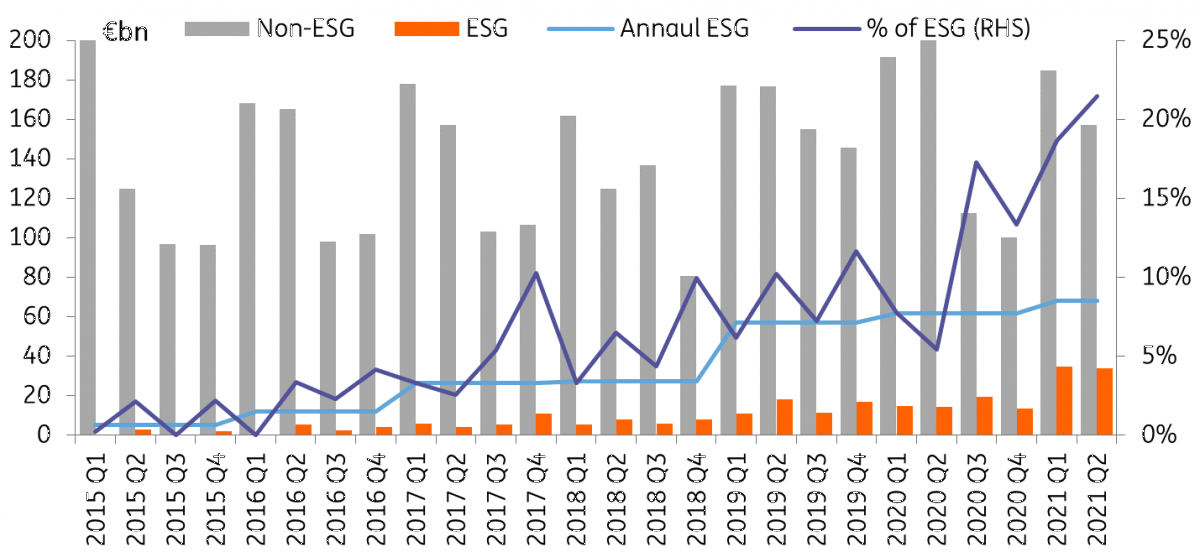

The percentage of ESG supply to overall supply is also growing. The dark blue line in the chart below demonstrates this increase year on year. In both 2019 and 2020, total ESG supply accounted for 9% of the total overall supply. So far in 2021, ESG supply accounts for 20% of the overall supply. Of course, relative to last year, there is indeed more ESG supply and less overall supply. However, this increase in supply is still lacking the insatiable demand for ESG credit. Many investors are already increasing their ESG holdings.

ESG supply is increasing substantially

ECB purchases combat any over-supply

We do not see over-supply as any credit negative threat on spreads. Indeed supply will increase, but the market has shown over the past three years it has a taste for heavy levels of such supply. Furthermore, the ECB has supported spreads through large purchasing of corporate debt via CSPP, its Corporate Sector Purchase Programme, mainly from the primary market, and will continue to do so for some years to come. Even after the ECB decides to stop actively purchasing corporate debt, they will still have notable reinvestments thereafter. Read more on this in our report ECB - Smoking out fossil fuels, where we outline future projections of monthly corporate purchases under CSPP and PEPP, the Pandemic Emergency Purchase Programme.

Underperformance of carbon intensive names and sectors

Indeed carbon-intensive names and sectors will likely see somewhat more underperformance and will also likely need more funding. The 'greenium' will certainly increase notably through:

- Slightly more oversupply due to higher investment needs

- Increasing CAPEX as a result, pushing leverage higher

- Demand for carbon-intensive is already falling substantially, with many investors shying away

We see the European Central Bank's push for corporates towards zero carbon as a positive for credit, namely from a growth of the ESG market perspective. Any increase in supply will be met by the ECB's considerable support through CSPP purchases.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article