ECB - Smoking out fossil fuels

Last week, the European Central Bank published its long-awaited plans to further integrate climate change considerations into its policy framework. We take a look at what this means and how it could affect markets

As the ECB's "ambitious roadmap" still lacks detail, we don’t expect it to have major performance implications yet. However, once the central bank’s ambitions take further shape in the next few years, they will unquestionably become a factor of significance to the bond market. Within the corporate bond sector, we still expect to see high carbon-intensive debt underperform, potentially similar to what we saw happen to the tobacco industry after it was stigmatised for its negative health effects some 10-15 years ago.

The ECB's plan to further integrate climate change considerations into its policy framework form one plank of the central bank’s strategy review, which started in January 2020. (See our research preview, The greening of monetary policy. The Bank aims to use a set of measures over a period of four years, at most, which are designed to be consistent with its objective of price stability. This means that the 'greening' of policy will come via its role as bank supervisor rather than through monetary policy.

It's important to note that at this stage, the ECB has only laid out its ambitions; there are no concrete proposals as of yet. While the ECB has underscored its determination to make its collateral framework and asset purchases greener, actual proposals on this are not expected to be published before next year. As such, any major performance implications should not be expected until the details become clearer.

Furthermore, while the intended greening of the monetary policy framework involves the central bank’s Asset Purchase Programme and collateral framework, the roadmap makes no mention of the potential greening of Targeted Longer-Term Refinancing Operations. In September last year, ECB President Christine Lagarde confirmed that 'green' TLTROs would be considered by the central bank as part of its strategy review. In the coming years, as banks are better able to measure the taxonomy alignment of their assets, this may be a topic that could become part of the discussion again.

We would also highlight that the incorporation of climate change risks is focused on the Corporate Sector Purchase Programme (CSPP). The Public Sector Purchase Programme (PSPP), Covered Bond Purchase Programme (CBPP3) and Asset-Backed Securities Purchase Programme (ABSPP) are not explicitly mentioned in the roadmap. For the CBPP3 and ABSPP, this may be related to the fact that banks are not major direct emitters of greenhouse gasses themselves, while green bonds only make up a small portion of these markets.

Green bonds also have a small share in the eurozone public sector bond market. And central bank buying of sovereign bonds is mostly driven by the capital key. EU regulations supporting transparency and data-availability on the climate-related footprint of issuers are, at this stage, primarily designed for large and listed companies (NFRD/CSRD) or financial market participants/financial advisers (SFDR), not for sovereigns. This, in our view, may explain why the ECB’s roadmap is biased towards private sector assets, both for the collateral framework and asset purchase purposes.

Corporate Sector Asset Purchases

The ECB has already been pushing its agenda for climate change, for example, by increasing and concentrating ESG asset purchases in both its Asset Purchase Programme and the Pandemic Emergency Purchase Programme. As it stands, the ECB holds 170 ESG corporate bonds, purchased under CSPP and PEPP. This accounts for 10% of the total corporate debt purchased by the ECB - a substantial chunk of the eligible ESG market. Of these 170 bonds, 104 of them were purchased after November 2019, accounting for 14% of the total purchases since then.

This is indeed a substantial amount considering that demand for ESG debt has been so strong and supply has not really kept pace with this. One catalyst for growth in the ESG market has been the Covid-19 pandemic, which we discuss in our report, Covid the catalyst for ESG in credit.

The ECB has already included a provision in its guidelines for step-up bonds which are, in principle, ineligible as collateral, making the bonds eligible if they are tied to ESG targets. As a result, sustainability linked bonds (SLBs) have become eligible as collateral and for the ECB to purchase. In its roadmap, the central bank stresses that it will remain supportive of financial innovations such as SLBs.

Looking forward

The ECB will adjust the framework for the allocation of corporate bond purchases to incorporate climate change criteria. This will include:

- the alignment of issuers with EU legislation implementing the Paris agreement through climate change-related metrics or,

- commitments of the issuers to such goals.

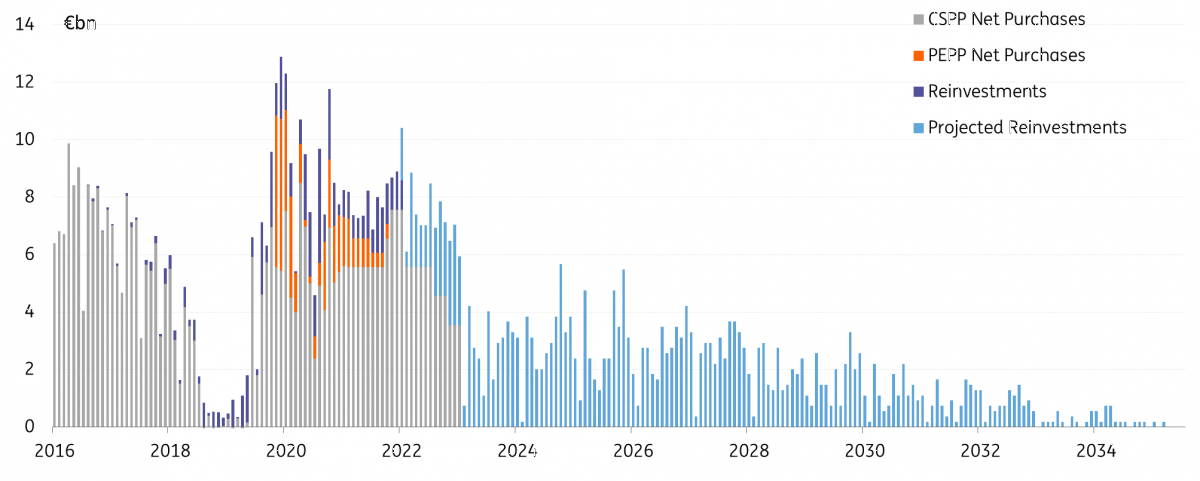

The ECB will develop proposals to adapt the CSPP framework to include climate change considerations between now and mid-2022. Thereafter, the changes will be implemented. The ECB has stated it will continue its net purchases under the APP until shortly before it starts raising rates. Our economists believe this will likely occur in late 2023 to early 2024. In which case, we can assume the ECB will continue actively purchasing up until around mid-2023. From that point onwards, the ECB will continue its reinvestments, which we expect to be around €2.5-3bn per month.

Actual & Projected CSPP, PEPP and reinvestments

Monthly net purchases and reinvestments of CSPP and corporate purchases under PEPP, alongside reinvestments

The ECB still has to nail down specifics on the sustainable allocation criteria under the CSPP. There may also be a transition period for issuers to align themselves with the new criteria in order to remain eligible. Therefore, there will not be any effect on credit spreads as of yet.

In her speech on 14 June 2021, ECB board member Isabel Schnabel hinted that the market neutrality principle could be replaced with a market efficiency principle for the private sector Asset Purchase Programme as a better way of considering climate externalities. However, she also addressed some important implementation challenges. For instance, negative screening policies, where purchases of bonds issued by polluting sectors would be halted, could remove incentives for carbon-intensive sectors to reduce their greenhouse gas emissions. Furthermore, tilting strategies towards the green bond market alone could have a negative impact on the liquidity and price discovery mechanism of this market. As an alternative, tilting strategies could also favour issuers that have a clear path and commitment to reducing their greenhouse gas emissions.

Hence the extent of the impact on spreads going forward will pretty much depend on the strategy the central bank ultimately opts for. It is fair to say that long term, bonds that are bought more actively will outperform those that are purchased less frequently or not at all.

Particularly high carbon intensive companies remain at risk of underperformance, especially as other market participants may follow suit, meaning demand for these high carbon intensive bonds will drop substantially. This may look like something similar to the tobacco industry 10-15 years ago when spreads were nearly double those of other sectors, even in the same ratings bracket.

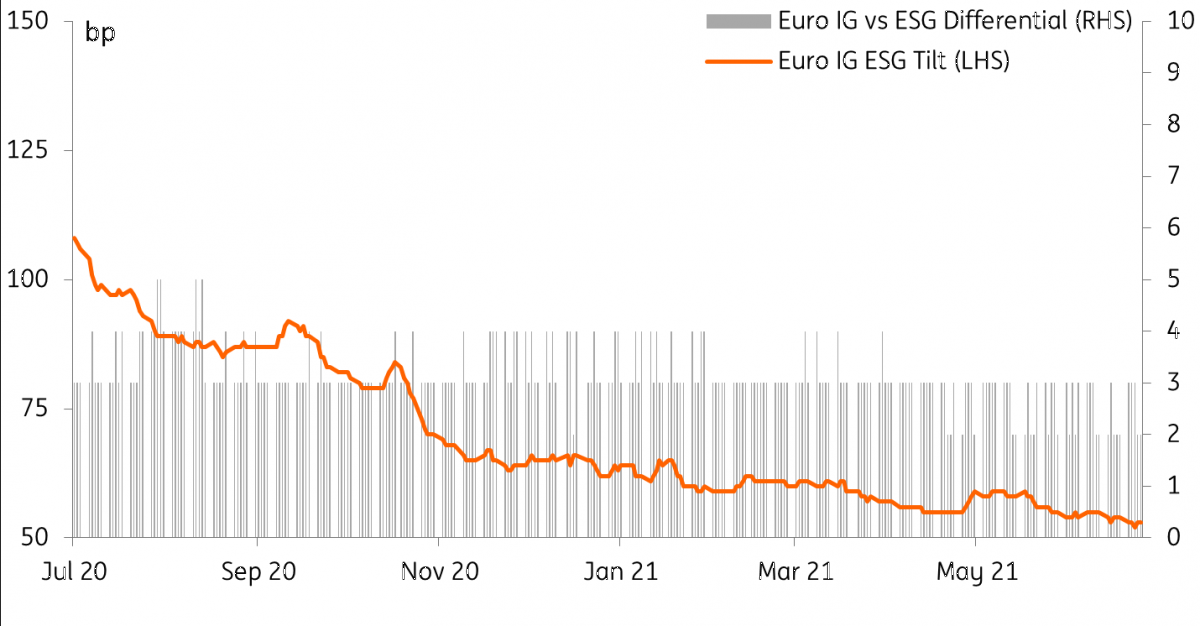

As seen below, currently there is very little spread differential between ESG-titled spreads and the overall index. However, this is due to the current compression trend leaving spreads at tight levels with little differential between any debt. In the coming years, when we see times of volatility, the non-ESG debt and particularly high carbon intensive debt will suffer notably from a lack of demand.

Euro ESG tilted spreads vs overall index

Selling Credit?

In the meantime, the ECB will also be conducting a climate stress test on its own holdings. If the Bank concludes that its current holdings are already too carbon intensive, it may consider actively selling its carbon intensive debt, although this is not too likely. This would be more of a nuclear option for the credit market where we would see a sudden shock from the mass exodus from high carbon intensive companies.

The effect on spreads would be very significant and very sudden for all carbon-intensive corporates. Spreads would widen across the curve creating a large differential between 'green' companies and ‘brown’ companies. The severity of this option would lead to significant market distortion. The market's herd mentality is already moving towards ESG, and if the ECB were to join that herd, real green/ sustainable investors may begin to be crowded out.

If the ECB were to begin selling either carbon-intensive corporates or lower ESG scored companies, it would likely create an aggressive sell-off in credit markets as a whole, ultimately causing a permanent change in classifying valuations in credit markets. This could then become as big a driver as ratings.

Green asset ratio disclosures may be of future relevance for collateral valuations

The ECB’s roadmap suggests that it will be just a matter of time before climate change considerations become a differentiation factor within the ECB’s collateral framework.

By mid-2022, the ECB intends to complete a review of its collateral valuation and risk control framework for climate change risks. This may result in changes to the framework where warranted. However, the ECB also plans to introduce disclosure requirements for private sector assets as a new diversifying eligibility criterion to the collateral and asset purchase treatment of these assets. These requirements are expected to become applicable in 2024 and will take into account the EU regulatory disclosure initiatives, such as the corporate sustainability reporting directive (CSRD).

We believe these plans may encompass the first steps towards a more favourable haircut treatment and a stronger asset purchase focus for assets that, based on the sustainability key performance indicators (KPIs) to be disclosed, are considered to have lower climate risks. These disclosure requirements will likely account for the applicable challenges in the field of sustainable disclosures by SMEs.

For collateral purpose direct corporate exposures may play second fiddle

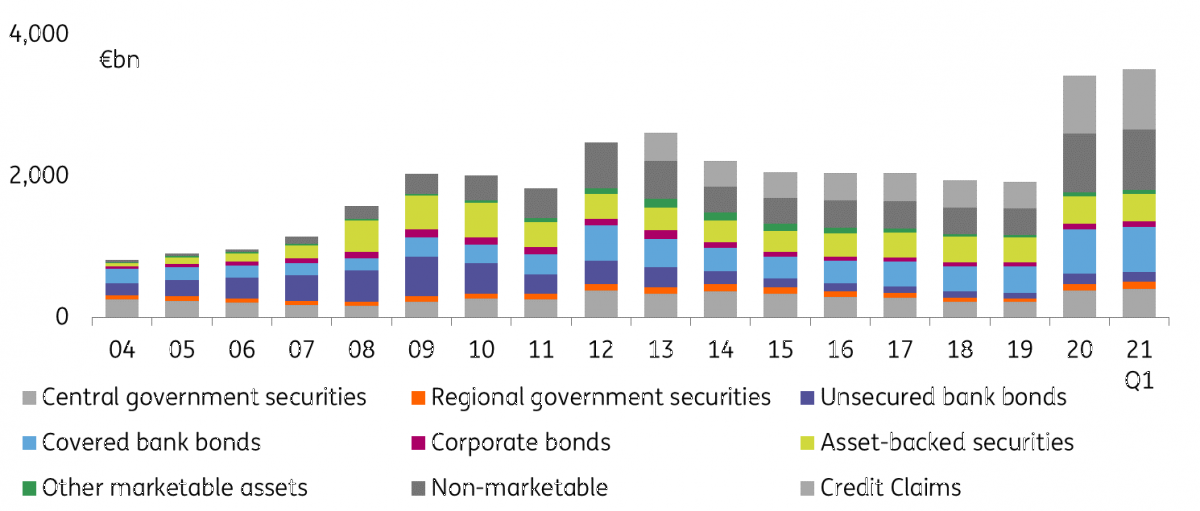

It will be interesting to see how these plans will be drafted with reference to the ECB’s collateral regime. For instance, we note that under normal (non-Covid-19) market circumstances, banks would predominantly use marketable assets, such as sovereign bonds and covered bonds, as collateral. Corporate bonds are less often pledged as collateral thanks to their less favourable haircut treatment.

For the greening of the asset purchase programmes, the ECB’s roadmap primarily focuses on corporate bonds. However, to make a difference under the collateral framework, the central bank would, in our view, have to expand its horizon beyond corporate exposures alone and at least consider covered and preferred senior bank bond exposures too.

The options to differentiate between bond exposures within the collateral framework are multiple, similar as for the Asset Purchase Programme. One can think, for instance, of more favourable haircuts for bonds marketed as green bonds under the EU Green Bond Standard (GBS), or otherwise of more favourable haircuts for bonds issued by companies or banks that report more favourable Green Asset Ratios (GAR). As an alternative, the central bank may also opt to take sustainability ratings as a haircut reference.

In any event, it is clear to us that the forthcoming changes to the ECB collateral framework will contribute to a shift in demand from banks towards debt instruments that are less exposed to climate risks.

Marketable assets are under normal circumstances most important as collateral

However, when it comes to having an impact on the greening of bank assets, one has to bear in mind that the proportion of marketable assets on bank balance sheets, such as securities, is much smaller than the share of non-marketable assets such as loans to corporates and households. Hence, these are the assets where banks can make the most difference in terms of supporting the environmental transition of their counterparties.

In April 2020, after the start of the Covid-19 pandemic, the ECB made a number of temporary and non-temporary changes to its collateral regime that contributed to a strong rise in the use of non-marketable assets and credit claims as collateral. Once these measures expire, and the abundant funds drawn from the TLTRO-III operations are repaid, the use of these assets as collateral will decline again. That said, the ECB’s roadmap may see changes being introduced to the collateral framework, promoting the further use of particularly climate friendly non-marketable assets as collateral.

Ultimately, even where it proves difficult to promote the greening of non-marketable assets on bank balance sheets via the collateral regime, we believe the climate-related stress tests for individual banks may give the hoped-for extra push in this direction.

The nine courses of action of the climate change roadmap

The ECB’s roadmap defines nine courses of action. Many of these actions were also briefly touched upon by Isabel Schnabel in her speech of 14 June 2021.

For instance, the central bank hopes to expand its analytical capacity in macroeconomic modelling, statistics and monetary policy with regard to climate change. As such, for the purpose of its staff macroeconomic projections, the ECB aims to introduce in 2021-2022 technical assumptions on carbon pricing for forecasting, and regularly evaluate the impact of climate-related fiscal policies on the macroeconomic projections baseline.

From 2022 to 2024, the ECB will accelerate the development of new models to assess the impact of climate risks and policies on the economy, the financial system and the transmission of monetary policy. To expand the statistical data available for climate change risk analysis, the ECB will develop new experimental indicators in 2021 and 2022, covering 1) green financial instruments and 2) the carbon footprint of portfolios of financial institutions, as well as 3) their exposures to climate-related physical risks. These indicators will be gradually enhanced as EU policies in the field of environmentally-sustainable disclosures and reporting evolve.

The ECB also commits to including climate change considerations in the areas of disclosures, risk assessment, collateral framework and corporate sector asset purchases. To this purpose, the ECB intends to introduce disclosure requirements for private sector assets as a new eligibility criterion for a differentiated treatment for collateral and asset purchases, by taking into account the EU regulatory disclosure and reporting initiatives. These requirements should support more consistent disclosure practices in the market, while maintaining proportionality through adjusted requirements for small and medium-sized enterprises. The ECB will announce a detailed plan in 2022, to be followed by an adaptation period for issuers in 2023. The disclosure requirements should enter into force in 2024.

Separately, the ECB will, by mid next year, complete a review of its collateral valuation and risk control framework to ensure that climate change risks are reflected. In the process, the central bank is committed to remaining supportive of financial innovations related to environmental sustainability. If warranted, the ECB may subsequently decide to make changes to the framework.

The ECB also aims to assess the issues arising from the market neutrality principle, which promotes central bank bond holdings proportional to market capitalisation. However, as carbon intensive companies tend to issue more bonds, the CSPP may currently have an unwanted bias towards the more carbon intensive sectors. The ECB will, this year, first complete its assessment of potential market allocation biases and the pros/cons of alternative allocations. Concrete proposals for alternative benchmarks are then expected to be made in 2022, particularly for the CSPP.

The ECB intends to conduct an enhanced due diligence to incorporate climate change risks in the CSPP. Climate-related disclosures related to the CSPP should have been prepared by the first half of 2023. The ECB also expects to come with proposals to adjust the CSPP framework for climate change considerations by mid-2022 at the latest, and to adapt the CSPP framework in 2H22.

By 2022 the ECB will also carry out stress tests to check its own balance sheet exposure to climate risk. Following the central bank’s 2021 economy-wide climate stress test, the ECB will conduct a separate supervisory climate stress test of individual banks. In 2023-2024, the central bank will build upon this pilot stress test and introduce regular climate stress-testing.

For collateral and asset purchase purposes, the ECB will also verify how rating agencies include climate risks in their ratings. Additionally, the central bank will develop minimum standards to ensure that those risks are consistently included in its own internal assessments. Subsequently, if warranted the ECB may decide to introduce requirements to the Eurosystem Credit Assessment Framework (ECAF) targeted at climate risks.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article