ECB pushes credit off the edge of a cliff

The ECB announced the end of CSPP on 1 July, alongside a rate hike of 25bp in July and another in September. Gross purchases fall off the edge of a cliff as reinvestments are low for the second half of this year. A different phase for credit has begun with a changing underlying rates environment and looming negative factors and risks, with no ECB to offer support

The end date of CSPP is set: 1st July

In addition, there will be a rate hike of 25bp in July, and another hike in September. It is also likely we will see another hike in December and in 1Q23. The backdrop for credit has changed as we now enter a different phase with a changing underlying rates environment. Peripheral spreads will be under pressure as the BTP-to-bund spread has already widened. Generally Italian corporates tend to be highly correlated with BTP, thus we would be cautious on Italian names.

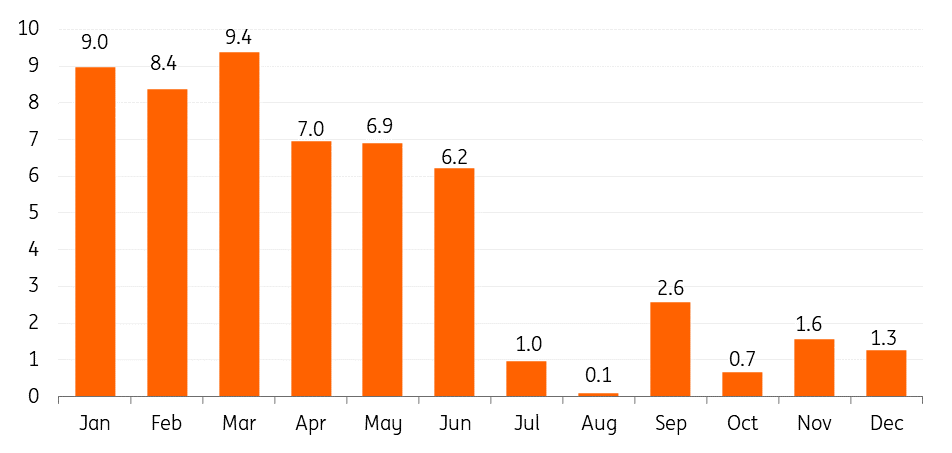

The ending of the corporate sector purchase programme (CSPP) weakens the technical picture for credit in the second half of this year. Reinvestments are rather low in the coming six months, at an average of just €1bn per month. This means gross purchases fall off the edge of a cliff, from an average of €8bn per month down to €1bn. This leaves credit unsupported and thus will add flames to the fire in times of volatility or widening.

Gross CSPP purchases will fall off the edge of a cliff

We still foresee three potential scenarios playing out

- Inflation persists resulting in further tapering and rising rates

- Inflation remains high while growth is under a lot of pressure, causing default rates top rise and earnings/ fundamentals weaken

- A soft landing, where inflation comes down without substantial pressure on growth.

The first two scenarios are indeed rather bearish for credit, and as such the lack of European Credit Bank support will likely increase volatility and increase the severity of any widening. The primary markets will of course be under the most pressure as CSPP ends. Already, issuers bringing a bond to the market need to pay a significant new issue premium (NIP). Furthermore, new issues have not seen any performance after issuance, and at times the secondary curve is actually widening out to meet the new issue, as opposed to the new issue tightening down to the secondary curve. This is a clear indication of a bear market. As a result, we would be cautious towards secondary market exposure to corporates that are potentially bringing new bonds to the market. We do see opportunity in new issues that are offering decent NIP, and in the widened out secondary curve. In terms of supply, there will likely be a last dash to come to market before the programme fully ends on 1 July. Already the pipeline is looking decent. Although most issuers have already pre-funded. Supply should therefore be manageable in the coming weeks. Back in April the ECB reduced their order in books down to 30% from 40%, and now again have dropped down to 20%. We may see some supply indigestion in September, October and November as the market will miss the big buyer. But overall, we expect relatively light supply, with a forecast of between €250-290bn. We currently sit at €145bn YTD.

Reinvestments pick up in January 2023 onwards with an average of €2-3bn per month. This of course will give credit an extra bid throughout the year. But until then, we now prefer ineligible debt over eligible. We also favour names and sectors that the ECB does not hold a lot of. Higher beta sectors such as construction, retail, real estate, autos, travel, oil & gas and industrials have been favoured by the ECB. The end of CSPP will leave these sectors rather vulnerable as they rely more heavily on the big buyer. We expect these sectors to underperform. The ECB is also holding a significant amount of utilities bonds. Normally this sector would be rather defensive and lower beta. However, at the moment the utilities sector has a question mark around it due to increased energy prices. We are more comfortable with defensive lower beta sectors in these uncertain times. We would be cautious when it comes to sectors that are favoured by the ECB for purchasing.

Amount held under CSPP as a percentage of the amount of bonds in iBoxx per sector

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article