ECB preview: Clarification of the clarification

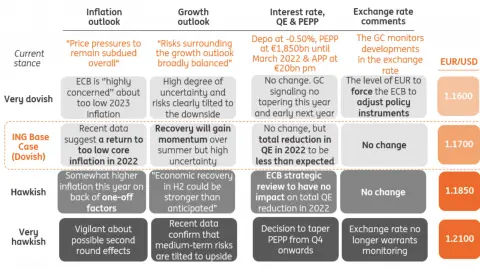

Today's ECB meeting should shed more light on whether the new strategy is just window-dressing and the formalisation of the well-known monetary policy stance or actually a shift towards more dovishness and even more determined monetary policy easing to achieve what the ECB's hasn't achieved for a decade: bringing inflation back to target

Until a week or so ago, today's ECB meeting was set to be a non-event; an intermediate meeting to bridge the time until the 9 September meeting. However, with the release of the ECB’s strategy review last week, any ECB watcher hoping for early summer vacation had to change their plans. Now it's suddenly become very interesting as it should bring more clarity around how the ECB wants to implement its new strategy.

New strategy - new questions

Remember, the new strategy has set the inflation target from ‘below, but close to 2%’ to ‘2%’ with a commitment to symmetry, meaning that ‘the Governing Council considers negative and positive deviations from this target as equally undesirable’, however, temporary or transitory deviations from the target will be tolerated. Particularly the latter can be seen as a reconfirmation of the current stance of looking through the period of higher inflation, mainly driven by one-off factors.

The new strategy can be interpreted in two ways: it is either just an official formalisation of what the ECB has been doing over the last few years anyway or it is a step towards more dovishness as 2% implies a more resolute effort, leaving less flexibility than ‘below but close to’. If the latter is the case, the ECB’s own inflation projection of 1.4% in 2023 would forbid any tapering in the coming months. It would even not allow for an end of the front-loading of the asset purchases under the Pandemic Emergency Purchase Programme (PEPP), which currently runs until March next year. In fact, a strict interpretation of the strategy might even suggest paving the way for more but definitely not less asset purchases.

We don’t think the ECB will go as far as actually stepping up its bond purchases given the hawks at the ECB were already suggesting a reduction of the asset purchases at the June meeting. But given that the delta variant and new waves of Covid-19 in several eurozone countries cast enough uncertainty for the hawks to keep silent until the September meeting but stepping up bond purchases would clearly be a step too far.

New forward guidance

After the presentation of the strategy review, ECB president Christine Lagarde suggested changes to the ECB’s forward guidance at next week’s meeting. But what could this be?

Currently, the ECB has basically three kinds of forwards guidance: on rates, on the PEPP and the Asset Purchase Programme (APP). Interest rates are expected to remain at their current or lower levels until the inflation outlook has ‘robustly’ converged to the ECB’s target. PEPP will last until the end of March 2022 or ‘until the Governing Council judges that the coronavirus crisis phase is 'over’. Forward guidance on APP is probably the vaguest as it is expected ‘to run for as long as necessary to reinforce our policy rates’ accommodative impact and end before the first rate hike.

The new strategy and more dovishness suggest that the total reduction of the monthly purchases in 2022 will be less than previously expected

In our view, there is little to change in the forward guidance on rates. Instead, the ECB could prepare its own operation twist, linking the APP closer to the inflation target, which would open the door for reduced PEPP purchases and, at the same time, increases of the APP purchases. Another important point could be clarifying the ECB’s definition of the end of the ‘coronavirus crisis’. Is the pandemic over when the eurozone has reached herd immunity, or when the economy has reached its pre-crisis level or when the ECB’s own inflation projections are back to where they were in late-2019?

All of this makes next week’s ECB meeting an exciting meeting, and we expect a very heated debate behind the scenes. On top of the new strategy, the ECB is also facing a new inflation reality, in which views on the risks of second-round effects and the pass-through from higher producer prices to consumer prices clearly differ, to say the least.

We still think that eventually, the ECB will reduce the PEPP purchases and increase the APP purchases. However, the new strategy and more dovishness suggest that the total reduction of the monthly purchases in 2022 will be less than previously expected. The ECB’s new strategy is meant to clarify and simplify the conduct of monetary policy.

To get there, we definitely need another round of clarifications, hopefully, next week.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

15 July 2021

It’s ECB day: What you need to know This bundle contains 5 Articles