ECB & EUR: Pouring oil into the fire

The ECB didn't surprise on the dovish side today. No rate cuts and a muted QE would normally lead to higher EUR/USD. But the lack of conviction that the ECB is willing to do ‘whatever-it-takes’ reintroduced risk premium into the EUR. Now the ball is in the Federal Reserve's court to send EUR/USD higher

As we wrote earlier, the European central bank announced a series of measures, hoping the several, targeted but smaller measures can make a difference.

On first glance, it's nothing overwhelming and underscoring the view that the ECB's usual unconditional toolkit (for cutting rates further into the negative territory and increasing QE meaningfully) is largely exhausted and government actions on the fiscal side must be taken to make a difference to the economy.

Under normal circumstances, the apparent lack of dovishness from the ECB would lead to a stronger EUR and higher EUR/USD, particularly if the Federal Reserve is likely to cut interest rates aggressively and speculation about the Fed's QE plans continue to rise. Yet, two factors lead to the weakening, rather than strengthening of the cross:

- The clear break down in markets, where funding issues in the cross-currency basis swaps market and the sharp decline in equity markets pushed USD higher across the board (even against the safe-haven yen). See USD: The wrong kind of rally for more

- The lack of perceived conviction from ECB President Christine Lagarde that the central bank is willing to do whatever it takes to help euro asset markets.

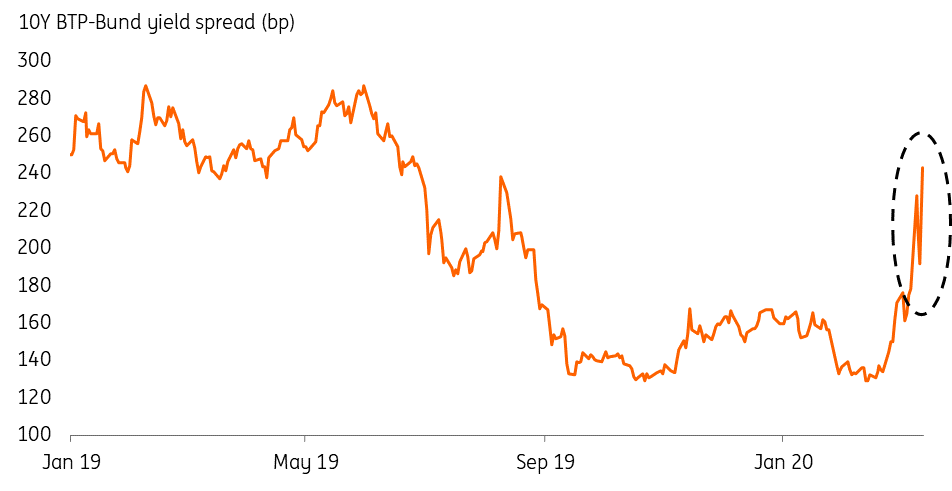

The remarks “we are not here to close spreads” do risk re-introducing a risk/credit premium into EUR assets and are reminiscent of pouring oil into the fire. The widening of the BTP-bund spread, as shown below in the figure provides the case in point.

10Y BTP-Bund Spread

Looking beyond the very short term, we still see scope for higher EUR/USD and the cross to return to 1.15 should the Fed deliver aggressive rate cuts and move towards QE. Moreover, any signs of a possible road to the coordinated eurozone fiscal easing in the European group meeting taking place next week could also help to the euro.

But with no ‘whatever-it-takes’ moments today, the euro has the renewed potential issue to face – the risk premium issue – particularly if eurozone states fail to deliver credible fiscal stimulus.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

12 March 2020

In case you missed it: Pandemic pandemonium This bundle contains 13 Articles