Dutch transport & logistics outlook 2023: Aviation rebound continues, freight logistics slows

The return of passenger transport will offset slipping freight volumes in 2023. Costs are rising sharply, but persistent staff shortages and tight capacity are still supportive to price rises. Therefore the market remains in relatively good shape for Dutch transport companies, although parcel and e-logistics face a growth correction

Transport and logistics enters a new phase

After a double-digit rebound in 2022, the Dutch transport and logistics sector has returned to well above pre-Covid levels of growth. Following a freight-driven recovery during most of the pandemic, growth is now fully attributable to the passenger transport rebound. Since the lifting of Covid-19 restrictions, passenger transport has been revitalised. So far in 2023, the pace of recovery is slowing, but aviation and the public transport service are growing at double-digit levels. Combined with lower transport demand on the freight side, volume growth in the sector is declining but remains positive (+2%).

Passenger transport continues to recover, parcel transport faces post-pandemic correction

Volume development subsectors transport and logistics in the Netherlands (index, 2019 = 100)

Differences between sub-sectors still significant due to prolonged pandemic effect

The gap between subsectors and also between companies has been shrinking this year, but remains much larger than usual, with a clear dividing line between passenger transport and freight transport. Dutch aviation recovered more strongly than expected in 2022 and is expected to return in volume this year to around 5% of the 2019 level.

After parcel transport benefited greatly from the e-commerce wave during the pandemic, the correction continues in 2023 and the volume of mail and parcel transport is down by 2.5%. The broadly active logistics services – already a structural growth sector – is expected to be the frontrunner in terms of volume by the end of 2023. Turnover in the transport and logistics sector is also expected to be significant. After an average sales increase of 25% in 2022, it is expected to increase by 8% in 2023, mainly due to higher prices.

Business confidence ‘only’ slightly negative at the start of 2023

The confidence of market players in transport and logistics has been shaken by the war in Ukraine. Over the course of 2022, sentiment slipped further due to the impact of higher energy and fuel prices and economic deterioration. At the beginning of 2023, this was slightly improved by better-than-expected economic data and the drop in energy and fuel prices due to the relatively mild winter. Confidence should continue to improve this year due to signals of improvement among industrial customers and the reversal of China's zero-Covid policy, which will help support the global economy in the second half of the year.

Companies in transport & logistics on balance slightly negative about the start of 2023

Economic sentiment survey Dutch T&L companies: opinion on the upcoming three months*

Profitability in 2023 will be more challenging

Another factor that has bolstered confidence is that transport and logistics companies are managing to survive reasonably well financially amid the inflationary shock. This is also reflected in the increase in (freight) tariffs. In the first three quarters of 2022, transport and logistics prices went up by about 15%, and that was not only due to shipping and aviation, which were affected by supply constraints due to disruption. In road transport, services prices also increased by around 12%.

The number of bankruptcies in 2022 was also incredibly low.

2023 will become more challenging with significantly higher wages (through new road freight collective agreements and port-related companies) as demand weakens. In addition, the exceptionally high global container tariffs, which also benefited inland waterway transport and some logistics providers, have ended.

Transport and logistics sector still expected to grow – large underlying differences between subsectors

Forecasts Dutch transport & logistics sector (% YoY)*

Public transport use should pick-up

Passenger traffic on public transport recovered to almost 80% of pre-pandemic levels by the end of 2022. Business travellers are commuting less. One in five passengers previously indicated that they would continue to travel less by train after the pandemic. In 2023, however, the recovery in public transport is expected to continue and the volume is set to reach 90% of pre-pandemic levels. Structural growth (population growth) will contribute to this. The Knowledge Institute for Mobility Policy expects buses, trams and the metro to return to their pre-pandemic volume levels in 2024, but this will not be the case for trains until 2026.

Public transport still 20% below pre-pandemic level at the start of 2023

Flight passengers back into the air faster than expected

An unexpectedly rapid return of passengers taking flights in 2022 put aviation to the test in 2022, and demand from holiday and leisure travellers remains high. Air traffic to and from European airports was back at 87% of pre-pandemic levels in January 2023. This recovery is also reflected in the surge in passenger numbers of low-cost carriers Easyjet, Ryanair and Wizz Air.

Travellers continue to return to the skies despite higher taxes and ticket fares

At Amsterdam's Schiphol airport, the number of passengers and flights in 2022 was down to 73% and 80% of 2019 levels, respectively. Easyjet recorded a level of 79% in the last quarter. Passenger traffic at Eindhoven airport – which Ryanair and Wizz Air fly to – was already close 94% of the 2019 level for the whole of 2022. Signals on bookings suggest that this will continue in 2023, despite the fact that the airline ticket charge this year will rise from about €8 to more than €26 per ticket, and this may eventually slow demand. After problems with scaling up, Schiphol is expected to be able to better facilitate the demand for air travel.

Number of flights and airline passengers at Schiphol is recovering

Index recovery airline traffic at Schiphol airport compared to pre-Covid base (2019)

Schiphol's connectivity crucial for future growth

Schiphol's connectivity – which is considered important for the attractiveness of the Netherlands as a location – has so far proved to be quite robust (see figure). From an economic point of view, it is important that air freight transport be given space. In 2022, freight traffic accounted for 4.6% of flights, but was more likely to account for as much as a quarter of the value added.

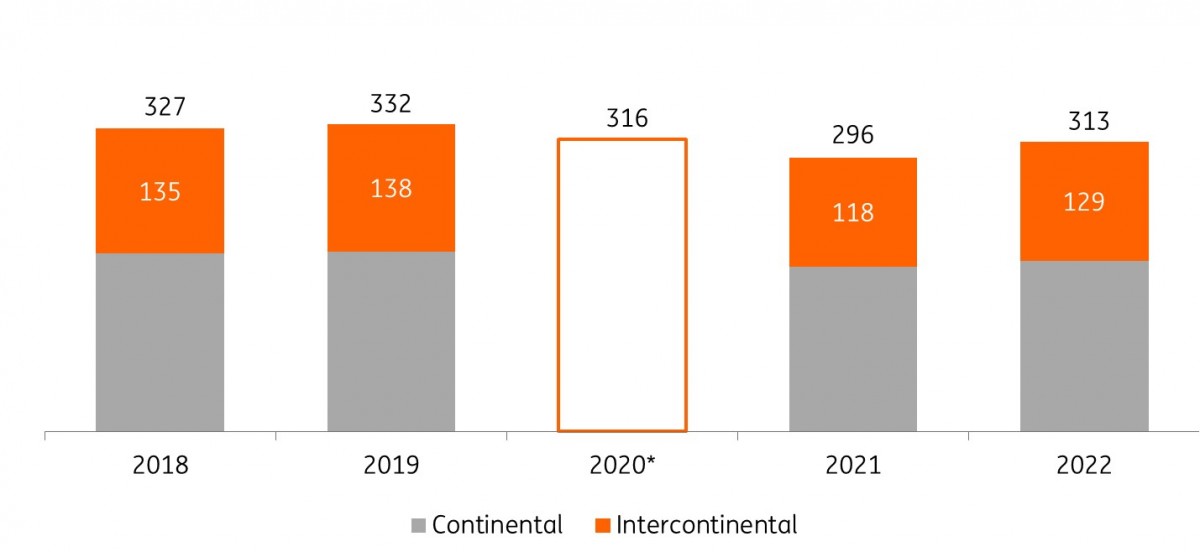

Hub function Schiphol persisted relatively well during the pandemic

Number of destinations at Schiphol airport per year (connectivity)

Freight volumes after strong and turbulent phase

Unlike in passenger transport, most companies in the transport and logistics of goods (about 75% of the sector) enjoyed a busy time during the pandemic.

With slightly lower growth prospects for clients in industry, construction, retail and shippers abroad, road transport and shipping are not expected to grow in 2023. In consumer products, in particular, warehouses are still well stocked, with more anticipation of supply disruptions and higher demand. This is a weak start to the year, especially in container transport by road and water. Early 2023 demand may pick up over the course of the year.

Flattening world trade and Russia impact

Faltering world trade in the last months of 2022 was reflected in the major Western European ports of Rotterdam and Antwerp, where transshipments dropped as they did elsewhere in the world. This was due to reduced spending and the earlier ordering of goods for the holiday season. As an essential transshipment seaport for cargo heading for Eastern Europe, Rotterdam in particular notes the disappearance of Russian container cargo (transshipment onto ‘feeder ships’). This also applies to the transshipment of crude oil and metals from Russia. In 2023, the ban on imports of Russian oil products (such as bunker oil and diesel, as of 2 May 2023) will become more pronounced with shifts in supply and, on balance, less trade. Due to the energy crisis, the revival of coal will continue in 2023, as will the growth of liquefied natural gas (LNG) and biomass for the production and blending of biofuels.

Port throughput slides due to sanctions and disruptions in trade

Protectionism keeps global trade under pressure

Overall, world trade will only grow very slightly in 2023. It is positive for global trade that transport costs for container transport have returned to pre-pandemic levels on the spot market and air freight has also fallen sharply in price. Delivery times are also expected to decline further. This gives some counterweight to increasing protectionism. A lesson from supply chain disruptions is that shippers retain larger stocks. Logistical management is key in the restructuring of supply chains. This can be beneficial for logistics service providers.

Early cyclical air freight falls sharply, but may recover over the course of 2023

After a rapid recovery in 2020 and 2021, air cargo volumes fell sharply again in 2022. This can be explained by the fact that it is mainly high-quality consumer products that are transported by air. Airbridge cargo also lost a major player at Schiphol Airport. The revival of air transport has been characterised by a significant increase in the volume of freight going into the ‘belly’. This takes some of the pressure off capacity constraints caused by the war in Ukraine. At the same time, slot space for freighters remains important for the flexibility of air cargo operations. There are many new freighters in order worldwide, including those of Martinair. The beginning of the year can be expected to return to growth in air cargo on the way to 2024 with some economic improvement.

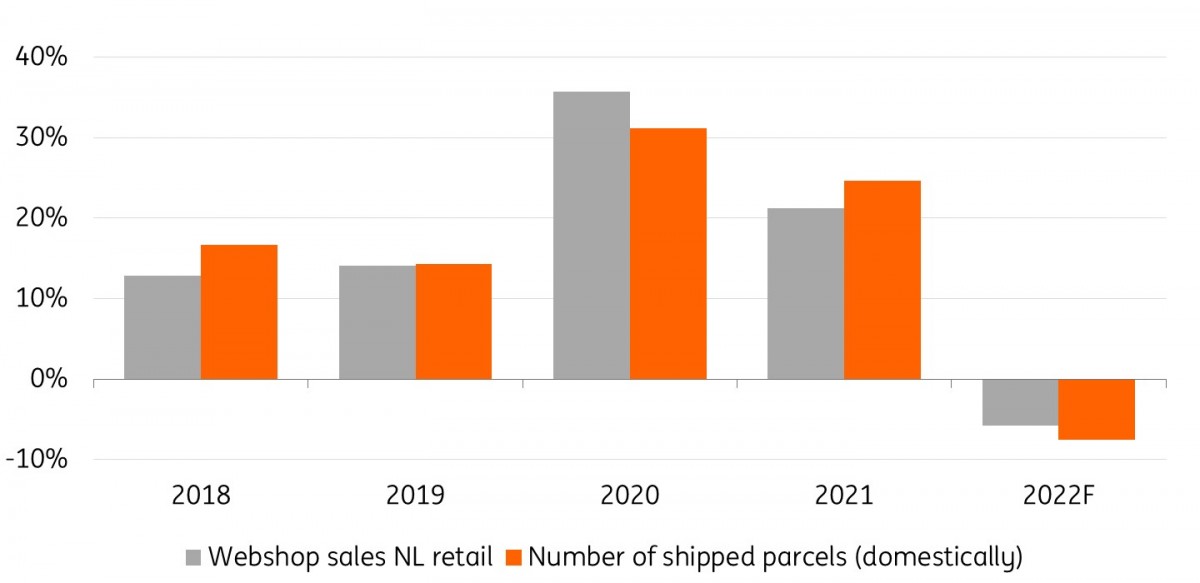

Parcel delivery (and e-logistics) faces post-pandemic correction

Turnover growth for online shops and number of domestically-delivered parcels (% YoY)

E-logistics turns to a lower gear

E-commerce volumes are declining for the first time since the pandemic's growth explosion. The logical correction is still ongoing in 2023. An exception is PostNL (still the market leader with approximately 60% of Dutch package volume) which is also to be seen in the air freight sector. Volumes are still larger than they were pre-Covid, but the post-Covid growth path is expected to be lower. This is also because an increasing number of retailers are inevitably opting for a form of (return) shipping pricing. In combination with the shrinking traditional postal sector, postal and parcel transport is therefore falling into the negative in 2023.

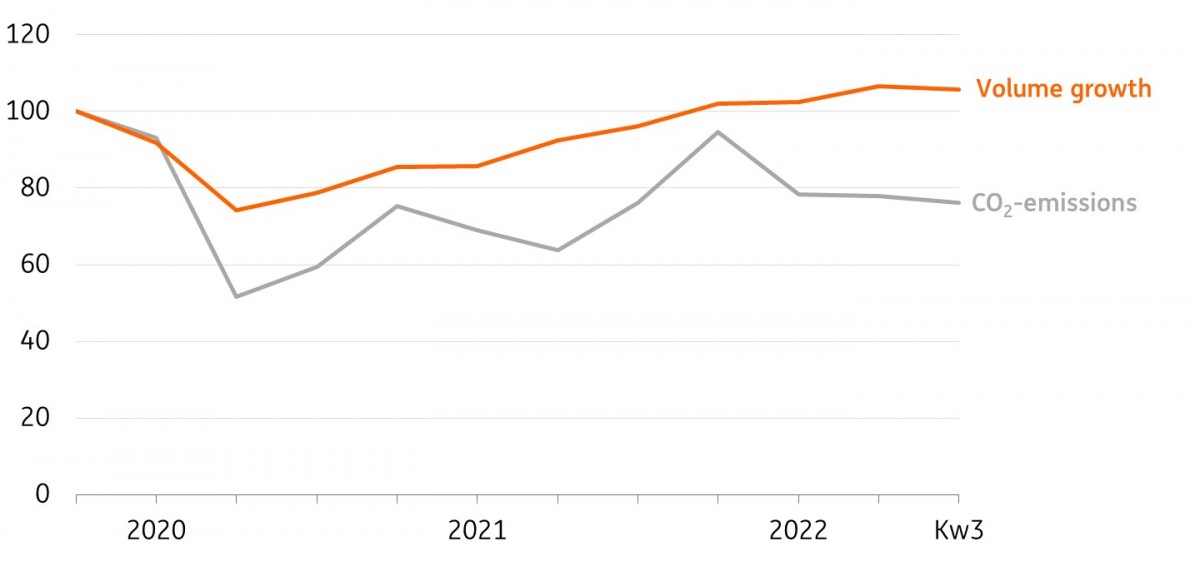

CO2 emissions transport remains lower despite volume recovery

Index CO2-emissions and volume transport companies in The Netherlands (2019 = 100)

CO2 emissions from transport sector rising again

While volumes in the transport and logistics sector surpassed pre-Covid levels in 2022, CO2 emissions from transport companies fell. Total greenhouse gas emissions from the mobility sector in the third quarter of last year were still 15% lower than during the same period in 2019. It seems that companies, particularly in road transport, but also in aviation, have made more of a contribution to fuel efficiency in recent years. Higher fuel prices have, of course, been an additional incentive.

Labour shortages still the most prominent barrier for companies active in transport & logistics

Barriers in transport & logistics, % of the companies experiencing a specific constraint

Staff shortages persist

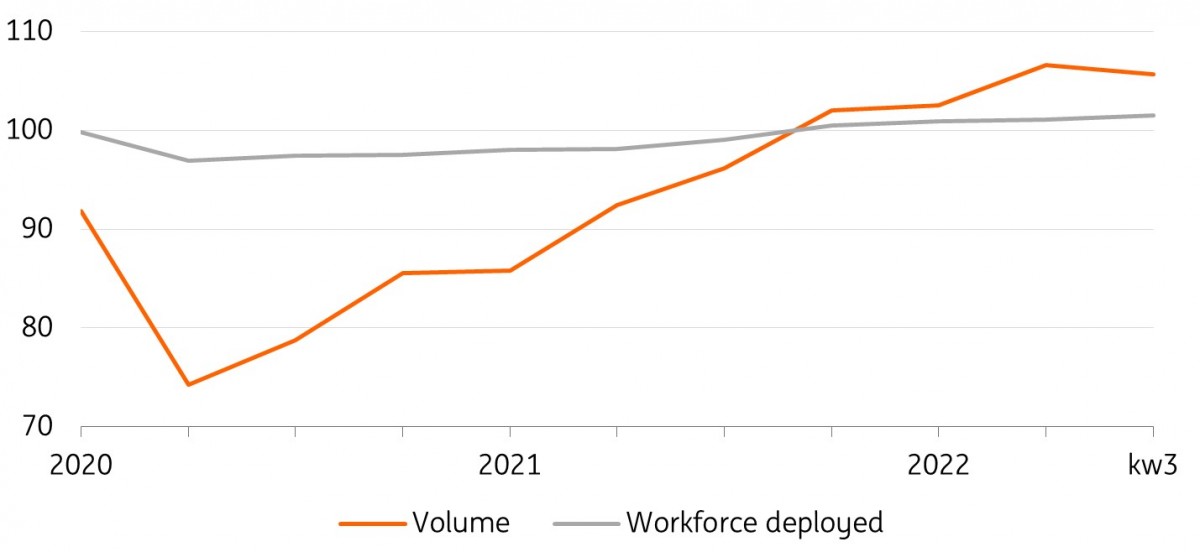

Even in the current less favourable economic climate, the shortage of staff remains, strikingly, the biggest obstacle to transport and logistics companies. While client demand is still widespread, the shortage of staff for almost half of the companies is slowing growth. In 2022, shortages were already apparent at Schiphol and NS, but also at the many small companies in road transport, the shortage of staff is larger than it was a year ago. Sickness absenteeism is still one percent higher than the average for the last 10 years, but more drivers are flowing and young people are less likely to find a career in transport. Labour capacity is increasingly the starting point for business planning. However, this is not just a burden. The continued tight market makes it easier to pass on higher costs.

Job vacancy rate transport & logistics still close to record level

Vacancy rate transport & logistics sector (vacUpload Newancies per 1.000 existing jobs)

Workload transport and logistics mounted as sector volume surpassed the pre-pandemic level

Development volume en workforce in the total Dutch transport & logistics sector (index, 2019 = 100)

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article