Central Banks: Our latest calls

As recession fears build, our team outline their forecasts for global central banks

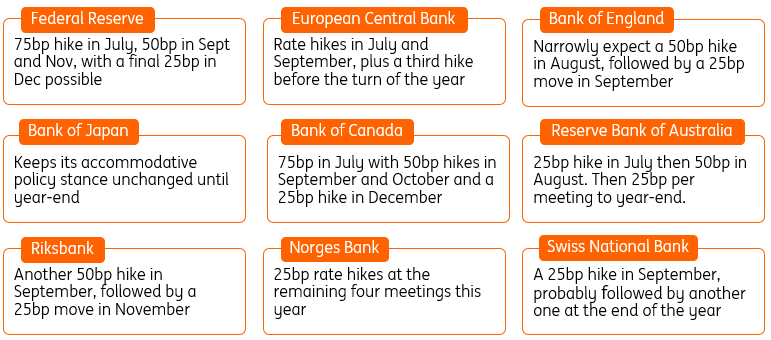

Developed markets: Our calls at a glance

Federal Reserve

Our call: 75bp in July, 50bp in September and November before switching to 25bp in December. Rate cuts in 2H23. Quantitative tightening (QT) to continue until rate cuts begin.

Rationale: To get inflation down quickly we would ideally like to see the supply-side capacity improve to meet strong demand in the US economy. However, supply chain strains, geopolitics/energy prices, and a lack of suitable workers mean this isn’t likely in the near term. Consequently, the onus is on the Fed to respond aggressively to dampen demand, but moving into restrictive territory means a rising chance of recession. Inflation could fall quickly from early next year, opening the door to rate cuts from summer 2023.

Risk to our call: Two-way. On the one hand, the tight labour market continues with rising wages making inflation stickier at high levels. Conversely, the economy reacts badly to rate hikes (the housing market is vulnerable) and recession prompts a lower peak and a more rapid reversal in Fed policy.

James Knightley

European Central Bank

Our call: Rate hikes totaling 100bp before the end of the year.

Rationale: Stubbornly high inflation and longer-term inflation projections above the 2% target have made a first rate hike overdue. Still, the very gradual (and slow) approach to normalising when other central banks act more determined and aggressively suggests a still divided ECB. Support within the ECB to end net asset purchases and the era of negative interest rates is strong but views on the timing and pace still differ. With a high risk of the eurozone and US economy falling into technical recession towards the end of the year and inflation coming down in 2023, there will be hardly any room for the ECB to deliver additional hikes in 2023.

Risk to our call: A faster and more severe recession could push the ECB to stop normalising after 75bp and could even trigger cuts in early 2023. On the other hand, positive growth surprises and little signs of inflation weakening could motivate the ECB to hike more aggressively this year and bring the refi to 2% in 2023.

Carsten Brzeski

Bank of England

Our call: 50bp rate hike in August, 25bp in September before a pause.

Rationale: It's a very close call on August's meeting, and in isolation there's not much in the latest data to suggest the Bank needs to move more aggressively. Core inflation looks like it is at, or close to, a peak (even if the headline will go to 11% in October), while unemployment has stopped falling. But the hawks are clearly worried about recent weakness in sterling, and the prospect of another 75bp Fed hike coupled with the fact that a 50bp rate hike is virtually priced for August, means we narrowly think that's the most likely outcome. Still, a 50bp hike – if it happens – is likely to be a one-off. We're not far from what's arguably neutral interest rate territory now (probably around 2%), and the Bank loses one of its biggest hawks after August, who will be replaced by a more dovish official. We still doubt the Bank rate will go as high as 3% or above, as markets are still pricing.

Risk to our call: If the Fed goes even more aggressively, or if core inflation moves unexpectedly higher in the coming months, then we could see more than one 50bp hike and a higher terminal rate.

James Smith

Bank of Japan

Our call: Bank of Japan will maintain an accommodative policy stance.

Rationale: CPI will stay above 2% until the end of 2022, but BoJ will downplay it as cost-push-driven inflation that will prove temporary. Market expectations of possible policy changes (at least broadening the long-end yield target) are still alive but are not going to materialise easily for a while.

Risk to our call: If signs of wage growth are detected and the sharp yen weakening continues over 135, then the bank could reconsider its policy stance, but that will become more likely when Governor Haruhiko Kuroda retires next April.

Min Joo Kang

Bank of Canada

Our call: 75bp hike in July with 50bp moves in September and October with a final 25bp hike in December.

Rationale: The Canadian economy is growing strongly with employment at record levels and inflation running at its fastest rate since January 1983. The Canadian economy’s red hot housing market and strong commodity focus are additional reasons for a strong central bank response. The Bank of Canada is worried about inflation expectations becoming unanchored and is implementing a swift run down in its balance sheet in combination with rapid interest rate increases.

Risks to our call: Predominantly to the upside given the positive economic outlook, especially if labour shortages become more of a problem and wage growth accelerates. This would add to upward pressure on home prices, which will also make the BoC nervous.

James Knightley

Reserve Bank of Australia

Our call: A further 25bp hike in July ahead of the 2Q CPI figures, then 50bp in August and another 25bp in September. 25bp hikes per month to the end of the year.

Rationale: The RBA found itself way short of where it needed to be (modestly restrictive) once it realised that inflation was not only higher than it had expected but would last longer. New inflation data is not due until after the next RBA meeting in July, so given their pledge to be “data-dependent”, a more cautious 25bp hike is warranted in July, but followed in August by 50bp as 2Q22 inflation is likely to post new year-on-year highs. Hikes should then revert back to 25bp in September.

Risk to our call: The RBA may feel that even without new inflation data, it is still sufficiently short of a modestly restrictive rate, that it makes more sense to keep hiking by 50bp in the near term until it reaches 2.5%, and then adopt a more data-dependent approach.

Rob Carnell

Riksbank

Our call: Another 50bp rate hike in September, followed by 25bp in November.

Rationale: The Riksbank is concerned that a tight labour market and forthcoming wage negotiations could result in a sustained pick-up in pay growth – and of course it is keeping a wary eye on the ECB's rate hike plans this summer. Swedish policymakers have also only two meetings left this year, compared to four at most other central banks, which means each one needs to count. We expect June's 50bp hike to be matched in September, but we're less sure about November given mounting global growth concerns. Sweden's housing market is also showing some cracks, which may also limit how far the Riksbank is willing to go.

Risk to our call: Given the Riksbank itself has signaled it wants to do a third 50bp rate hike in November, the risk is clearly that we get a little more tightening than we're now forecasting later this year.

James Smith

Norges Bank

Our call: 25bp rate hikes at the remaining four meetings this year.

Rationale: Higher inflation, aggressive tightening overseas, and a weaker krone prompted a 50bp hike at the June meeting, which came with a pre-commitment to another 25bp move in August. Norges Bank is effectively priming us for 50bp worth of tightening each quarter, but spread across the two quarterly meetings and until the deposit rate reaches the 3% area. With energy prices set to stay supported and the Fed determined for the time being to keep hiking aggressively to get inflation lower, it's hard to argue with Norges Bank's latest policy signals.

Risk to our call: If the Fed feels obliged to take the funds rate above 4%, then Norges Bank would probably step up the pace of tightening again.

James Smith

Swiss National Bank

Our call: After the 50bp rate hike in June, a 25bp hike is expected in September and another one at the end of the year is not excluded.

Rationale: After years of fighting it, the appreciation of the franc is now considered a positive element by the SNB as it moderates inflationary pressures, which explains the rate hike before the ECB in June. The SNB should therefore continue on its path and raise rates by 25bp in September, especially since we expect the ECB to have hiked by 75bp by then. A further increase at the end of the year would not be illogical to follow the ECB, but a strong Swiss franc could lead the SNB to stop sooner.

Risk to our call: A rapid slowdown in the eurozone and rising geopolitical risks could lead to a further appreciation of the Swiss franc, which would limit the number of rate hikes by the SNB.

Charlotte de Montpellier

Central and Eastern Europe/EMEA: Our calls at a glance

National Bank of Hungary

Our call: Tightening continues at least until inflation peaks.

Rationale: Hungary's central bank has created a cleaner situation by levelling the base rate and the one-week deposit rate at 7.75% in June. The NBH has now hiked by a total of 715bp in 12 months. Despite the largest tightening cycle in the region, Hungarian assets remain under pressure due to political and geopolitical risks. The only realistic point of monetary policy impact remains the currency To keep EUR/HUF stable, the central bank needs to continue its decisive tightening at least until inflation peaks. Our base case is a 50bp increase per month with a terminal rate of 9.25-9.75% in September-October, where we see the highest probability for inflation to peak.

Risk to our call: With intensified upside risks in inflation and uncertainties regarding the rule-of-law dispute, we think the risk for interest rates is tilted to the upside. The fulfillment of risks might see new episodes of forint sell-offs, triggering extraordinary interest rate hikes.

Peter Virovacz

Czech National Bank

Our call: Stable rates until the end of this year and the first rate cut in 1H23.

Rationale: From 1 July, the CNB will be led by a new Governor, Ales Michl, and a new board. In our view, the central bank will thus undergo a significant transformation from the biggest hawk in the region to the biggest dove. The change in view is also supported by the central bank's expectation that inflation will peak in June. At the same time, we expect continued FX interventions to support the koruna despite the higher cost. We expect the first rate cut in 1H23, earlier than the consensus.

Risk to our call: The composition of the new board is the biggest risk that could change our call significantly. For now, we know little about the views of the new governor and board members. Recent statements so far imply a dovish shift, but we don't know to what extent. Moreover, we are skeptical about inflation slowing in the second half of the year, as the CNB expects, due to continuing rising energy and fuel prices. This may ultimately push the new board to raise rates further.

Frantisek Taborsky

National Bank of Poland

Our call: 75bp hike in July to 6.75%, rate hikes continue towards 8.50%.

Rationale: After hikes from 0.1% to 6% in June, the NBP governor has switched to a dovish tone, though we still see further hikes despite that. The persistent rise in core CPI points to large second-round effects. Our own survey shows very high inflation expectations (30% of Poles see CPI between 20-40%). Moreover, with more than 3% fiscal stimulus the policy mix only recently turned contractionary. Not only does this mean high CPI, which should peak at 15-20% in 2H22, but also a C/A deficit. It turned from 3% of GDP surplus to 3% deficit and should reach a deficit of circa 5% at the end of 2022. In the coming months, the NBP governor will be sensitive to slowing GDP growth but should keep hiking to contain CPI and prevent Polish zloty depreciation. The zloty fundamentals deteriorated recently. In the short term, inflation fears may soften due to a slower rise in food prices in the summer, but long-term challenges remain and should resurface in 2H22 and the beginning of 2023.

Risk to our call: The monetary policy council getting excessively dovish during the summer due to their worries about a GDP slowdown, but the inflationary backdrop in Poland is the worst in the CEE region, which should backfire via a weaker zloty.

Rafal Benecki

Central Bank of Turkey

Our call: Interest rates remain on hold for the rest of the year.

Rationale: We have seen some policy moves lately with the objectives of:

- Putting a break on commercial TRY loan growth.

- Strengthening FX reserves.

- Aiming to divert local demand away from FX.

- Strengthening demand for local government bonds.

- Increasing the appeal of TRY assets for foreign investors.

The CBT has signalled that it will not change its course and continue to use these types of measures rather than a direct policy rate adjustment.

Risk to our call: After a pronounced TRY weakness in recent weeks and pressure on reserves, we see a stabilisation in net reserves (excluding swaps) thanks to a wave of measures, particularly impacted by higher FX selling requirements for goods and services exporters, out of their FX revenues. Given there has been no change in policy direction to prioritise inflation and allow a normalisation in real rates, risks to the macro outlook will likely remain a key concern depending on exchange rate developments and higher price pressures.

Muhammet Mercan

National Bank of Romania

Our call: Terminal key rate at 6.00% by the end of 2022.

Rationale: The key rate gap versus the CEE3 peers (Poland, Czechia, Hungary) has widened even more since NBR’s last meeting in May. Moreover, the above-expectation GDP numbers are likely to make it easier for the NBR to at least maintain its 75bp hiking pace at the July and August policy meetings, though larger hikes cannot be excluded. However, this would hardly be considered a hawkish surprise as the market perception seems to be that the NBR is still far behind the curve.

Risk to our call: The pace of rate hikes in the CEE3 space doesn’t seem to be slowing down and NBR will be forced to follow. On the other hand, eventual rate cuts are less likely to be followed over the next couple of years.

Valentin Tataru

Asia (ex Japan): Our calls at a glance

People's Bank of China

Our call: Policy rate cuts put on hold, though the central bank will continue urging banks to cut the 5Y Loan Prime Rate by 10bp in July, before pausing for the rest of the year.

Rationale: Quarantine rules for positive Covid cases have been relaxed, and it's expected that the government has changed its focus from Covid control to balancing Covid control and economic growth. The number of Covid cases has remained in the single digits for weeks. We should see a mild consumption recovery in the June data and a faster recovery in July. The summer holiday spending should be similar to 2021.

Risk to our call: Covid cases could rise and the government could react by tightening quarantine rules again. This would likely trigger rate cuts.

Iris Pang

Reserve Bank of India

Our call: A further 50bp hike at each of the August and September meetings. No hike at the December meeting. The repo rate ending the year at 5.9%.

Rationale: The RBI needs policy to exit accommodation and move to at least neutral in short order. We believe that repo rates will catch up with core inflation at about 6% towards the end of the year (so basically zero real rates), and that could provide cover for the RBI to halt the withdrawal of its accommodation.

Risk to our call: The most likely source of error is inflation being higher than forecast, requiring the RBI to keep its tightening bias through to the year-end, and the repo rate ending at over 6%.

Rob Carnell

Bank of Korea

Our call: Rate hike in July, August, October and November then entering an easing cycle from 4Q23.

Rationale: We expect CPI to stay above 6% in 3Q22, while GDP growth is likely to slow only modestly and remain relatively healthy on the back of reopenings and supportive fiscal policy. We expect the BoK to set its terminal rate at 2.75% by the end of 2022, but markets expect it to be 3.00-3.25%, reaching there by 1H23.

Risk to our call: If financial markets do not stabilise with inflation exceeding 6% in June, the BoK may take a big step in July and reach 3.00% by the year-end. But more and faster rate hikes will move forward the next rate cut to 3Q23.

Min Joo Kang

Bank Indonesia

Our call: A string of 25bp rate hikes in August, September and October. The 7-day reverse repo rate at 4.25% by the end of the year.

Rationale: BI has some space to delay rate hikes in the near term as core inflation remains relatively well-behaved (2.7%). The pressure on the Indonesian rupiah has stepped up in recent weeks, but the partial resumption of palm oil exports should translate to a renewed widening of the trade surplus, which should be supportive of the currency. BI may also go easy on rate hikes (75bp total for the year) after it announced a programmed increase in reserve requirements from March through to September, which should bring the RR from 6% to 9%.

Risk to our call: BI indicated that its pain point for rate hikes would be the acceleration of core inflation. We could see a more aggressive hiking cycle should core inflation see a more pronounced pickup with BI taking the 7-day reverse repo rate to 4.75% for the year.

Nicholas Mapa

Bangko Sentral ng Pilipinas

Our call: A series of 25bp rate hikes in August, September, November and December. BSP’s overnight reverse repo at 3.5% by end-2022.

Rationale: Inflation is expected to average 5.6% in the second half of the year, all but ensuring that BSP breaches the 2-4% inflation target for 2022. BSP has indicated it is open to doing “all it takes” to get inflation down, but at the same time officials have shown a preference for gradual and measured adjustments to policy.

Risk to our call: Inflation accelerating past current BSP forecasts may trigger front-loaded aggressive rate hikes to rein in inflation expectations and limit the spread of second-round effects. Inflation breaching 7% could trigger 50bp rate hikes in August and September, followed by 25bp each in November and December. A BSP overnight repo rate at 4.0% for the year in this scenario.

Nicholas Mapa

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article