Dollar Regime Change: The Prequel

There are early signs that the dollar is undergoing a significant regime change – particularly in the nature of the dollar’s decline. If the 10% fall in the trade weighted dollar in 2017 was a ‘benign decline’ driven by the re-rating stories of overseas economies, then this year’s 4% dollar drop looks far more self-inflicted

Dollar Drop: Made in America

Nowhere are the emerging signs of a regime shift more evident than in USD/JPY. This year has seen a sharp collapse in the positive correlation between US yields and USD/JPY. In fact the drop in the positive correlation is amongst some of the sharpest on record. Looking at the 6-month rolling correlation between changes in USD/JPY and nominal 10-year yield differentials since 1990, we note that we’ve only witnessed such a sharp de-coupling that we’ve seen this week on 32 prior occasions. On those occasions where it was a negative $ story, the follow-through in USD/JPY downside has been sharp – on average falling by 6% in 3-month window after the de-coupling.

We think that this regime shift has been driven by a variety of factors, most of which are sourced from Washington. We’ve covered several of these factors in our report: A Mercantilist and Mercurial Dollar Policy published on 1 February. Protectionism and what is turning into the benign neglect of the dollar by the US Treasury are two key factors. A third may well be emerging concerns over the US fiscal trajectory, with the FT’s Martin Wolf describing this year’s US tax cut as ‘fiscally irresponsible’.

End of a beautiful relationship: USD/JPY vs. real interest rate differentials

Why rising US yields are not helping the dollar

November 2016’s surge in US yields and the dollar feels like a lifetime ago. Why hasn’t this year’s rise in US yields helped the dollar?

The answer we think rests in the factors which have driven the rise in yields. Back in November 2016 the story was Donald Trump’s reflationist agenda, where both inflation expectations and the term premium drove US yields higher. The rise in inflation expectations accounted for around half of the rise in Treasury yields in late 2016 and embodied a US growth story.

In contrast inflation expectations have only accounted for around 20% of this year’s rise in Treasury yields. In fact the rising term premium has been the biggest factor driving US yields higher in 2018. Typically the term premium is seen as the extra risk premium longer term bond investors require to account for inflation and demand/supply imbalances. Could Donald Trump’s fiscal largesse now be impacting US Treasuries? We’re still very early in this story, but we suspect we are starting to see a fiscal risk premium priced into the dollar – explaining this year’s correlation breakdown.

Two episodes of rising US yields... two different FX market reactions

EUR and JPY to benefit at the dollar’s expense.

We expect this dollar bear trend to extend for several years. The main beneficiaries of a loss of confidence in the dollar will be the EUR and the JPY. Both are running large current account surpluses and are the few currencies to provide sufficient liquidity for FX diversification strategies for both public and private sector investors.

We have medium term fair value calculations for EUR/USD and USD/JPY at 1.22 and 104 respectively. However, we believe the dollar risk premium can see the dollar extend into undervalued territory and currently have conservative year-end targets for the two pairs at 1.30 and 100.

Emerging markets have been holding up well, can this last?

In terms of the outlook for EM FX, it is not necessarily the outright level of UST yields but rather the pace of the adjustment that will in our view impact the EM currencies. Should the current trend of an orderly move in UST yields higher and a weaker USD continue, this may not be detrimental for EM. The EM currency segment should retain support, with (negative) higher dollar funding costs being offset by the (positive) currency effect of a weaker dollar. This seems to be the current situation. Yet amongst the EM FX, high yielders with external funding needs may underperform (those external vulnerabilities are typically observed in the likes of TRY, UAH and ARS).

An abrupt Treasury yield adjustment would be troubling

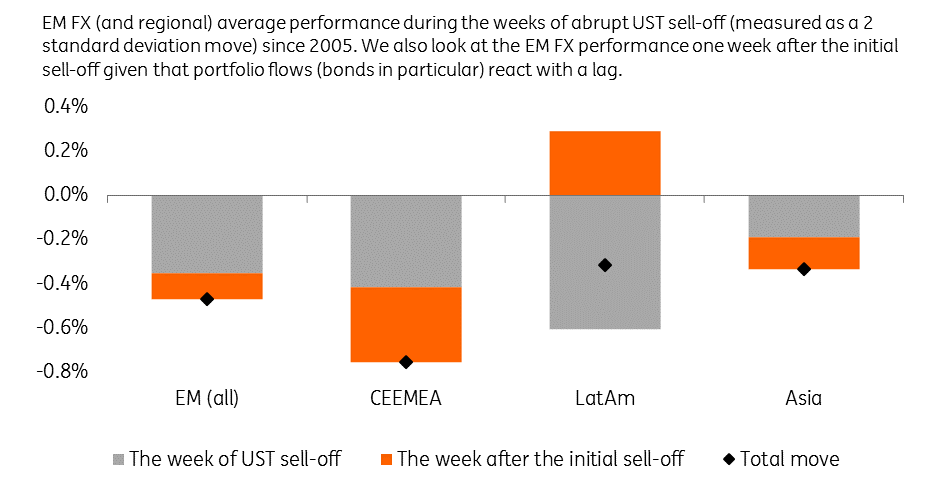

However, were we to see a more abrupt move in US yields (for example, a sell-off in 10y UST equivalent to / higher than a 2 standard deviation move), then the broader EM FX complex would be at risk. Indeed, out of the 24 occasions we’ve seen 2 sd moves since 2005, we find:

- portfolio flows have adjusted with a lag, but understandably debt has been hit more than equity flows

- EM FX reacts immediately (front-running the portfolio channel), with debt-driven FX such as CEEMEA and LatAm underperforming, while Asia (equity-driven) outperforms. LatAm FX in particular reacts the fastest and most negatively during the initial UST sell-off, with MXN and CLP being historically the main EM underperformers during such period of stress.

For reference we would define an ‘abrupt’ move in 10 year US Treasury yields as 2sd or 24bp based on price action since 2005.

CEEMEA and LatAm FX vulnerable to higher UST yields

Most roads lead to a weaker dollar

Our conviction call is that the dollar is going to weaken over the next couple of years. Going into 2018 this call had largely been based on the cyclical factors of a re-rating story in overseas economies. But in late January we cut our USD/JPY forecasts on the emergence of risk premium associated with the policies emerging from Washington. EM FX looks insulated for the time being, but were the Treasury sell-off to prove disorderly, high yield EM FX and the more debt-centric blocs of CEEMEA and LatAm look most vulnerable.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article