Divided Europe: As some regions thrive, others may never recover

More than 10 years on from the financial crisis, regional labour markets across Europe continue to feel the impact. Will the next decade be any different?

Deep impact

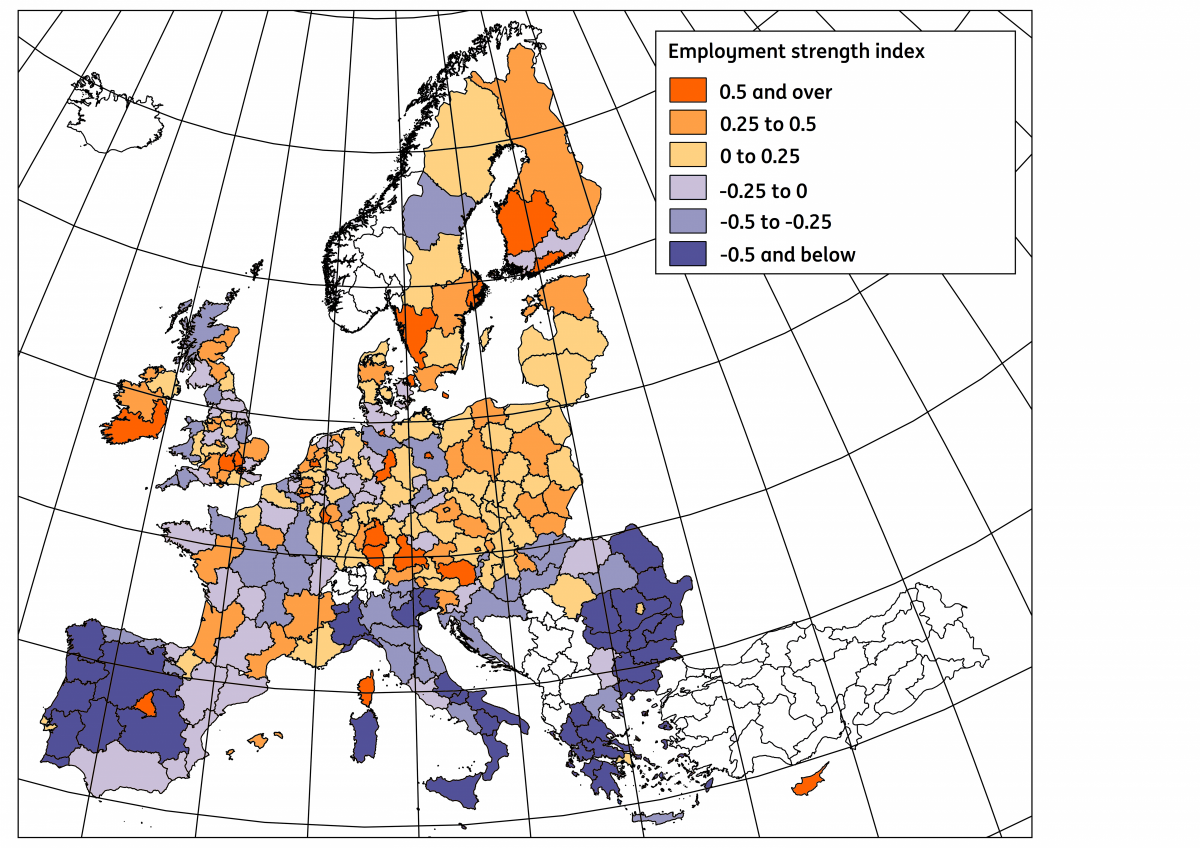

In September 2008, the bankruptcy of Lehman Brothers marked the low point of the financial crisis. Ten years on, the European economy has recovered, but the scars of the crisis are still visible at a regional level. While employment – measured as employed persons - for the European Union is now 2% above the 2008 peak, this is not the case for many local economies. The crisis has had a long-lasting and deep effect on economic activity and on employment, and many regions have only recently begun to recover. The chart below highlights this stark regional divide.

The Employment Strength Index

Another lost decade

Some regions have not even shown signs of bottoming out, with employment still in decline. Take the German regions Sachsen-Anhalt and Thüringen, for example, which have seen employment decline steadily over the past decade despite the German Wirtschaftswunder. The strong growth in German employment has not lifted the tide in these regions, indicating the persistence of regional differences. In Italy, strong growth in the northern regions and around Rome masks dismal job creation since the start of the crisis in the southern regions. This begs the question, what differentiates the winners from the losers and will the next decade be any different?

We find that:

Deep scars caused by the crisis are still impacting regional labour markets across Europe. Many regions are still recovering, with the unemployment rate still above the natural rate, according to our estimates.

Structural strength or weakness seems to be driven in part by the region’s digital infrastructure, the vulnerability to globalisation, the innovative capacity of the region and the residents’ level of education.

A large divide between urbanised and younger regions and rural and ageing regions, with the latter in general performing much more poorly. This confirms the view of a split in society between areas that are vulnerable to population outflow and ones with prolonged high structural unemployment and those which are more vibrant and generally profit from large societal trends.

When looking at the current state of those structural drivers, the strongest regions are large metropolitan centers, which seem set up for continued strength in the years ahead.

We also find that there are several regions across Europe – mainly in the southern outer ring of the European Union – which are likely to remain weak in the years to come. As such, investment in infrastructure and intellectual capacity in these regions will be key. Structural improvements at the national level will also be needed, with a large concentration of the weakest regions in a few, mainly Southern European countries. Without this, these areas could face another lost decade of employment growth.

More redistribution at the European level seems unlikely given the political environment at the moment. With stagnation a possibility for many regions, the appetite for the populist vote, from an economic perspective, at least, could increase.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

1 May 2019

What’s happening in Australia and around the world? This bundle contains 8 Articles