Debt sustainability issues, once again

The rise in bond spreads in most eurozone countries could be a problem. Nevertheless, the long period of extremely low interest rates and the very gradual rollover of public debt give governments some leeway, even if spreads rise further. That said, any reduction in economic growth would diminish this buffer

Bond yields and spreads on the rise

The dramatic adjustment in interest rates over the last few months has many implications. One of the most serious of these is the issue of debt sustainability in highly indebted countries, as the steep rise in yields together with other key geopolitical factors threaten to push the eurozone economy into stagflation, or even recession.

The rise in inflation, which started in 2021, has been exacerbated by the war in Ukraine, with price increases extending well beyond the energy domain. The European Central Bank's decision to accelerate its normalisation path by stopping net purchases in all of its programmes and by raising interest rates has induced a sharp increase in government debt rates, particularly in heavily indebted countries.

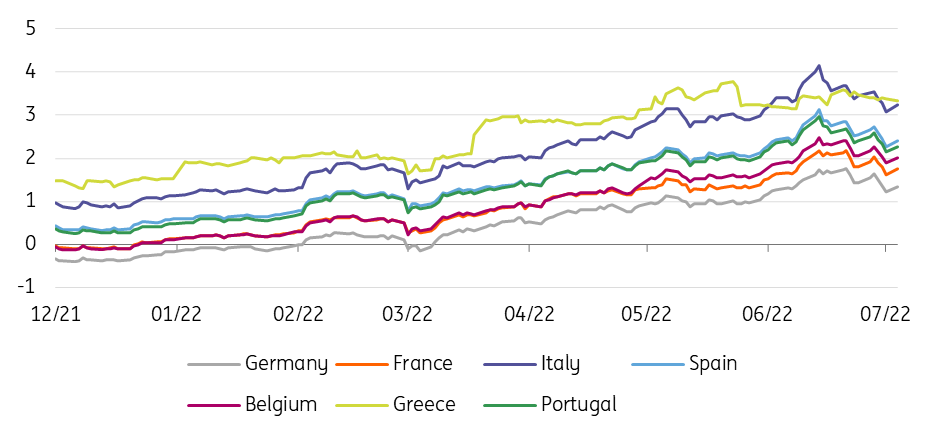

Since early December, the 10-year Bund yield has increased a whopping 190bp, with Italian BTPs rising some 265bp. The spread currently hovers at around 200bp. The ECB's decision to accelerate the end of net purchases under its Asset Purchase Programme has put pressure on spreads of highly indebted countries. Gone are the days of the ECB fully funding the deficits, as seen over the pandemic. However, the temporary reinvestment of bond holdings maturing under the APP, and the flexible reinvestment of maturing bonds under the Pandemic Emergency Purchase Programme will clearly help the transition towards private funding.

A widening of spreads in a rising rates environment is not surprising: as core rates rise, government bond investors may decide to switch out of peripheral bonds into German Bunds to get the same return with a better credit profile. At the current time, the widening in Italian spreads seems to be consistent with the post-sovereign debt crisis norm, while Spanish and, more markedly, Portuguese bonds are widening less than the historic statistical relationship would suggest.

The sharp increase in interest rates and the declining support from the ECB have re-awakened dormant concerns about debt sustainability, particularly for highly indebted countries. Are these concerns justified? In order to answer this question, we have made some simple public debt simulations for a selection of eurozone countries, trying to single out those more exposed to the sustainability risk under different spread assumptions, starting from our base case forecast. As a sustainability benchmark, we look at the ability of the debt-to-GDP ratio to fall or at least stabilise over time.

Bond yields have dramatically increased since the turn of the year

Reference yield in % for some eurozone countries

Short-run and medium-long run sustainability

A common feature of the countries examined is a relatively high weighted-average maturity of the debt, ranging from 7.1 years for Italy and Germany to 18.2 years for Greece, the latter reflecting the dominant role of ultra-long official loans in Greek debt. A relatively long average maturity is a key factor in favour of debt sustainability. The longer the average maturity, the longer it will take for an interest rate shock to affect the whole stock of the debt and, as a consequence, the average cost of debt.

The other factor temporarily helping to secure debt sustainability in the short term is inflation, so long as the market underestimates the outlook for price growth. Inflation (in as far as it is also reflected in the GDP deflator) acts both via the fiscal drag and through the so-called inflation tax, which reduces the real value of non-indexed debt. Even though governments are spending more to help households and businesses withstand skyrocketing energy bills, higher tax revenues as a result of higher inflation, at least in the short run, outweigh the increased interest rate cost incurred to roll over maturing debt, improving public accounts.

Some buffer

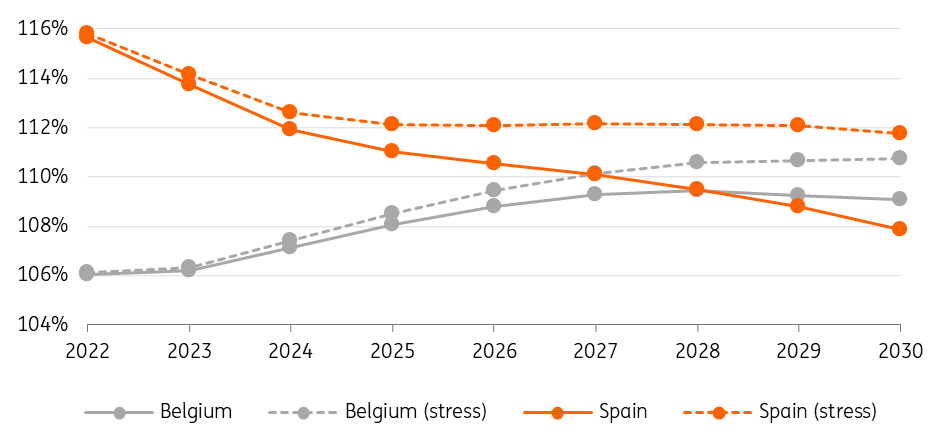

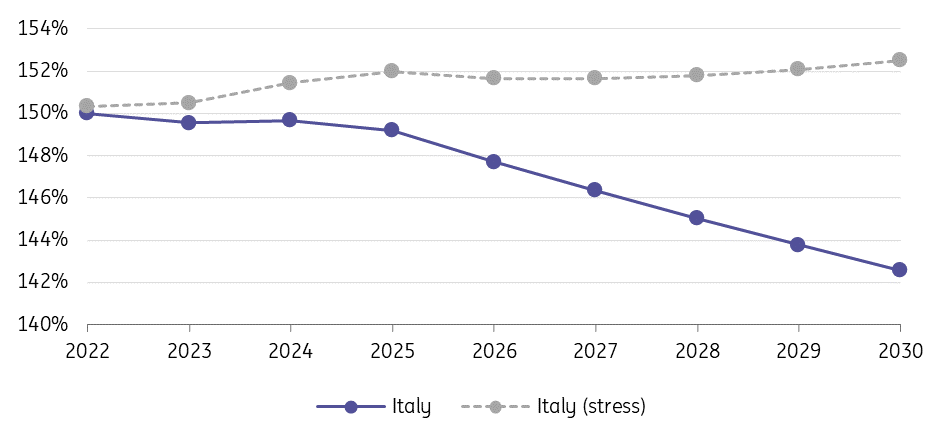

The simulations we run, assuming persistent interest rate shocks, show that because the average maturity of debt is so long, the debt profile is not particularly worrying even under unspectacular projected growth profiles. Indeed, in our baseline scenario with moderate trend growth, inflation close to the ECB's medium-term target, non-zero but moderate bond spreads and fiscal efforts to reduce primary public finance deficits, no country is on a dangerous public finance path. To test the resilience of these trajectories, we simulate a doubling of bond spreads compared to our baseline scenario. In the medium term, this means a spread of 300bp for Italy and Greece, 160bp for Spain and Portugal, 90bp for Belgium and 80bp for France. In the short term (2022), spreads are set even higher. All other things being equal, such a doubling would represent an additional €420 billion interest burden for the euro area between 2022 and 2030. This being the case, the trajectory of the debt ratio for the euro area as a whole would remain on a downward path. However, this encompasses very different situations. Italy, Spain and Belgium would no longer be able to reduce their debt ratio (see charts below). A snowball effect would also be observed at the end of the period in Italy and Belgium. The other countries would maintain a downward trajectory in their debt ratios.

Impact of a doubling of bond spreads on public debt trajectory

Belgium and Spain

Impact of a doubling of bond spreads on public debt trajectory

Italy

Growth is crucial

For highly indebted countries like Italy, getting the debt-to-GDP ratio onto a downward path over the medium term would require a return to stable primary surpluses. As time passes, the interest rate shock would gradually apply to a greater share of the existing debt, pushing up the average implicit interest rate. When the existing debt gets bigger than nominal GDP growth, the so-called “snowball effect” starts to kick in on the debt/GDP ratio, requiring some compensation in the form of a primary surplus.

Reducing the primary deficit and maintaining sufficient growth is therefore essential for the stability of public finances. For example, cutting economic growth by one percentage point each year over the forecast horizon relative to the baseline scenario would have a snowball effect in France, Belgium, Italy and Spain, even if one assumes that the primary deficit as a percentage of GDP does not deteriorate relative to the initial path.

Unsurprisingly, current medium-term fiscal planning documents in highly indebted countries such as Italy and Greece already foresee a return to primary surpluses over the next three years. The level of primary surplus required will depend crucially on how effectively countries can shift to a faster growth path on a sustainable basis. How countries use the Recovery and Resilience Facility, with its blend of expenditure and reform, will play a key role here.

When examining the vulnerabilities to the sustainability risk we cannot ignore the fact that investor behaviour could bring about market fragmentation, even in the absence of relevant changes in fundamental macro drivers. The recent episode in which the BTP-Bund spread rapidly widened to the 250bp area is a case in point, inducing the ECB to call an emergency meeting to announce anti-fragmentation measures.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

7 July 2022

ING Monthly: Europe’s recovery is cancelled This bundle contains 14 Articles