Dealing with power price volatility: PPA growth continues to slow

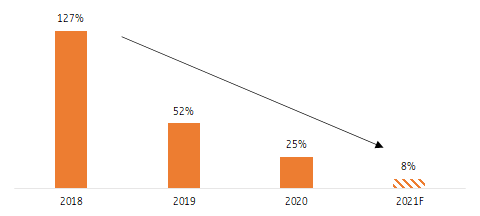

The market for Power Purchase Agreements (PPAs) continues to grow globally. For companies, PPAs are a means to decarbonise their power supply. For developers, PPAs are a means to mitigate power price risk and stabilise cash flows. Growth is less buoyant though, with growth figures halving each year since 2018, reaching 8% in 2021

What's a PPA?

The World Business Council for Sustainable Development (WBCSD) defines a Purchasing Power Agreement (PPA) as a contract between the buyer (off-taker) and the power producer (developer, independent power producer, investor) to purchase electricity. Usually at pre-agreed prices for pre-agreed periods, but also without any pre-agreed price level or volume (route to market). The contract contains the commercial terms of the electricity sale: length, delivery point/date, volume and price. Contracts are not standardised, so many forms exists (pay as produced, baseload, or variations). The electricity can be supplied by existing renewable energy assets or new build projects.

Next to corporate PPAs there are PPAs from utilities, like Vattenfall, Eneco and Stattkraft. The utility PPA market exists much longer than the corporate PPA market. In this article we use the PPA database of Bloomberg New Energy Finance which includes PPAs from corporates and utilities.

There are two types of PPAs in both markets. In the case of physical PPAs, the renewable asset and power user operate on the same grid. Think of the Dutch railroad company (NS) buying green power from Dutch solar or wind projects. That is not the case with virtual PPAs. Think of Amazon buying green power from an offshore wind farm in the Netherlands to procure the power consumption of their distribution and data centers elsewhere in Europe.

Continued but lower growth

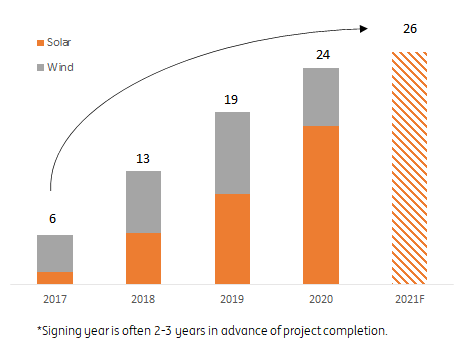

The global market for PPAs has grown rapidly, with PPA volumes rising from 6 GW in 2017 to an estimated 26 GW in 2021. The pace of growth is declining though, with growth halving each year since 2017.

The PPA market continues to grow...

Yearly signed PPAs for solar and wind projects globally in GW*

...but growth halves every year

Yearly growth rate of global PPA market

The three factors behind strong PPA growth

Three factors have contributed to the strong growth of the PPA market from 2017 onwards.

First, PPAs are a way to stabilise cash flows for renewable energy projects that do not derive their revenues from regulated sources. Although renewables in most power markets in Europe still benefit from regulatory support, subsidy-free bids on wind and solar projects have entered some power markets from 2017 onwards and face higher merchant risks that can be managed with PPAs. Developers are also looking for ways to stabilise cash flows to increase leverage and stabilise return on equity.

Second, many companies are setting clean energy targets as part of their Corporate Social Responsibility strategies. Power heavy companies in the telecom, media & technology sectors and in manufacturing are entering the PPA market as a way to decarbonise their power supply.

Third, electrification is an important factor to decarbonise industries that heavily rely on fossil fuels, such as manufacturing and transportation. Global power demand could rise by 80% by 2040 in our scenario that limits global warming to the goals of the Paris Climate Agreement. Sourcing power demand from renewables and managing the power price risk of renewable energy projects becomes vital in such a world.

These factors explain the strong uptake in PPA procurement from about 6 GW in 2017 to an anticipated 26 GW in 2021.

| 26 GW |

Anticipated growth of the global PPA market in 2021gigawatts |

Push from buyers to the PPA market

Companies have different options to decarbonise their power supply. They can invest in renewable capacity themselves, for example by building on site wind turbines or solar projects. However, this requires permits and a lot of space. And if offers no solution for wind-free and cloudy days when the company also needs electricity, unless the company also invests in storage facilities like batteries. It can also extend the balance sheet if these assets are owned by the company.

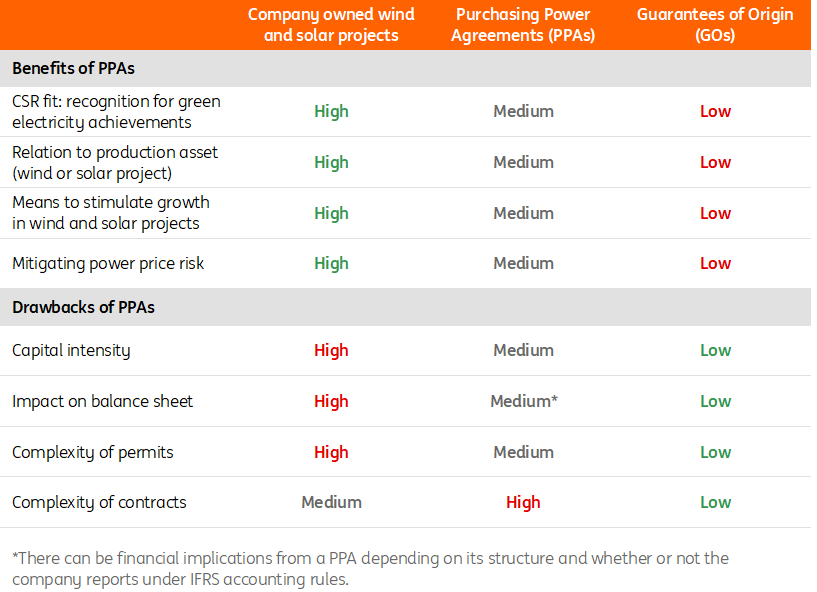

PPAs are an alternative to invest in renewables

Companies can also buy green power from utilities or developers which demonstrate their 'greenness' through guarantees of origin (GOs). GOs exist in some of the North-West European power markets and are tradable certificates that guarantee that the power comes from renewable energy projects. This market has been operating for many years, but has some drawbacks for companies looking to green their power supply. First, most power is hydro power out of the Nordics but companies often want to support the energy transition towards wind and solar energy closer to their production sites. Second, there is a weak link between the generating asset and the off-taker. Nowadays, a select group of companies with high sustainability targets are demanding more control over their sustainable power procurement. Important stakeholders like NGOs demand that too. As a result, these companies more often want to have direct involvement in the development of solar and wind farms.

PPAs offer a middle way between owning wind and solar assets and the abstract market for GOs.

PPAs as a middle way between company owned renewables and GOs

Benefits and drawbacks of PPAs compared to owned projects and GOs

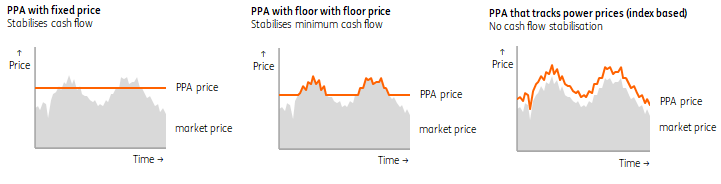

PPA price and tenor are decisive in stabilising cash flows

In principle there are two types of PPAs. Either the off-taker buys the generated power as and when a project generates renewable power. Or the off-taker requires a (hourly/monthly/yearly) baseload PPA contract whereby the generator must deliver a pre-defined quantity of MWh of electricity irrespective of whether it generates this, or not. In either case, the off-taker can buy the power at a pre-agreed indexed or unindexed price (price contract), or at the then prevailing market price in the spot market. The contracts differ in the type of price and volume volatility that is hedged. Fixed price pay as produced contracts offer the best opportunities to stabilise cash flows as the generator just gets paid for the actual MWh’s produced at the pre-set or market price. Base load contracts offer considerable less value in stabilising cash flows as the generator takes dispatch and market price risk.

Different PPAs, different degrees to stabilise cash flows

Three types of price contracts

Not all alike

Every PPA needs to be judged on its own merits as PPA contracts are not standardised. Nevertheless, the market continues to grow as market players seek ways to stabilise cash flows.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

23 June 2021

Energy transition and power prices: ING’s view on long and short-term price moves This bundle contains 5 Articles