Data centre growth proves crucial in the shift towards a digital economy

Smartphones, streaming services and applications such as video calls have now become part of our everyday lives. And as demand for these services grows, so too does the need for data centres to store and distribute the data

Fast ICT growth means more data centres

The Information and Communications Technology (ICT) sector in the EU and the US has shown above-average growth rates, in line with policies such as the European Commission's action plan, Europe’s Digital Decade. This has been enabled by the strong growth of the data centre sector. As we expect the ICT sector to continue to show above-average growth rates, the data centre sector is expected to grow as well.

In related articles, we write about the opportunities to manage the increasing energy and water use that accompany this growth.

Strong GDP growth of ICT sector compared to broader US economy

Strong GDP growth of ICT sector compared to other sectors of the economy in the EU

Strong historical and future growth of data centres

The ICT sector's strong growth in recent years can be seen in the charts above. Data from Eurostat and a special Bureau of Economic Analysis investigation into the ICT sector (more specifically, segment-priced digital services) shows above-average growth rates in both the EU and US. In both regions, the sector makes up an increasingly large portion of total GDP. This holds true even without accounting for the fact that the sector also enables growth in other segments of the broader economy.

What's driving growth?

Growth of the ICT sector is facilitated by investment in (digital) infrastructure, such as data centres. The increasing contribution of digital services to the broader economy has been fuelled by the growth in computing power, which is provided through data centres. It is, therefore, no surprise that the data centre sector has shown strong growth over the years. The International Data Corporation (IDC) forecasts that worldwide spending on public cloud services will reach $1.35 trillion in 2027, reflecting a five-year compound annual growth rate of around 20%. IDC also estimates that the spending on cloud infrastructure will reach over $150 billion in 2027 and is expected to grow with a compound annual growth rate of around 11% until then. Therefore, the investments in the compute and storage hardware markets enable the accelerated revenue growth in services. According to Masanet et al (2020), the number of servers globally has increased from 35.8 million in 2010 to 45.1 million in 2018. The growing number of servers, efficiency improvements and the resulting energy use are discussed in a related article in this series.

One explanation for the growing demand for data centre capacity is the services and benefits the sector offers. Companies often decide to move their servers to data centres because these operate at a lower cost, and therefore help with decreasing their total cost of IT ownership. These cost-reduction opportunities arise from significant economies of scale in the data centre sector. Other benefits from outsourcing are improved interconnectedness and better speeds. Decisions are sometimes also made to upgrade the legacy IT stack to a modern, cloud-based IT infrastructure. Engaging with a hyperscaler allows enterprises to benefit from their cloud-based communications networks as well as their buying power with third-party suppliers and DC engineering skills, including the application of modular DC designs. Hyperscalers are able to offer an array of services and cybersecurity that would be prohibitively expensive for enterprises to replicate in an on-premise environment

These factors explain why the demand for data centres has been growing at a similar rate as ICT services. The fact that the ICT sector is growing faster than other sectors is particularly relevant for ageing societies and policymakers. If we want to improve our GDP per capita (labour productivity), it becomes particularly relevant to focus on sectors that show above-average growth rates. This is also what the EU is aiming for with its Digital Economy action plan.

Additional benefits

Besides general factors such as the contribution to GDP growth and employment, positive effects include the creation of communication hubs, as well as possible spin-off effects like the emergence of new companies that are located in the proximity of data centres. For other companies, the close proximity to data centre services can be beneficial. The presence of data centres also gives governments control over regulations impacting data centres and their services, such as environmental standards and internet and communication networks.

Rising concerns and new resistance

While the data centre sector contributes to economic growth, there is sometimes resistance to the construction of new facilities. The Netherlands and Singapore, for instance, had a moratorium in place on new hyperscalers. Singapore now has strict demands for the construction of new hyperscalers and in the Netherlands this legislative process is still ongoing.This resistance is because the strong sector growth raises questions about the negative externalities, such as high energy use, heat, water usage and a changing landscape.

However, the sustainability of data centres has been improving. The management of these externalities is often part of sustainable finance objectives, which can be part of sustainable finance frameworks. As with many economic activities, data centres can be beneficial for society overall (with said benefits being larger than direct and indirect costs), but this does not imply that every location is suited to building a data centre. This could be the case given a scarce local green energy supply, for instance.

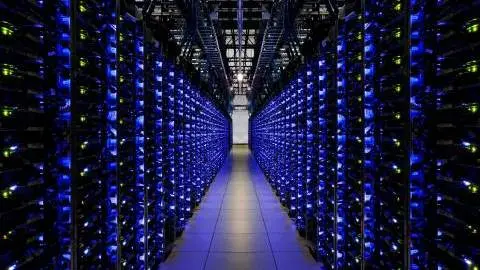

Data centres explained

Data centres are physical locations that house a network of computer servers which can be used to store, process or distribute data. In general, three types of data centres can be distinguished:

- Enterprise data centres are used by one single organisation but are often relatively small data centres.

- Colocation data centres are often larger. These data centres can be used by multiple organisations. The organisations have their own servers; the data centre provides the location and additional services, such as cooling, power, communication lines, and security services.

- Hyperscale data centres are the largest type of data centres. These facilities are generally built by and for single occupants such as Microsoft, Amazon, Alphabet or Meta. These large companies need a lot of computing and storage capacity. The combination of similar computing tasks and scale makes it possible to achieve efficiencies through data centre design, the efficient use of hardware, optimal procurement policies and tailor-made hardware and software designs. Services that can be performed through these data centres are managed services, cloud computing or communication services.

Locational factors

Some places are better suited to locate data centres than others. Data centre operators prefer to choose a safe place that has large amounts of (green) energy available. This safety is determined by whether locations are safe – i.e., are tectonically stable, and have a low risk of flooding. Since the cooling of data centre servers costs a lot of energy, locations in mild climates are preferable. Locations with network effects are also desirable. This means that there is an established IT sector, good availability of knowledge, and fast connections through up-to-date infrastructure. A favourable regulatory and tax regime is also important.

Different types of data centres

This article is part of a series which also evaluates the energy use of the data centre sector, as well as measures that the financial industry can take to reduce its environmental impact. Through green bonds and other sustainability frameworks, the financial industry can help promote the increasing efficiency of data centres and support the decarbonisation efforts of the sector.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

24 October 2023

The data centre surge, energy efficiency and the ICT boom This bundle contains 4 Articles