Czech Republic: Record high credit activity for households in 2017

Last year was a record high from the perspective of new housing loans provided to households. Some deceleration is likely this year due to higher rates and tightened credit standards

Housing loans improved again in December

New credit statistics from December reveal that the volume of newly provided housing loans increased again at the end of the last year after a somewhat weaker third quarter. Banks provided new loans for CZK30bn, which is slightly above the 2017 average figure. Czech households are likely motivated by an expectation of further interest rate growth and seek to obtain credit under more favourable conditions. However, the average rate for mortgage loans has been rising marginally in the past few months, only by 0.1ppt since Aug-2017, when the CNB hiked its interest rate for the first time. This means that banks have so far been contending with rising market rates by lowering their margins, but the current average mortgage rate of 2.2% is inadequately low given the market longer-term interest rates and with a further increase ahead.

| 2.2% |

average mortage ratehas not been reacting significantly to the CNB hikes so far |

New credit for non-financial companies are still lower

New loans to non-financial corporations improved in December, as the volume of loans above CZK49bn is the highest monthly volume in 2017. Nevertheless, there is a typical seasonality for these types of loans and Decembers’ figures are usually strong. This is given by the fact that both clients and banks are motivated to complete the transaction before the end of the calendar year. Compared to the previous year's December figures, however, the CZK49bn is still well weaker than in past years.

The last year was a record high for credit volumes provided to households

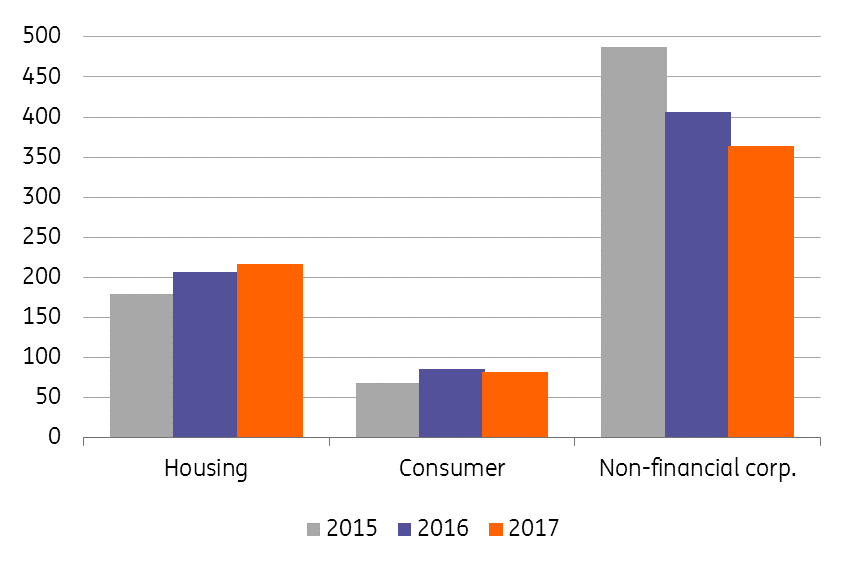

The favourable economic situation supported by extremely low interest rates led to a record high credit activity in 2017. Banks and building societies provided housing loans of CZK217bn, which represents 5% YoY growth. These are truly new loans that do not consist of refinanced or consolidated loans, only the part that has been increased during the refinancing/consolidating. The total volume of new loans including refinancing reached CZK346bn and also increased slightly in YoY terms. As such, 2017 volume even overcame the strong year 2016 despite the CNB's tightened recommendations, which restricted lending to households in the second half of last year due to stricter LTV limits (see Chart).

The volume was also record-high for newly granted consumer loans last year, which grew by 13% YoY (CZK118bn). However, part of the new volumes was due to refinancing and consolidation of loans. Looking at really new consumer loans only, 2017 volume was comparable to the previous year and reached CZK82bn.

New credit without refinanced and consolidated loans (CZKbn)

FX loans are more popular for corporate loans

In the case of new loans to non-financial corporations, 2017 was somewhat weaker and ended 10% below the level of 2016. This is a slightly puzzling result given the strong economic activity last year and might be related to sufficient own resources of companies. There is, however, a clear trend observed in the past few years with respect to credit to corporates. Companies are using more and more non-CZK loans, as the share of FX-loans increased from 19% in 2013 to 30% at the end of 2017.

Some deceleration in new loans to households is expected this year

This year, the volume of newly granted housing loans is very likely to fall below 2017 level. This will be due to higher interest rates, which will gradually increase as a result of the CNB's hiking cycle and higher longer-term market rates and might move gradually to 3% at the end of this year. Also, according to the recent credit standards survey, banks are planning to further tighten their standards and conditions for housing loans. This is not only due to the stricter recommendations of the CNB, but some banks are also more cautious about the overall economic situation, which may not remain so optimistic in the future.

From the Czech central bank perspective, the credit statistics clearly confirmed the intention of the CNB to further hike rates. Firstly, the volume of new housing loans is still relatively high, and secondly, the transmission of the main CNB interest rate into client rates has been relatively weak for the time being.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article